Tamilnadu State Board New Syllabus Samacheer Kalvi 7th Social Science Guide Pdf Economics Term 3 Chapter 1 Tax and its Importance Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 7th Social Science Solutions Economics Term 3 Chapter 1 Tax and its Importance

7th Social Science Guide Tax and its Importance Text Book Back Questions and Answers

I. Choose the correct answer:

Question 1.

Taxes are ………………. payment.

a) Voluntary

b) Compulsory

c) a&b

d) None of the above

Answer:

b) Compulsory

![]()

Question 2.

Minimum possible amount should be spent in the collection of taxes is

a) canon of equality

b) canon of certainity

c) canon of economy

d) canon of convenience

Answer: a) canon of equality

Question 3.

This taxation is a very opposite of progressive taxation.

a) degressive

b) proportional

c) regressive

d) none

Answer:

c) regressive

Question 4.

Income tax is a

a) direct tax

b) indirect tax

c) a & b

d) degressive tax

Answer:

a) direct tax

![]()

Question 5.

Which tax is raised on provision of service.

a) wealth

b) corporate

c) wealth

d) service

Answer:

b) Compulsory

II. Fill in the blanks:

1. ………………. is a term for when a taxing authority usually a government levies or imposes a tax.

Answer:

Taxation

2. ………………. is the method, where the rate of tax is the same regardless size of the income.

Answer:

Proportional Taxation

![]()

3. ………………. is paid to the Government by the recipient of the gift depending on the value of the gift.

Answer:

Gift Tax

4. ………………. burden cannot be shifted by taxpayers.

Answer:

Indirect tax

5. Indirect tax is elastic.

Answer:

more

III. Match the following:

| A | B |

| 1. Principle of taxation | a) Direct Tax |

| 2. Estate tax | b) Goods and Service Tax |

| 3. Excise Tax | c) Adam Smith |

| 4. 01.07.2017 | d) Less elastic |

| 5. Direct Tax | e) Indirect Tax |

Answer:

| A | B |

| 1. Principle of taxation | a) Direct Tax |

| 2. Estate tax | b) Goods and Service Tax |

| 3. Excise Tax | c) Adam Smith |

| 4. 01.07.2017 | d) Less elastic |

| 5. Direct Tax | e) Indirect Tax |

![]()

IV. Odd one out:

Question 1.

Which one of the following is not an indirect tax?

a) Service tax

b) Value Added Tax(VAT)

c) Estate duty

d) Excise duty

Answer:

c) Estate duty

V. Correct one out:

Question 1.

Which one of the following tax is a direct tax?

a) Service tax

b) Wealth tax

c) Sales tax

d) Progressive tax

Answer:

d) Progressive tax

![]()

VI. Give a short answer:

Question 1.

Define tax.

Answer:

Taxes are compulsory payments to the government without expectations of direct or return or benefit to the taxpayers.

Question 2.

Why taxes are imposed?

Answer:

- For the welfare of society, the government has to perform various functions so it requires revenue.

- The main source of revenue is tax.

Question 3.

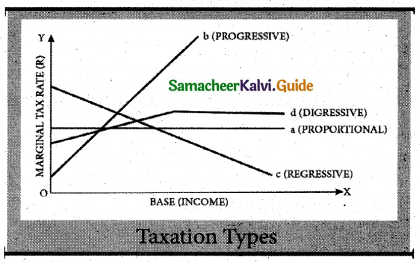

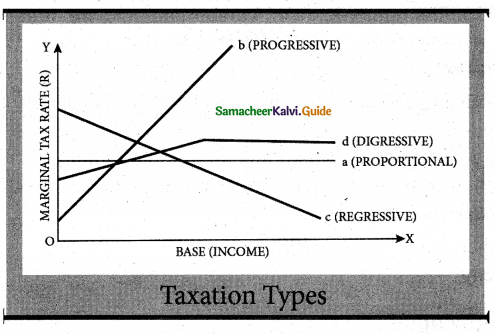

Write the name of taxation types and draw its diagram.

Answer:

There are three types of Taxation:

- Proportional Tax

- Progressive Tax

- Regressive Tax.

![]()

Question 4.

Write any three importance of tax.

Answer:

- Health

- Education

- Governance.

Question 5.

What are the types of tax? and explain it.

Answer:

Taxes are classified into two types. They are:

1. Direct Tax:

- A Direct tax is paid directly by an individual or organisation to imposing an entity

- Eg: Income tax, Wealth Tax, etc.

2. Indirect Tax:

- Indirect Tax is a tax whose burden can be shifted to others.

- Eg: Service tax, Value added tax, etc.

![]()

Question 6.

Write a short note on Gift Tax and Service Tax.

Answer:

Gift Tax:

It is paid to the Government by the recipient of the gift depending on the value of the gift.

Service Tax:

- It is raised on the provision of Service.

- This tax is collected from the service recipients and paid to the Central Government.

Question 7.

What is Goods and Service Tax?

