Students can Download Tamil Nadu 11th Commerce Model Question Paper 2 English Medium Pdf, Tamil Nadu 11th Commerce Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 11th Commerce Model Question Paper 2 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 2:30 Hours

Maximum Marks: 90

PART – 1

Choose the correct answer. Answer all the questions. [20 × 1 = 20]

Question 1.

Wholesalers buy in ………………………… quantity of goods.

(a) Small

(b) Large

(c) Medium

(d) Limited

Answer:

(b) Large

![]()

Question 2.

Small scale fixed retailers include ……………………..

(a) General stores

(b) Pedlars

(c) Cheap jacks

(d) Hawkers

Answer:

(a) General stores

Question 3.

In India, GST became effective from ………………………

(a) 1st April 2017

(b) 1st January 2017

(c) 1st July 2017

(d) 1st March 2017

Answer:

(a) 1st April 2017

![]()

Question 4.

‘One share – one vote’ principle is followed in kind of organization.

(a) Co – operatives

(b) Partnership

(c) Company

(d) None of these

Answer:

(c) Company

Question 5.

……………………. is not a type of general insurance.

(a) Marine insurance

(b) Life insurance

(c) Fidelity insurance

(d) Fire insurance

Answer:

(b) Life insurance

Question 6.

Self – help groups convert the sayings into a common find known as ……………………..

(a) Common fund

(b) Group corpus fund

(c) Group fund

(d) None of the above

Answer:

(b) Group corpus fund

![]()

Question 7.

A major disadvantage of sole proprietorship is ……………………….

(a) Limited liability

(b) Unlimited liability

(c) Easy formation

(d) Quick decision

Answer:

(b) Unlimited liability

Question 8.

Which one of the following is not correctly matched?

(a) Mercantile agents – Functional middleman

(b) Merchant middleman – Wholesalers

(c) Retailer – Small quantities

(d) Wholesaler – Last middleman in the distribution

Answer:

(d) Wholesaler – Last middleman in the distribution

Question 9.

From which of the following deposit holders can get overdraft facilities?

(a) Savings deposits

(b) Current deposits

(c) Recurring deposits

(d) Fixed deposits

Answer:

(b) Current deposits

![]()

Question 10.

The role of government in logistics management is through ……………………….

(a) Legislations

(b) Governance

(c) Transport

(d) Distribution

Answer:

(d) Distribution

Question 11.

The local area banks are promoting ………………………

(a) Rural savings

(b) Business savings

(c) Industrial development

(d) Agricultural development

Answer:

(a) Rural savings

Question 12.

Way bill is a document issued by ………………………

(a) Railway transport

(b) Air transport

(c) Road transport

(d) Water transport

Answer:

(c) Road transport

![]()

Question 13.

The types of development banks are ……………………….

(I) IFCI

(II) State Bank of India

(III) MUDRA Bank

(IV) Karur Vysya Bank

(a) (I) and (II)

(b) (II) and (IV)

(c) (I) and (III)

(d) (II) and (IV)

Answer:

(c) (I) and (III)

Question 14.

Auxiliaries to trade is also called as ……………………..

(a) Trade

(b) Advertisement

(c) Warehousing

(d) Aids to trade

Answer:

(d) Aids to trade

Question 15.

Consumers co-operation was first successful in …………………………

(a) England

(b) USA

(c) Swiss

(d) India

Answer:

(a) England

![]()

Question 16.

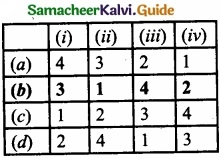

Match List – I with List – II and select the correct answer using the codes given below:

|

List – 1 |

List – 2 |

| (i) Overdraft | 1. Debit card |

| (ii) ATM card | 2. Short term credit instrument |

| (iii) Time deposit | 3. Current deposits |

| (iv) Discounting of bills | 4. Fixed deposits |

Answer:

Codes:

Question 17.

Who is the first middleman in the channel of distribution?

(a) Wholesaler

(b) Producer

(c) Retailer

(d) Customer

Answer:

(a) Wholesaler

Question 18.

Find out which is not advantage of partnership from the following:

(a) Easy formation

(b) Division of work

(c) Limited liability

(d) Easy dissolution

Answer:

(c) Limited liability

Question 19.

