Tamilnadu State Board New Syllabus Samacheer Kalvi 11th Accountancy Guide Pdf Chapter 8 Bank Reconciliation Statement Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 8 Bank Reconciliation Statement

11th Accountancy Guide Bank Reconciliation Statement Text Book Back Questions and Answers

![]()

I. Multiple Choice Questions

Choose the correct answer.

Question 1.

A bank reconciliation statement is prepared by ________.

a) Bank

b) Business

c) Debtor to the business

d) Creditor to the business

Answer:

b) Business

Question 2.

A bank reconciliation statement is prepared with the help of ________.

a) Bank statement

b) Cash book

c) Bank statement and bank column of the cash book

d) Petty cash book

Answer:

c) Bank statement and bank column of the cash book

Question 3.

Debit balance in the bank column of the cash book means ________.

a) Credit balance as per bank statement

b) Debit balance as per bank statement

c) Overdraft as per cash book

d) None of the above

Answer:

a) Credit balance as per bank statement

Question 4.

A bank statement is a copy of ________.

a) Cash column of the cash book

b) Bank column of the cash book

c) A customer’s account in the bank’s book

d) Cheques issued by the business

Answer:

c) A customer’s account in the bank’s book

![]()

Question 5.

A bank reconciliation statement is prepared to know the causes for the difference between:

a) The balance as per the cash column of the cash book and bank column of the cashbook

b) The balance as per the cash column of the cash book and bank statement

c) The balance as per the bank column of the cash book and the bank statement

d) The balance as per petty cash book and the cash book

Answer:

c) The balance as per the bank column of the cash book and the bank statement

Question 6.

When money is withdrawn from bank, the bank ________.

a) Credits customer’s account

b) Debits customer’s account

c) Debits and credits customer’s account

d) None of these

Answer:

b) Debits customer’s account

Question 7.

Which of the following is not the salient feature of bank reconciliation statement?

a) Any undue delay in the clearance of cheques will be shown up by the reconciliation

b) Reconciliation statement will discourage the accountant of the bank from embezzlement

c) It helps in finding the actual position of the bank balance

d) Reconciliation statement is prepared only at the end of the accounting period

Answer:

d) Reconciliation statement is prepared only at the end of the accounting period

Question 8.

Balance as per cash book is ₹ 2,000. Bank charge of ₹ 50 debited by the bank is not yet shown in the cash book. What is the bank statement balance now?

a) 1,950 credit balance

b) 1,950 debit balance

c) 2,050 debit balance

d) 2,050 credit balance

Answer:

a) 1,950 credit balance

Question 9.

Balance as per bank statement is 1, 000. Cheque deposited, but not yet credited by the bank is 2, 000. What is the balance as per bank column of the cash book?

a) 3,000 overdraft

b) 3,000 favourable

c) 1,000 overdraft

d) 1,000 favourable

Answer:

b) 3,000 favourable

Question 10.

Which one of the following is not a timing difference?

a) Cheque deposited but not yet credited

b) Cheque issued but not yet presented for payment

c) Amount directly paid into the bank

d) Wrong debit in the cash book

Answer:

d) Wrong debit in the cash book

![]()

II. Very Short Answer Questions

Question 1.

What is meant by bank overdraft?

Answer:

An amount of money that a customer with a bank account is temporarily allowed to owe to the bank. An overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero.

Question 2.

What is bank reconciliation statement?

Answer:

The bank reconciliation statement is a statement that reconciles the balance as per the bank column of cash book with the balance as per the bank statement by giving the reasons for such difference along with the amount. The internal record of the business (bank column of cash) can be reconciled with the external record (bank statement).

Question 3.

State any two causes of disagreement between the balance as per bank column of cash book and bank statement.

Answer:

- Cheques issued but not presented for payment.

- Cheques paid into bank for collection but not yet collected.

Question 4.

Give any two expenses which may be paid by the banker as per standing instruction.

Answer:

- Bank Charges

- Interest

Question 5.

Substitute the following statements with one word/phrase.

Answer:

- A copy of customer’s account issued by the bank – PASS BOOK

- Debit balance as per bank statement – BANK OVERDRAFT

- Statement showing the causes of disagreement between the balance as per cash book and balance as per bank statement – BANK RECONCILIATION STATEMENT

Question 6.

Do you agree on the following statements? Write “yes” if you agree, and write “no” if you Disagree

Answer:

- Bank reconciliation statement is prepared by the banker. – Yes

- Adjusting the cash book before preparing the bank reconciliation statement is compulsory. – No

- Credit balance as per bank statement is an overdraft. – No

- Bank charges debited by the bank increases the balance as per bank statement. – No

- Bank reconciliation statement is prepared to identify the causes of differences between balance as per bank column of the cash book and balance as per cash column of the cash book. – Yes

![]()

III. Short Answer Questions

Question 1.

Give any three reasons for preparing bank reconciliation statement.

Answer:

- To identify the reasons for the difference between the bank balance as per the cash book and bank balance as per bank statement.

- To identify the delay in the clearance of cheques.

- To ascertain the correct balance of bank column of cash book.

- To discourage the accountants of the business as well as bank from misusing funds.

Question 2.

What is meant by the term “cheque not yet presented?”

Answer:

- When the cheques are issued by the business, it is immediately entered on the credit side of the cash book by the business.

- This may not be entered in the bank statement on the same day.

- It will be entered in the bank statement only after it is presented with the bank.

Question 3.

Explain why does money deposited into bank appear on the debit side of the cash book, but on the credit side of the bank statement?

Answer:

- The assets will be entered in the debit side. The balance of deposits held by bank is recorded.

- It denotes a favourable balance as per cash boor unfavourable balance as per the pass book.

On the debit side, receipts of cash and cheques are recorded. - Deposited cash in to bank decreases the amount of cash available and is, therefore, credited to cash account (cash column of the cash book).

- But, it also increases the bank balance and is therefore, debited to bank account (bank column of the cash book).

Question 4.

What will be the effect of interest charged by the bank, if the balance is an overdraft?

Answer:

- If the business has taken any loan or overdrawn, interest has to be paid by the business.

- The entries for bank charges and interest are made in the bank statement.

- The cash book shows more balance than the bank statement.

Question 5.

State the timing differences in BRS with examples.

Answer:

Cheques issues but not presented for payment for payment:

When the cheques are issued by the business, it is immediately entered on the credit side of the cash book by the business. But, this may not be entered in the bank statement on the same day.

lt will be entered in the bank statement only after it is presented with For example, the balances as per cash book and bank statement are ₹ 20,000 for X & Co. X & Co. issued a cheque in favour of Y & Co for ₹ 10,000, on 27th March 2017. So, X & Co’s cash book is credited with ₹ 10,000 on 27th March 2017. But, the cheque is presented to bank on 2nd April 2017.

In case, bank sends a statement to X & Co, upto 31st March 2017, it will not contain this transaction. As a result, there will be a difference of 10,000, between balance shown as per cash book and balance as per bank statement.

Cheques deposited into bank but not yet credited:

When the cheques are deposited into bank, the amount is debited in the cash book on the same day. But, these may not be shown in the bank pass book on the same day because these will be entered in the bank statement only after the collection of the cheques.

For example, the balances as per cash book and bank statement are ₹ 20,000 for X & Co. X & Co. receives a cheque on 25th March 2016, from ABC Limited for ₹ 5,000. On the same day, X & Co, debits its cash book with ₹ 5,000.

But bank credits X & Co’s account only when the cheque is collected from ABC Limited’s bank. This shows that is a time gap between depositing the cheque by the customer (X & Co) and collection of cheque by the bank.

Bank Charges and interest on loan and overdraft charged by the bank:

The bank has to cover the cost of running the customer’s account. So debit is given to the account of the business towards bank charges.

Also, if the business had taken any loan or over drawn, interest has to be paid by the business. These entries for bank charges and interest are made in the bank statement. But, the entry is made in the cash book only when the bank statement is received by the business.

