Students can Download Tamil Nadu 11th Accountancy Model Question Paper 3 English Medium Pdf, Tamil Nadu 11th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 11th Accountancy Model Question Paper 3 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3:00 Hours

Maximum Marks: 90

PART – I

Answer all the questions. Choose the correct answer: [20 × 1 = 20]

Question 1.

One of the major role of an accountant is ……………………..

(a) Record keeper

(b) Owner

(c) Employee

(d) Investors

Answer:

(a) Record keeper

![]()

Question 2.

…………………….. is the amount invested by the owner or proprietor in an organisation.

(a) Capital

(b) Drawings

(c) Goods

(d) Asset

Answer:

(a) Capital

Question 3.

………………………… is analytical in nature.

(a) Book – keeping

(b) Accounting

(c) Journal

(d) Ledger

Answer:

(b) Accounting

![]()

Question 4.

………………………. Accounts are closed at the end of accounting period.

(a) Periodicity

(b) Dual aspect

(c) Matching

(d) Cost

Answer:

(a) Periodicity

Question 5.

……………………. is a negotiable instrument.

(a) Pay – in – slip

(b) Cheque

(c) Voucher

(d) Invoice

Answer:

(b) Cheque

![]()

Question 6.

Rectifying entries are passed to make correction of errors in ……………………… accounting.

(a) Single entry

(b) Opening entry

(c) Rectifying entry

(d) Closing entry

Answer:

(c) Rectifying entry

Question 7.

A journal entry has more than one debit or more than one credit or both is called as ………………………

(a) Single entry

(b) Opening entry

(c) Compound entry

(d) Closing entry

Answer:

(c) Compound entry

Question 8.

…………………….. is normally prepared at the end of the accounting period.

(a) Trial balance

(b) Journal

(c) Ledger

(d) Proper journal

Answer:

(a) Trial balance

![]()

Question 9.

The page number of the ledger in which the supplier’s account appears is recorded in …………………….. column.

(a) Date

(b) Particulars

(c) Invoice number

(d) Ledger folio

Answer:

(d) Ledger folio

Question 10.

……………………… motivates the debtor to make the payment at an earlier date to avail discount facility.

(a) Trade discount

(b) Cash discount

(c) Sales

(d) Purchases

Answer:

(b) Cash discount

![]()

Question 11.

The two accounts involved in a transaction are cash account and bank account is called as ………………………

(a) Contra entry

(b) Single entry

(c) Compound entry

(d) Opening entry

Answer:

(a) Contra entry

Question 12.

…………………….. are recorded on the debit side of cash book.

(a) Cash receipts

(b) Cash payments

(c) Expenses paid

(d) Salary paid

Answer:

(a) Cash receipts

Question 13.

Favourable balance as per bank statement will appear as a …………………………

(a) Credit balance

(b) Debit balance

(c) Unfavourable

(d) Cash book

Answer:

(a) Credit balance

![]()

Question 14.

Sales book is overcast by ? 200 is an example of …………………………

(a) Errors of casting

(b) Principle error

(c) Compensating error

(d) Suspense account

Answer:

(a) Errors of casting

Question 15.

Fixed installment method is otherwise called ………………………….

(a) Straight line

(b) Written down value

(c) Diminishing balance

(d) Annuity

Answer:

(a) Straight line

Question 16.

……………………. gives benefit for more than one accounting period.

(a) Capital expenditure

(b) Revenue expenditure

(c) Revenue receipt

(d) None of these

Answer:

(a) Capital expenditure

![]()

Question 17.

……………………… are assets of a relatively permanent nature used in the operations of business and not intended for sale.

(a) Fixed assets

(b) Current assets

(c) Liquid assets

(d) None of these

Answer:

(a) Fixed assets

Question 18.

Goodwill is an example of ………………………

(a) Intangible fixed asset

(b) Fixed asset

(c) Current asset

(d) Furniture

Answer:

(b) Fixed asset

Question 19.