Answer:

- Goods and Services Tax is a kind of tax imposed on the sale, manufacturing, and usage of goods and services.

- This is applied to achieve overall economic growth.

- GST is particularly designed to replace indirect taxes.

Question 8.

Write a distinction between direct and indirect tax.

Answer:

Direct Tax:

- Burden cannot be shifted by taxpayers.

- Tax is imposed on personal income and corporate income.

- Direct tax has no inflation pressure.

- The impact and incidence are the same in case of direct tax.

- Direct tax is less elastic.

Indirect Tax:

- Easily be shifted to another person.

- Taxes imposed on various goods and services.

- This tax has inflation pressure.

- The impact and incidence are different in the case of indirect tax.

- Indirect tax is more elastic.

![]()

VII. Give a brief answer:

Question 1.

Write answer briefly the principles of taxation.

Answer:

Adam Smith’s principles or camions of taxation still form the basis of the tax structure of a modem state.

Adam Smith’s four Canons of Taxation:

- Canon of Equality

- Canon of Certainty

- Canon of Convenience

- Canon of Economy.

1. Canon of Equality:

- The government should impose taxes in such a way that people have to pay according to their ability.

- It does not mean an equal amount of tax but it means that the burden of a tax must be fair and just.

2. Canon of Certainty:

Certainty creates confidence in the taxpayer’s cost of collection of taxes and increases economic welfare because it tends to avoid all economic waste.

3. Canon of Convenience:

- Taxes should be levied and collected in such a manner that it provides maximum convenience to the taxpayers.

- It should always be kept in view that the taxpayers suffer the least inconvenience in payment of the tax.

4. Canon of Economy:

- Minimum possible money should be spent in the collection of taxes.

- The collected amount should be deposited in the Government treasury.

Question 2.

Explain the taxation types.

Answer:

There are three types of Taxation:

- Proportional Tax

- Progressive Tax

- Regressive Tax

Proportional Taxation:

- The rate of tax is the same regardless of the size of the income.

- The tax amount realized will vary in the same proportion as that of income.

Progressive Taxation:

The rate of tax will also increase with the increase of income of the person.

Regressive tax;

- A regressive tax is a tax applied uniformly, taking a larger percentage of income from low-income earners than from high-income earners.

- It is in opposition to a progressive tax.

![]()

Question 3.

Explain the importance of tax.

Answer:

Importance of Tax: Taxes are crucial because governments collect this money and use it to finance the following social projects.

Health:

- Without taxes, government contributions to the health sector would be impossible.

- Taxes go to funding health services such as social healthcare, medical research, social security, etc.

Education:

- Education could be one of the most deserving recipients of tax money.

- Governments put a lot of importance in the development of human capital and education is central in this development.

Governance:

- Governance is a crucial component in the smooth running of country affairs.

- Poor governance would have far-reaching ramifications on the entire country with a heavy toll on its economic growth.

- Good governance ensures that the money collected is utilized in a manner that benefits citizens of the country.

Other important sectors are infrastructure development, transport, housing, etc.

- Apart from social projects, governments also use money collected from taxes to fund sectors that are crucial for the wellbeing of their citizens such as security, scientific research, environmental protection, etc.

- Some of the money is also channeled to fund projects such as pensions, unemployment benefits, childcare, etc,

Question 4.

Explain the direct and indirect tax with examples.

Answer:

Taxes are classified into two types. They are:

1. Direct Tax:

- A Direct tax is paid directly by an individual or organisation to an imposing entity.

- Eg: Incometax, WealthTax,etc.

2. Indirect Tax:

- IndirectTaxisataxwhoseburdencanbeshiftedtoothers. LSIOTT

- Eg: Servicetax,Valueaddedtax,etc.

Direct Tax:

Gift Tax:

It is paid to the Government by the recipient of the gift depending on the value of the gift.

Estate Duty:

- It is charged from success or of inherited property.

- It is not desirable to avoid payment of taxes

WealthTax:

It is imposed on the property of individuals depending upon the value of the property.

Indirect Tax :

Service Tax:

- It is raised on the provision of Service.

- This tax is collected from the service recipients and paid to the Central Government.

Sales TaxorVAT:

It is an indirect tax on the sale of goods because the liability to collect tax is that of the shopkeeper but the burden of that tax falls on the customer.

Goods and Services Tax(GST):

- Goods and Services Tax is a kind of tax imposed on the sale, manufacturing, and usage of goods and services.

- This is applied to achieve overall economic growth.

- GST is particularly designed to replace indirect taxes.

![]()

Question 5.

Why the need for a tax on people’s welfare? And explain it.

Answer:

- The levying of taxes aims to raise revenue to fund governing or to alter prices in order

to affect demand. - Some of these include expenditures on economic infrastructure like transportation, sanitation, public safety, education, health-care systems, etc., military, scientific research, culture, and the arts, public works, public insurance, etc., and the operation of government itself.

- When expenditures exceed tax revenue, a government accumulates debt. A portion of taxes may be used to service past debts.