Till then, the cash book shows more balance than bank statement. For example, the opening balance as per cash book and the bank statement as on 1st March 2017 is ₹ 7,000. Bank debits for bank charges ₹ 300 as on 27th March 2017. But there is no entry for the same in the cash book as on such date.

![]()

IV. Exercises

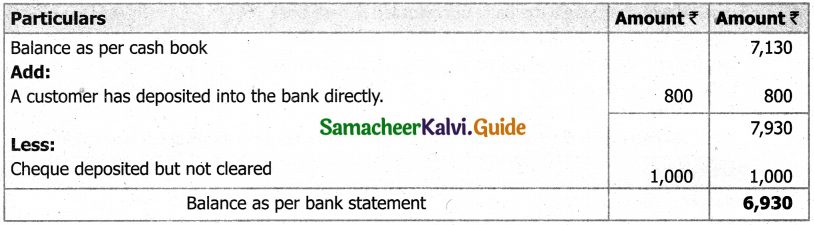

Question 1.

From the following particulars prepare a bank reconciliation statement of Jayakumar as on 31st December, 2016.

a) Balance as per cash book ₹ 7,130

b) Cheque deposited but not cleared ₹ 1,000

c) A customer has deposited ₹ 800 into the bank directly

Solution:

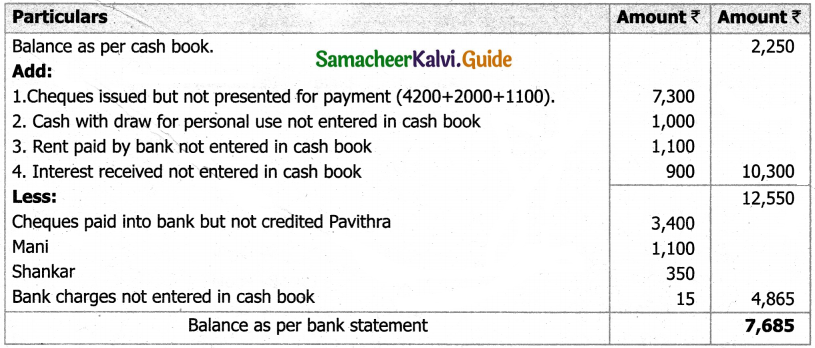

Bank reconciliation statement of Jayakumar as on 31st December, 2016.

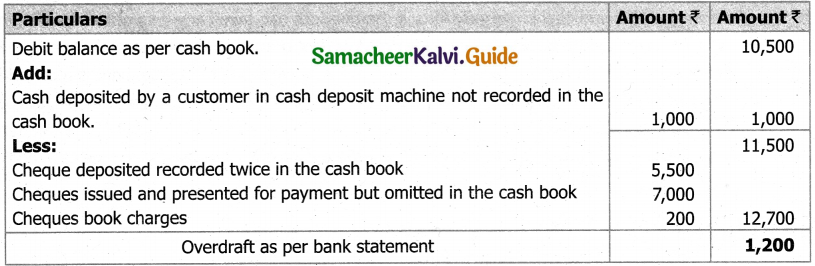

Question 2.

From the following particulars of Kamakshi traders, prepare a bank reconciliation statement as on 31st March, 2018.

a) Debit balance as per cash book ₹ 10,500

b) Cheque deposited into bank amounting to ₹ 5,500 credited by bank, but entered twice in the cash book

c) Cheques issued and presented for payment amounting to ₹ 7,000 omitted in the cash book

d) Cheque book charges debited by the bank ₹ 200 not recorded in the cash book.

e) Cash of ₹ 1,000 deposited by a customer of the business in cash deposit machine not recorded in the cash book.

Solution:

Bank reconciliation statement of Kamakshi traders as on 31st March, 2018.

Question 3.

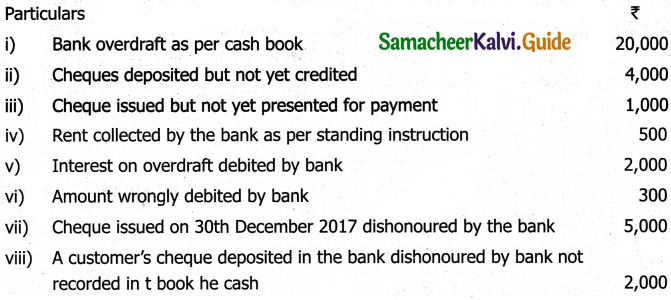

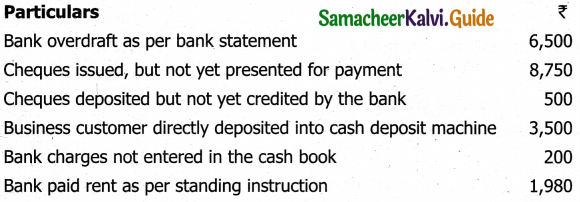

From the following information, prepare bank reconciliation statement to find out the bank statement balance as on 31st December, 2017.

Solution:

Bank reconciliation statement of Kamakshi traders as on 31st March, 2018.

Question 4.

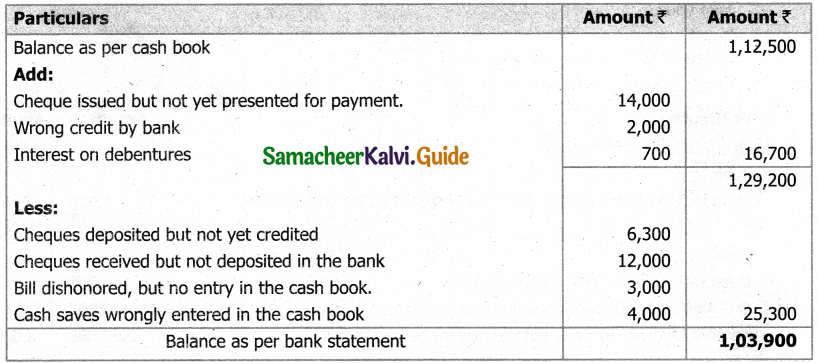

On 31st March, 2017, Anand’s cash book showed a balance of ₹ 1,12,500, Prepare bank reconciliation statement,

a) He had issued cheques amounting to ₹ 23,000 on 28,3.2017, of which cheques amounting to ₹ 9,000 have so far been presented for payment.

b) A cheque for ₹ 6,300 deposited into bank on 27.3.2017, but the bank credited the same only on 5th Aprii 2017.

c) He had also received a cheque for ₹ 12,000 which, although entered by him in the cash book, was not deposited in the bank.

d) Wrong credit given by the bank on 30th March 2017 for ₹ 2,000.

e) On 30th March 2017, a bill already discounted with the bank for ₹ 3,000 was dishonoured, but no entry was made in the cash book.

f) Interest on debentures of ₹ 700 was received by the bank directly.

g) Cash sales of ₹ 4,000 wrongly entered in the bank column of the cash book.

Solution:

Bank reconciliation statement of Mr, Anand as on 31st March, 2017

![]()

Question 5.

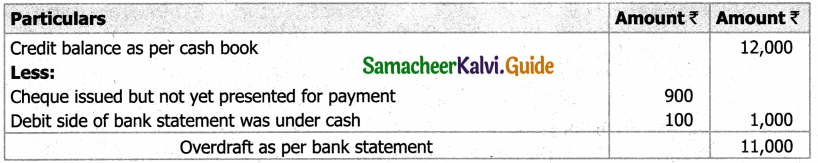

From the following particulars of Siva and Company, prepare a bank reconciliation state- ment as on 31st December, 2017.

a) Credit balance as per cash book ₹ 12,000

b) A cheque of ₹ 1,200 Issued and presented for payment to the bank, wrongly credited in the cash book

c) Debit side of bank statement was under cast by ₹ 100

Solution:

Bank reconciliation statement as on 31st December, 2017.

Question 6.

