Tamilnadu State Board New Syllabus Samacheer Kalvi 11th Accountancy Guide Pdf Chapter 12 Final Accounts of Sole Proprietors – I Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 12 Final Accounts of Sole Proprietors – I

11th Accountancy Guide Final Accounts of Sole Proprietors – I Text Book Back Questions and Answers

I. Multiple Choice Questions

Choose the correct answer.

![]()

Question 1.

Closing Stock is an item of ________.

a) Fixed Asset

b) Current asset

c) Fictitious Asset

d) Intangible asset

Answer:

b) Current asset

Question 2.

Balance sheet is ________.

a) An account

b) A statement

c) Neither a statement nor an account

d) None of the above

Answer:

b) A statement

Question 3.

Net profit of the business increases the ________.

a) Drawings

b) Receivables

c) Debts

d) Capital

Answer:

d) Capital

Question 4.

Carriage inwards will be shown ________ .

a) In the trading account

b) In the profit and loss account

c) On the liabilities side

d) On the assets side

Answer:

a) In the trading account

Question 5.

Bank overdraft should be shown ________.

a) In the trading account

b) Profit and loss account

c) On the liabilities side

d) On the assets side

Answer:

c) On the liabilities side

![]()

Question 6.

Balance sheet shows of the business ________.

a) Profitability

b) Financial position

c) Sales

d) Purchases

Answer:

b) Financial position

Question 7.

Drawings appearing in the trial balance is ________.

a) Added to the purchases

b) Subtracted from the purchases

c) Added to the capital

d) Subtracted from the capital

Answer:

d) Subtracted from the capital

Question 8.

Salaries appearing in the trial balance is shown on the ________.

a) Debit side of trading account

b) Debit side of profit and loss account

c) Liabilities side of the balance sheet

d) Assets side of the balance sheet

Answer:

b) Debit side of profit and loss account

Question 9.

Current assets does not include ________.

a) Cash

b) Stock

c) Furniture

d) Prepaid expenses

Answer:

c) Furniture

Question 10.

Goodwill is classified as ________.

a) A current asset

b) A liquid asset

c) A tangible asset

d) An intangible asset

Answer:

d) An intangible asset

![]()

II. Very Short Answer Type Questions

Question 1.

Write a note on trading account.

Answer:

- Trading refers to buying and selling of goods with the intention of making profit.

- Trading account is a nominal account which shows the result of buying and selling of goods for an accounting period.

- It is prepared to find out the difference between the revenue from sales and cost of goods sold.

Question 2.

What are wasting assets?

Answer:

- When the asset is used regularly, it depreciates, eventually having little or no residual value.

- During the period of depreciation, the asset is called a “wasting asset”.

- Example, natural resources, such as gas and timber, are wasting assets that eventually are used and then have no remaining value.

Question 3.

What are fixed assets?

Answer:

- Fixed assets are those assets which are acquired or constructed for continued use in the business and last for many years such as land and building, plant and machinery, motor vehicles, furniture etc.

- It is classified into a. Tangible Assets and b. Intangible Assets.

Question 4.

What is meant by purchases returns?

Answer:

- Purchases returns or returns outwards, are a normal part of business.

- Goods may be returned to supplier if they carry defects or if they are not according to the specifications of the buyer.

Question 5.

Name any two direct expenses and indirect expenses. .

Answer:

- Direct Expenses: Carriage inwards, Wages, Import Duty, and Royalty

- Indirect Expenses: Office Expenses, Selling Expenses, Administrative Expenses

![]()

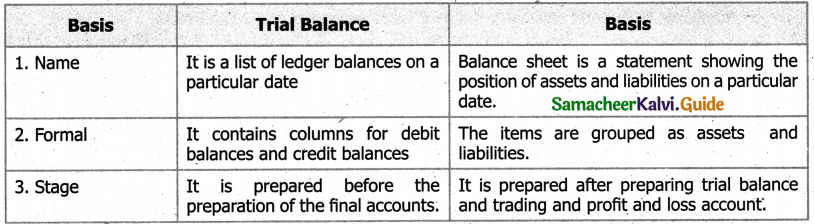

Question 6.

Mention any two differences between trial balance and balance sheet.

Answer:

Question 7.

What are the objectives of preparing trading account?

Answer:

- Trading account provideds information about gross profit and gross loss.

- It provides an opportunity to safeguard against possible losses.

- It provides information about direct expenses and direct incomes.

Question 8.

What is the need for preparing profit and loss account?

Answer:

- Ascertainment of net profit and net loss

- To compare the profits

- To have a control on expenses

- It is used to prepare the balance sheet

III. Short Answer Questions

Question 1.

What are final accounts? What are its constituents?

Answer:

- The business entities are interested in knowing periodically the results of business operations carried on and the financial soundness of the business.

- In other words, they want to know the profitability and the financial position of the business.

- These can be ascertained by preparing the final accounts or financial statements.

- The final accounts are usually prepared at the end of the accounting period on the basis of balances of ledger accounts shown by the trial balance.

The final accounts or financial statements include the following:

- Income Statement or Trading and Profit and Loss Account and

- Position Statement or Balance Sheet.

The purposes of preparing the financial statements are:

- To ascertain the financial performance of an enterprise and

- To ascertain the financial position of an enterprise.

- The income statement and balance sheet are prepared for these purposes respectively.

- Income statement gives the manner in which the profit or loss for an accounting period is arrived at.

- Hence, at the close of the accounting period, all nominal accounts (i.e. expenses, losses, revenues, gains, purchases, purchases returns, sales and sales returns) are to be closed by transferring to the income statement or trading and profit and loss account.

![]()

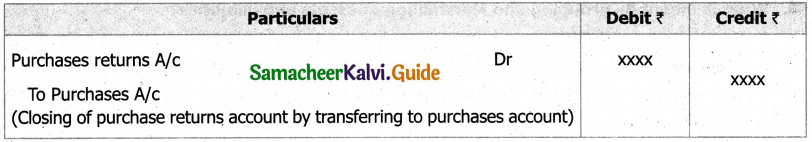

Question 2.

What is meant by closing entries? Why are they passed?

Answer:

1. Balances of all the nominal accounts are required to be closed on the last day of the accounting year to facilitate the preparation of trading and profit and loss account.

2. It is done by passing necessary closing entries in the journal proper.

3. Purchases have debit balance and a purchases return has credit balance.

4. At the end of the accounting year, the balance in purchases returns account is closed by transferring to purchases account.

5. Similarly, sales account has credit balance and sales returns have debit balance.

6. At the end of the accounting year, the balance in sales returns account is closed by transferring to sales account.

7. The various closing entries are as follows

(e.g.) for closing purchases returns account

Question 3.

What is meant by gross profit and net profit?

Answer:

Gross profit:

- The difference between the totals of two sides of the trading account indicates either gross profit or gross loss.

- If the total of the credit side is more, the difference represents gross profit.

- On the other hand, if the total of the debit side is higher, the difference represents gross loss.

- The gross profit or gross loss is transferred to profit and loss account.

Net profit:

- After debiting indirect expenses and losses and crediting all indirect incomes and gains, if the total of the credit side of the profit and loss account exceeds the debit side, the difference is termed as net.

- profit.

- On the other hand, if the total in the debit side exceeds the credit side, the difference is termed as net loss. Net profit or net loss is transferred to the capital account.

Question 4.

“Balance sheet is not an account”- Explain.

Answer:

1. A balance sheet is a part of the final accounts. However, the balance sheet is a statement and not an account. It has no debit or credit sides and as such the words ‘To’ and ‘By’ are not used before the names of the accounts shown therein.

2. A balance sheet is a summary of the personal and real accounts, which have balances. Personal and real accounts having debit balances are shown on the right hand side known as assets side, whereas personal and real accounts having credit balances are shown on the left hand side known as liabilities side.

3. The totals of the two sides of the balance sheet must be equal. If the totals are not equal, it indicates existence of error. It must satisfy the accounting equation, i.e., Assets = Capital + Liabilities, following the dual aspect concept.

4. Balance sheet is prepared on a particular date and not for a fixed period. It discloses the financial position of a business on a particular date. It gives the balances only for the date on which it is prepared.

5. It shows the financial position of the business according to the going concern concept.

Question 5.

What are the advantages of preparing a balance sheet?

Answer:

1. The main purpose of preparing a balance sheet is to ascertain the true financial position of the business at a particular point of time.

2. It helps in comparing the cost of various assets of the business such as the amount of closing stock, amount due from debtors, amount of fictitious assets, etc.

Moreover as assets and liabilities of similar nature are grouped and presented in balance sheet, a comparative study of these assets and liabilities is facilitated. It helps in comparing the various liabilities of the business.

3. It helps in finding out the solvency position of the firm. The firm’s solvency position is favourable if the assets exceed the external liabilities. The firm’s solvency position is not favourable it the external liabilities exceed the assets.

Question 6.

What is meant by grouping and Marshalling of assets and liabilities?

Answer:

- The assets and liabilities shown in the balance sheet are grouped and presented in a particular order.

- The term ‘grouping’ means showing the items of similar nature under a common heading.

- For example, the amount due from various customers will be shown under the head ‘Sundry debtors/ Similarly, under the head ‘Current assets’, the balance of cash, bank, debtors, stock and other current assets will be shown.

- ‘Marshalling’ is the arrangement of various assets and liabilities in a proper order.

- Marshalling can be made in one of the following two ways:

a) In the order of liquidity:

- According to this method, an asset which is most easily convertible into cash, i.e., cash in hand is shown first and then will follow those assets which are comparatively less easily convertible, So that the least liquid asset i.e., goodwill is shown last.

- In the same way, the liabilities which are to be paid at the earliest will be shown first. In other words, current liabilities are shown first, then fixed or long-term liabilities and finally the proprietor’s capital.

b) In the order of permanence:

- This method is exactly the reverse of the first method.

- Asset which is more permanent, i.e., goodwill is shown first followed by assets which are less permanent. Similarly, those liabilities which are to be paid last will be shown first.

- In other words, the proprietor’s capital is shown first, then fixed or long-term liabilities and lastly the current liabilities. Joint stock companies are required under the Companies Act to prepare their balance sheet in the order of permanence.

![]()

