Students can download 10th Social Science Economics Chapter 4 Government and Taxes Questions and Answers, Notes, Samacheer Kalvi 10th Social Science Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

Tamilnadu Samacheer Kalvi 10th Social Science Solutions Economics Chapter 4 Government and Taxes

Samacheer Kalvi 10th Social Science Government and Taxes Text Book Back Questions and Answers

I. Choose the correct answer

Question 1.

The three levels of governments in India are:

(a) Union, State and local

(b) Central, State and village

(c) Union, Municipality and Panchayat

(d) None of the above

Answer:

(a) Union, State and local

Question 2.

In India, taxes are including ……………..

(a) Direct taxes

(b) Indirect taxes

(c) Both (a) and (b)

(d) None of these

Answer:

(c) Both (a) and (b)

![]()

Question 3.

Which is the role of government and development policies?

(a) Defence

(b) Foreign policy

(c) Regulate the economy

(d) all of above

Answer:

(d) all of above

Question 4.

The most common and important tax levied on an individual in India is ……………..

(a) Service tax

(b) Excise duty

(c) Income tax

(d) Central sales tax

Answer:

(c) Income tax

Question 5.

Under which tax one nation, one uniform tax is ensured:

(a) Value added tax (VAT)

(b) Income tax

(c) Goods and service tax

(d) Sales tax

Answer:

(c) Goods and service tax

Question 6.

Income tax was introduced in india for the first time in the year ……………

(a) 1860

(b) 1870

(c) 1880

(d) 1850

Answer:

(a) 1860

Question 7.

…………………….. tax is charged on the benefits derived from property ownership.

(a) Income tax

(b) Wealth tax

(c) Corporate tax

(d) Excise duty

Answer:

(b) Wealth tax

Question 8.

What are identified as causes of black money?

(a) Shortage of goods

(b) High tax rate

(c) Smuggling

(d) All of above

Answer:

(d) All of above

Question 9.

Tax evasion is the illegal evasion of taxes by:

(a) Individuals

(b) Corporations

(c) Trusts

(d) All of the above

Answer:

(d) All of the above

![]()

Question 10.

Payments are ………….

(a) Fees and fines

(b) Penalties and forfeitures

(c) None of the above

(d) a and b

II. Fill in the blanks

- …………………. is levied by Government for the development of the state’s economy.

- The origin of the word ‘tax’ is from the word ………………….

- The burden of the …………………. tax cannot be shifted to others.

- tax is levied on companies that exist as separate entities from their shareholders.

- The Goods and Service Tax act came into effect on ………………….

- The unaccounted money that is concealed from the tax administrator is called ………………….

Answers:

- Tax

- taxation

- direct

- Corporate tax

- 1st July 2017

- Black Money

III. Choose the correct statement

Question 1.

Which of the following statement is correct about GST?

(i) GST is the ‘one point tax’.

(ii) This aims to replace all direct taxes levied on goods and services by the Central and State Governments.

(iii) It will be implemented from 1 July 2017 throughout the country.

(iv) It will unified the tax structure in India.

(a) (i) and (ii) are correct

(b) (ii), (iii) and (iv) are correct

(c) (i), (iii) and (iv) are correct

(d) All are correct

Answer:

(d) All are correct

![]()

Question 2.

Choose the incorrect statements.

(i) Shortage of goods, whether natural or artificial, is the root cause of black money.

(ii) Industrial sector has been the major contributor to black money.

(iii) Smuggling is one of the major sources of black money.

(iv) When the tax rate is low, more black money is generated.