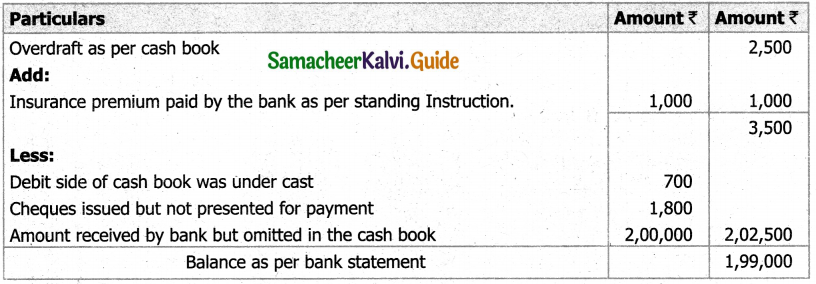

From the following particulars of Raheem traders, prepare a bank reconciliation statement as on 31st March, 2018.

a) Overdraft as per cash book ₹ 2,500

b) Debit side of cash book was under cash by ₹ 700

c) Amount received by bank through RTGS amounting to ₹ 2,00,000, omitted in the cash book.

d) Two cheques issued for ₹ 1,800 and ₹ 2,000 on 29th March 2018. Only the second cheque is presented for payment.

e) Insurance premium on car for ₹ 1,000 paid by the bank as per standing instruction not recorded in the cash book

Solution:

Bank reconciliation statement as on 31st March, 2018.

Question 7.

From the following information, prepare bank reconciliation statement as on 31st December,

Solution:

Bank reconciliation statement as on 31st December, 2017

Question 8.

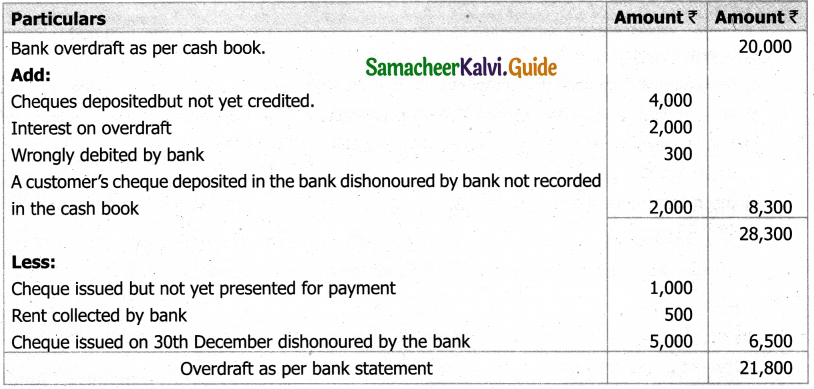

Prepare bank reconciliation statement from the following data.

Solution:

Bank reconciliation statement

Question 9.

From the following particulars of Veera traders, prepare a bank reconciliation statement as on 31st December, 2017.

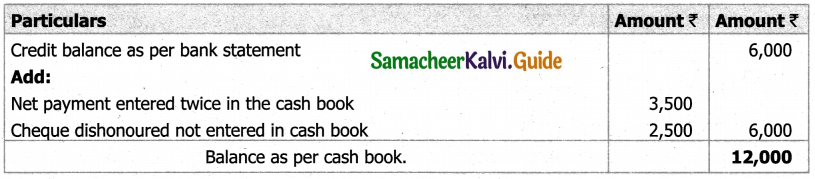

a) Credit balance as per bank statement ₹ 6,000

b) Amount received by bank through NEFT for ₹ 3,500, entered twice in the cash book.

c) Cheque dishonoured amounting to ₹ 2,500, not entered in cash book.

Solution:

Bank reconciliation statement as on 31st December, 2017.

Question 10.

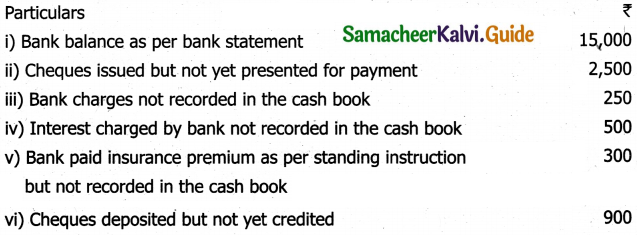

Prepare bank reconciliation statement from the following data and find out the balance as per cash book as on 31st March, 2018.

Solution:

Bank reconciliation statement as on 31st March, 2018.

Question 11.

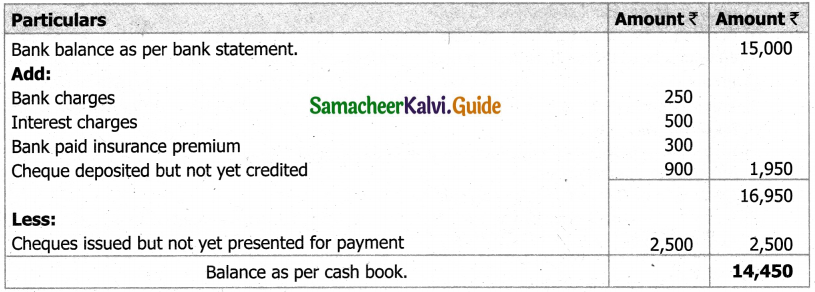

Ascertain the cash book balance from the following particulars as on 31st December, 2017

i) Credit balance as per bank statement ₹ 2,500

ii) Bank charges of ?60 have not been entered in the cash book

iii) Cheque deposited on 28th December 2017 for ₹ 1,000 was not yet credited by the bank

iv) Cheque issued on 24th December 2017 for ₹ 700, not yet presented for payment

v) A dividend of ₹ 400 collected by the bank directly but not entered in the cash book

vi) Acheque of ₹ 600 had been dishonoured, but no entry was made in the cash book

vii) Interest on term loan ₹ 1,200 debited by bank but not accounted in cash book

viii) No entry had been made in the cash book for a trade subscription of ₹ 500 paid vide banker’s order on 23rd December 2014

Solution:

Bank reconciliation statement as on 31st December, 2017.

![]()

Question 12.

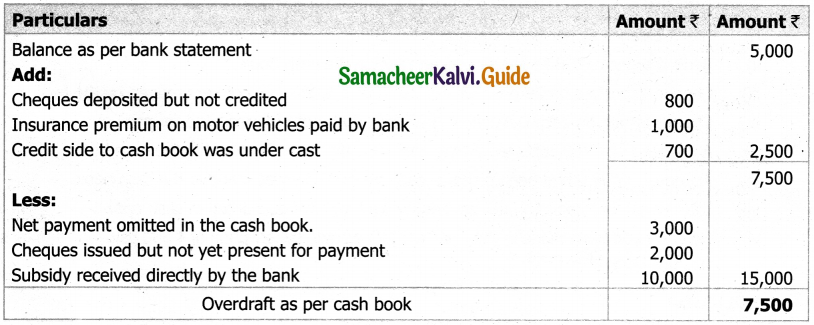

From the following particulars of Raja traders, prepare a bank reconciliation statement as on 31st January, 2018.

a) Balance as per bank statement ₹ 5,000

b) Cheques amounting to ₹ 800 had been recorded in the cash book as having been deposited into the bank on 25th January 2018, but were entered in the bank statement on 2nd February 2018.

c) Amount received by bank through NEFT amounting to ₹ 3,000, omitted in the cash book.

d) Two cheques issued for ₹ 3,000 and ₹ 2,000 on 29th March 2018. Only the first cheque is presented for payment.

e) Insurance premium on motor vehicles for ₹ 1,000 paid by the bank as per standing instruction not recorded in the cash book.

f) Credit side of cash book was undercast by ₹ 700

g) Subsidy received directly by the bank from the state government amounting to ? 10,000, not entered in cash book.

Solution:

Bank reconciliation statement of Mr. Raja traders as on 31st January, 2018.

Question 13.

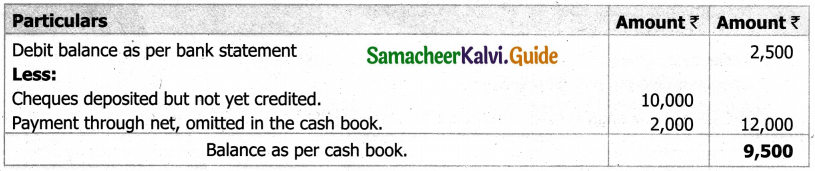

From the following particulars of Simon traders, prepare a bank reconciliation statement as on 31st March, 2018.

a) Debit balance as per bank statement ₹ 2,500

b) Cheques deposited amounting to ₹ 10,000, not yet credited by bank.

c) Payment through net banking for ₹ 2,000, omitted in the cash book.