IV. Exercises

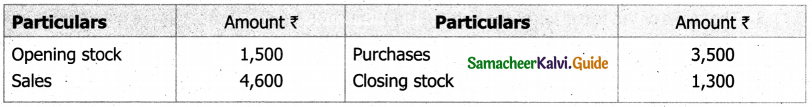

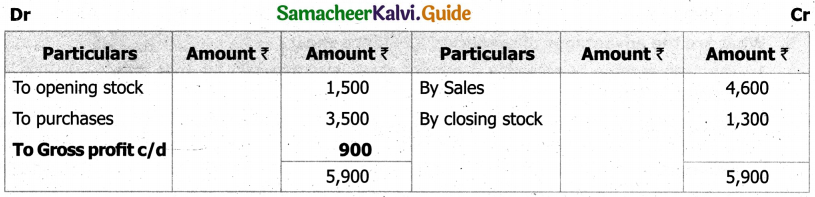

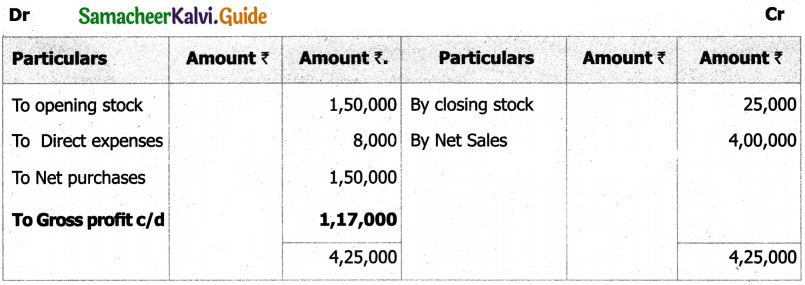

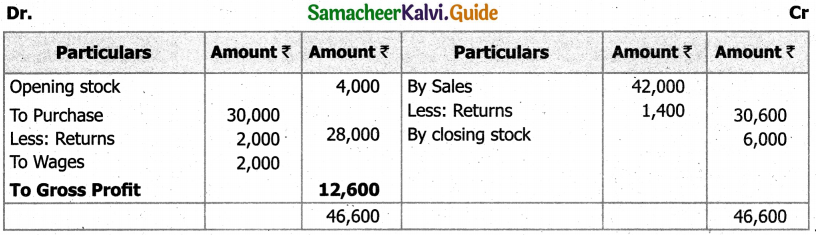

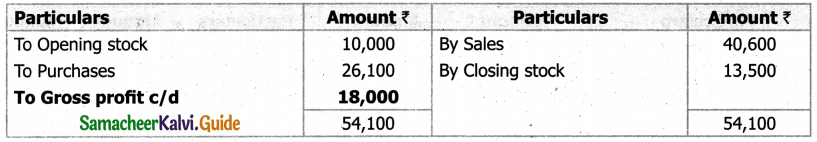

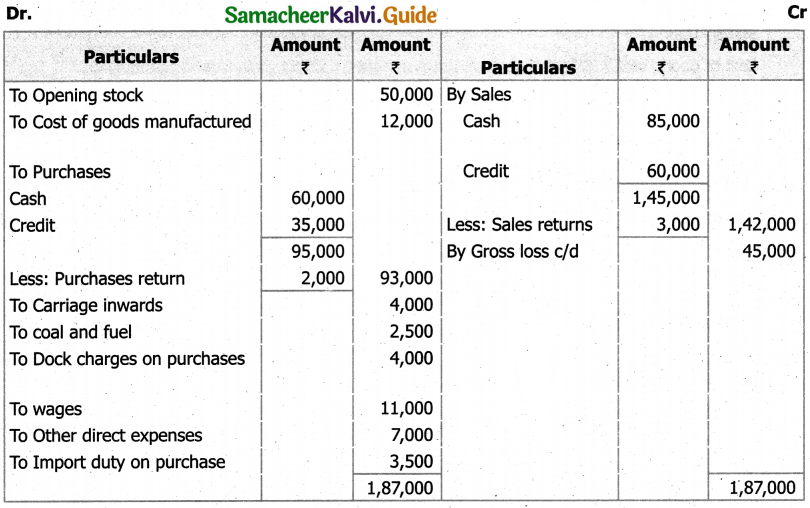

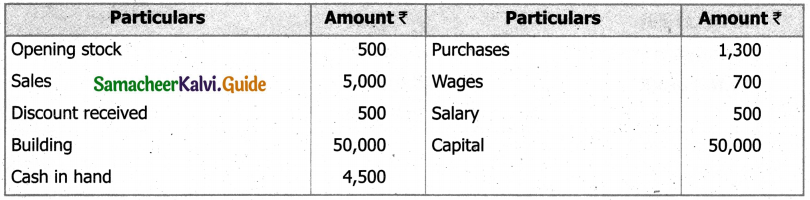

Question 1.

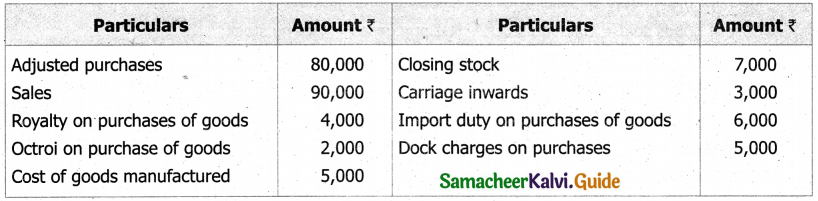

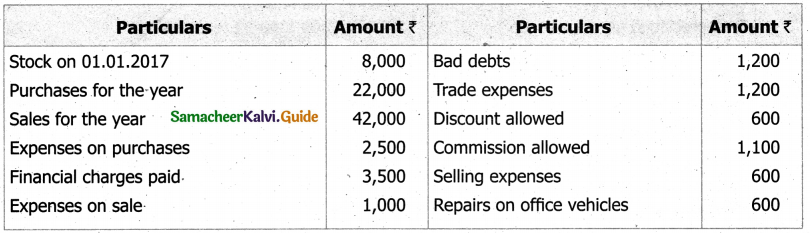

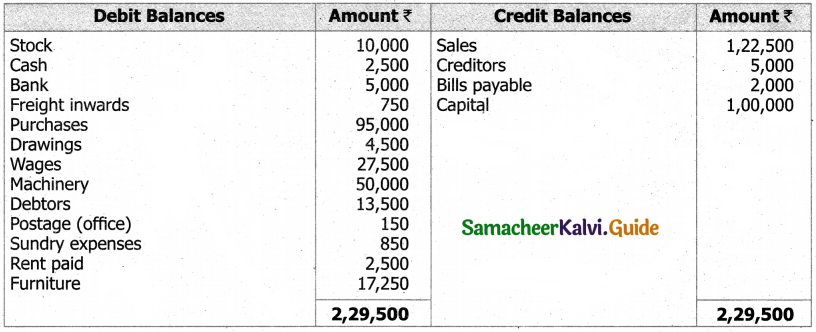

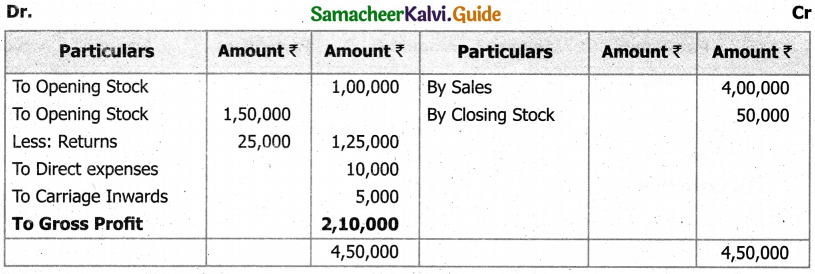

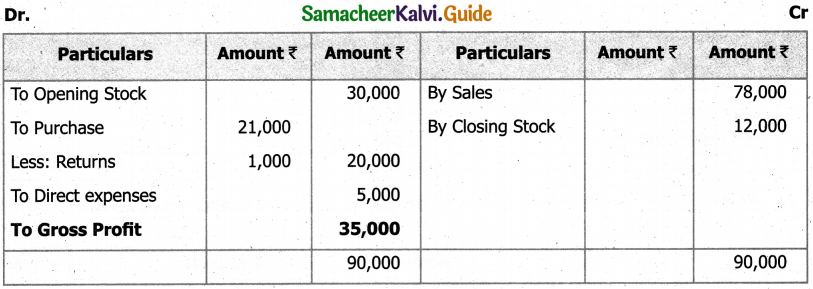

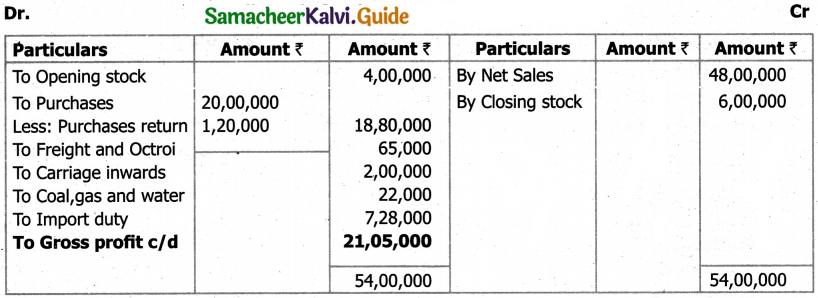

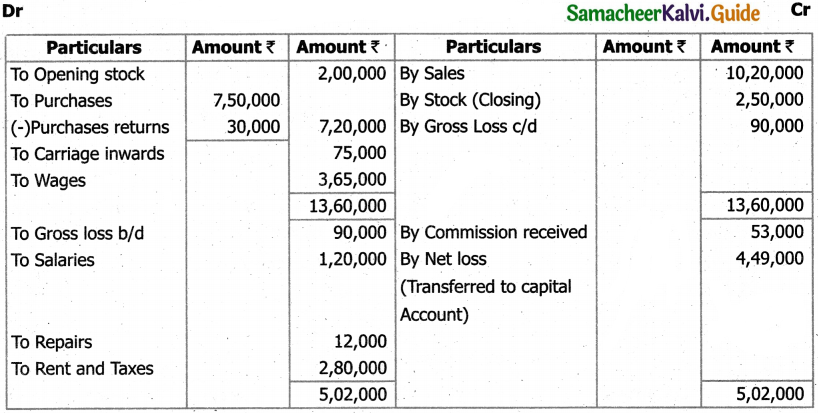

Prepare trading account in the books of Sivashankar from the following figures

Solution:

Trading account

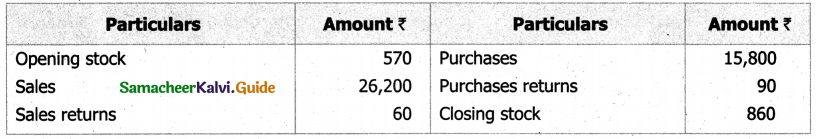

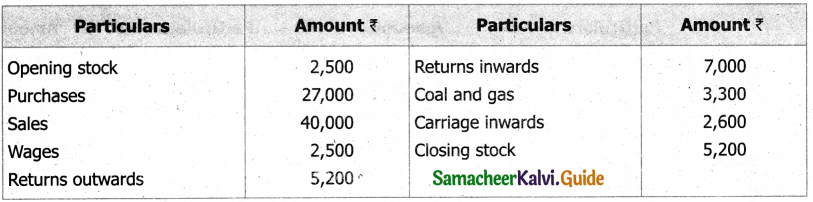

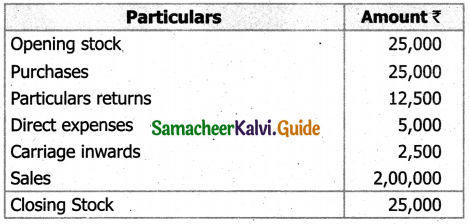

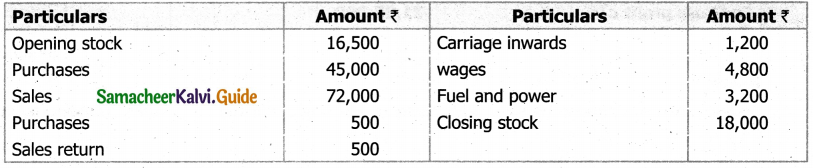

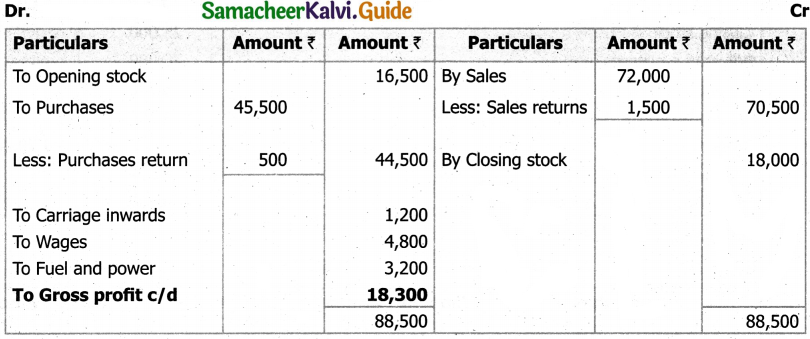

Question 2.