- Governments also use taxes to fund welfare and public services. These services can include education systems, pensions for the elderly, unemployment benefits, and public transportation.

- Energy, water, and waste management systems are also common public utilities.

- The purpose of taxation is to maintain the stability of the currency, express public policy regarding the distribution of wealth, subsidizing certain industries or population groups, or isolating the costs of certain benefits, such as highways or social security.

7th Social Science Guide Tax and its Importance Additional Important Questions and Answers

I. Choose the Correct answer:

Question 1.

According to Prof. Seligman, taxes are defined as a compulsory contribution from a person to the government to defray the expenses incurred in the common interest of ail without reference to special benefits conferred.

a) Chamberlin

b) Seligman

c) Adam smith

d) Marshal

Answer:

b) Seligman

![]()

Question 2.

A regressive tax is a tax applied uniformly, taking a larger percentage of income from low-income earners than from high-income earners.

a) Progressive tax

b) Regressive tax

c) Proportional tax

d) Health

Answer:

b) Regressive tax

Question 3.

Without taxes, governments would be unable to meet the demands of their societies.

a) societies

b) Revenue

c) Economic

d) Expenditure types

Answer:

a) societies

![]()

Question 4.

Wealth tax is imposed on the property of individuals depending upon the value of the property.

a) Company

b) Gift

c) Wealth tax

d) Direct tax

Answer:

c) Wealth tax

Question 5.

The gift tax is paid to the Government by the recipient of the gift depending on the value of the gift.

a) Gift tax

b) Indirect tax

c) Direct tax

d) Service

Answer:

a) Gift tax

Question 6.

Goods and service tax is applied on services and goods at a national level with the purpose of achieving overall economic growth.

a) State

b) National

c) Rounding off

d) Town

Answer:

b) National

![]()

Question 7.

Excise tax in India is levied by the Central Government.

a) Service tax

b) VAT

c) Excise tax

d) direct tax

Answer:

b) VAT

II. Fill in the blanks:

1. …………………..is the government should impose taxes in such a way that people have to pay according to

their ability.

Answer:

Canon of Equality

2. …………………. is the taxes should be levied and collected in such a manner that it provides a maximum of convenience to the taxpayers.

Answer:

Canon of Convenience

![]()

3. …………………. is the minimum possible money should be spent in the collection of taxes.

Answer:

Canon of Economy

4. …………………. could be one of the most deserving recipients of tax money.

Answer:

Education

5. A …………….is paid directly by an individual or organisation to imposing entity.

Answer:

Direct tax

6. The central Board of Revenue act implemented in the year.

Answer:

1963

7. The tax is levied on the profit of corporations and companies is

Answer:

Corporation Tax

![]()

8. ………………… is a liability to collect tax is that of shopkeeper but the burden of that tax falls on the customer.

Answer:

VAT

9. ………………… is a kind of tax imposed on the sale, manufacturing, and usage of goods and services.

Answer:

Goods and Services Tax

10. A government’s ability to raise taxes is called its ………………….

Answer:

fiscal capacity

III. Match the following

| A | B |

| 1. Adam smith | a) Payment using aadhar |

| 2. Progressive tax | b) 1963 |

| 3. Digital India | c) 2005 |

| 4. Central Board of Revenue Act | d) Canon of Taxation |

| 5. VAT | e) increase the income |

Answer:

| A | B |

| 1. Adam smith | d) Canon of Taxation |

| 2. Progressive tax | e) increase the income |

| 3. Digital India | a) Payment using aadhar |

| 4. Central Board of Revenue Act | b) 1963 |

| 5. VAT | c) 2005 |

IV. Odd one out:

Question 1.

a) Service Tax – Swachh Bharat cess

b) Road Development – Toll-Tax Road Tax

c) Indirect Tax – More elastic.

Answer:

a) Service Tax – Swachh Bharat cess

![]()

V. Give a short answer:

Question 1.

What was the Kalidas said about taxes?

Answer:

“It was only for the good of his subjects that he collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousandfold”.

Question 2.

What are Adam Smith’s four Canons of Taxation?

Answer:

- Canon of Equality

- Canon of Certainty

- Canon of Convenience

- Canon of Economy.

Question 3.

Mention some of the Wealth Taxes.

Answer:

- Home

- Motor Car

- Jewellery

- Cash

- Urban Land

- Yachats, Boats, Aircraft.

![]()

V. Detail

Question 1.

Explain the following

a) Toll Tax and & Road Tax

b) Swachh Bharat Cess

Answer:

a) Toll Tax and & Road Tax:

Toll tax is a tax you often pay to use any form of infrastructure developed by the government, for example, roads and bridges. The tax amount levied is rather negligible which is used for maintenance and basic upkeep of a particular project.

b) Swahh Bharat Cess:

This is a cess imposed by the government of India and was started on 15 November 2015. This tax is applicable on all taxable services arid the cess currently stands at 0.5%. Swachh Bharat cess is levied over and above the 14% service tax that is prevalent in the present times.