The decrease in book value of fixed assets due to usage or passage of time is called ………………………….

(a) Depreciation

(b) Prepaid

(c) Accrued

(d) Bad debts

Answer:

(a) Depreciation

![]()

Question 20.

Which one is matched correctly?

(a) Finacle – banking software

(b) DOS – programming software

(c) COBOL – operating software

(d) MS – Office – specific purpose software

Answer:

(a) Finacle – banking software

PART – II

Answer any seven questions in which question No. 21 is compulsory: [7 × 2 = 14]

Question 21.

Who are the parties interested in accounting information?

Answer:

- Internal users and

- External users

![]()

Question 22.

What is meant by accounting concepts?

Answer:

Accounting concepts are the basic assumptions or conditions upon which accounting has been laid. Accounting concepts are the results of broad consensus. The word concept means a notion or abstraction which is generally accepted.

Question 23.

What is real account?

Answer:

All accounts relating to tangible and intangible properties and possessions are called real accounts. In case of real accounts, the rule is debit what comes in and credit what goes out.

![]()

Question 24.

What is a ledger?

Answer:

Ledger is known as principal book of accounts. It is a book which contains all sets of accounts, namely, personal, real and nominal accounts.

Question 25.

What is trial balance?

Answer:

Trial balance is a statement containing the debit and credit balances of all ledger accounts on a particular date. It is arranged in the form of debit and credit columns placed side by side and prepared with the object of checking the arithmetical accuracy of entries made in the books of accounts and to facilitate preparation of financial statements.

![]()

Question 26.

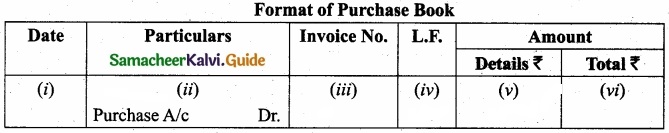

Give the format of Purchase Book?

Answer:

Question 27.

What is Cash discount?

Answer:

Cash discount is allowed to the parties making prompt payment within the stipulated period of time or early payment. It is discount allowed (loss) for the creditor and discount received (gain) for the debtor who makes payment.

Question 28.

Rectify the following errors?

- Sales book was undercast by ₹100.

- Purchases returns book was overcast by ₹200.

Answer:

- Sales account should be credited with ₹100.

- Purchases returns account should be debited with ₹200

![]()

Question 29.

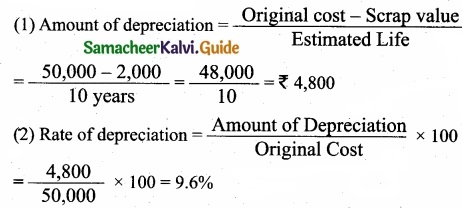

A company purchased a building for ₹50,000. The useful life of the building is 10 years and the residual value is ₹2000. Find out the amount and rate of depreciation under straight line method?

Answer:

Question 30.

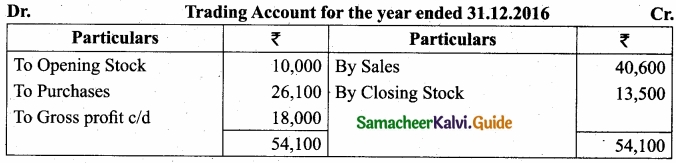

From the following information, prepare Trading account for the year ended 31.12.2016. Opening stock ₹10,000; Purchases ₹26,100; Sales ₹40,600; Closing Stock ₹13,500?

Answer:

PART – III

Answer any seven questions in which question No. 31 is compulsory: [7 × 3 = 21]

Question 31.

What are the components of computerised accounting system?

Answer:

- Hardware

- Software

- People

- Procedure

- Data and

- Connectivity

![]()

Question 32.