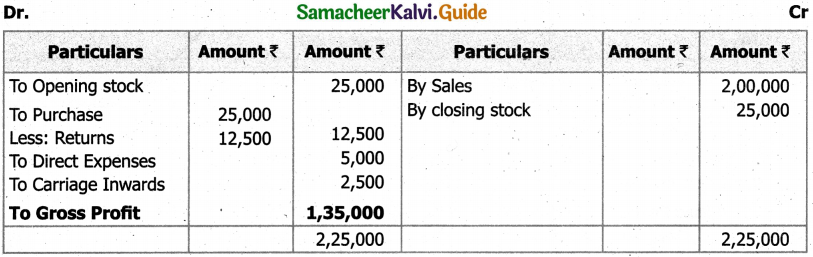

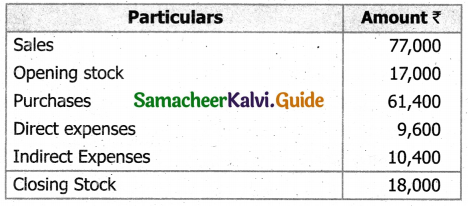

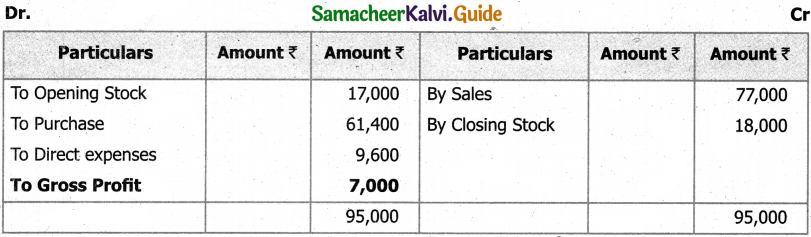

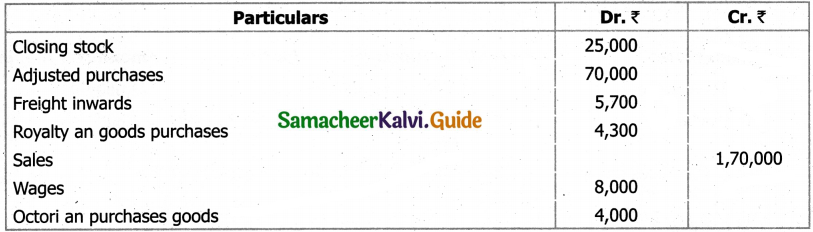

Prepare trading account in the books of Mr. Sanjay for the year ended 31st December 2017

Solution:

Trading account as on 31st Dec 2017

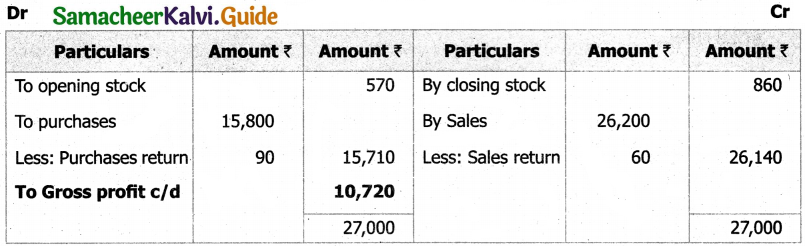

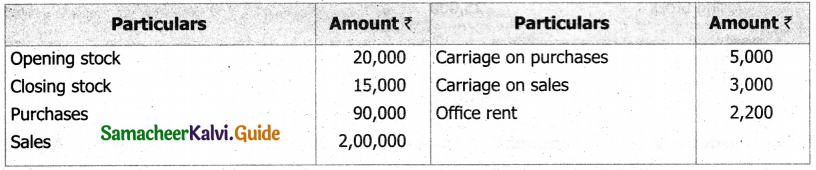

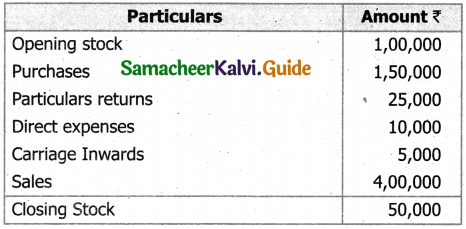

Question 3.

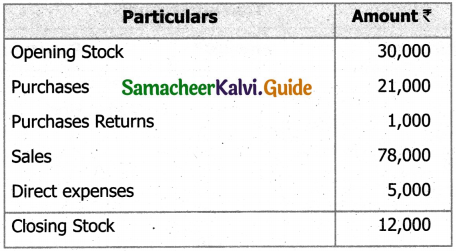

From the following balances taken from the books of Saravanan, calculate gross profit for the year ended December 31, 2017

Solution:

Trading account as on 31st Dec 2017

Question 4.

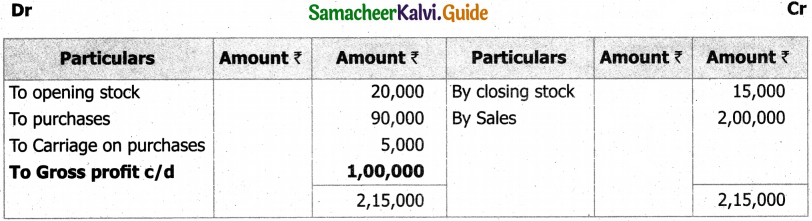

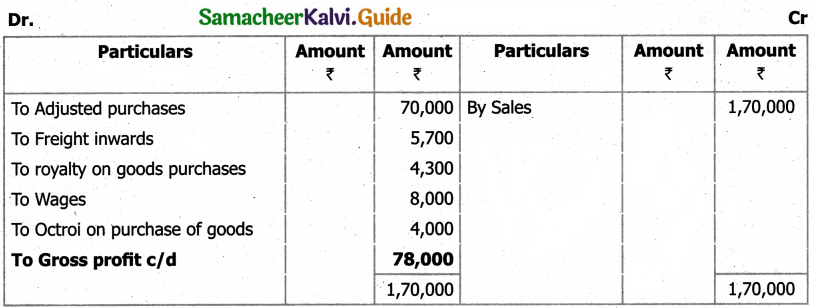

From the following details for the year ended 31st March, 2018, prepare trading account.

Solution:

Trading account as on 31st Mar 2018

Question 5.

Ascertain gross profit or gross loss from the following:

Solution:

Trading account

Question 6.

From the following balances taken from the books of Victor, prepare trading account for the t year ended December 31, 2017:

Solution:

Trading account as on 31st Dec 2017

Question 7.

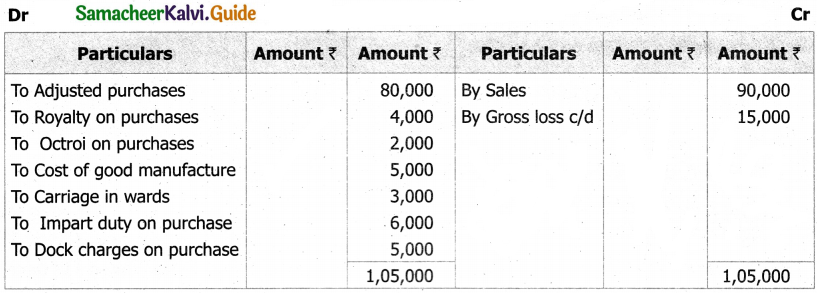

Compute cost of goods sold from the following information

Solution:

Compute cost of goods sold from the following information.

Cost of goods sold = Opening stock + Net purchases + Direct expenses – Closing stock

= 10,000 + 80,000 + 7,000 -15,000 .

= ₹ 82,000

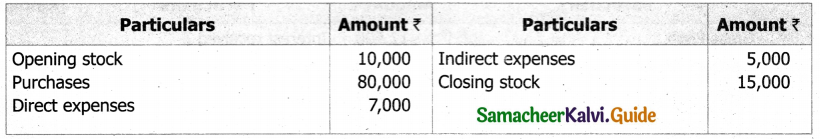

Question 8.

Find out the amount of sales from the following information:

Solution:

Find out the amount of sales from the following information:

Cost of goods sold = Opening stock + Net purchases – Closing stock

= 30,000 + 2,00,000 – 20,000

= ₹ 2,10,000

Let the sales be = 100

Less: Gross profit (30% on sales i.e,100) = 30

Cost of goods sold = ₹ 70

Therefore percentage of gross profit on cost of goods sold is \(\frac { 30 }{ 70 }\) x 100

= 42.86%

Gross profit = 42.86% on ₹ 2,10,000

i.e = \(\frac { 42.86 }{ 100 }\) x 2,10,000

= 90,000

Sales = Cost of goods sold + Gross profit

= 2,10,000 + 90,000

Sales = ₹ 3,00,000

![]()

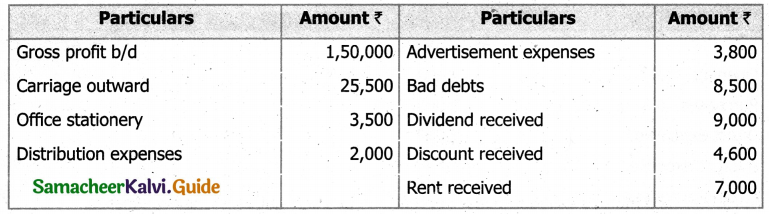

Question 9.

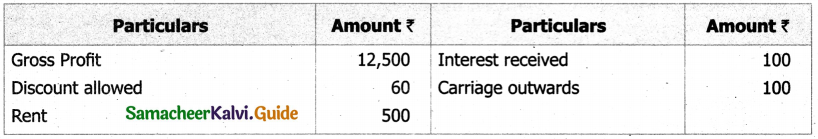

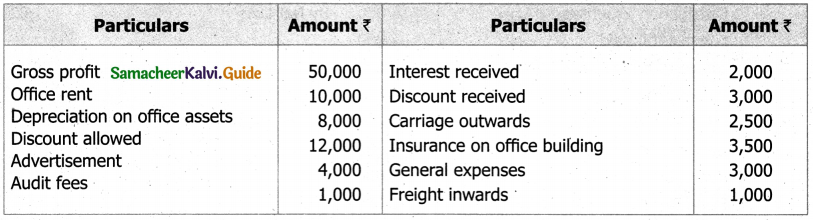

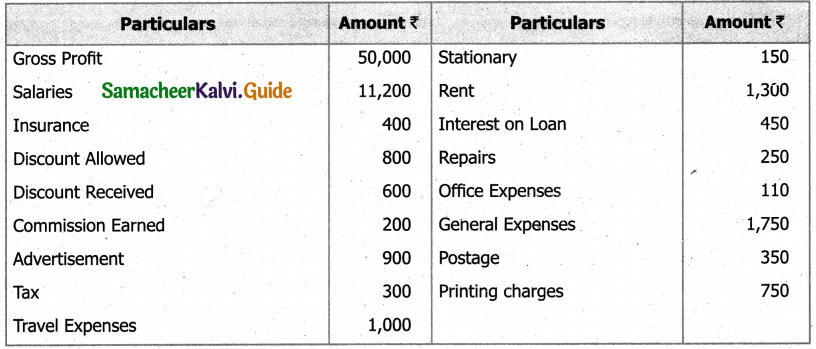

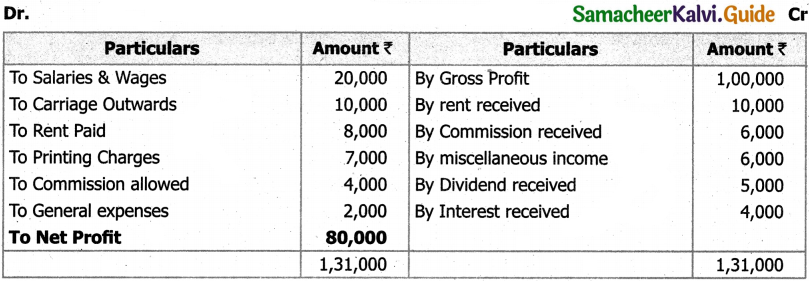

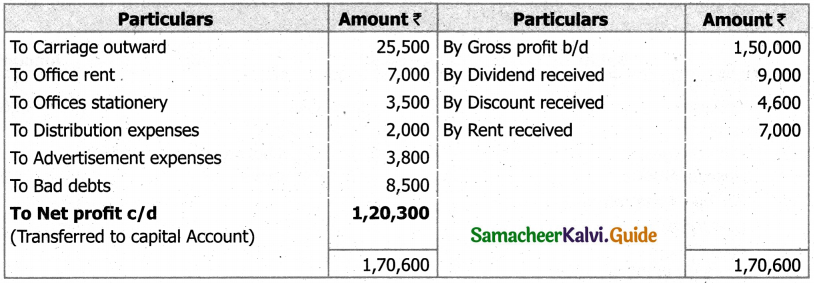

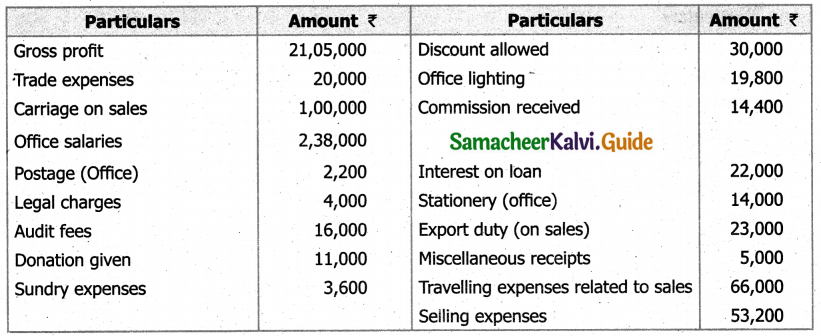

Prepare profit and loss account in the books of Kirubavathi for the year ended 31st December, 2016 from the following information:

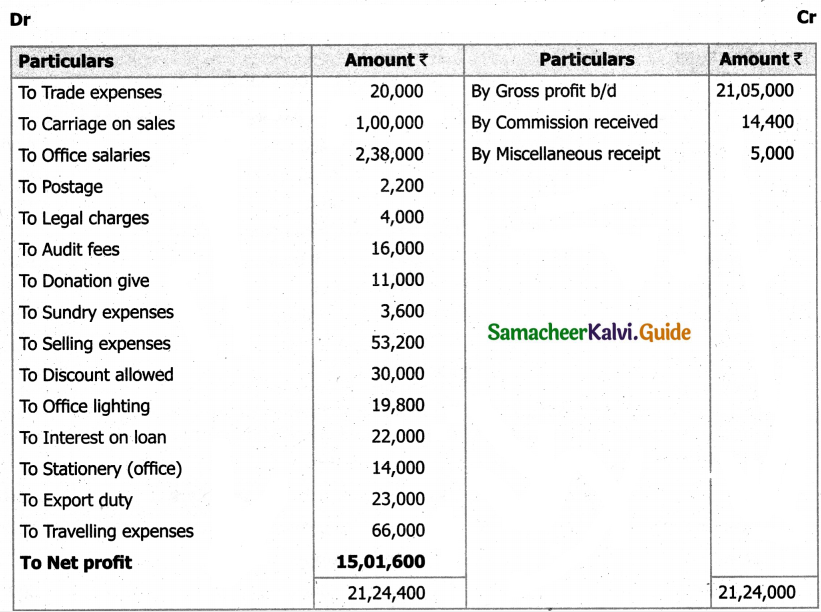

Solution:

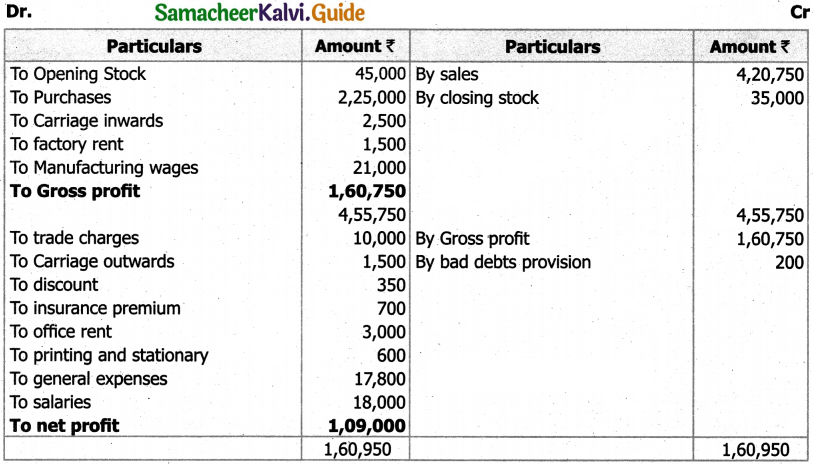

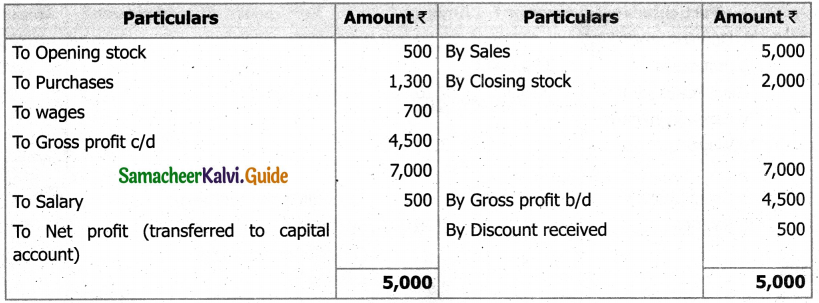

Trading account as on 31st Dec 2016

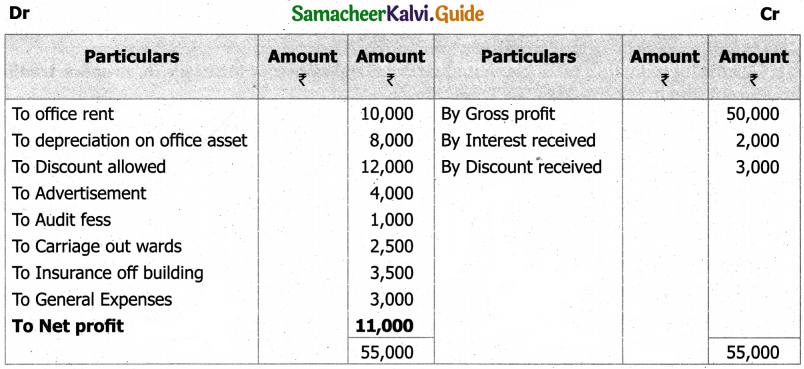

Question 10.

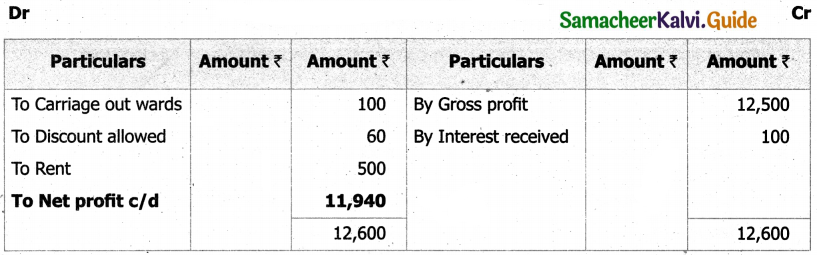

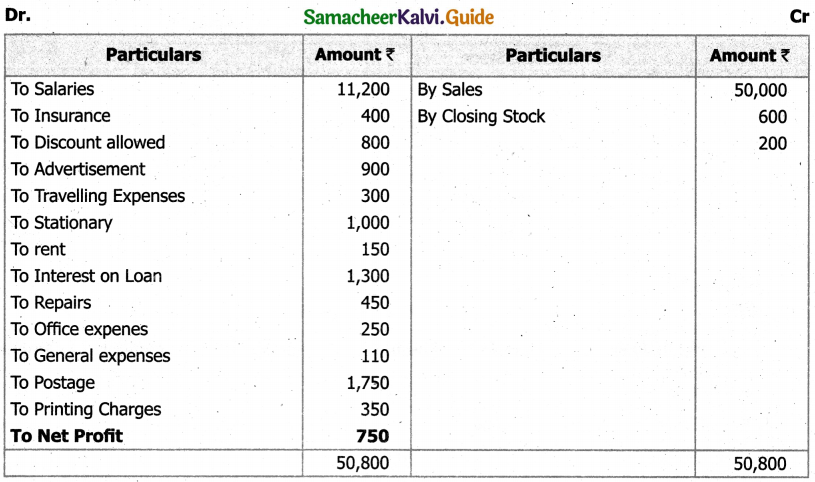

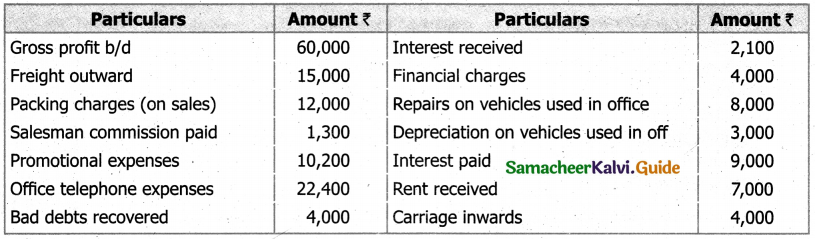

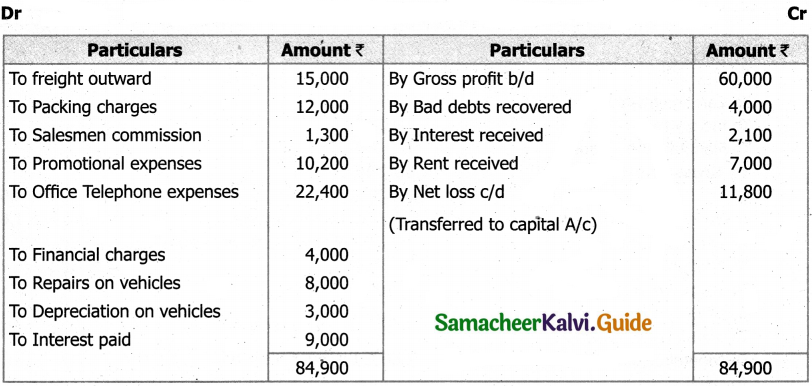

Ascertain net profit or net loss from the following:

Solution:

Trading account

Question 11.

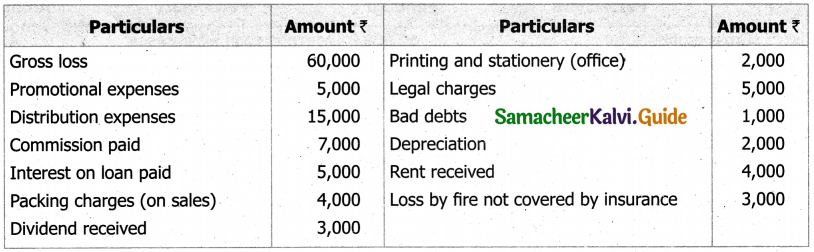

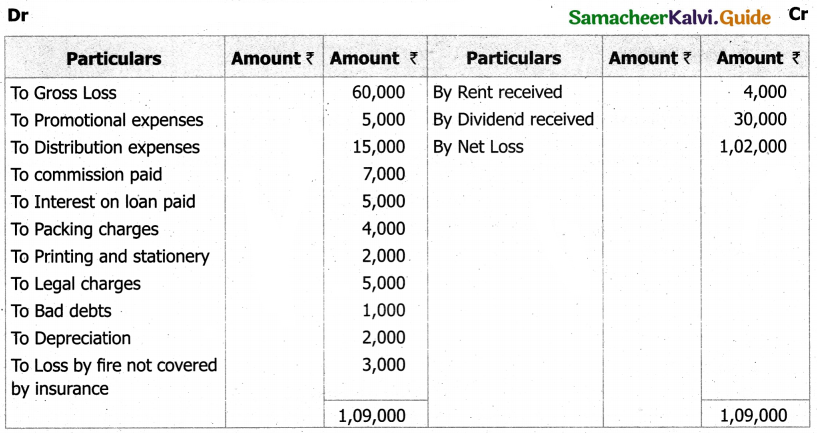

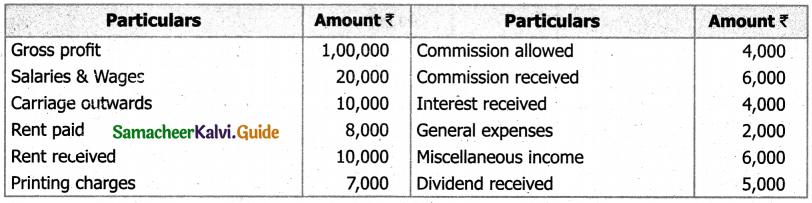

From the following details, prepare profit and loss account.

Solution:

Trading account

Question 12.

From the following information, prepare profit and loss account for the year ending 31st December, 2016.

Solution:

Trading account as on 31st Dec 2016

Question 13.

From the following balances obtained from the books of Mr. Ganesh, prepare trading and profit and loss account.

Solution:

Trading and Profit & loss account

![]()

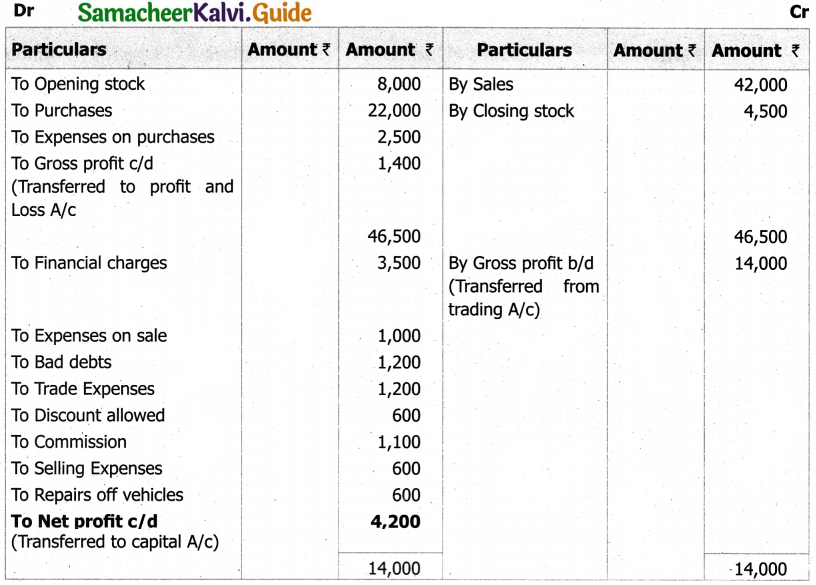

Question 14.

From the following balances extracted from the books of a trader, ascertain gross profit and net profit for the year ended March 31st, 2017.

