TN State Board 11th Commerce Important Questions Chapter 20 International Finance

Question 1.

Who are Foreign Institutional Investors?

Answer:

Fils are the investments made by an individual investor or an investment fund, into the financial markets of another nation. Organisations like hedge funds, insurance companies, pension funds and mutual funds can be called as institutional investors.

Question 2.

What is a Depository Receipt?

Answer:

- A depository receipt is a negotiable financial instrument issued by a bank to represent a foreign company’s equity shares or securities.

- They are issued to attract a greater amount 01s investment from other countries. Any foreign investor can invest in a foreign stock directly without worrying about differences in currency, accounting practices, or language barriers, etc.

![]()

Question 3.

What is a GDR (Global Depository Receipt)?

Answer:

GDR is an instrument issued abroad by a company to raise funds in some foreign currencies and is listed and traded on a foreign stock exchange.

Question 4.

What is an American Depositary Receipt (ADR)?

Answer:

ADR is a dollar denominated negotiable certificate representing a non-US company in US market which allows the US citizens to invest in overseas securities.

Question 5.

What is a Foreign Currency Convertible Bonds?

Answer:

Foreign currency convertible bond is a special type of bond issued in the currency other than the home currency. In other words, companies issue foreign currency convertible bonds to raise money in foreign currency.

![]()

Question 6.

Explain the importance of international finance.

Answer:

Importance of International finance:

International finance plays a pivotal role in the international trade and in the sphere of exchange of goods and services among the nations.

- International finance helps in calculating exchange rates of various currencies of nations and the relative worth of each and every nation in terms thereof.

- It helps in comparing the inflation rates and getting an idea about investing in international debt securities.

- It helps in ascertaining the economic status of the various countries and in judging the foreign market.

Question 7.

What are Foreign Currency Convertible Bonds?

Answer:

Foreign currency convertible bond is a special type of bond issued in the currency other than the home country. In otherwords, companies issues foreign currency convertible bonds to raise money in foreign currency.

Question 8.

Explain any three disadvantages of FDI.

Answer:

(i) Exploiting Natural Resources:

The FDI Corhpanies deplete natural resources like water, forest, mines etc. As a result such resources are not available for the usage oN common man in the host country.

(ii) Heavy Outflow of capital:

Foreign companies are said to take away huge funds in the form of dividend, royalty fees etc. This causes a huge outflow of capital from the host country.

(iii) Not Transferring Technology:

Some foreign enterprises do not transfer the technology to developing countries. They mostly transfer second hand technology to the host country.

![]()

Question 9.

State any three features of ADR.

Answer:

- ADRs are denominated only in US dollars.

- They are issued only to investors who are American residents.

- The depository bank should be located in US.

Question 10.

State any three features of GDR.

Answer:

- It is a negotiable instrument and can be traded freely like any other security.

- Indian companies with sound financial track of three years are readily allowed to access international financial markets through GDR. However clearances are required from the Foreign Investment Promotion Board (FIPB) and the Ministry of Finance.

- GDRs are issued to investors across the country. It is denominated in any acceptable freely convertible currency.

Question 11.

Describe the importance of international finance?

Answer:

- International finance helps in calculating exchange rates of various currencies of nations and the relative worth of each and every nation in terms thereof.

- It helps in comparing the inflation rates and getting an idea about investing in international debt securities.

- It helps in ascertaining the economic status of the various countries and in judging the foreign market.

- International Financial Reporting System (IFRS) facilitates comparison of financial statements made by various countries.

- lt helps in understanding the basics of international organisations and maintaining the balance among them.

![]()

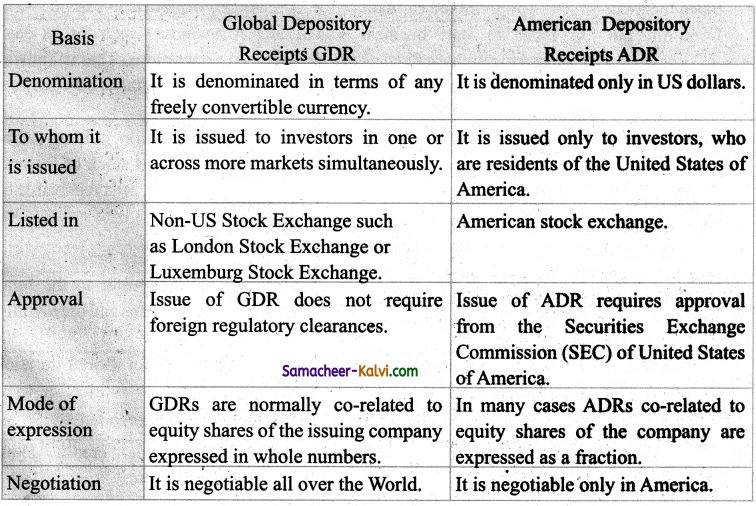

Question 12.