Presently IRDAI headquarters is in ……………………….

(a) Hyderabad

(b) Chennai

(c) Mumbai

(d) Delhi

Answer:

(a) Hyderabad

![]()

Question 20.

The aggregate income under fine heads is termed as ……………………….

(a) Gross total income

(b) Total income

(c) Salary income

(d) None of the above

Answer:

(b) Total income

PART – II

Answer any seven questions in which question No. 30 is compulsory: [7 × 2 = 14]

Question 21.

Who are middlemen?

Answer:

The term ‘middlemen’ refers to all those who are in the link between the primary producer and the ultimate consumer in the exchange of goods or service.

Question 22.

Mention any four examples of MNC?

Answer:

A multinational company is one which is incorporated in one country, but it may be operated in many countries. Examples: Coca – Cola, International Business Machine (IBM), Sony Corporation and Microsoft Corporation.

Question 23.

There are various hindrances in business. The manufacturers and consumers do not know each other. But the goods are purchased and sold by these two persons. What kind of hindrance is this? How is it removed?

Answer:

This is ‘hindrance of a person’. Manufacturers do not know the consumer, who is using the products, produced by him. This difficulty or hindrance is removed by the traders.

![]()

Question 24.

Give any three functions of warehouses?

Answer:

- Storage

- Price stabilization

- Equalization of demand and supply

Question 25.

What is meant by private company?

Answer:

Private limited company is a type of company which is formed with minimum two shareholders and two directors, the minimum requirement with respect to authorised or paid up capital of Rs. 1,00,000 has been omitted by the Companies (Amendment) Act, 2015 w.e.f. 29th of May, 2015.

Another crucial condition of a private limited company is that it by its articles of association restricts the right to transfer its shares and also prohibits any invitation to the public to subscribe for any securities of the company.

Question 26.

Is low taxes possible in co – operative society?

Answer:

Yes, Low taxes are possible in co – operative society because it is a non-profit enterprise, and government provides various exemptions and tax concessions.

Question 27.

Write any two advantages of water transport?

Answer:

- It is considered as the cheapest mode of transport among the other modes of transport.

- It is most suitable for heavy loads.

![]()

Question 28.

What are the non-corporate enterprises?

Answer:

- Sole trading concern

- Partnership firm

- Joint Hindu family business

Question 29.

Mention any three differences between warehouse warrant and warehouse receipt?

Answer:

|

Warehouse Warrant |

Warehouse Receipt |

| 1. It is a document of title of goods. | 1. It is not a document of title of goods. |

| 2. It is not only an acknowledgement for the receipt of goods but also gives an authority to get delivery of goods. | 2. It is only an acknowledgement the receipt of goods. |

| 3. It can be given as a collateral security for getting loan. | 3. Ita cannot be given as collateral security |

Question 30.

Mention any four kinds of partners?

Answer:

- Active partner

- Sleeping partner

- Nominal partner

- Partner in profits only

PART – III

Answer any seven questions in which question No. 40 is compulsory: [7 × 3 = 21]

Question 31.

List the five heads of income?

Answer:

The five heads of income are:

- Income from‘Salaries’ [Sections 15 – 17];

- Income from ‘House Property’ [Sections 22 – 27];

- Income from ‘Profits and Gains of Business or Profession’ [Sections 28 – 44];

- Income from ‘Capital Gains’ [Sections 45 – 55]; and

- Income from ‘Other Sources’ [Sections 56 – 59].

![]()

Question 32.

Explain the concept of business?

Answer:

Business refers to any human activity undertaken on a regular basis with the object to earn profit through production, distribution, sale or purchase of goods and services.

Business activities are connected with raising, producing or processing of goods. Industry creates form utility to goods by bringing materials into the form which is useful for intermediate consumption or final consumption by consumers.

Question 33.

Explain any three features of Self – Help Group?

Answer:

- The motto of every group members should be “saving first – credit latter”.

- Self Help Group is homogeneous in terms of economic status.

- The ideal size of a Self Help Group ranges between 10 and 20 members.

Question 34.

Explain the features of general stores?