Closing stock on December 31.12.2017 was ₹ 4,500

Solution:

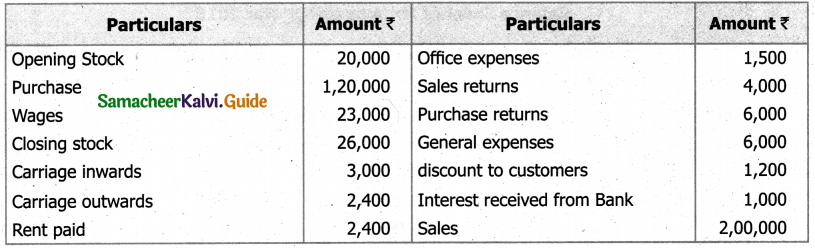

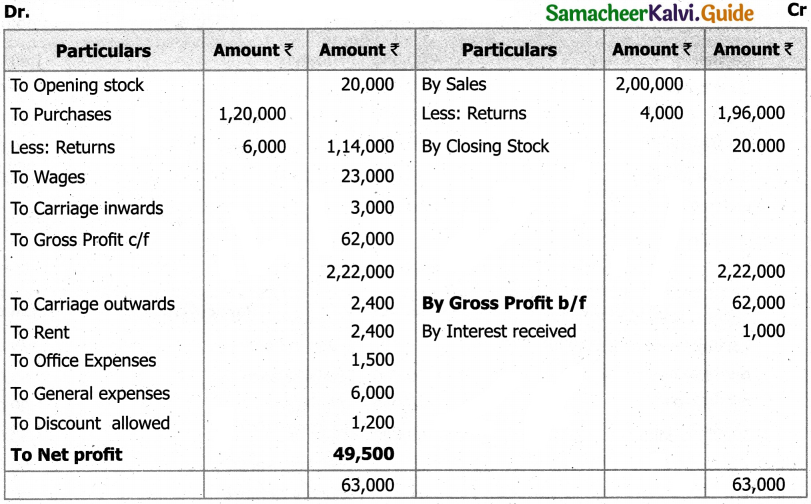

Trading and Profit & loss A/c for the year ended 31st Mar 2017

Question 15.

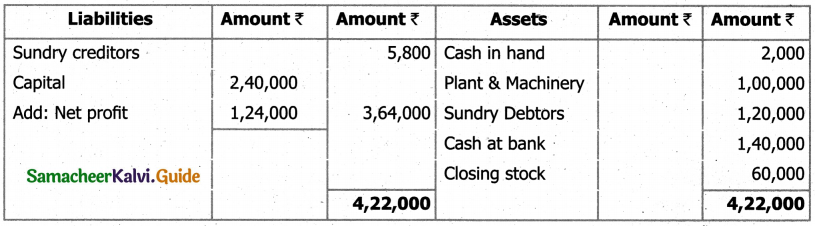

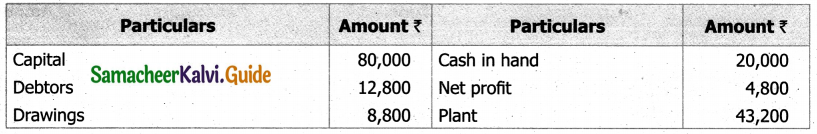

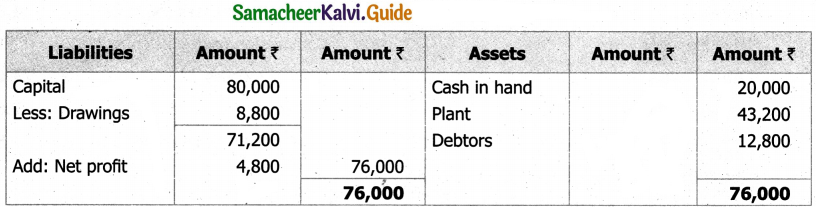

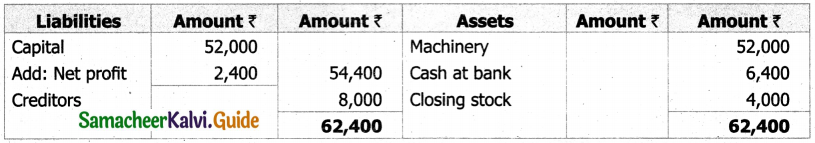

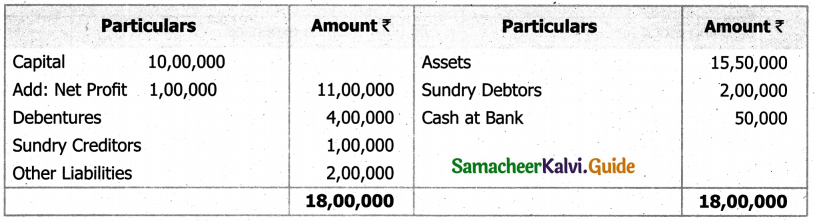

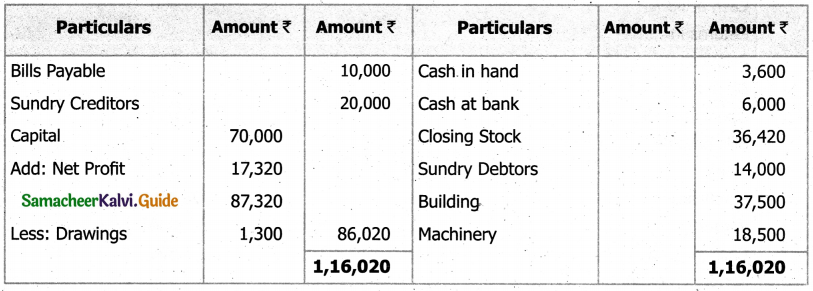

From the following particulars, prepare balance sheet in the books of Bragathish as on 31st December, 2017

Solution:

Balance Sheet as on 31st Dec 2017

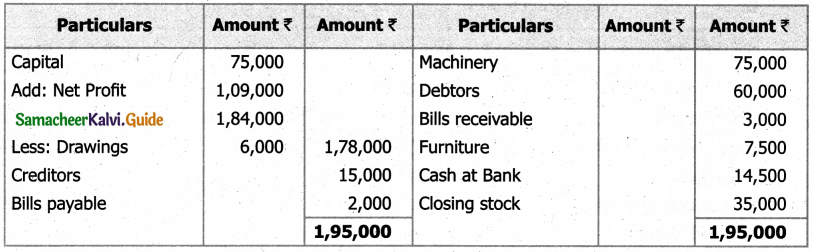

Question 16.

Prepare trading and profit and loss account in the books of Ramasundari for the year ended 31st December, 2017 and balance sheet as on that date from the following information:

Solution:

Trading and Profit & loss A/c for the year ended 31st Dec 2017

Balance Sheet as on Ramasundari on 31st December 2017

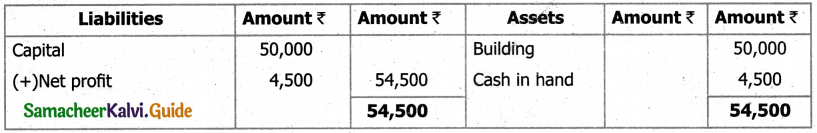

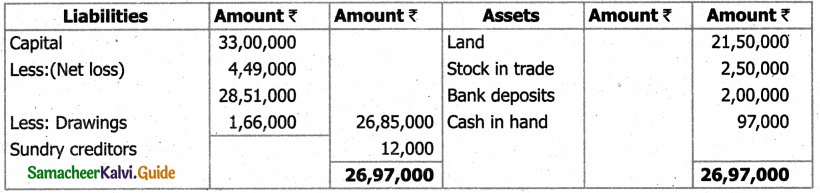

Question 17.

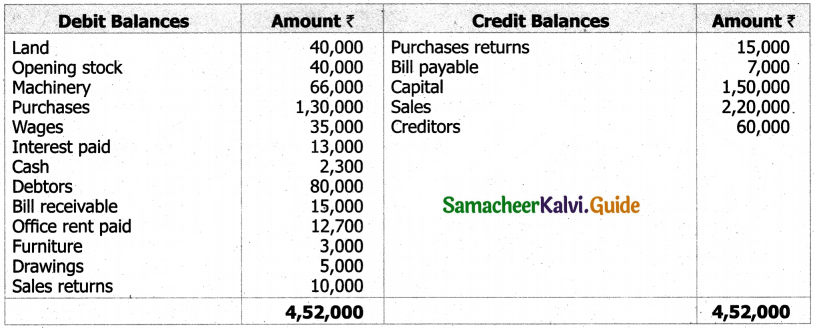

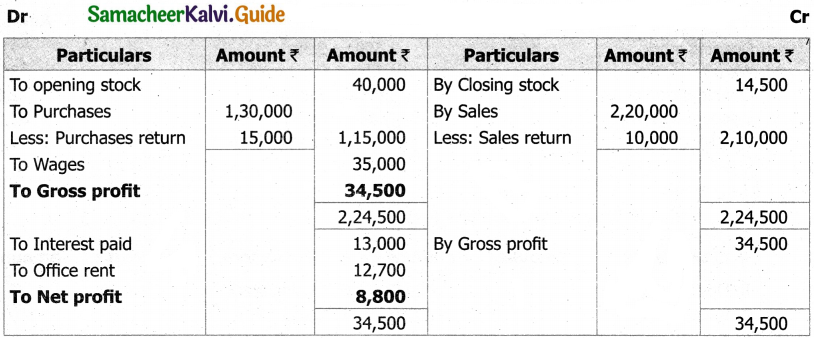

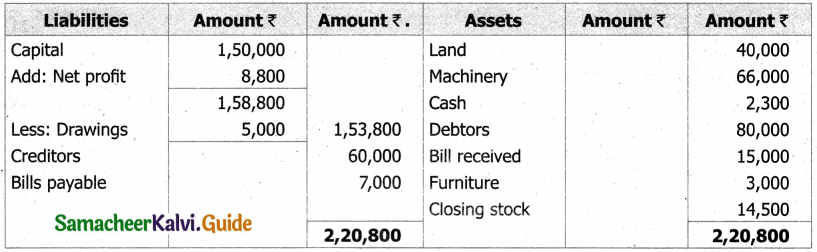

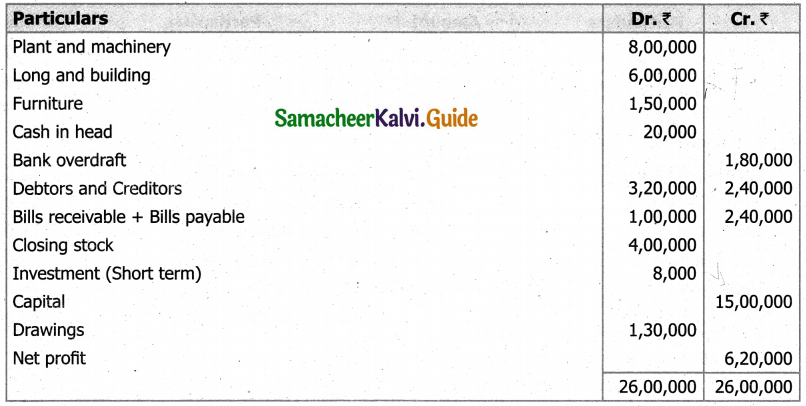

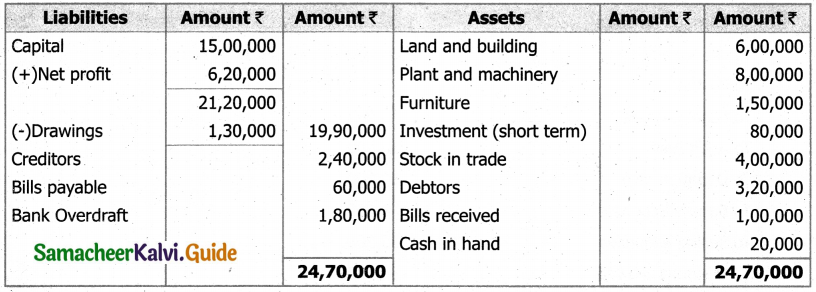

From the Trial balance, given by Saif, prepare final accounts for the year ended 31st March, 2018 in his books.