(a) (i) and (ii)

(b) (iv)

(c) (i)

(d) (ii) and (iii)

Answer:

(b) (iv)

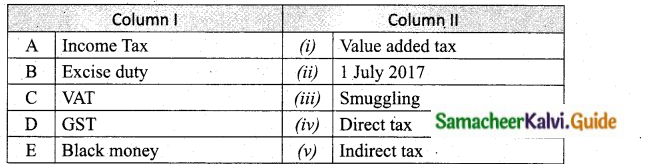

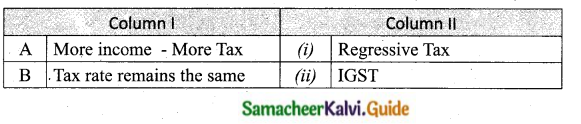

IV. Match the following

Answer:

A. (iv)

B. (v)

C. (i)

D. (ii)

E. (iii)

V. Give Short Answers

Question 1.

Define tax.

Answer:

Tax is levied by the government for the development of the state’s economy. The revenue of the government depends on direct and indirect taxes.

Question 2.

Why we pay tax to the government?

Answer:

We pay tax to the Government because the country have to carryout many functions like building infrastructure like transportation, sanitation, public , safety, education, healthcare, military, public works etc.,

Question 3.

Write the canons of tax system?

Answer:

Every type of tax has some advantages and some disadvantages. So we have a tax system, that is, a collection of variety of taxes. All countries use a variety of taxes. There are some characteristics of tax system that economists think should be followed while designing a tax system. These characteristics are called as canons of taxation.

![]()

Question 4.

What are the types of tax? Give examples.

Answer:

Direct taxes – Eg: Income tax, wealth tax and corporation tax.

Indirect taxes – Eg: Stamp duty, Entertainment tax and Excise duty, Goods and services tax.

Question 5.

Write short note on Goods and Service Tax.

Answer:

Goods and Service Tax is defined as the tax levied when a consumer buys a good or service. That aims to replace all indirect taxes levied on goods and services by the Central and state governments. GST would eliminative the cascading effect of taxes on the production and distribution of goods and services. It is also a “one-point tax” unlike value-added tax (VAT), which was a multipoint tax.

Question 6.

What is progressive tax?

Answer:

Progressive tax is the tax in which the rate of taxation increases as the tax base increases. When income increases, the tax rate also increases. This is known as a progressive tax.

Question 7.

What is meant by black money?

Answer:

Black money is funds earned on the black market on which income and other taxes have not been paid. The unaccounted money that is concealed from the tax administrator is called black money.

Question 8.

What is tax evasion?

Answer:

The illegal non – payment of taxes is generally called as tax evasion, either by individuals corporations and trusts.

Question 9.

Write some causes of tax evasion.

Answer:

Tax evasion resulting in black money prevents the resource mobilisation efforts of the Union government. Shortage of funds distorts the implementation of developmental plans and forces the government to resort to deficit financing in case public expenditure is inelastic.

Tax evasion interferes with the declared economic policies of the government by distorting saving and investment patterns and availability of resources for various sectors of the economy.

Question 10.

What is the difference between tax and payments?

Answer:

Tax is a compulsory payment whereas payment is voluntary. Payment for getting any service gives direct benefits whereas payments for tax will not give any direct benefit.

![]()

VI. Brief Answer

Question 1.

Briefly explain the role of government in development policies.

Answer:

In India, there are three levels of Governments. They are Union Government, State Government and Local Government. They carryout functions for the benefit of people and society. The role of Government can be studied under the following heads.

(i) Defence: To create and maintain defence forces in the country as an essential security function to protect our country from enemies. (Army, Navy and Air Force)

(ii) Foreign policy: India is committed to world peace. We maintain friendly economic relationship to all the countries of the world.

(iii) Conduct of periodic elections: India is a democratic country. We elect our representatives to parliament and State Assemblies.

(iv) Law and order: To settle disputes, the Union Government consists of strong judicial system with court at the National, State and Lower levels. The State Governments takes responsibility to maintain law and order with responsibility from police department.

(v) Public administration and provision of public goods: The public administration is done by the Government with the help of departments for revenue, health, education, rural development etc. Also, it provides public goods like rural roads, drainage, drinking water etc.

(vi) Redistribution of Income and Abolision of poverty: The Government spends money in such a way that the poorer are given basic necessities of life like food, clothing, shelter, education, health care, etc. Thereby the redistribution of income should eradicate poverty in the country.