Answer:

General Stores sell a wide variety of products under one roof, most commonly found in a local market and residential areas to satisfy the day – to – day needs of the customers residing in nearby localities. They remain open for long hours at convenient timings and often provide credit facilities to their regular customers.

Question 35.

How is it possible to maintain secrecy in sole proprietorship?

Answer:

In sole proprietorship, the trader is the sole owner of the business. Since he/she manages all the affairs of the business, the secrecy can be maintained easily.

![]()

Question 36.

What is the importance of bonded warehouses?

Answer:

Bonded warehouses are those warehouses which are licensed by government. It is used to accept the storage of imported goods which are cleared for non – payment of customs duty by the importer. Strict supervision and control is imposed by customs authorities on their functioning.

Question 37.

Describe any three advantages of international trade?

Answer:

Advantages of international trade:

- Optimum use of natural resources: International trade operates on a simple principle that a country can produce more efficiently and trade the surplus production.

- Economic development: International trade helps the developing countries in achieving rapid economic development by importing machinery, technology and talent.

- Generation of employment: International business generates employment opportunities by assisting the expansion and growth of agricultural and industrial activities.

![]()

Question 38.

What are the advantages of MNC?

Answer:

1. Low Cost Labour:

MNC set up their facilities in low cost countries and produce goods/services at lower cost.

2. Quality Products:

The resource, experience and expertise of MNCs in the sphere of research and development enables the host country to establish its research and development system which helps it in producing quality goods and services at least possible cost.

Question 39.

India is an agricultural country. It has so many villages. Agriculture is inevitable to our country. What kind of insurance is needed to safeguard agriculture?

Answer:

Crop insurance is taken for safeguarding the agriculture. This policy is to provide financial support to farmers in case of a crop failure due to drought or flood. It generally covers all risks of loss or damages relating to production of rice, wheat, millets, oil seeds and pulses.

Question 40.

Why is balance of payment prepared?

Answer:

Balance of payments help in framing monetary, fiscal and trade policies of country. Government keenly observes balance of payment position of its important trade partners in making policy decisions. It reveals whether a country produces enough economic output to pay for its growth.

PART – IV

Answer all the questions: [7 × 5 = 35]

Question 41 (a).

Memorandum of Association is a legal document prepared to form and register a joint stock company. It reveals the powers and activities, the company is permitted to undertake. What are the contents of memorandum of Association? Explain?

Answer:

1. Name Clause:

The name clause requires you to state the legal and recognized name of the company. You are allowed to register a company name only if it does not bear any similarities with the name of an existing company.

2. Situation Clause:

The registered office clause requires you to show the physical location of the registered office of the company. You are required to keep all the company registers in this office in addition to using the office in handling all the outgoing and incoming communication correspondence.

3. Objective Clause:

The objective clause requires you to summarize the main objectives for establishing the company with reference to the requirements for shareholding and use of financial resources.

You also need to state ancillary objectives; that is, those objectives that are required to facilitate the achievement of the main objectives.

4. Liability Clause:

The liability clause requires you to state the extent to which shareholders of the company are liable to the debt obligations of the company in the event of the company dissolving.

You should show that shareholders are liable only their shareholding and/or to their commitment to contribute to the dissolution costs upon liquidation of a company limited by guarantee.

5. Capital Clause:

The capital clause requires you to state the company’s authorized share capital, the ’ different categories of shares and the nominal value (the minimum value per share) of the shares. You are also required to list the company’s assets under this clause.

6. Association Clause:

The association clause confirms that shareholders bound by the MOA are willingly associating and forming a company. You require seven members to sign an MOA for a public company and not less than two people for a MOA of a private company. You must conduct the signing in the presence of witness who must also append his signature.

[OR]

(b) Explain any five rights of partners?

Answer:

- Right to take part in business: Every partner has a right to take part in the management of the business.

- Right to be consultant: Every partner has the right to be consulted in all the matters concerning the firm. The decision of the majority will prevail in all the routine matters.

- Right of access to books, record and document: Every partner has the right of access to all records and books of accounts, and to examine and copy them.

- Right to share profit: Every partner is entitled to share the profits in the agreed ratio. If no profit-sharing ratio is specified in the deed, they must be shared equally.

- Right to receive interest: A partner’ has the right to receive interest on loans advanced by him to the firm at the agreed rate, and where no rate is stipulated, interest @ 6% p.a. allowed.