Closing stock (31-12-2017) ₹ 14,500

Solution:

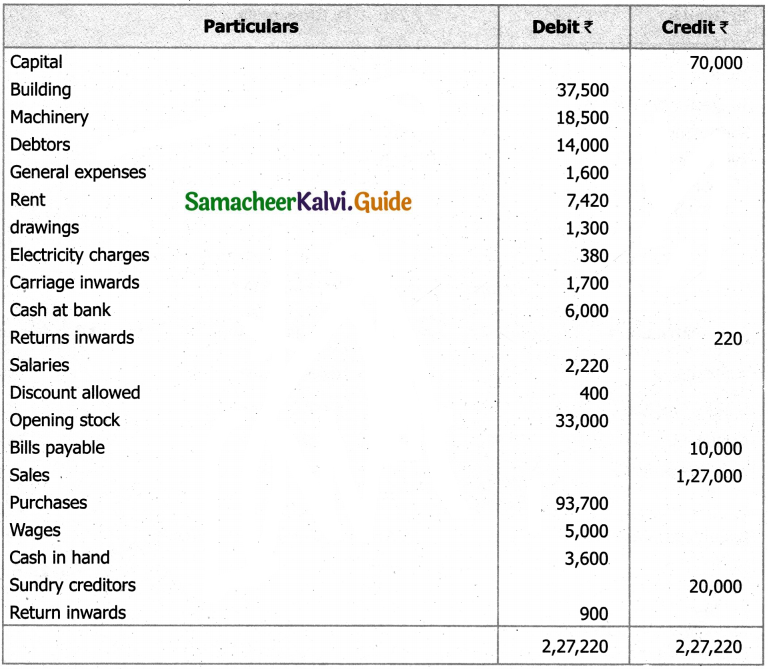

Trading and Profit & loss A/c for the year ended 31st Mar 2018

Balance sheet of saif on 31st Mar 2018

Question 18.

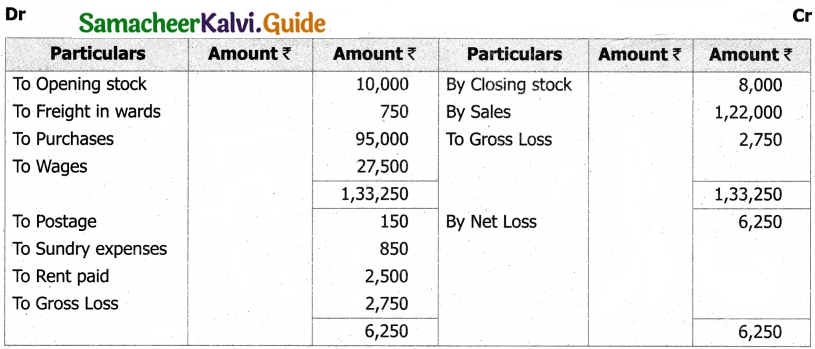

Prepare trading and profit and loss account and balance sheet in the books of Deri, a trader, from the following balances as on March 31, 2018.

Closing stock (31st March, 2018) ₹ 8,000

Solution:

Trading and Profit & loss A/c for the year ended 31st Mar 2018

Balance sheet of Deri as on 31st March 2018.

![]()

11th Accountancy Guide Final Accounts of Sole Proprietors – I Additional Important Questions and Answers

I. Choose the correct answer.

Question 1.

Carriage outwards will be shown ________.

a) In the trading account

b) In the profit and loss account

c) On the liabilities side

d) On the assets side

Answer:

b) In the profit and loss account

Question 2.

Opening stock is ________.

a) Debited in trading account

b) Credited in trading account

c) Credit ¡n profit and loss account

d) Debited in profit and loss account

Answer:

a) Debited in trading account

Question 3.

___________ account enables the trader to find out gross profit or loss.

a) Trading Account

b) Profit and loss Account

c) Balance sheet

d) Trial balance

Answer:

a) Trading Account

Question 4.

__________ account enables the trader to find out Net profit or loss.

a) Trading Account

b) Profit and loss Account

c) Balance sheet

d) Trial balance

Answer:

b) Profit and loss Account

Question 5.

Fixed assets does not include ________.

a) Plant

b) Stock

c) Furniture

d) Computer

Answer:

c) Furniture

Question 6.

Current Liabilities does not include ________.

a) Sundry Creditors

b) Bills Payable

c) Debentures

d) Outstanding Expenses

Answer:

c) Debentures

![]()

Question 7.

All incomes are ________ in the profit and loss account.

a) Debited

b) Credited

c) Assets

d) Liabilities

Answer:

b) Credited

Question 8.

Bad debt is a ________ expense.

a) Office expenses

b) Administrative expenses

c) Selling expenses

d) Distribution expenses

Answer:

c) Selling expenses

Question 9.

Wages is an example of ________.

a) Capital expenses

b) Indirect expenses

c) Direct expenses

d) Revenue expenses

Answer:

c) Direct expenses

Question 10.

Fixed assets have ________.

a) Short life

b) long life

c) no life

d) All of these

Answer:

b) long life

Question 11.

________ refers to buying and selhng of goods with the intention of making profit.

a) Trading

b) Trial balance

c) Profit and loss account

d) Balance sheet

Answer:

a) Trading

Question 12.

The goods remaining unsold at the end of the accounting period are known as _________

a) Opening stock

b) Closing stock

c) Average stock

d) None of these

Answer:

b) Closing stock

Question 13.

________ is the arrangement of various assets and liabilities in a proper order.

a) Marshalling

b) Grouping

c) Recording

d) Packing

Answer:

a) Marshalling

![]()

Question 14.

Net profit or Net loss ¡s traflsferred to the ________ account.

a) Trading

b) Profit and loss

c) Capital

d) None of these

Answer:

c) Capital

Question 15.

Gross profit or Grosš loss is transferred to the _______ account.

a) Trading

b) Profit and loss

c) Capital

d) None of these

Answer:

b) Profit and loss

II. Very Short Answer Type Questions

Question 1.

Definition of trading accounting?

Answer:

According to J. R. Batliboi, “The trading account shows the results of buying and selling of goods. In preparing this account, the general establishment charges are ignored and only the transactions in goods are included.”

Question 2.

What is opening stock?

Answer:

The stock of goods remaining unsold at the end of the previous year is the opening stock of the current year. This item will not be there in a newly started business. It will not appear if it is adjusted with pur-chases. As opening stock would have been sold during the year, the cost of opening stock is included in trading account.

Question 3.

What do you mean by direct expenses?

Answer:

All the expenses incurred on the purchase of goods and for bringing the goods to the go down or place of business and to make them to saleable condition are known as direct expenses.

Question 4.

What is Carriage inwards or Freight inwards?

Answer:

Amount paid for transporting the goods purchased to the go down or business premises is called carriage inwards or carriage on purchases or freight inwards.

Question 5.

What is Wages?

Answer:

Amount paid to workers who are directly engaged in loading, unloading and handling of goods purchased is known as wages.

Question 6.

What is Dock Charges?

Answer:

These are the charges levied for shipping the cargo while entering or leaving docks. When they are paid on import of goods, they are treated as direct expenses.

![]()

Question 7.

What do you mean by direct expenses?

Answer:

The goods remaining unsold at the end of the accounting period are known as closing stock. They are valued at cost price or net realisable value (market price) whichever is lower.

Question 8.

Definition of Profit and Loss?

Answer:

According to Prof. Carter, “A Profit and Loss Account is an account into which all gains and losses are collected, in order to ascertain the excess of gains over the losses or vice-versa”.

Question 9.

Definition of Balance Sheet?

Answer:

According to J.R. Batliboi, “A Balance Sheet is a statement prepared with a view to measure the exact financial position of a business on a certain fixed date.”

Question 10.

State Methods of drafting a balance sheet.

Answer:

The balance sheet of business concern can be presented in the following two forms.

- Horizontal form

- Vertical form

Question 11.

Explain the Tangible fixed assets?

Answer:

Tangible fixed assets are those which have physical existence or which can be seen and felt. Examples: plant and machinery, building and furniture.

![]()

III. Short Answer Questions

Question 1.

What do you mean by current assets?

Answer:

- Current assets are those assets which are either in the form of cash or can be easily converted into cash in the normal course of business or within one year.

- In the words of Howard and Upton, “The current assets are usually defined as those assets which are convertible into cash through the normal course of business within a short time, ordinarily in a year.”

- Current assets include cash in hand, cash at bank, short-term investments, bills receivable, debtors, prepaid expenses, accrued income, closing stock, etc.

- Among these, closing stock is valued at cost or realisable value whichever is lower and debtors are shown after deducting a reasonable provision for bad and doubtful debts.

Question 2.

Explain the Intangible fixed assets?

Answer:

- Intangible fixed assets are those which do not have any physical existence or which cannot be seen or touched.

- Examples: goodwill, trade-marks, copy rights and patents. Intangible assets are as much valuable as tangible assets because they also help the firm in earning profits.

- For example, goodwill helps in attracting customers and patents represent the know-how which helps in producing the goods.

Question 3.

What is the Need for preparation of trading account?

Answer:

i) Provides information about gross profit or gross loss:

- It shows the gross profit or gross loss of the business for an accounting year.

- This helps the business persons to find out gross profit ratio by expressing the gross profit as a percentage of sales.

- It helps to compare and analyse with the ratios of the previous years.

- Thus, it provides data for com-parison, analysis and planning for a future period.

ii) Provides an opportunity to safeguard against possible losses:

- If the ratio of gross profit has decreased in comparison to the preceding years, effective measures can be taken to safeguard against future losses.

- For example, the sale price of goods may be increased or steps may be taken to analyse and control the direct expenses.

iii) Provides information about direct expenses and direct incomes:

- All the expenses incurred on the purchase of goods are direct expenses. They are recorded in the trading account.

- Trading account also shows sales revenue, which is a direct income. With the help of trading account, percentage of such expenses on sales revenue can be calculated and compared with similar ratios of the previous years.

- Thus, it enables the management to have control over the direct expenses.

Question 4.

What is the Need for preparation of profit and loss account?

Answer:

i) Ascertainment of net profit or net loss:

- The profit and loss account discloses the net profit available to the proprietor or net loss to be borne by him.

- Ascertainment of profitability helps in planning for the growth and efficiency of a business enterprise.

- Inter-firm comparison and intra-firm comparison of profit and loss account items help in assessing efficiency in comparison with other enterprises and other departments of the same enterprise respectively.

ii) Comparison of profit – The net profit of the current year can be compared with the profit of the previous years. It helps to know whether the business is conducted efficiently or not.

iii) Control on expenses – Profit and loss account helps in comparing various expenses with the expenses of the previous years. The percentage of individual expenses to net sales can be calculated and compared with the similar ratios of previous years. Such a comparison will be helpful in taking effective steps for controlling unnecessary expenses.

iv) Helpful in the preparation of balance sheet – A balance sheet can be prepared only after ascertaining the net profit or loss through profit and loss account. Net profit or loss is shown in the balance sheet. Thus, it facilitates preparation of balance sheet.

![]()

Question 5.

What is the Need for preparation of balance sheet?

Answer:

a) The main purpose of preparing a balance sheet is to ascertain the true financial position of the business at a particular point of time.

b) It helps in comparing the cost of various assets of the business such as the amount of closing stock, amount due from debtors, amount of fictitious assets, etc.

Moreover as assets and liabilities of similar nature are grouped and presented in balance sheet, a comparative study of these assets and liabilities is facilitated. It helps in comparing the various liabilities of the business.

c) It helps in finding out the solvency position of the firm. The firm’s solvency position is favourable if the assets exceed the external liabilities. The firm’s solvency position is not favourable it the external liabilities exceed the assets.

Question 6.

What are the Characteristics of balance sheet?

Answer:

a) A balance sheet is a part of the final accounts. However, the balance sheet is a statement and not an account. It has no debit or credit sides and as such the words ‘To’ and ‘By’ are not used before the names of the accounts shown therein.

b) A balance sheet is a summary of the personal and real accounts, which have balances. Personal and real accounts having debit balances are shown on the right hand side known as assets side, whereas personal and real accounts having credit balances are shown on the left hand side known as liabilities side.

c) The totals of the two sides of the balance sheet must be equal. If the totals are not equal, it indicates existence of error. It must satisfy the accounting equation, ie., Assets = Capital + Liabilities, following the dual aspect concept.

d) Balance sheet is prepared on a particular date and not for a fixed period. It discloses the financial position of a business on a particular date. It gives the balances only for the date on which it is prepared.

e) It shows the financial position of the business according to the going concern concept.

Question 7.

What is the Classification of assets?

Answer:

a) Fixed assets – Fixed assets are those assets which are acquired or constructed for continued use in the business and last for many years such as land and building, plant and machinery, motor vehicles, furniture, etc. According to Finley and Miller, “Fixed assets are assets of a relatively permanent nature used in the operations of business and not intended for sale”.

b) Current assets – Current assets are those assets which are either in the form of cash or can be easily converted into cash in the normal course of business or within one year. In the words of Howard and Upton, “The current assets are usually defined as those assets which are convertible into cash through the normal course of business within a short time, ordinarily in a year.”