Solution:

Bank reconciliation statement as on 31st March, 2018.

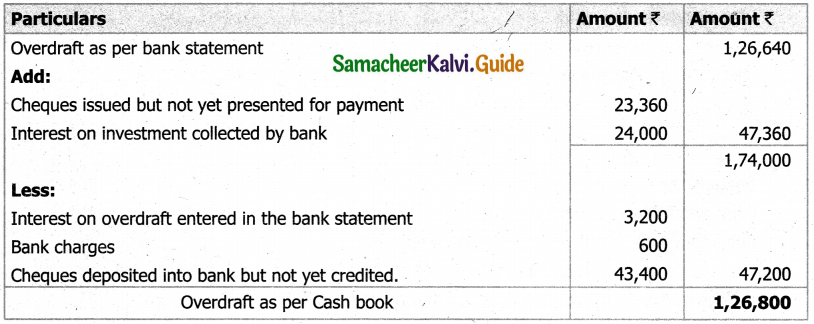

Question 14.

From the following particulars, ascertain the cash book balance as on 31st December, 2016.

i) Overdraft balance as per bank statement ₹ 1,26,640

ii) Interest on overdraft entered in the bank statement, but not yet recorded in cash book ₹ 3,200

iii) Bank charges entered in bank statement, but not found in cash book ₹ 600

iv) Cheques issued, but not yet presented for payment ₹ 23,360

v) Cheques deposited into the bank but not yet credited ₹ 43,400

vi) Interest on investment collected by the bank ₹ 24,000

Solution:

Bank reconciliation statement as on 31st December, 2016.

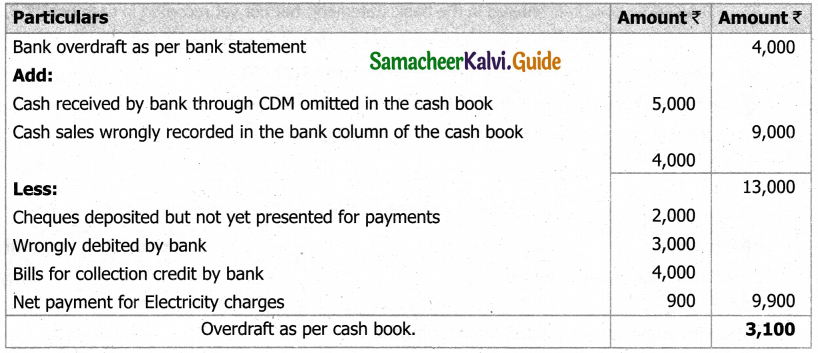

Question 15.

From the following particulars of John traders, prepare a bank reconciliation statement as on 31st March, 2018.

a) Bank overdraft as per bank statement ₹ 4,000

b) Cheques amounting to ₹ 2,000 had been recorded in the cash book as having been deposited into the bank on 26th March 2018, but were entered in the bank statement on 4th April 2018.

c) Amount received by bank through cash deposit machine amounting to ₹ 5,000, omitted in the cash book.

d) Amount of ₹ 3,000 wrongly debited to John traders account by the bank, for which no details are available.

e) Bills for collection credited by the bank till 29th March 2017 amounting to ₹ 4,000, but no advice received by John traders.

f) Electricity charges made through net banking for ₹ 900 was wrongly entered in cash column of the cash book instead of bank column.

Solution:

Bank reconciliation statement as on 31st March, 2018.

Question 16.

Prepare bank reconciliation statement from the following data.

Solution:

Prepare bank reconciliation statement.

Question 17.

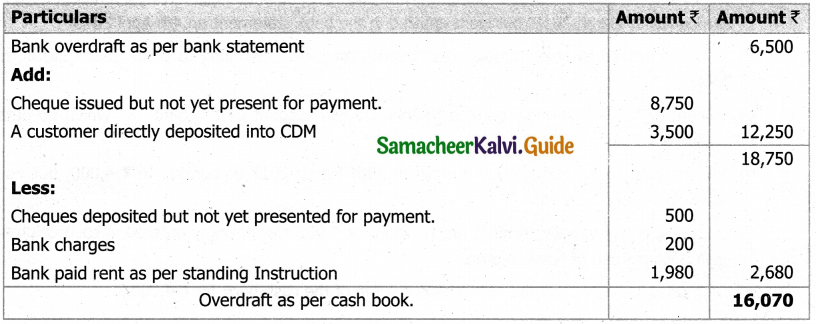

Prepare bank reconciliation statement as on 31st March, 2017 from the following extracts of cash book and bank statement.

Cash book (Bank column only)

Bank statement

Solution:

Bank reconciliation statement as on 31st March, 2017

![]()

Question 18.

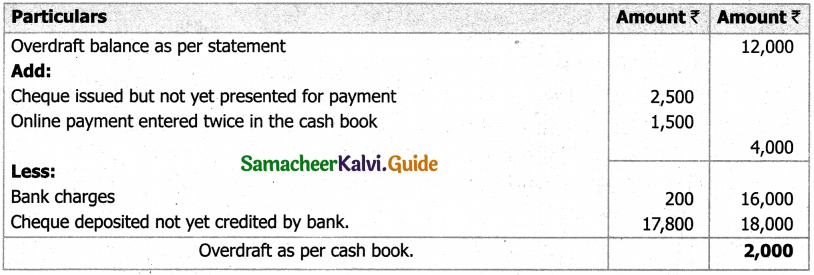

A trader received his bank statement on 31st December, 2017 which showed an overdraft balance of ₹ 12,000. On the same day, his cash book showed a debit balance of ₹ 2,000.

Analyse the following transactions. Choose the possible causes and prepare a bank reconciliation statement to show the causes of differences.

a) Cheque deposited for ₹ 2,000 on 21st December, 2017. Bank credited the same on 26th December, 2017.

b) Cheque issued for payment on 26th December, 2017 amounting to ₹ 2,500, not yet presented until 31st, December, 2017.

c) Bank charges amounting to ₹ 200 not yet entered in the cash book.

d) Online payment for ₹ 1,500 entered twice in the cash book.

e) Cheque deposited amounting to ₹ 1,000, but omitted in the cash book. The same cheque was dishonoured by bank, but not yet entered in cash book.

f) Cheque deposited, not yet credited by bank amounting to ₹ 17,800.

Solution:

Bank reconciliation statement as on 31st December, 2017.

![]()

11th Accountancy Guide Bank Reconciliation Statement Additional Important Questions and Answers

I. Choose the correct answer.

Question 1.

A Bank Reconciliation Statement is prepared with the help of ________.

a) Bank statement and bank column of the cash book

b) Journal

c) Ledger

d) None of the above

Answer:

a) Bank statement and bank column of the cash book

Question 2.

Bank reconciliation statement is ______

a) Part of bank statement

b) Part of the cash book

c) A separate statement

d) A sub-division of journal

Answer:

a) Part of bank statement

Question 3.

Uncollected cheques are also known as ______.

a) Outstanding cheques

b) Uncleared cheques

c) Outstation cheques

d) Both a & c

Answer:

d) Both a & c

Question 4.

When cheque is not paid by the bank it is called as ______.

a) Honoured

b) Endorsed

c) Dishonoured

d) None of these

Answer:

c) Dishonoured

Question 5.

A bank reconciliation statement is prepared by ______.

a) Banker

b) Accountant of the business

c) Auditors₹

d) None of the above

Answer:

b) Accountant of the business

Question 6.

The cheque which is deposited into bank but not cleared at the end of a particular year is called ______.

a) Uncredited cheque

b) Unpresented cheque

c) Omitted cheque

d) Dishonoured cheque

Answer:

b) Unpresented cheque

Question 7.

In cash book bank charges recorded in the ______.

a) Credit side

b) Debit Side

c) Both a & b

d) None of the above

Answer:

a) Credit side

![]()

Question 8.