![]()

Question 42 (a).

Explain the contents of prospectus?

Answer:

Prospectus means a document inviting the public to buy its shares or debentures. It also applies to advertisements inviting deposits from the public.

Contents:

- The prospectus contains the main objectives of the company.

- The name and address of the signatories of the Memorandum of Association.

- The name, address and occupation of directors and managing directors.

- The number and classes of shares and debentures.

- The qualification share of directors.

- The name and address of the vendors of any property acquired by the company.

- Particulars about the directors, secretaries and the treasures and their remuneration.

- The amount for the minimum subscription.

- The estimated amount of preliminary expenses.

- Name and address of the auditors, bankers and solicitors of the company,

- Time and place where copies of balance sheets, profits and loss account and the auditor’s report may be inspected.

[OR]

(b) Write a note on Consumer Co – operative Society?

Answer:

A Consumer Co – operative Society is organized by consumers. It sells quality goods at better prices to the consumers.

Features:

- It can sell the goods at a lesser price rather than the traditional retail stores.

- They also supply essential goods through Public Distribution System (PDS).

- Nationally, the most widely used co – operative form is the credit union.

- Credit unions are essentially co – operatives of people that use banking services.

- It purchases goods directly from the manufacturers, which helps to fix the lower price. – Example – Students Co – operative Stores, Supermarkets, etc.

![]()

Question 43 (a).

Goods were exchanged for goods prior to invention of money. Each party must have surplus goods for exchange. What does it mean? What are the constraints of that system?

Answer:

The system in which the goods were exchanged for goods was called ‘barter system’. The barter system has many constraints. They are:

- Lack of double coincidence of Wants: Unless two persons who have surplus have the demand for the goods possessed by each other, barter could not materialize. If this “coincidence of wants” does not exist, Barter cannot take place.

- Non – existence of common measure of value: Barter system could not determine the value of commodities to be exchanged as they lacked commonly acceptable measures to evaluate each and every commodity.

- Lack of direct contact between producer and consumers: It was not possible for buyers and sellers to meet face to face in many contexts for exchanging the commodities for commodities.

- Lack of surplus stock: Absence of surplus stock was one of the impediments in barter system. If the buyers and sellers do not have surplus then no barter was possible.

[OR]

(b) Describe any five objectives of business?

Answer:

1. Economic Objectives:

Economic objectives of business refer to the objective of earning profit and also other objectives that are necessary to be pursued to achieve the profit objective, which includes creation of customers, regular innovations and best possible use of available resources.

2. Social Objectives:

Social objective are those objectives of business, which are desired to be achieved for the benefit of the society. Since business operates in a society by utilizing its scarce resources, the society expects something in return for its welfare.

3. Organizational Objectives:

The organizational objectives denote those objectives an organization intends to accomplish during the course of its existence in the economy like expansion and modernization, supply of quality goods to consumers, customers’ satisfaction, etc.

4. Human Objectives:

Human objectives refer to the objectives aimed at the well – being as well as fulfillment of expectations of employees as also of people who are disabled, handicapped and deprived of proper education and training.

The human objectives of business may thus include economic well – being of the employees, social and psychological satisfaction of employees and development of human resources.

5. National Objectives:

Being an important part of the country, every business must have the objective of fulfilling national goals and aspirations.

![]()

Question 44 (a).

Banks can be classified as follows:

- Based on the functions of banks

- Based on the status given by RBI

- Based on the ownership pattern

What are the banks based on functions or organization? Explain any five kinds of banks.

Answer:

1. Commercial banks:

Banks which accept deposits from the public and grant loans to traders, individuals, agriculture, industries, transport, etc. in order to earn profit. Their lending is in comparatively small amounts and mostly for short and medium period. e.g., State Bank of India.

2. Development Banks:

Huge finance required for investment, expansion and modernisation of big industries and others are granted by a separate type of banks called development Banks. They are also called industrial banks, e.g., IFCI, SIDBI.

3. Co – operative Banks:

All Co – operative banks in India are owned by its customers or members who are farmers, small traders and others. Co – operative banks in India are either urban based or rural based. e.g.,NAFED, Tamil Nadu State Apex Co-operative Bank – Head Office, Chennai.