Current assets include cash in hand, cash at bank, short-term investments, bills receivable, debtors, prepaid expenses, accrued income, closing stock, etc.

c) Liquid assets – Liquid assets are the assets which are either in the form of cash or which can be immediately converted into cash within a very short period of time, such as cash at bank, bills receivable, short-term investments, debtors and accrued incomes.

In other words, if prepaid expenses and closing stock are excluded from current assets, the balance is known as liquid assets.

d) Investments – Amount invested outside the business in shares, debentures, bonds and other securities is called investments.

If it is invested for a period more than a year they are called long-term investments. If they are invested for a period less than a year they are short term investments and shown under current assets.

e) Wasting assets – These are the assets which get exhausted gradually in the process of excavation. Examples: mines and quarries.

![]()

Question 8.

Explain the type of liabilities.

Answer:

a) Fixed or long-term liabilities – The liabilities which are to be repaid after one year or more are termed as long-term liabilities. Example: Long-term loans.

b) Current or short-term liabilities – The liabilities which are expected to be paid within the normal operating cycle or one year are termed as current or short-term liabilities. These include bank overdraft, creditors, bills payable, outstanding expenses, etc.

c) Contingent liabilities – These are the liabilities which are not certain at the time of preparation of balance sheet. These liabilities may or may not occur.

These are the liabilities which will become payable only on the happening of some specific event which itself is not certain, otherwise these need not be paid. Such liabilities are as follows:

IV. Problems and solutions

Question 1.

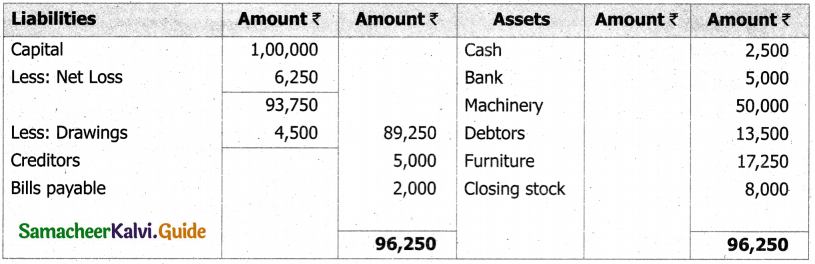

From the following particulars prepare the trading account and calculate the gross profit.

Solution:

Trading Account

Question 2.

From the following figures, ascertain the gross profit

Solution:

Trading Account

Question 3.

Front the information given below prepare trading account.

Solution:

Trading Account

Question 4.

From the following particulars calculate gross profit.

Solution:

Trading Account

Question 5.

Calulate the Grose profit from the fllowing figures

Solution:

Trading Account

Question 6.

Prepare profit and loss account for the year ending 31.3.2017

Solution:

Trading Account

Question 7.

From the following information, prepare the Profit and Loss Account of a Trader for the year ending 31st March, 2017.

Solution:

![]()

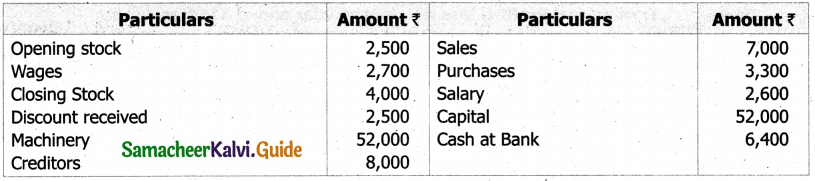

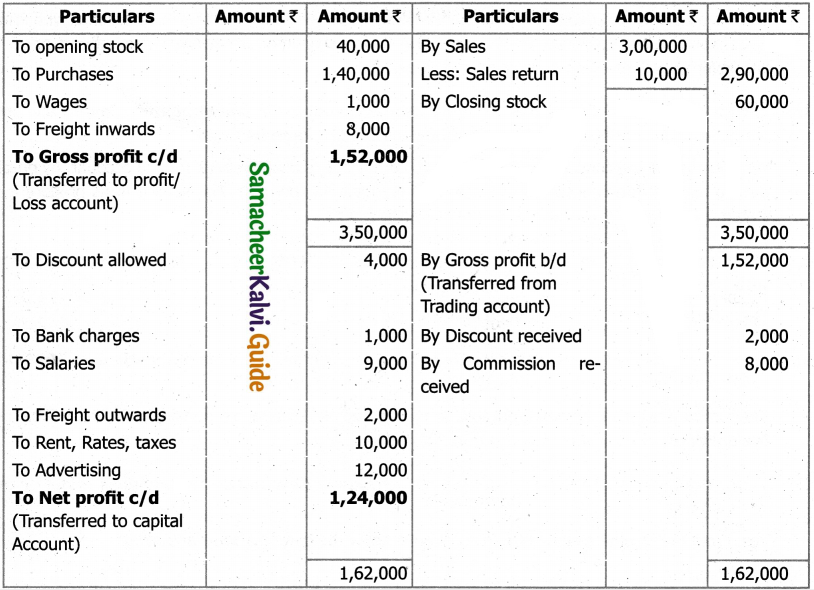

Question 8.

Prepare Trading and Profit Si Loss account from the following information:

Solution:

Trading and Profit & loss A/c Cr

Question 9.

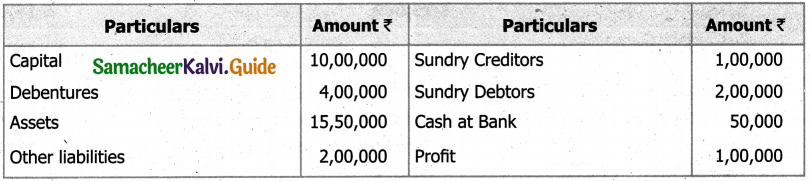

From the following information, prepare a Balance Sheet of Mr.A as at 31st March 2016.

Solution:

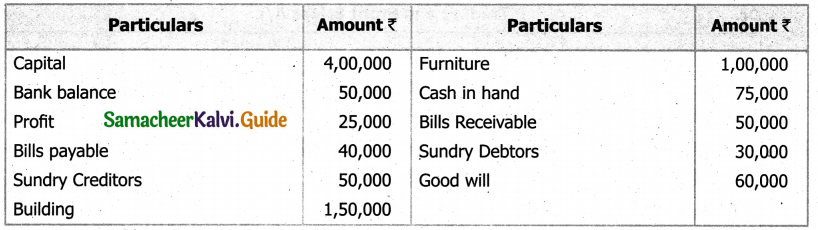

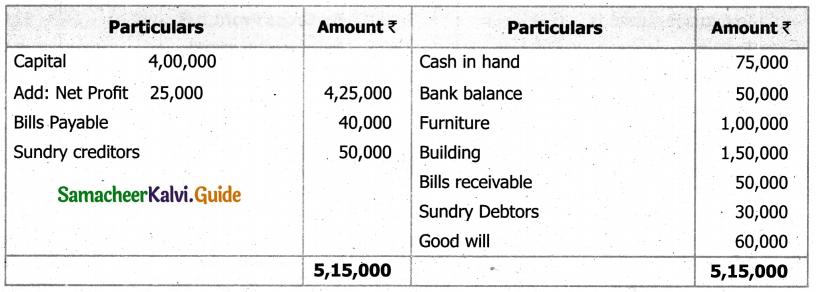

Question 10.

From the following information prepare balance sheet

Solution:

Balance Sheet

Question 11.

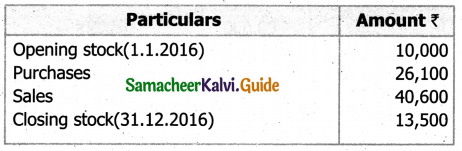

From the following information prepare trading account for the year ended 31.12.2016.

Solution:

Trading A/c for the year ended 31st Dec 2016

Question 12.

From the following balance extracted from the books of M/S Lavanya and sons, prepare trading account for the year ended 31st March 2017.

Solution:

Trading A/c for the year ended 31st Mar 2017

Question 13.

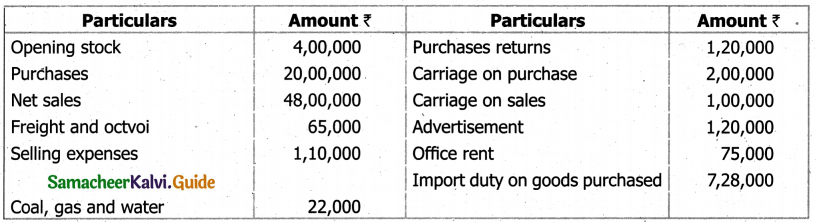

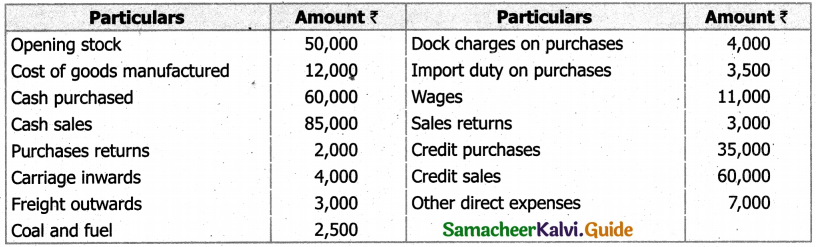

Prepare trading account for the year ended 31st December 2017 from the following.

Closing stock is valued at ₹ 6,00,000

Solution:

Trading A/c for the year ended 31st Dec 2017

Note: Selling expenses, carriage on sales advertisement and office rent will not appear in trading account as they are indirect expenses.

![]()

Question 14.

Following in then extract of a trial balance as on 31st December 2017 prepare trading account.

Solution:

Trading A/c for the year ended 31st Dec 2017

Note:

Closing stock will not appear

Question 15.

From the following information prepare trading account for the year ending 31st December, 2017.

Solution:

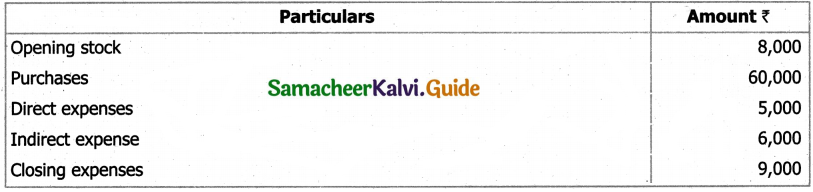

Trading A/c for the year ended 31st Dec 2017

Question 16.

Compute cost of goods sold from the following.

Solution:

Cost of goods sold = Opening stock + Net purchases + Direct expenses – Closing stock

= 8,000 + 60,000 + 5,000 – 9,000

= ₹ 64,000

Note : Indirect expenses do not form part of cost of goods sold.

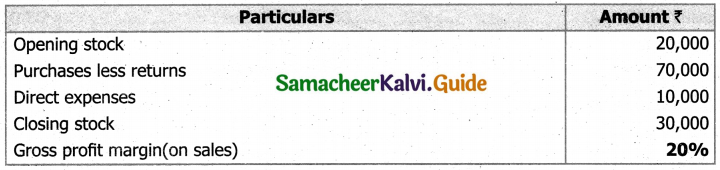

Question 17.

Find the amount of sales from the following.

Solution:

Cost of goods sold = Opening stock + Net purchases + Direct expenses – Closing stock

= 20,000 + 70,000 + 10,000 – 30,000

= ₹ 70,000

Let the sales be less Gross profit (20% on sales i.e,100) (100 – 20 = 80)

cost of goods sold

Therefore percentage of Gross profit on cost of goods sold is \(\frac { 20 }{ 80 }\) x 100 = 25%

Gross profit = 25% on 70,000 (Ex) \(\frac { 25 }{ 100 }\) x 70,000 = 17,500

Sales = Cost of goods sold + Gross profit

= 70,000 + 17,500

= ₹ 87,500

![]()

Question 18.

Following the information prepare profit and loss account for 31st March 2018.

Solution:

Profit and loss account for the year ended 31st march 2018

Question 19.

Prepare the profit and loss account for the year ended 31st December 2017.

Solution:

Profit and loss account for the year ended 31st December 2017

Note: Carriage inwards will not appear in profit and loss account as is a direct expense.