(vii) Regulate the Economy: The Central Government with the help of the Reserve Bank of India, controls supply of money in the economy and the Interest rate, inflation and foreign exchange. The various agencies like securities Exchange Board of India and competition commission if India are also a tool for the Government to control the economy.

Question 2.

Explain some direct and indirect taxes.

Answer:

Types of Taxes:

Direct Taxes: A tax imposed on an individual or organisation, which is paid directly, is a direct tax. The burden of a direct tax cannot be shifted to others. J.S. Mill defines a direct tax as “one which is demanded from the very persons who it is intended or desired should pay it.” Some direct taxes are income tax, wealth tax and corporation tax.

Income tax: Income tax is the most common and most important tax levied on an individual in India. It is charged directly based on the income of a person. The rate at which it is charged varies, depending on the level of income.

Corporate tax: This tax is levied on companies that exist as separate entities fronl their shareholders. It is charged on royalties, interest gains from sale of capital assets located in India and fees for a technical services and dividends. Foreign companies are taxed on income that arises or is deemed to arise in India.

Wealth tax: Wealth tax is charged on the benefits derived from property ownership. The same property will be taxed every year on its current market value. The tax is levied on the individuals and companies alike.

Indirect Taxes: If the burden of the tax can be shifted to others, it is an indirect tax. The impact is on one person while the incidence is on the another person. Therefore, in the case of indirect taxes, the tax payer is not the tax bearer. Some indirect taxes are stamp duty, entertainment tax, excise duty and goods and service tax (GST).

Stamp duty: Stamp duty is a tax that is paid on official documents like marriage registration or documents related to a property and in some contractual agreements.

Entertainment tax: Entertainment tax is a duty that is charged by the government on any source of entertainment provided. This tax can be charged on movie tickets, tickets to amusement parks, exhibitions and even sports events.

Excise duty: An excise tax is any duty on manufactured goods levied at the movement of manufacture, rather than at sale. Excise is typically imposed in addition to an indirect tax such as a sales tax.

![]()

Question 3.

Write the structure of GST.

Answer:

Structure of GST

SGST (State Goods and Services Tax):

Levied Intra-state (or) within the state

Eg:

- VAT / sales tax, purchase tax

- Entertainment tax, luxury tax

- Lottery tax

- State surcharges and cesses.

Payable to state Government.

CGST (Central Goods and Service Tax):

Levied Intra state (or) within the state.

Eg:

- Central Excise Duty, services tax

- Customs duty, surcharges

- Education and sec. Hr. sec. cess.

Payable to Central Government.

IGST (Integrated Goods and Services Tax)

Levied Inter State (or) between States.

Payable to Central Government.

Four major GST rates are

5%, 12%, 18%, 28%

Question 4.

What is black money? Write the causes of black money.

Answer:

Black Money

Black money is funds earned on the black market on which income and other taxes have not been paid. The unaccounted money that is concealed from the tax administrator is called black money.

Causes of Black Money:

Shortage of goods: Shortage of goods, whether natural or artificial, is the root cause of black money. Controls are often introduced to check black money.

Licensing proceeding: It is firmly believed that the system of controls permits, quotes and licences are associated with maldistribution of commodities in short supply, which results in the generation of black money.

Contribution of the industrial sector: Industrial sector has been the major contributor to black money. For example, the Controller of Public Limited Companies tries to buy commodities at low prices and get them billed at high amounts and pockets the difference personally.

Smuggling: Smuggling is one of the major sources of black money. When India had rigid system of exchange controls, precious metals like gold and silver, textiles and electronics goods were levied a heavy excise duty. Bringing these goods by evading the authorities is smuggling.

Tax structure: When the tax rate is high, more black money is generated.

![]()

Question 5.

Explain the role of taxation in economic development.

Answer:

Resources Mobilisation:

- The Government is able to mobilise resources and earn revenue from tax.

- They utilise this revenue for the welfare of the people.