An amount of Rs,2G0Q is debited twice in the bank statement. What will the reflect when overdraft as per the cash book is the starting point ______.

a) ₹ 2000 will be deducted

b) ₹ 2000 will be added

c) ₹ 4000 will be deducted

d) ₹ 4000 will be deducted

Answer:

b) ₹ 2000 will be added

Question 9.

If any amount is directly deposited into the bank then ______.

a) Cash book will show less balance & bank book will show more

b) Cash book will show more balance & bank book will show less

c) Cash book will show double balance

d) Bank book will show double

Answer:

a) Cash book will show less balance & bank book will show more

Question 10.

Which of the following error results in unadjusted cash book balance?

a) Outstanding cheques

b) Unpresented Cheques

c) deposit in Transit

d) Omission of Bank charges

Answer:

d) Omission of Bank charges

Question 11.

Credit balance in the bank column of the cash book means ______.

a) Credit balance as per bank statement

b) Debit balance as per bank statement

c) Overdraft as per cash book

d) None of the above

Answer:

b) Debit balance as per bank statement

Question 12.

When balance as per Cash Book is the starting point, to ascertain balance as per bank statement interest allowed by Bank is ______.

a) Subtracted

b) added

c) not adjusted

d) None of the above

Answer:

b) added

Question 13.

When balance as per Cash Book is the starting point, to ascertain the balance as per bank statement interest charged by Bank is:

a) Added

b) subtracted

c) not adjusted

d) None of the above

Answer:

b) subtracted

Question 14.

When the balance as per Cash Book is the starting point to ascertain balance as per bank statement, direct deposits by customers are:

a) Added

b) subtracted

c) not adjusted

d) None of the above

Answer:

a) Added

Question 15.

When the balance as per Cash Book is the starting point to ascertain balance as per bank statement, direct payments by bank are:

a) Added

b) subtracted

c) not adjusted

d) None of the above

Answer:

b) subtracted

Question 16.

______ is not possible to have unfavourable cash balance in the cash book.

a) Bank statement

b) Bank overdraft

c) Cash overdraft

d) Cash book

Answer:

b) Bank overdraft

Question 17.

Bank overdraft is available only to the ______ holders.

a) Saving Account

b) Fixed Account

c) Joint Account

d) Current Account

Answer:

d) Current Account

![]()

Question 18.

______ is simply a copy of the customer’s account in the books of a bank.

a) Cash book

b) Bank statement

c) Bank Account

d) None of these

Answer:

b) Bank statement

Question 19.

A bank statement is a copy of ______ .

a) the cash column of a customer’s cash book

b) the bank column of a customer’s cash book

c) the customer’s account in the bank’s ledger

d) none of these

Answer:

c) the customer’s account in the bank’s ledger

Question 20.

Debit balance in the Cash Book means ______.

a) overdraft as per bank statement

b) credit balance as per bank statement

c) overdraft as per Cash Book

d) none of these

Answer:

b) credit balance as per bank statement

![]()

II. Additional Questions & Answers

Question 1.

Differences between bank column of cash book and bank statement.

Answer:

Bank column of cash book:

- It is prepared by business concern.

- Cash deposits are entered on the debit side.

- Cash withdrawals are entered on the credit side.

- Cheque deposits are debited on the day of deposit.

- Cheques issued are credited on the day of issue of cheque.

- Collections and payments as per standing instructions of the business are entered only after checking with the bank statement.

- It is balanced at the end of a specific period.

Bank statement:

- It is prepared by bank (banker).

- Cash deposits are entered in the credit column.

- Cash withdrawals are entered in the debit column.

- Cheque deposits are credited only at the time of realisation of cheque.

- Cheques issued by customers are debited by bank on the date on which the payment is made.

- Collections and payments as per standing instructions of the business are entered in the banker’s book on the date of realisation or payment.

- It is balanced after each transaction.

Question 2.

What are the items recorded on the debit side of the bank column of the cash book?

Answer:

- Cheques deposited but not credited.

- Credits in the pass book only.

• Interest credited in bank statement

• Dividend and other income

• Direct deposit by a party - Any error in cash book/ bank statement which has the effect of increasing the balance as per bank statement.

Question 3.

What are the items recorded on the credit side of the bank column of the cash Book?

Answer:

- Cheques deposited but not credited

- Cheques dishonoured but not entered in cash book

- Debits in bank statement only

• Interest debited

• Insurance premium, loan instalment, etc., paid as per standing instructions

• Direct payment by banker - Any error in cash book/ bank statement which has the effect of decreasing the balance as per bank statement

Question 4.

What is meant by the term “Cheques deposited into bank but not yet credited?”

Answer:

When the cheques are deposited into bank, the amount is debited in the cash book on the same day. But, these may not be shown in the bank pass book on the same day because these will be entered in the bank statement only after the collection of the cheques.

For example, the balances as per cash book and bank statement are ₹ 20,000 for X & Co. X & Co. receives a cheque on 25th March 2016, from ABC Limited for ₹ 5,000. On the same day, X & Co, debits its cash book with ₹ 5,000.

But bank credits X & Co’s account only when the cheque is collected from ABC Limited’s bank. This shows that is a time gap between depositing the cheque by the customer (X & Co) and collection of cheque by the bank.

Question 5.

What will be the effect of Interest and dividends collected by the bank?

Answer:

The bank may collect dividends on its customer’s investment in shares and also interest on any investment. The entry for this will be made in the bank statement on the date of collection. But the entry is made in the cash book only when the bank statement is received by the customer. Till then, the cash book shows less balance than the bank statement.

Question 6.

What will be the effect of Dishonour of cheques and bills?

Answer:

When the cheque is received from outside parties, it is deposited with the bank and debited in the cash book. If the cheque is dishonoured, the bank cannot collect the amount of such cheque from outside parties’ bank. It is not credited in the bank statement. As a result of this, the two records would differ.

While discounting the bills receivables, in the cash book it is entered in the debit side and in the bank statement it is credited. When the bill is presented by the bank to the drawee of the bill and the payment is not received, the bank debits the same to cancel the credit.

But, credit is made in the cash book only when the customer gets the entries made in the bank statement is received. The bank may also charge some amount for such dishonour.

![]()

Question 7.

What will be the effect of Amount paid by parties directly into the bank?

Answer:

Sometimes, debtors or the customers of the business may directly deposit the money into bank account of the business. It may be done by directly visiting the branch of the bank by paying cash (including NEFT, RTGS) or swiping debit or credit or business card or depositing the money in cash deposit machine or transfer through online banking facility.

This will be credited in the banker’s book. But the entry is made in the cash book only when the bank statement is received by the customer. Until then, the cash book shows less balance than bank statement.

Question 8.

What will be the effect of Amount paid directly by the bank to others?

Answer:

Sometimes the bank may be instructed to make payments such as, insurance premium, instalment of loan, etc., as an agent of the customer on behalf of its customer. In all such cases, debit is made in bank statement. But, the entry is made in the cash book only when the bank statement is received by the customer. Till then, the cash book shows more balance than bank statement.

Question 9.

What will be the effect of Bills collected by the bank on behalf of its customers?

Answer:

When goods are sold by the business, the documents may be sent through the bank. When the bank collects the amount, it is credited in bank records. But, the entry is made in the cash book only when the bank statement is received by the business. Till then, the bank statement shows more balance than cash book.

Question 10.

Explain the differences arising due to errors in recording the entries.

Answer:

Errors committed in recording the transactions by the business in the cash book:

Sometimes, errors may be committed in the cash book. For example, omission or wrong recording of transaction relating to cheques deposited or issued, wrong balancing, etc. In these cases, obviously, there will be differences between bank balance as per bank statement and bank balance as per cash book.

Errors committed in recording the transactions by the bank:

Sometimes errors may be committed in the banker’s book. For example, omission or wrong recording of transaction relating to cheques deposited and wrong balancing. In these cases, obviously, there will be differences between bank balance as per bank statement and bank balance as per cash book.

Question 11.

What is the need for bank reconciliation statement?