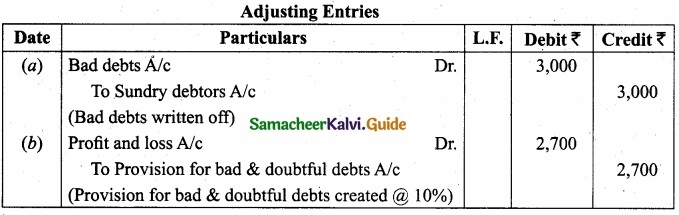

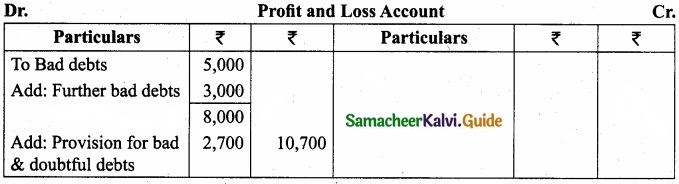

The following are the extracts from the trial balance. Sundry debtors ₹30,000; bad debts ₹5,000;

Additional information:

- Write off bad debts ₹3,000.

- Create 10% provision for bad and doubtful debts. You are required to pass necessary adjusting entries and show how these items will appear in profit and loss account and balance sheet.

Answer:

![]()

Question 33.

Classify the following items into capital and revenue:

- ₹50,000 spent for railway siding.

- Loss on sale of old furniture.

- Carriage paid on goods sold.

Answer:

- Capital

- Revenue

- Revenue

Question 34.

A firm purchased a plant on 01.01.2018 for ₹9,000 and spent ₹1,000 as erection charges. Calculate the amount of depreciation for the year 2018 @ 15% per annum under the written down value method. Accounts are closed on 31st March every year?

Answer:

Original cost = 9,000 + 1,000 = 10,000

Rate of depreciation = 15%

Date of purchase = 01.01.2018

Number of months used = 01.01.2018 to 3 1.03.2018 = 3 months

Amount of depreciation = 15% on 10,000 for 3 months

= 10,000 × 15/100×3/12

= ₹375.

![]()

Question 35.

Rectify the following errors discounted after the preparation of the trial balance:

- Rent paid was carried forward to the next page ₹500 short.

- Wages paid was carried forward ₹250 excess.

- The sales book was overcast by ₹1,500.

Answer:

- Rent account should be debited with ₹500.

- Wages account should be credited with ₹250.

- Sales account should be debited with ₹1,500.

![]()

Question 36.

Expand the following terms:

- ATM

- CDM

- POS

- NEFT

- RTGS

- L.F

Answer:

- Automated Teller Machine (ATM)

- Cash Deposit Machine (CDM)

- Point of Sale (POS)

- National Electronic Funds Transfer (NEFT)

- Real Time Gross Settlement (RTGS)

- Ledger folio (L.F.)

Question 37.

Complete the followings:

- Total of debit > Total of credit = ?

- Total of credit > Total of debit = ?

- Total of debit = Total of credit = ?

Answer:

- Debit balance

- Credit balance

- Nil balance

![]()

Question 38.

Define bill of exchange?

Answer:

According to the Negotiable Instruments Act, 1881, “Bill of exchange” is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.

Question 39.

Write any three advantages of Petty cash book?

Answer:

- There can be better control over petty payments.

- There is saving of time of the main cashier.

- Cash book is not loaded with many cash payments.

![]()

Question 40.

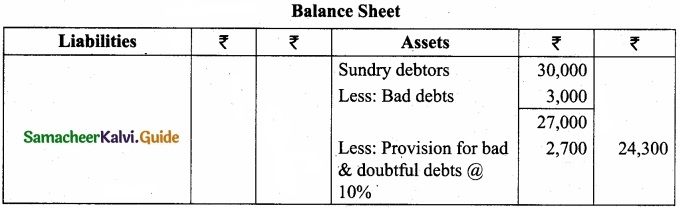

From the followings prepare a bank reconciliation statement of Jayakumar as on 31st December, 2016?