Reduction in Inequalities of Income:

- Taxation follows the principal of equity.

- When the nature of taxes are progressive that is when income increases, the tax rate also increases. .

- So, poor will not be taxed much when their income is less.

Social welfare: Higher taxes are levied on undesirable products like alcoholic products thereby promoting social welfare.

Foreign Exchange: Taxation encourages exports and restricts imports. When there is no tax on export items, country earn more foreign exchange. Regional development: Generally, when industries are set up in backward regions, to motivate such business firms, tax incentives (or) tax hoildays are given to encourage development.

Control of Inflation: Through Taxation Government can control inflation of reducing the tax on the commodities.

VII. Activity and Projects

Question 1.

Collect information about the local taxes (water, electricity and house tax etc).

Water Tax: (with respect to the city Chennai)

Answer:

- The rate of water tax is fixed at the 1.5% of the assessed annual value.

- The administration is related to water tax in the city of Chennai is vested with (CMWS and SB) Chennai Metro Water Supply and Sewage Board.

- Water tax is levied on private individuals and businesses on tap water.

- Payment for water tax can be done online receipts will be generated within 24 hours of payment.

- The time line of payment will be specified in the demand notice.

- Failing to make the payment even after demanding legal proceedings added with fine and other charges are made.

Electricity Tax:

- Electricity tax is an excise duty that is charged on the supplies of electricity made on or after 1st October 2008.

- The tax is charged on the final supply of electricity to the consumer.

- The liability of payments arises at the time the electricity is supplied.

- The tax at a rate of 5% of the consumption charges.

House Tax / Property Tax:

- A property tax or a house tax is a tax on the value of a property like house, office building etc.

- This tax is levied by the governing authority of the area in.which the property is located.

![]()

Question 2.

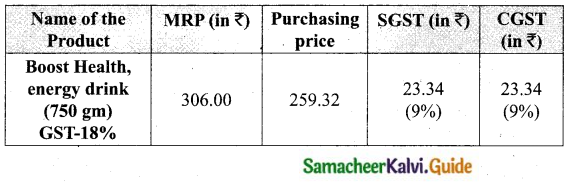

Students purchase some goods on the shop. The teacher and students discuss those goods, maximum retail price, purchasing price or GST.

Answer:

Question 3.

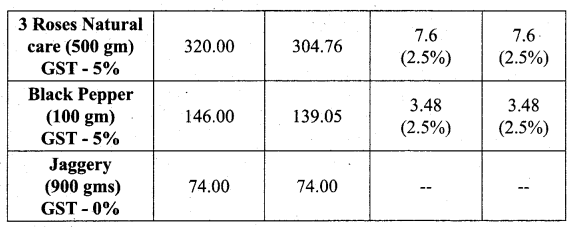

Students are asked to search a Income Tax website and know the Income Tax Slab for current year.

Answer:

Website: www.apnaplan.com

New Income Tax Slabs and rates for financial year 2019-20

![]()

Samacheer Kalvi 10th Social Science Additional Important Questions and Answers

I. Choose the correct answer

Question 1.

The Government mobilises its …………………. resources by levying taxes.

(a) financial

(b) physical

(c) material

(d) all the above

Answer:

(a) financial

Question 2.

……………. tax is levied on companies that exist as seperate entities from their shareholders.

(a) direct

(b) Income

(c) Corporate

Answer:

(c) Corporate

Question 3.

Tax system should be designed in such a way that the people automatically pay more tax revenue with increase in income :

(a) Canon of equity

(b) Canon of elasticity

(c) Canon of certainty

(d) Canon of Economy

Answer:

(b) Canon of elasticity

Question 4.

In India almost all the direct taxes are collected by the ……………..

(a) Union Government

(b) State Government

(c) local bodies

Answer:

(a) Union Government

![]()

Question 5.

Energy, water and waste management systems are common public :

(a) utilities

(b) properties

(c) systems

(d) all of these

Answer:

(d) all of these

Question 6.