Distinguish between GDR and ADR.

Answer:

Question 13.

State any five features of FCCB.

Answer:

- FCCB is issued by an Indian company in foreign currency.

- These are listed and traded in foreign stock exchange and similar to the debenture.

- It is a convertible debt instrument. It carries interest coupon. It is unsecured.

- It gives its holders the right to convert for a fixed numbers of shares at a pre-determined price.

- It can be converted into equity or depository receipt after a certain period.

Question 14.

Explain any five advantages of FDI.

Answer:

(i) Achieving Higher Growth in National Income:

Developing countries get much needed capital through FDI to achieve higher rate of growth in national income.

(ii) Help in Addressing BOP Crisis:

FDI provides inflow of foreign exchangeresources into a country. This helps the country to solve adverse balance of payment position.

(iii) Faster Economic Development:

FDI brings technology, management and marketing skills along with it. These are crucial for achieving faster economic development of developing countries.

(iv) Generating Employment Opportunities:

FDI generates a lot of employment opportunities in developing countries, especially in high skill areas.

(v) Encouraging Competition in Host Countries:

Entry of FDI into developing country promotes healthy competition therein. This leads to enterprise in developing countries operating efficiently and effectively in the market. Consumers get a variety of products of good quality at market determined price which usually benefits the customers.

![]()

Question 15.

Role of World Bank in globalization.

Answer:

The Bretton woods institutions the IMF and World Bank have an important role to play in making globalization work better. They were created in 1944 to help restore and sustain the benefits of global integration by promoting international economic co-operation.

Question 16.

The concept of Hot Money.

Answer:

Hot money refers to funds that are controlled by investors who actively seek short term returns. These investors scan the market for short term, high interest rate investment opportunities. A typical short term- investment opportunity that attracts hot money is the certificate of deposit.

Question 17.

Possibilities of making the western and American countries in favour of Indian Depository Receipt (IDR).

Answer:

An IDR is meant to diversify your holding across regions to free you from a region bias or the risk of a port folio getting too concentrated in the home market you need to study the firms. Financials before you buy its IDR.

![]()

Question 18.

Petrodollar system and its future.

Answer:

If you have never heard of the petrodollar system. It will not surprise me. It is certainly not a topic that makes its way out Washington and wall street circles too often. The mainstream media rarely if ever discusses the inner working of the petrodollar system.

Choose the Correct Answer:

Question 1.

An instrument representing ownership interest in securities of a foreign issuer is called:

(a) an ownership certiìcate

(b) a depositary receipt

(c) an ownership receipt

(d) None of the above

Answer:

(b) a depositary receipt

Question 2.

Issuance of DRs is based on the increase of demand in the:

(a) international market

(b) local market

(e) existing shareholders

(d) all of the above

Answer:

(a) international market

Question 3.

ADRs are issued in:

(a) Canada

(b) China

(c) India

(d) the USA

Answer:

(d) the USA

![]()

Question 4.

Depositary receipts that are traded in an international market other than the United States are called:

(a) Global Depositary Receipts

(b) International Depositary Receipts

(c) Open Market Depositary Receipts

(d) Special Drawing Rights.

Answer:

(a) Global Depositary Receipts

Question 5.

________ bond is a special type of bond issued in the currency other than the home currency.

(a) Government Bonds

(b) Foreign Currency Convertible Bond

(c) Corporate Bonds

(d) Investment Bonds

Answer:

(b) Foreign Currency Convertible Bond

Samacheer Kalvi 11th Commerce Notes Chapter 20 International Finance

→ International finance is a branch of financial economics that deals with the monetary interaction that occur between two or more – countries. This section is concerned with topics that include foreign direct investment and currency exchange rate. It involves issues pertaining to financial management such as political and foreign exchange risk that comes with managing multinational corporation.

→ International finance place on important role ADRs are issued in the international trade and in the sphere of

exchange of goods and services among the nations.

→ Importance of international finance. International finance helps in calculating exchange rates of various currencies nations.

→ It helps in comparing the inflation rates. It help in ascertaining the economic status of various countries. International finance organisation such as IMF, world bank etc. Mediate and resolve financial disputes among member nations.