4. Foreign Banks:

Banks which have registered office in a foreign country and branches in Ipdia are called foreign banks, e.g., Bank of America – USA.

5. Regional Rural Banks (RRBs):

The RRBs were formed under the Regional Rural Bank Act 1976, jointly by the Central Government, State Government, and a sponsor bank. e.g., Pandian Grama Bank.

[OR]

(b) In India Joint Hindu Family Business is a distinct form of organisation. A person can become member by his birth. What are the features of Joint Hindu Family Business? Explain any five features?

Answer:

Features of Joint Hindu Family Business are:

- Governed by Hindu Law

- Management

- Membership by birth

- Liability

- Permanent existence

- Implied authority of Karta

- Minor as a co – parcener

- Dissolution

Explanation:

- Governed by Hindu law: The business of the Joint Hindu Family is controlled and managed by the hindu law.

- Membership by birth: The membership of the family can be acquired only by birth. As soon as a male child is bom in the family, the child becomes a member.

- Liability: Except the Kartha, the liability of all other members is limited to their shares in the business.

- Minor also as a co-parcener: In a Joint Hindu Family firm even a new bom baby can be a co-parcener.

- Dissolution: It can be dissolved only at the will of the members of the family.

![]()

Question 45 (a).

Explain any five types of Cooperative societies?

Answer:

Types of Co – operative societies:

1. Consumers Co – operative:

Consumer Co – operatives are organized by consumers that want to achieve better prices or quality in the goods or services they purchase. In contrast to traditional retail stores or service providers, a consumer co – operative exists to deliver goods or services rather than to maximize profit from selling those goods or services.

2. Producers Co – operative:

Producer co – operatives are created by producers and owned and operated by producers. Producers can decide to work together or as separate entities to help increase marketing possibilities and production efficiency.

3. Marketing Co – operative:

Co – operative marketing societies are associations of small producers formed for the purpose of marketing their produce. The marketing co-operatives perform certain marketing functions such as grading, warehousing, advertising etc.

4. Credit Co – operative:

Cooperative credit societies are societies formed for providing short-term financial help to their members. Agriculturists, artisans, industrial workers, salaried employees, etc., form these credit societies.

5. Housing Co – operative:

These co – operative housing societies are meant to provide residential accommodation to their members on ownership basis or on rent.

People who intend to build houses of their own join together and form housing societies. These societies advance loans to members, repayable over a period of 15 to 20 years.

[OR]

(b) Partnership is formed by an agreement. It may be oral or written. The agreement is called partnership deed. Explain the contents of partnership deed.

Answer:

The contents of partnership deed include:

- Name: Name of the Firm.

- Nature of Business: Nature of the proposed business to be carried on by the partners.

- Duration of Partnership: Duration of the partnership business whether it is to be run for a fixed period of time or whether it is to be dissolved after completing a particular venture.

- Capital Contribution: The capital is to be contributed by the partners. It must be remembered that capital contribution is not necessary to become a partner for, one can contribute his organising power, business acumen, managerial skill, etc., instead of capital.

- Withdrawal from the Firm: The amount that can be withdrawn from the firm by each partner.

- Profit/Loss Sharing: The ratio in which the profits or losses are to be shared. If the profit sharing ratio is not specified in the deed, all the partners must share the profits and bear the losses equally.

- Interest on Capital: Whether any interest is to be allowed on capital and if so, the rate of interest.

- Rate of Interest on Drawing: Rate of interest on drawings, if any.

- Loan from Partners: Whether loans can be accepted from the partners and if so the rate of interest payable thereon.

- Account Keeping: Maintenance of accounts and audit.

- Salary and Commission to Partners: Amount of salary or commission payable to partners for their services. (Unless this is specifically provided, no partner is entitled to any salary).

- Retirement: Matters relating to retirement of a partner. The arrangement to be made for paying out the amount due to a retired or deceased partner must also be stated.

- Goodwill Valuation: Method of valuing goodwill on the admission, death or retirement of a partner.

- Distribution of Responsibility: Distribution of managerial responsibilities. The work that is entrusted to each partner is better stated in the deed itself.

- Dissolution Procedure: Procedure for dissolution of the firm and the mode of settlement of accounts thereafter.