……………… has been the major contributor to black money.

(a) Agriculture sector

(b) Industrial sector

(c) Tax sectors

Answer:

(b) Industrial sector

Question 7.

An …………………. tax is a duty on manufactured goods levied at the movement of manufacture.

(a) Sales

(b) Excise

(c) Stamp duty

(d) Entertainment

Answer:

(b) Excise

Question 8.

The major Indirect taxes in India are …………………. and GST.

(a) Customs duty

(b) Sales tax

(c) Excise duty

(d) Stamp duty

Answer:

(a) Customs duty

Question 9.

The structure of GST in India consists of …………………. forms.

(a) 3

(b) 4

(c) 2

(d) 5

Answer:

(a) 3

Question 10.

Sales tax is an example of …………………. taxation.

(a) Progressive

(b) Proportional

(c) Regressive

(d) Degressive

Answer:

(c) Regressive

![]()

II. Fill in the blanks

- India is committed to …………………..

- The origin of the word tax is from taxation which means …………………..

- The symbol PIB means …………………..

- Goods and services tax is one of the …………………..

- ………………….. was the first country to implement GST.

- ………………….. was a multi-point tax.

- France introduced GST in the year …………………..

- Indian tax system adheres to Canon of ………………….. more than anything else.

- The ticket to amusement park is an example for ………………….. tax.

- SIT means …………………..

- ………………….. is the payment for getting any service.

- Taxation follows the principal of …………………..

Answer:

- World peace

- Estimate

- Press Information Bureau

- Indirect taxes

- France

- VAT

- 1954

- Certainty

- Entertainment

- Special Investigation Team

- Fee

- equity

![]()

III. Choose the correct statement

Question 1.

(i) Black money refers to the unaccounted money.

(ii) Taxation should be used as an instrument for controlling inflation.

(iii) Tax payer does not expect any direct benefit from direct taxes.

(iv) Unreporting income is a form of tax evasion.

(a) (i), (ii) are correct

(b) (ii), (iii), (iv) are correct

(c) (i), (iii), (iv) are correct

(d) All are correct.

Answer:

(d) All are correct.

Question 2.

(i) Foreign Account Tax Compliance Act is a recent legislation to curb black money in India.

(ii) Tax evasion is the illegal way of evading taxes by individuals only.

(iii) Overstating deductions is a form of generating black money.

(iv) Tax evasion penalties can be harsh depending on the severity of the crime.

(a) (i), (ii) are correct

(b) (ii), (iii), (iv) are correct

(c) (i), (iv) are correct

(d) All are correct

Answer:

(c) (i), (iv) are correct

Question 3.

(i) Tax evasion undermines the equity attribute of the tax system.

(ii) Each Canons of taxation has its own unique characteristics.

(iii) GST is a form of direct tax.

(iv) GST came into force from 8th Nov – 2018.

(a) (i), (ii), (iii) are correct

(b) (i), (ii) are correct

(c) (ii), (iv) are correct

(d) only (iv) is correct

Answer:

(b) (i), (ii) are correct

![]()

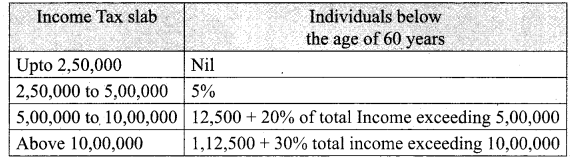

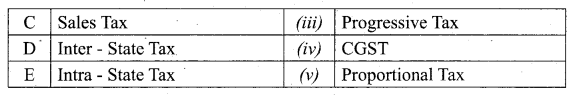

IV. Match the following

Question 1.

Match the Column I with Column II

Answer:

A. (iii)

B. (v)

C. (i)

D. (ii)

E. (iv)

Question 2.

Match the Column I with Column II.

Answer:

A. (v)

B. (iii)

C. (i)

D. (ii)

E. (iv)

V. Give Short Answers

Question 1.