Answer:

- To identify the reasons for the difference between the bank balance as per the cash book and bank balance as per bank statement.

- To identify the delay in the clearance of cheques.

- To ascertain the correct balance of bank column of cash book.

- To discourage the accountants of the business as well as bank from misusing funds.

Additional Sums:

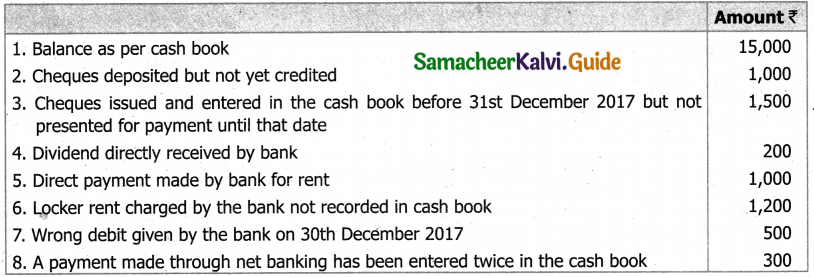

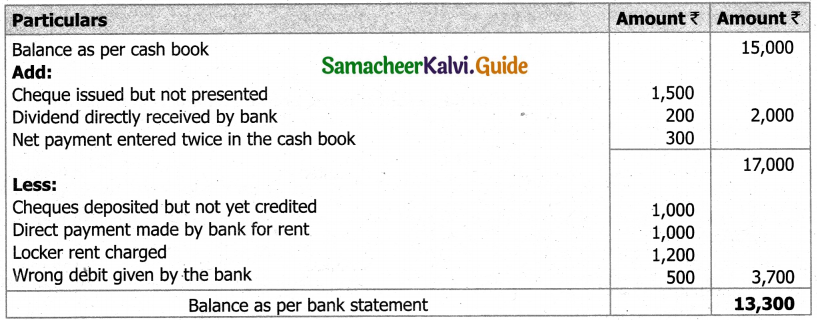

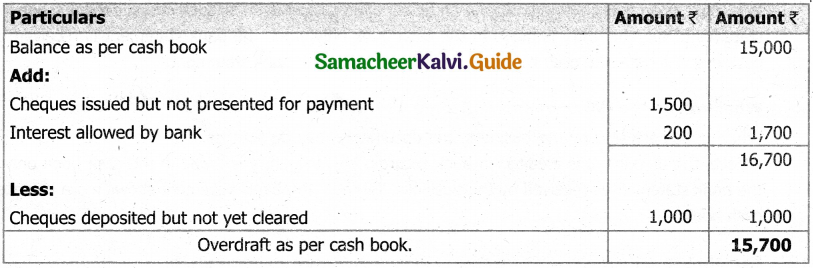

Question 1.

Prepare bank reconciliation statement of Mr. Bala as on 31.03.2013.

a) Balance as per cash book ₹ 15,000

b) Cheques deposited but not cleared ₹ 1,000

c) Cheques issued but not yet present for payments ₹ 1500 d. Interest allowed by bank ₹ 200

Solution:

Prepare bank reconciliation statement

Question 2.

Prepare bank Reconciliation statement to find out balance as per bank statement on 31st March 2018,

1. Cheques deposited but not yet collected by the bank ₹ 1,000

2. Cheques issued but not yet presented for payment ₹ 2,000

3. Bank Interest Charged ₹ 200

4. Rent paid by bank as per standing Instruction ₹ 400

5. Cash book balances ₹ 600

Solution:

Prepare bank reconciliation statement

![]()

Question 3.

Form the following particulars of Ashok and company; prepare a bank reconciliation statement as on 31st March 2018.

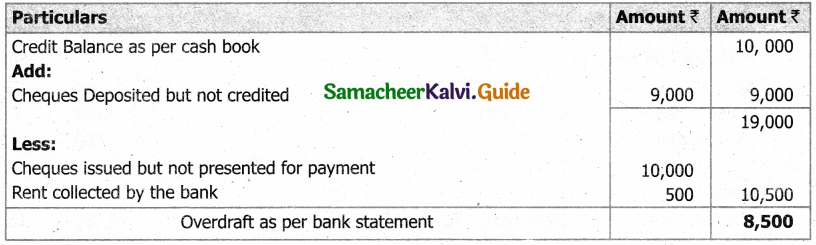

a) Credit balance as per cash book ₹ 10,000

b) Cheques issued but not yet presented for payment ₹ 10,000

c) Cheques Deposited but not credited ₹ 9000

d) Rent collected by the bank as per standing Instruction ₹ 500

Solution:

Bank Reconciliation statement Mr. Ashok as on 31st March 2018

Question 4.

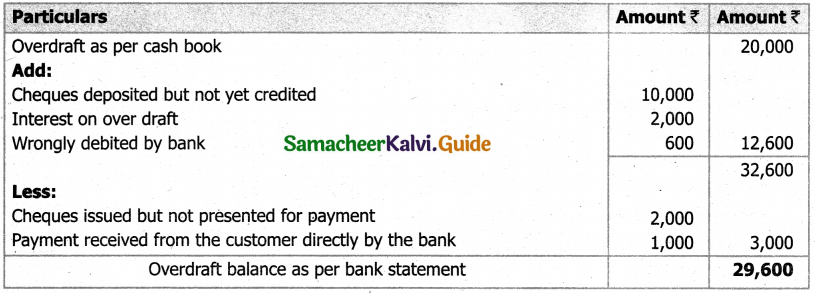

From the following information, Prepare bank Reconciliationstatement of Mr. Mohan as on 31st Dec. 2017 to find out the balance as per bank statement.

i) Overdraft as per cash book – 20000

ii) Cheques deposited but not yet credited – 10000

iii) Amount wrongly deposited by bank – 600

iv) Interest on overdraft debited by bank – 2000

v) Cheque issued but not yet present for payment – 2000

vi) Payment received from the customer directly by the bank – 1000

Solution:

Bank Reconciliation statement Mr. Mohan as on 31st Dec. 2018.

Question 5.

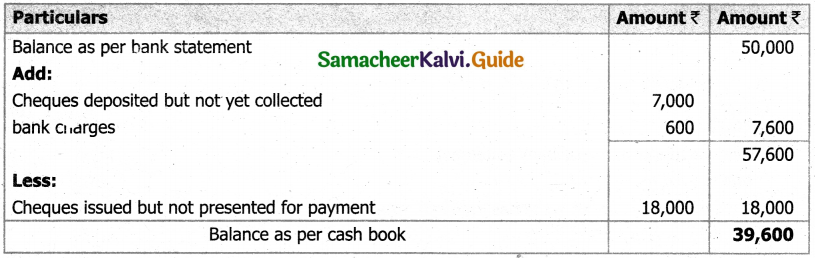

Prepare bank Reconciliation statement as on 31st December 2017. From the following in information.

a) Balance as perbank statement (pass book) is ₹ 50,000

b) Cheques deposited into bank amount into ₹ 7,000 were not yet collected.

c) Bank charges of ₹ 600 have not been entered in the cash book.

d) Cheques issued amount to ₹ 18,000 have not been presented by for payment.

Solution:

Bank Reconciliation statement as on 31st Dec. 2017.

Question 6.

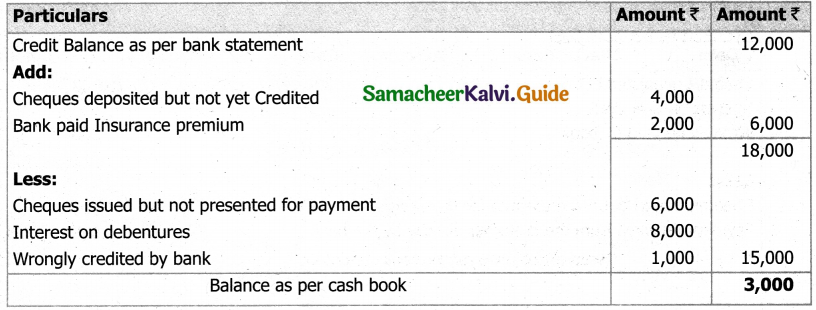

From the following information, prepare bank Reconciliationstatement as of Mr. Pugazh as on 31st Dec. 2017.

i) Credit balance as per bank statement ₹ 12,000

ii) Cheques deposited on 28th December 2017 but not yet credited ₹ 4000

iii) Cheques issued for 20000 on 20th December 2017 but not yet presented for payment 6000.

iv) Interest on debentures directly in cash book ₹ 8000

v) Insurance premium on building directly paid by the bank ₹ 2000

vi) Amount wrongly credit by bank ₹ 1,000

Solution:

Bank Reconciliation statement of Mr. Pugazh as on 31st Dec. 2017.