- Arbitration of Dispute: Arbitration in case of disputes among partners. The deed should provide the method for settling disputes or difference of opinion. This clause will avoid costly litigations.

![]()

Question 46 (a).

Explain the various primary functions of commercial banks?

Answer:

The primary functions of a commercial bank are of three types. They are:

(I) Accepting Deposits – The basic deposit accounts offered by commercial banks are listed below:

1. Demand Deposits: These deposits are repayable on demand on any day. These consist of –

- Savings Deposits: General public deposit their savings into this account. This account can be opened in one individual’s name or more than one name.

- Current Deposits: This account is suitable for business institutions. Individuals too . can open this account. A higher minimum balance should be kept in this account.

2. Time Deposits: These are repayable after a period. These include –

- Fixed Deposits (FD): Certain amount is deposited for a fixed period for a fixed rate of interest.

- Recurring Deposits (RD): Certain sum is deposited into the account every month for one year or five years or the agreed period. Interest rate is more than savings deposits and almost equal to fixed deposits.

(II) Granting Loans and Advances: Commercial banks lend money in order to earn interest.

1. Advances

- Overdraft: It is a credit facility extended mostly to current account holding business community customers.

- Cash Credit: It is a secured credit facility given mostly to business institutions. Stock in hand, raw materials, other tangible assets, etc., are provided as collateral.

- Discounting of Bills: Business customers approach banks to discount the commercial bills of exchanges and provide money.

2. Loans – Short term and medium term loans are provided by commercial banks against eligible collaterals to business concerns. Examples – housing loan, consumer loan, vehicle loan, educational loan, jewel loan, etc.

3. Creation of Credit – Apart from the currency money issued by the RBI, the credit money in circulation created by commercial banks influence economic activities of a country to a large extent. Credit money of commercial banks is far greater in volume than the currency money.

[OR]

(b) What are the advantages of warehousing?

Answer:

- It safeguards the stock for the merchants who do not have storage place.

- Warehouses reduce the distribution cost of the traders by storing the goods in bulk and allow the trader to take the goods in small lots to his shop.

- It helps in selection of channel of distribution. The producer will prefer whether to appoint a wholesaler or retailer.

- It assists in maintaining the continuous sale and avoid the possibilities of “Out of Stock”.

- It creates employment opportunities for both skilled and unskilled workers to improve their standard of living.

![]()

Question 47 (a).

Explain the features of a government company?

Answer:

The features of a government company are:

1. Registration Under the Companies Act:

A Government company is formed through registration under the Companies Act, 1956; and is subject to the provisions of this Act, like any other company.

However, the Central Government may direct that any of the provisions of the Companies Act shall not apply to a Government company or shall apply with certain modifications.

2. Executive Decision of Government:

A Government, company is created by an executive decision of the Government, without seeking the approval of the Parliament or the State Legislature.

3. Separate Legal Entity:

A Government company is a legal entity separate from the Government. It can acquire property; can make contracts and can file suits, in its own name.

4. Whole or Majority Capital Provided by Government:

The whole or majority (at least 51%) of the capital of a Government company is provided by the Government; but the revenues of the company are not deposited into the treasury.

5. Majority of Government Directors:

Being in possession of a majority of share capital, the Government has authority to appoint majority of directors, on the Board of Directors of a government company.

[OR]

(b) What are the advantages of co – operatives? Explain any five?

Answer:

Advantages of co – operatives:

1. Voluntary organisation:

The membership of a co – operative society is open to all. Any person with common interest can become a member. The membership fee is kept low so that everyone would be able to join and benefit from co – operative societies.

2. Easy formation:

Co – operatives can be formed much easily when compared to a company. Any 10 members who have attained majority can join together for forming a co – operative spciety by observing simple legal formalities.

3. Democracy:

A co – operative society is run on the principle of ‘one man one vote’. It implies that all members have equal rights in managing the affairs of the enterprises.

4. Equal distribution of surplus:

The surplus generated by the co – operative societies is distributed in an equitable manner among members. Therefore all the members of the co – operative society are benefitted.

5. Limited liability:

The liability of the members in a co – operative spciety is limited to the extent of their capital contribution. They cannot be personally held liable for the debts of the society.