Samacheer Kalvi 12th Commerce Notes Chapter 25 Government Schemes for Entrepreneurial Development

→ Job creation is a foremost challenge facing India. It has immense potential to innovate, raise entrepreneurs and create jobs for the benefit of the nation and the world. Financial assistance, insurance, subsidy, training helps early stage tech startup and business loans, special incentive is provided to set up a new enterprises for entrepreneurs.

→ India’s efforts at promoting entrepreneurship and innovations as startup India, Make in India, Atal Innovation Mission (AIM), Support to Training and Employment Program for women (STEP), Jandhan – Aadhaar – Mobile (JAM), Digital India, Stand-Up India etc., The other specific entrepreneurship schemes are M-SIPS, New Gen IEDC, AIC, SPRS etc.

→ Steps in promoting an entrepreneurial venture are selection of the product, selection of form of ownership, selection of site, designing capital structure, acquisition of manufacturing know-how and preparation of project report.

→ Meanwhile the project report should include technical feasibility, economic viability, financial viability, managerial competency, provisional registration certificate, permanent registration certificate, statutory license, power connection and arrangement of finance.

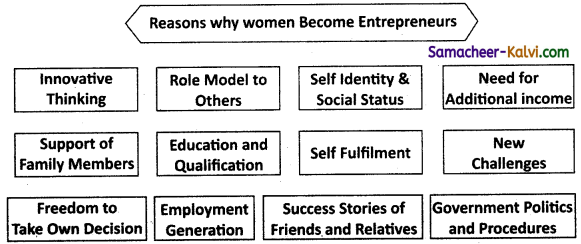

- Women will became a self employed women owned business are playing a pivotal role in entrepreneurial activity.

- Take off of women from a low development path to achieving higher level a self sustaining economic growth. Freedom to work and live on your own terms work life balance, strong skill and social intelligence .

- Women can Network.

- Women have tolerance.

- Women can Multi-task.

- Women have patience and can adjust and have leadership qualities. Women can take control over their careers.

How an Entrepreneur will make use of the various schemes Governments?

Pradhan Mantri Kaushal Vikas Yojana (PMKVY):

Youth people to get training in relevant skills to enhance employment opportunities for their livelihood.

Dairy Entrepreneurship Development Scheme:

Entrepreneur can set up small diary farm to get incentives and cost from this scheme of the Government. The M – SIPS schemes provides capital subsidy of 20% in SEZ and 25 % subsidy in Non-SEZ.