Write a note on Law and Order:

Answer:

Both the Union and state governments enact numerous laws to protect our rights, properties and to regulate our economy and society. To settle disputes, the Union government has a vibrant judicial system consisting of courts at the national state and lower levels and the state government take the responsibility for administrating the police force in respective states.

Question 2.

What are the types of taxes?

Answer:

Taxes are of two types

- Direct taxes

- Indirect taxes

Direct taxes are levied on the income of the persons and the indirect taxes are levied on goods and services.

![]()

Question 3.

What is wealth tax?

Answer:

It is charged on the benefits derived from property ownership. The same property will be taxed every year on its current market value. The tax is levied on the individuals and companies alike.

Question 4.

What are the forms of tax evasion?

Answer:

The tax evasion activities include:

- Under reporting income

- Inflating deductions (or) expenses

- Hiding money

- Hiding interest in off-shore accounts

- Dishonest tax reporting

- Overstating deductions.

Question 5.

Write a short note on Excise duty.

Answer:

An excise tax is any duty on manufactured goods levied at the movements of manufacture, rather than at sale. Excise is typically imposed in addition to an indirect tax such as a sales tax.

Question 6.

State the reason”ln the case of Indirect taxes, the taxpayer is not the tax bearer why?

Answer:

In the case of Indirect taxes, the tax can be shifted to the others. That is the impact is on one person while the incidence is on the other person. Therefore, in the case of indirect taxes, the tax payer is not the tax bearer.

Question 7.

What is the main purpose of taxation?

Answer:

The main purpose of taxation is to accumulate funds for the functioning of the Government.

![]()

Question 8.

How are taxes levied in India?

Answer:

Taxes is levied in three ways

- Progressive taxation

- Proportionate taxation

- Regressive taxation

Question 9.

Which Canon of tax system does Indian tax system adhere to?

Answer:

Indian tax system adheres to Canon of Certainty Government of India announce in advance the tax system so that every tax payer is able to calculate how much tax they have to pay.

Question 10.

When was the system of income tax introduced in India? and why?

Answer:

Income tax was introduced for the first time in India by Sir James Wilson in 1860 to meet the losses for the Government because of the sepoy mutiny of 1857.

Question 11.

What is meant by canon of equity?

Answer:

The canon of equity states that the rich should pay more tax revenue to the Government than the poor, thereby we can eliminate economic differences between them.

Question 12.

What is canon of certainty?

Answer:

The canon of certainty states that the Government should announce the tax system in advance and should not change it frequently.

Question 13.

What is canon of convenience?

Answer:

Tax should be collected from a person at the time he gets enough money to pay the tax. This is called canon of convenience.

Question 14.

What is canon of Economy?

Answer:

As tax payers, people may incur cost to process their accounts, In the same way, the Government also pay salary to its taxmen to run institution. The expenditure on all this should be economised or minimised.

Question 15.

What is canon of productivity?

Answer:

When the Government levies tax that can fetch more tax revenue to them then, it is called canon of productivity.

Question 16.

What is canon of Elasticity?

Answer:

The tax system should be designed in such a way that people automatically pay more tax revenue if their income grow. This is called canon of elasticity.

![]()

VI. Brief Answer

Question 1.

Write about the different canons of taxation.

Answer:

(i) Canon of Equity:

Since tax is a compulsory payment, all economists agree that equity is the cardinal principle in designing the tax system. The equity principal says that the rich should pay more tax revenue to government than the poor, because rich has more ability than the poor to pay the tax.

(ii) Canon of certainty:

Government should announce in advance the tax system so that every tax payer will be able to calculate how much tax amount one may have to pay during a year to the government.

(iii) Canons of Economy and Convenience:

These two canons are related. As tax payers we incur a cost to process our accounts and pay the tax, for example, salary paid to accountants and auditors.

Similarly government also pays salary to its taxmen and run huge institutions. If the tax is simple, then the cost of collecting taxes (tax payer cost + tax collector cost) will be very low.