![]()

V. Long Answers

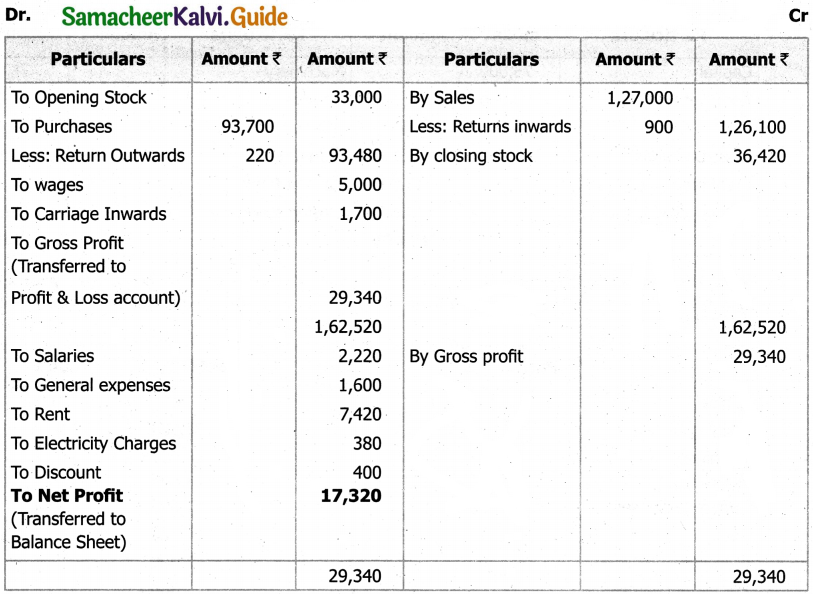

Question 1.

The following trial balance of Mr.A is extracted on 31.12.2017. Prepare Trading and Profit and Loss account. The closing stock is valued at ₹ 35,000,

Solution:

Trading and Profit & loss A/c for the year ended 31 Dec 2017

Balance Sheet of Mr. A as on 31.12.2017

Question 2.

From the following balances extracted from the accounts of Shri & Co for year ending 31.03.2018, prepare Trading and Profit & loss account and also Balance sheet as on that date.

Solution:

Trading Account of Shri & Co for the year ended 31 Mar 2018

Balance Sheet as on 31 Mar 2018

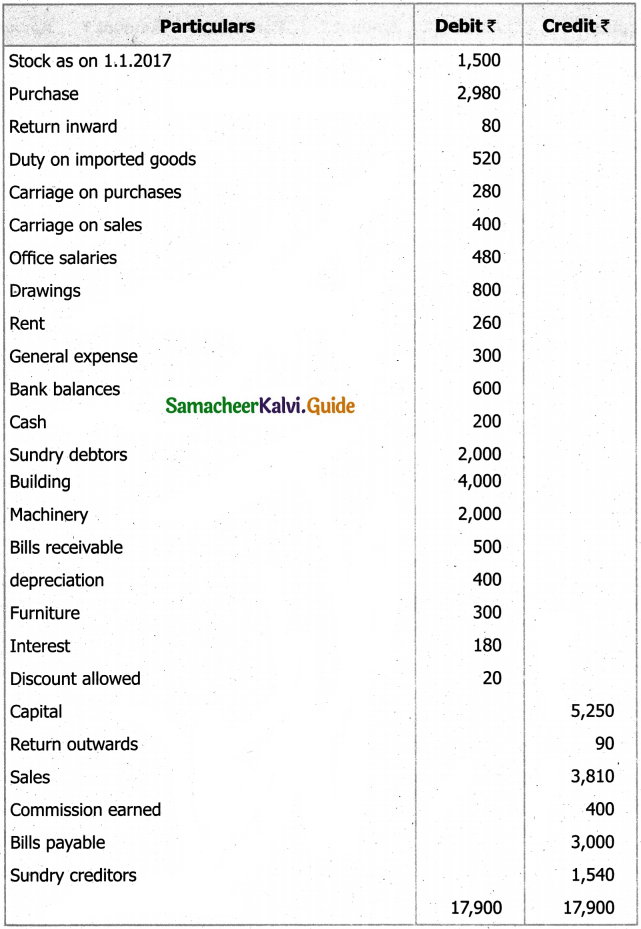

Question 3.

From the trial balance f Thiru.Vetri for the year ending 31.12.2017 prepare trading & profit & Loss account for that period and also Balance sheet as on that date.

Closing stock Rs. 1,970; outstanding rent ₹ 60

Solution:

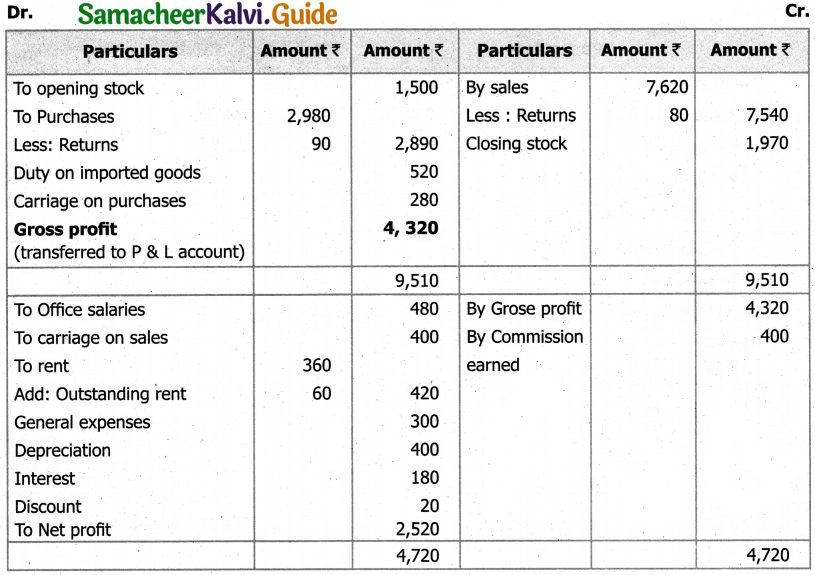

Trading and Profi & loss A/c of Mr. Vetri for the year ended 31 Dec 2017

Balance Sheets as on 31 Dec 2017

Question 4.

The following particulars prepare profits and loss account year ended 31st December 2017.

Solution:

Profit and loss account for the year ended 31st Dec 2017

![]()

Question 5.

Following balance of Niruban, prepare balance sheet as on 31st December 2017.

Solution:

Balance Sheet as on 31st Dec 2017

Question 6.

Prepare trading and profit and loss A/c of about Rahuman for the year ending 31st December, 2016 and balance sheet as on that date. The closing stock on 31st December 2016 was valued at ₹ 2,000

Solution:

Balance Sheet as on 31st Dec 2016

Balance sheet as on 31st December, 2016

Question 7.

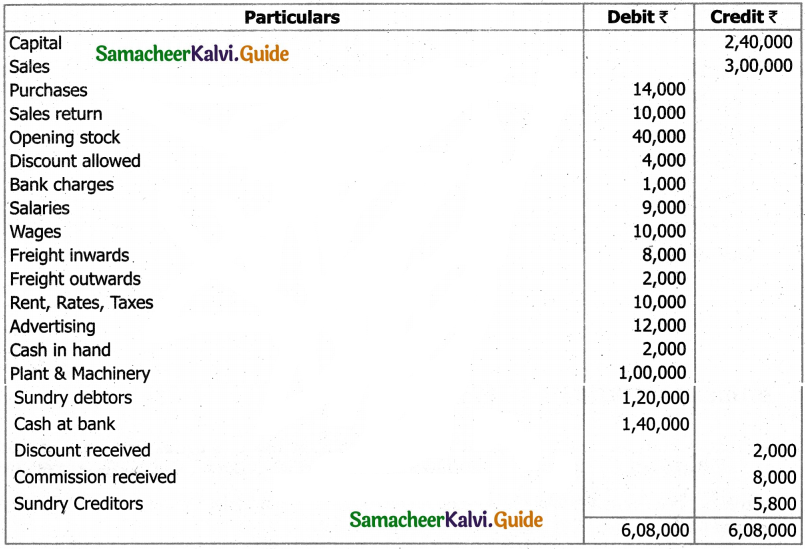

Trial balance of sharn, prepare trading and profit and loss account for the year ending 31st December 2013 was valued at 25,00,000

Solution:

Profit and loss account for the year ended 31st Dec 2013

Balance sheet as on sharan 31st December 2017

![]()

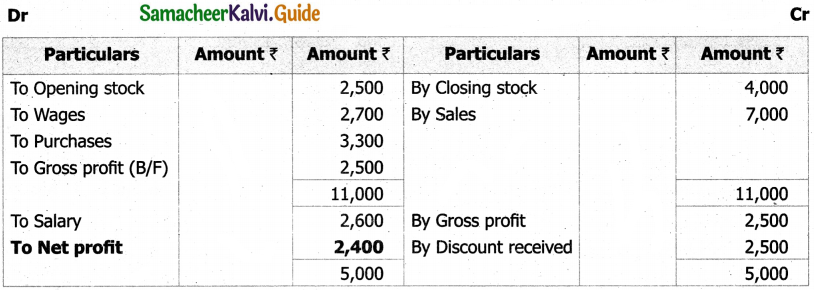

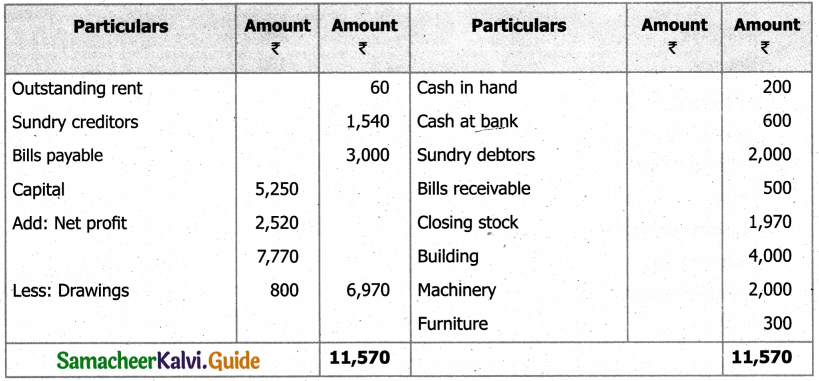

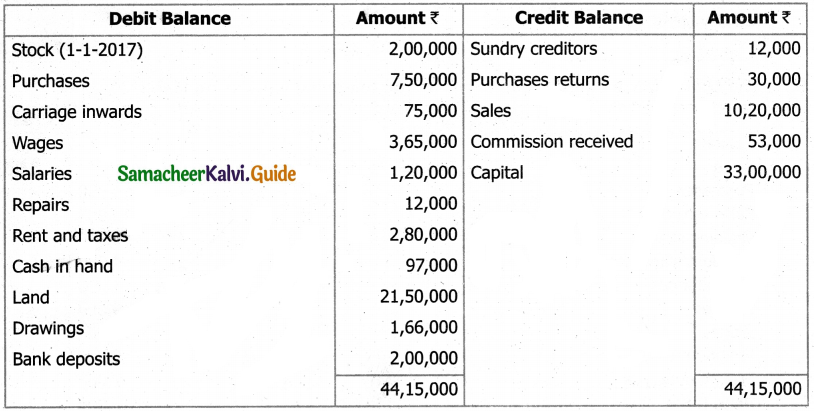

Question 8.

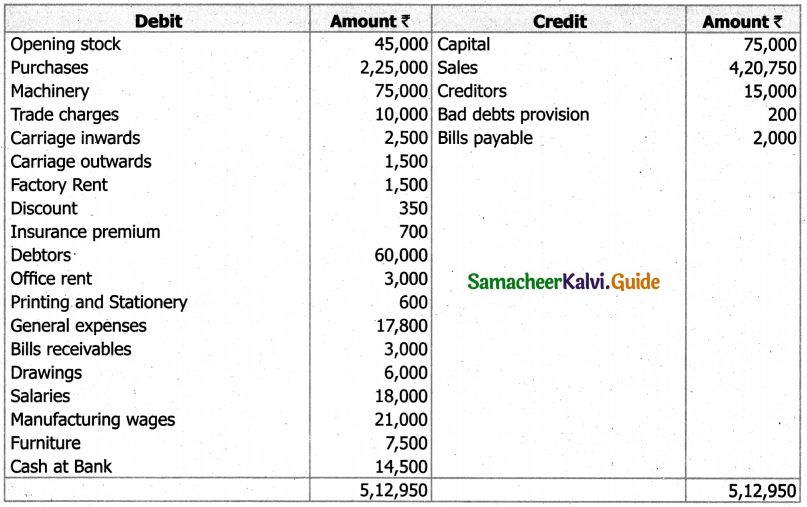

The trial balance of Ms. Kalpana shows the following balance on March 31.2017

Adjustment:

The closing stock was valued at ₹ 60,000

Balance sheet of Ms. Kalpana as on 31st March 2017