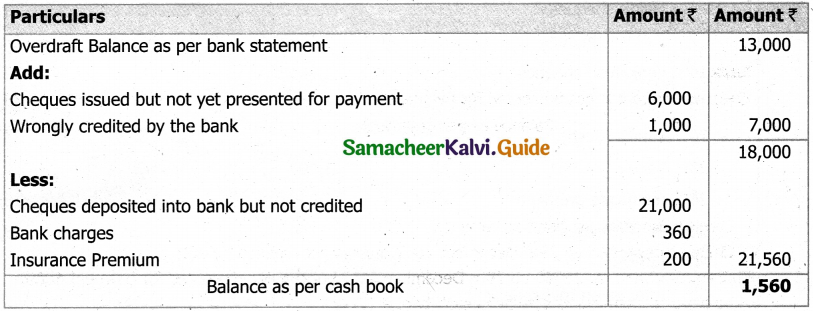

Question 7.

From the following data, as certain the cash book balance as on 31st Dec. 2017.

1) Overdraft balance as per bank statement ₹ 13,000

2) Cheques deposited into the bank but not yet credited ₹ 21,000

3) Wrongly credit by the bank ₹ 1,000

4) Cheques issued, but not yet presented for payment₹ 6,000

5) Bank charges debited by bank ₹ 360

6) Insurance Premium on building directly paid by bank ₹ 200

Solution:

Bank Reconciliation statement on 31st Dec. 2017.

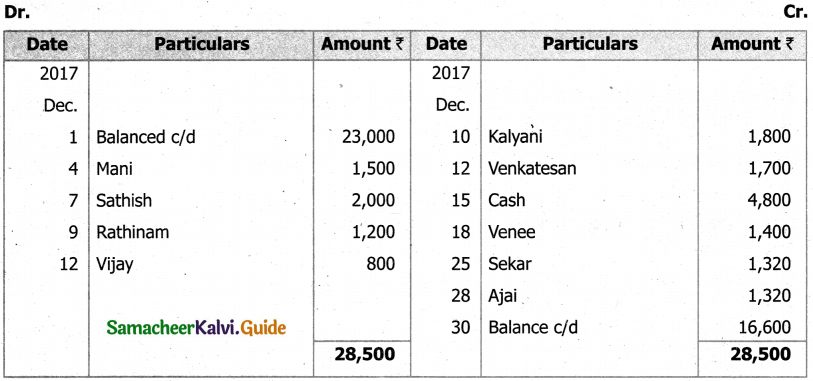

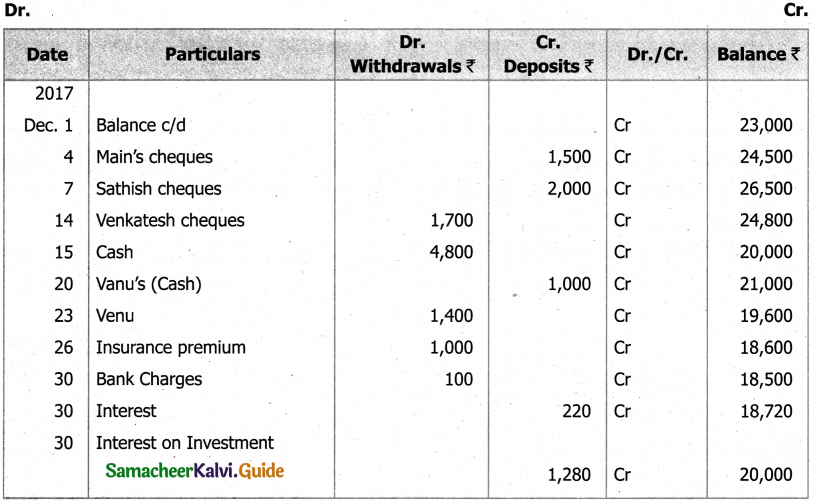

Question 8.

Prepare bank Reconciliation statement as on 31st Dec. 2017, From the following balance of cash book, and bank statement.

Cash book (Bank column)

Bank Statement

Solution:

Bank Reconciliation Statement on 31st Dec, 2017.

Question 9.

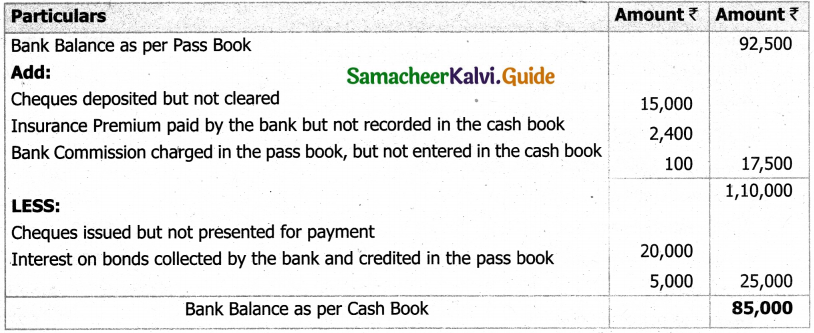

On 31st March 2017, the pass book of Mr, A showed a credit balance of Rs.92,500. A comparison of pass book and cash book revealed the following:

Solution:

Bank Reconciliation Statement of Mr. A as on 31st March 2017

![]()

Question 10.

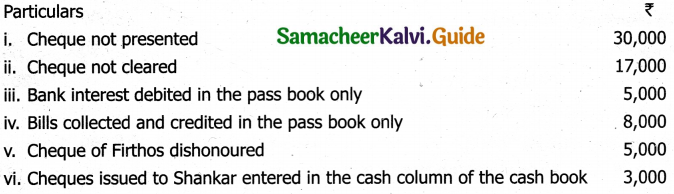

The bank overdraft of Rajini on 31.12.2017 as per cash book is 90,000. From the following particulars, prepare bank reconciliation statement:

Solution:

Bank Reconciliation Statement as on 31,12.2017 3,000

Question 11.

Prepare a bank reconciliation statement from the following data as on 31.12.2017.

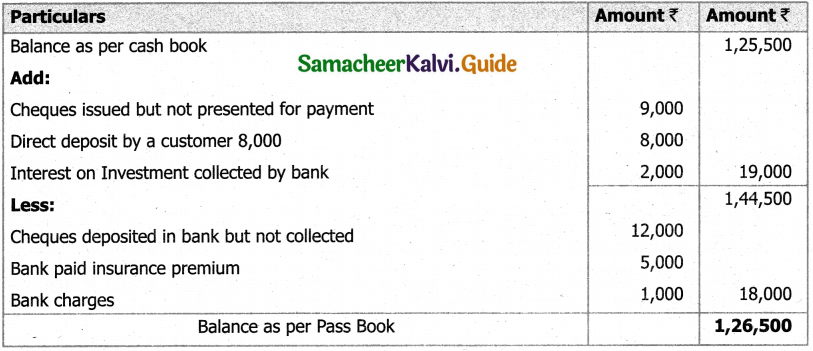

a) Balance as per cash book ₹ 1,25,500

b) Cheques issued but not presented for payment ₹ 9,000

c) Cheques deposited in bank but not collected ₹ 12,000

d) Bank paid insurance premium ₹ 5,000

e) Direct deposit by a customer ₹ 8,000

f) Interest on investment collected by bank ₹ 2,000

g) Bank charges ₹ 1,000

Solution:

Bank Reconciliation Statement as on 31.12.2017

Question 12.