- Balance as per cash book ₹7,130.

- Cheque deposited but not cleared ₹1,000.

- A customer has deposited ₹800 into the bank directly.

Answer:

PART – IV

Answer all the questions: [7 × 5 = 35]

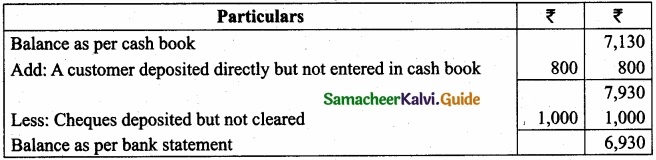

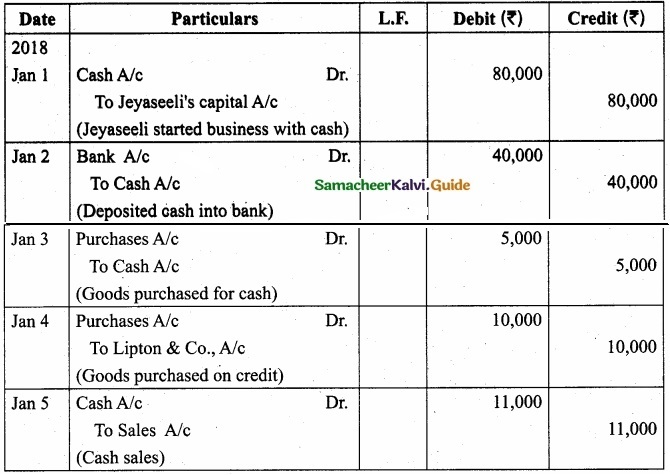

Question 41 (a).

Complete the missing informations:

Answer:

[OR]

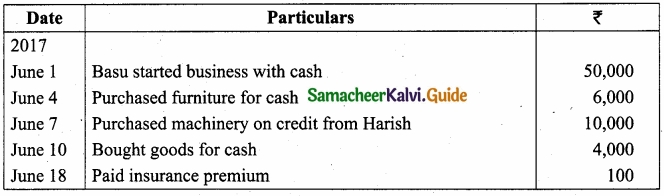

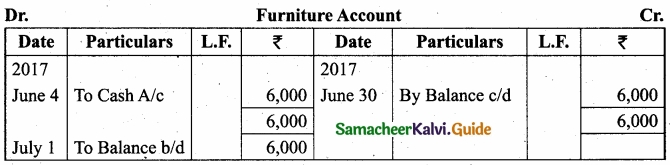

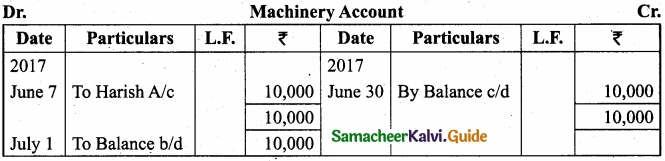

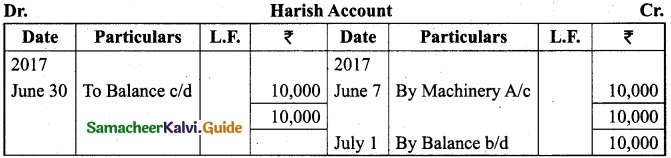

(b) Prepare Ledger accounts directly from the following informations:

Answer:

![]()

Question 42 (a).