Further, tax should be collected from a person at the time he gets enough money to pay the ‘ tax. This is called canon of convenience. A convenient tax reduces the cost of collecting tax.

(iv) Canons of Productivity and Elasticity:

Government should choose the taxes that can get enough tax revenue to it. Tax is paid by the people out their incomes. Therefore the tax system should be designed in such a way that the people automatically pay more tax revenue if their incomes grow. This is called canon of elasticity.

Question 2.

What are the penalties for a tax evader?

Answer:

- If a person evade tax, he may be imprisoned upto to five years and had to pay a huge amount as fine.

- The tax evader may also be ordered to pay for the costs of prosecution.

- Other tax evasion penalties include community service, probation and restitution depending on the circumstances of the case.

- If the crime of tax evader is very severe, the penalty can be harsh also.

Question 3.

What are the main differences between tax and other payments.

Answer:

Tax:

- It is a compulsory payment to the Government.

- Tax payer cannot expect direct benefit after paying taxes.

- Tax payer has to pay the tax once it is imposed. Otherwise he/she will be penalised.

- The purpose of levying tax is general. Money is used for the welfare of the people.

- Eg: Income tax, gift box, wealth tax etc.,

Payments:

- It is voluntary payment for getting any service.

- Once payment is done, the person can expert direct benefit from it.

- Payment need not be paid if the service is not necessary for a person.

- The purpose of making payments is to enjoy certain special benefits.

- Eg: Driving license, stamp fee, fee for Government Registration etc.,

Question 4.

What are the recent legislative measures to curb black money in India.

Answer:

- SIT – Special Investigation Team on black money under Chairman and (Vice – Chairman of two former judges of the Supreme Court.)

- The black money (undisclosed Foreign Income and Assets) and Imposition of,tax Act – 2015.

- MAG – Constitution of Multi Agency Group.

- DTAAS – Double Taxation Avoidance Agreement.

- FATCA – Foreign Account Tax Compliance Act.

- Money Laundering Act.

- Enactment of the Benami Transaction Amendment Act.

- Launching of Operation clean money.

- Lokpal and Lokayukta Act.

- The Real Estate Regulation and Development Act of 2016.

![]()

Question 5.

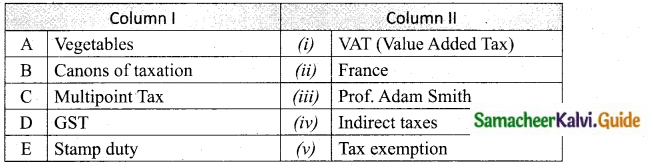

How are taxes leevied in India.

Answer:

Taxes is levied by the Government progressively, proportionately as well as Regressively.

Progressive Tax: Progressive Tax rate is one in which the rate of taxation increase as the tax base increases. When income increases, the tax rate also increases. This is known as a progressive tax.

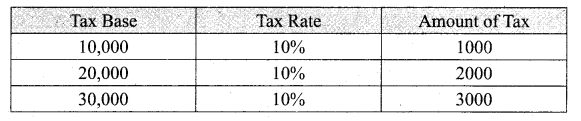

Proportional Tax: Tax levied on goods and services in fixed portion is known as proportionate taxes. Tax amount varies in the same proportion to that of Income.

Regressive Tax: It implies that higher the rate of tax, lower the income groups than in the case of higher income groups.

That is, tax is levied uniformly at a flat percentage regardless who the purchaser or owner Eg: Sales Tax, Property Tax.

![]()

Question 6.

As per the Interim budget for the financial year 2019 – 20, State the areas from where money / rupee is earned and spend hy Government of India (GOI).

Answer:

Earning money through:

- Income Tax, Corporation tax

- Customs

- Union excise duties

- GST

- Borrowing and other liabilities

- Non – dept capital assets

- Non – Tax Revenues

Money goes to:

- Interest payments

- Central sector schemes

- Centrally sponsored scheme

- Pension and other expenditure

- State share of duties and taxes

- Defence

- Subsidies

- Finance commission and

- Other transfers.