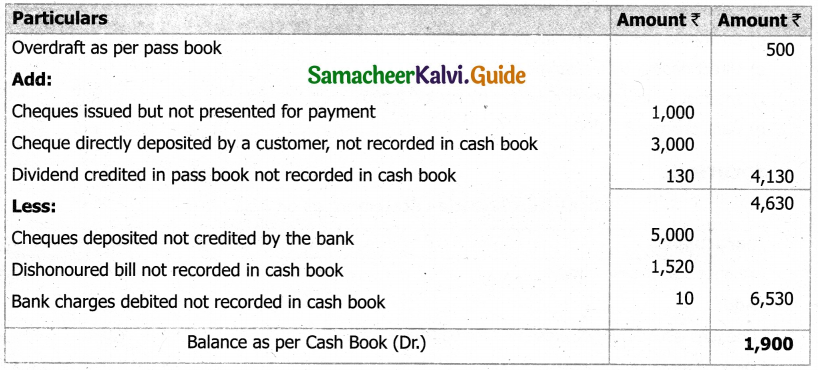

The pass book of X with his bank shows a debit balance of Rs. 500 on 31.10.2017. On comparison of the pass book with the cash book, it is observed that:

i. Cheques issued by X in October 2017 amounted to ₹ 4, 535 of which cheques amounting to ₹ 3,535 were paid by the bank by 31st October 2017.

ii. X deposited cheques amounting to ₹ 5, 000 on 31st October 2017. These cheques were realised by the bank on 1st November, 2017.

iii. Y a customer of X had directly deposited a sum of ₹ 3, 000 on 24th October 2017 to the credit of X account with the bank. X recorded this receipt on 4th November, 2017.

iv. The bank had debited X’s account with ₹ 1, 520 on 31.1.2017 on account of a dishonoured bill. No entry for the same has been made in the account books.

v. On 31.10.1995 X’s account was credited with ₹ 130 being dividend collected by the bank. On the same day, his account was debited with ₹ 10 being bank charges. Both these entries were recorded by X only on 5th November, 2017.

Prepare the Bank Reconciliation Statement as at 31.10.2017.

Solution:

Bank Reconciliation Statement as on 31.10.2017

Question 13.

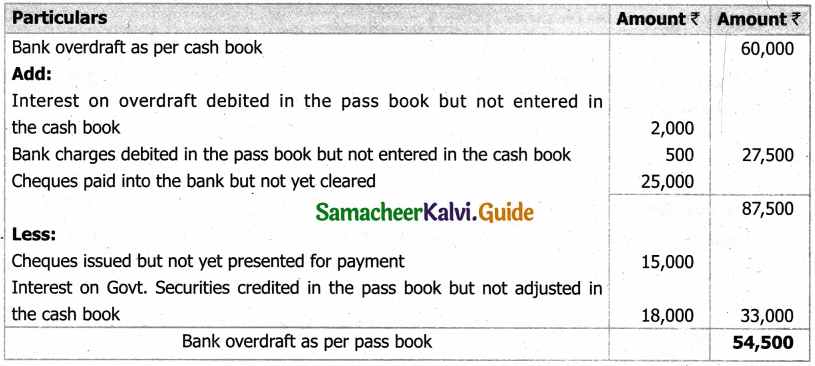

From the following particulars ascertain the bank balance as would appear in the pass‘book as on 31st December, 2016.

i. The bank overdraft (Credit balance) as per cash book on 31st December 2016 was ₹ 60,000

ii. Interest on overdraft, six months ending 31st December, amounting to ₹ 2,000 is debited in the pass book.

i. Bank charges for the above period also debited in the pass book which amounted to ₹ 500.

ii. Cheques issued but not presented for payment before 31st December amounted to ₹ 15,000.

iii. Cheques paid into the bank, but not cleared and credited before 31st December were ₹ 25,000.

iv. Interest on government securities collected by the bank and credited in the pass book amounted to ₹ 18,000.

Solution:

Bank Reconciliation Statement as on 31st March 2016

Question 14.

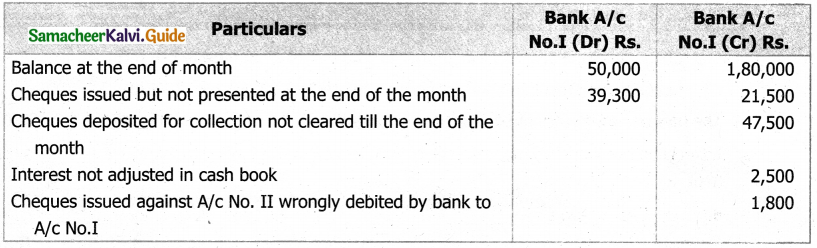

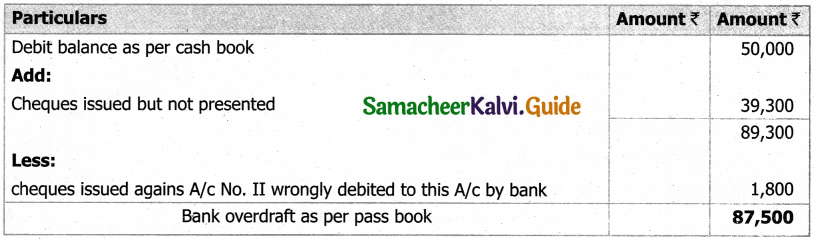

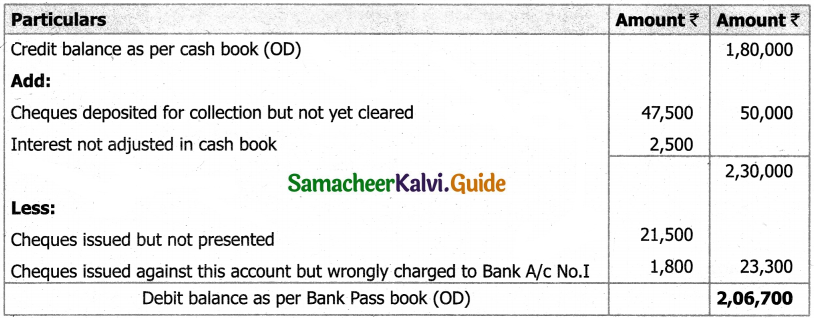

From the following information available from the books and records of X & Co., prepare BRS:

Solution:

Bank Reconciliation Statement for Bank A/c No. I

Bank Reconciliation Statement for Bank A/c No. II

![]()

Question 15.

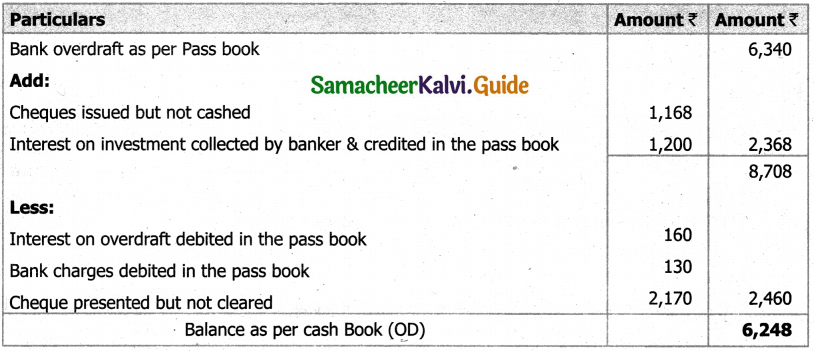

From the following particulars ascertain the bank balance that would appear in the cash book of Son 31.12.2016.

i) The bank overdraft as per pass book on 31.12.2016 ₹ 6,340

ii) Interest on on for the year ending 31.12.2016 ₹ 160 is debited in the pass book

iii) Bank charges of ₹130 for the above period are also debited in the pass book.

iv) Cheques issued but not cashed prior to 31.12.2016 amounted to ₹ 11,168

v) Cheques paid into bank but not cleared before 31.12.2016 were ₹ 2170

vi) Interest on investments collected by the bankers and credited in the pass book, ₹ 1,200

Solution:

Bank Reconciliation Statement as on 31st December 2016