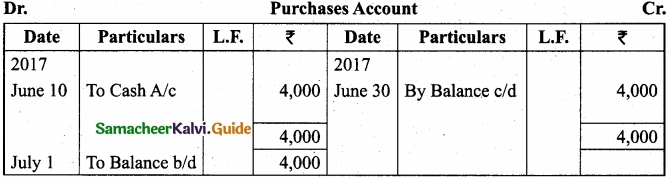

Show the effect of following business transactions on the accounting equation:

- Anbu started business with cash ₹20,000; goods ₹12,000; and machine ₹8,000;

- Goods purchased from Ramani on credit ₹7,000;

- Payment made to Ramani’s in full settlement ₹6,900;

- Sold goods to Rajan on credit costing ₹5,400 for ₹6,000;

Answer:

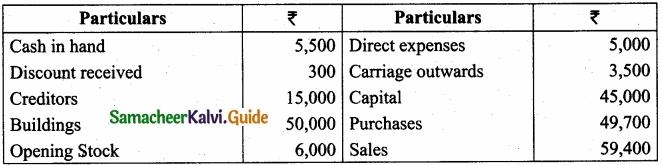

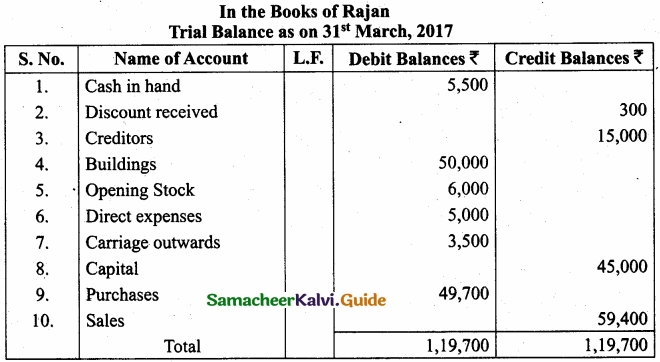

(b) From the following balances extracted from the books of Raj an a trader on automobiles, prepare Trial Balance as on 31stMarch, 2017?

Answer:

![]()

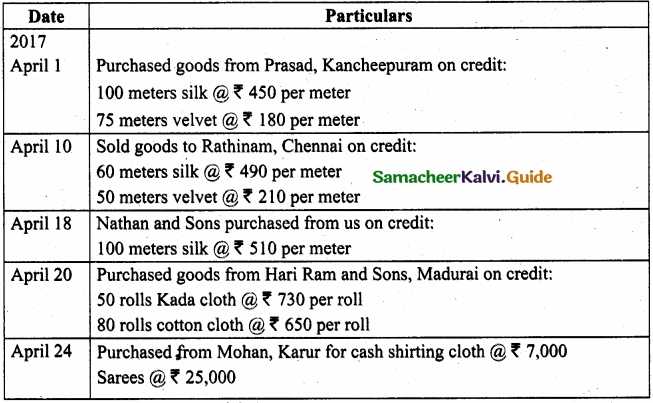

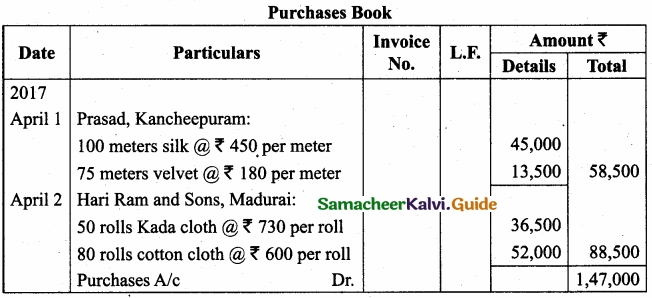

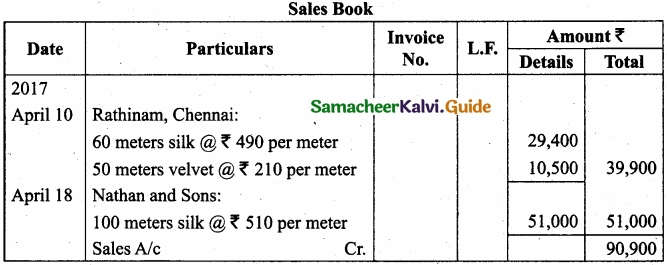

Question 43 (a).

Prepare Purchases Book and Sales Book in the books of Santhosh Textiles Ltd., from the following transactions given for April, 2017?

Answer:

[OR]

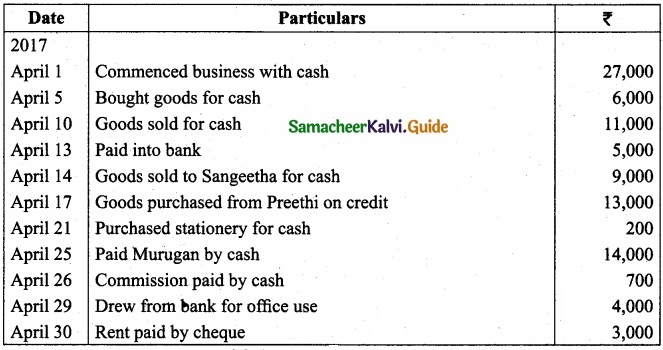

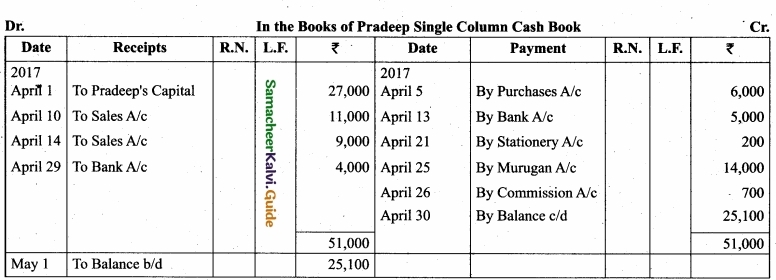

(b) Enter the following transactions in a single column Cash Book of Pradeep for April, 2017?

Answer:

![]()

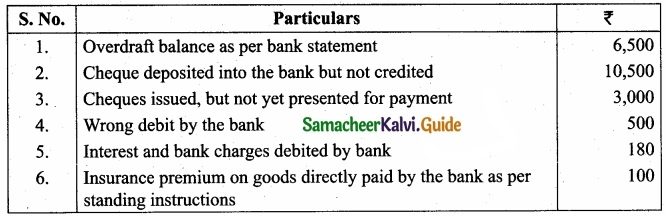

Question 44 (a).

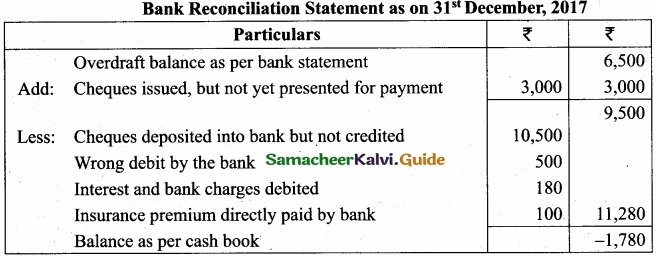

From the following data, ascertain the cash book balance as on 31st December, 2017?

Answer:

[OR]

(b) Pass journal entries to rectify the following errors located after the preparation of the trial balance. Assume that there exists a suspense account?

- The total of sales book was undercast by ₹2,000.

- The purchase of machinery for ₹3,000 was entered in the purchases book.

- A credit sale of goods for ₹45 to Mathi was posted in his account as ₹54.

- The purchases returns book was overcast by ₹200.

- The total of sales book ₹1,122 were wrongly posted in the ledger as ₹1,222.

Answer:

![]()

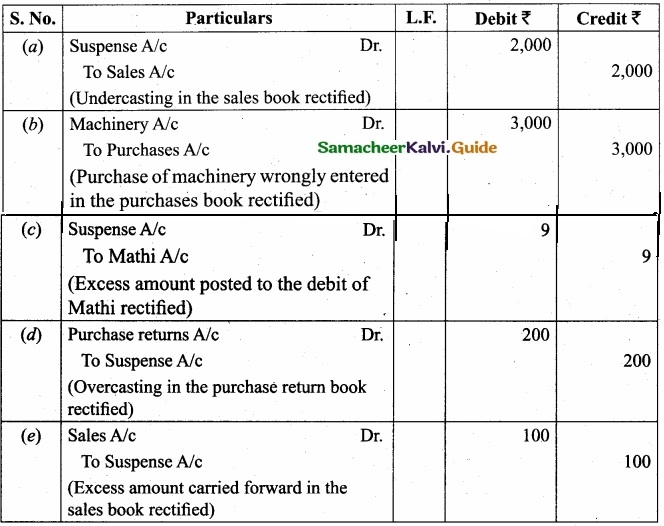

Question 45 (a).

M/s Ramco Textile Mills purchased machinery on 1st April, 2014 for 2,00,000 on credit from M/s. Nila and Co., and spent ₹10,000 on its installation. Depreciation is provided at 10% per annum on the written down value method. Prepare machinery account and depreciation account for the first three years. Books are closed on 31st March every year?

Answer:

[OR]

(b) State whether the following are capital or revenue items:

- ₹5,000 spent towards addition to buildings.

- Second-hand motor car purchased for ₹30,000 and paid ₹2,000 as repairs immediately.

- ₹10,000 was spent on painting the new factory.

- Freight and cartage on the new machine ₹150, erection charges ₹200.

- ₹150 spent on repairs before using a second-hand car purchased recently.

Answer:

- Capital expenditure

- Capital expenditure

- Capital expenditure

- Capital expenditure

- Capital expenditure

![]()

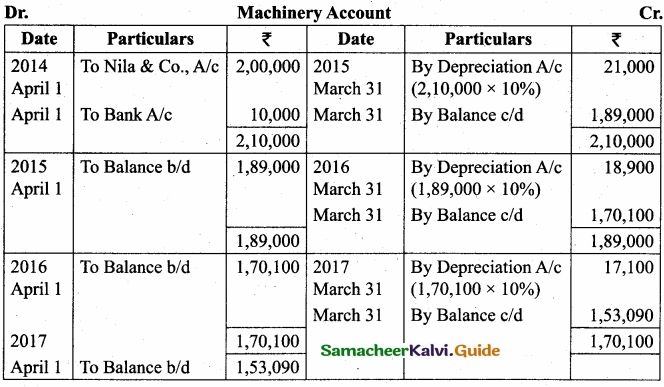

Question 46 (a).

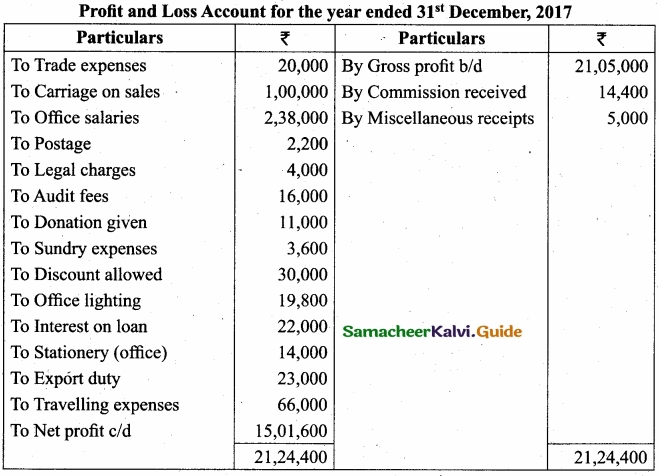

From the following particulars, prepare Profit and Loss account for the year ended 31st December, 2017?

Answer:

[OR]

(b) What are the features of Capital Expenditure?

Answer:

The following are the features of Capital expenditure:

- It gives benefits for more than one accounting period.

- It includes acquisition of fixed assets and all expenditure incurred upto the point an asset is ready for use.

- It contributes to the revenue earning capacity of the business.

- It is non-recurring in nature.

- It is shown on the assets side of the balance sheet.

![]()

Question 47 (a).

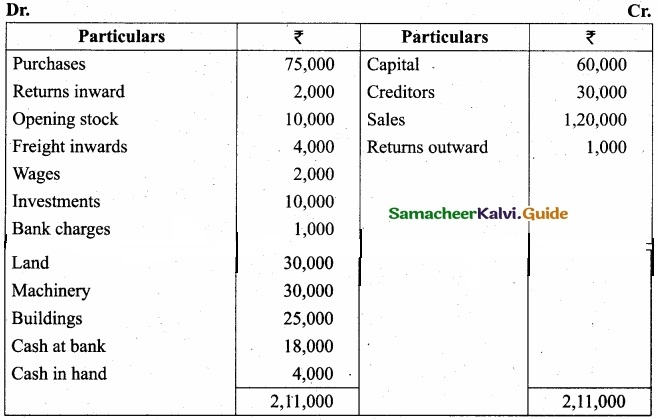

The following balances were extracted from the books of Thomas as on 31st March, 2018. Dr?

Adjustments:

- Closing Stock ₹9,000.

- Provide depreciation @ 10% on machinery.

- Interest accrued on investments ₹2,000

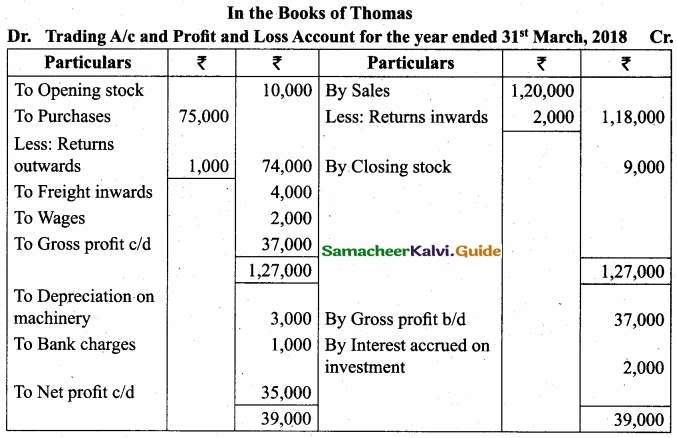

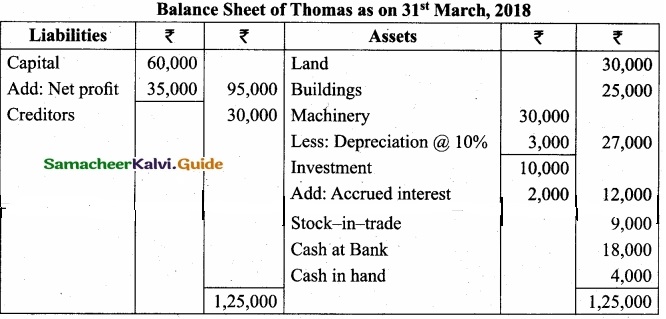

Prepare Trading A/c, Profit and Loss A/c and Balance Sheet as on 31st March, 2018. In the Books of Thomas

Dr. Trading A/c and Profit and Loss Account for the year ended 31st March, 2018 Cr.

Answer:

[OR]

(b) Write any five advantages of computerised accounting system?

Answer:

- Faster Processing: Computers require far less time than human beings in performing a particular task. Therefore, accounting data are processed faster using a computerised accounting system.

- Accurate Information: There is less space for error because only one account entry is needed for each transaction unlike repeated posting of the same accounting data in manual system.

- Reliability: Computer systems are immune to boredom, tiredness or fatigue. Therefore, these can perform repetitive functions effectively and are highly reliable.

- Easy Availability of Information: The data are easily available and can be communicated to different users at the same time.

- Up-to-date Information: Account balances will always be up-to-date since the records are automatically updated as and when accounting data are entered or stored.