Students can Download Tamil Nadu 12th Accountancy Model Question Paper 1 English Medium Pdf, Tamil Nadu 12th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 12th Accountancy Model Question Paper 1 English Medium

Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II. III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each. These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer.

- Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about 50 words.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in about 150 words.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in about 250 words. Draw diagrams wherever necessary.

Time: 2.30 Hours

Max Marks: 90

Part -I

Answer all the questions. Choose the correct answer. [Answers are in bold] [20 × 1 = 20]

Question 1.

Capital in the beginning of the accounting year is ascertained by preparing

(a) Debtors A/c

(b) Cash A/c

(c) Opening statement of affairs

(d) None of these

Answer:

(c) Opening statement of affairs

![]()

Question 2.

Single entry system can be adopted by

(a) Small firms

(b) Joint stock companies

(c) Co-op societies

(d) None of these

Answer:

(a) Small firms

Question 3.

An advance receipt of subscription from a member of the non-profit organisation is considered as an

(a) Expenses

(b) Liability

(c) Equity

(d) Assets

Answer:

(b) Liability

Question 4.

Income and expenditure account is based on

(a) Cash Accounting

(b) Government Accounting

(c) Management Accounting

(d) Accrual Accounting

Answer:

(d) Accrual Accounting

Question 5.

The name under which the business of a firm is carried on is called the

(a) Company name

(b) Firm name

(c) Partnership firm

(d) Partner’s name

Answer:

(b) Firm name

Question 6.

The profit or loss arising from the partnership business is shared by the partners ………. in the

(a) Old ratio

(b) New ratio

(c) agreed ratio

(d) Sacrifice ratio

Answer:

(c) agreed ratio

Question 7.

Which is the present value of a firm’s future excess earnings?

(a) Fixed assets

(b) Current assets

(c) Goodwill

(d) None of these

Answer:

(c) Goodwill

![]()

Question 8.

Goodwill is shown under fixed assets in the

(a) Trial balance

(b) Balance sheet

(c) Trading A/c

(d) P and L A/c

Answer:

(b) Balance sheet

Question 9.

Revaluation account is also called

(a) Accumulation profit and loss A/c

(b) Profit and loss adjustment A/c

(c) Profit and loss appropriation A/c

(d) None of these

Answer:

(b) Profit and loss adjustment A/c

Question 10.

When the value of assets increases it results in

(a) profit

(b) loss

(c) income

(d) expense

Answer:

(a) profit

Question 11.

When a partner leaves from a partnership firm, it is known as

(a) Admission

(b) Retirement

(c) Dissolution

(d) Death

Answer:

(b) Retirement

Question 12.

The firm is reconstituted and other partners continue the partnership firm with a new………..

(a) contract

(b) agreement

(c) start business

(d) none of these

Answer:

(b) agreement

Question 13.

In order to meet them production must be carried on a

(a) small scale

(b) large scale

(c) medium scale

(d) none of these

Answer:

(b) large scale

Question 14.

The capital of companies is divided into small unit is

(a) shares

(b) debentures

(c) dividend

(d) none of these

Answer:

(a) shares

Question 15.

Which statement are prepared by the business concerns at the end of the accounting period to ascertain the operating results and the financial position?

(a) Trend analysis

(b) Income statement

(c) Financial statement

(d) Balance sheet

Answer:

(c) Financial statement

![]()

Question 16.

Financial statements are prepared based on………..

{a) Past data

(b) Future cost

(c) Terminal cost

(d) Historical cost

Answer:

(d) Historical cost

Question 17.

The financial status and financial performance of business entities can be assessed through………..

(a) Financial analysis

(b) Managerial analysis

(c) Cash flow statement

(d) None of these

Answer:

(a) Financial analysis

Question 18.

If both items in a ratio are from balance sheet it is classified as………..

(a) Inter statement ratio

(b) Income statement ratio

(c) Balance sheet ratio

(d) All of these

Answer:

(c) Balance sheet ratio

Question 19.

CAS helps to compute various taxes and to deduct these and deposit the same to the………..

(a) Private A/c

(b) Company A/c

(c) Government A/c

(d) None of these

Answer:

(c) Government A/c

Question 20.

In 2009, Tally solutions introduced the software………..

(a) Tally ERP 9

(b) Tally ERP 10

(c) Tally ERP 6.0

(d) None of these

Answer:

(a) Tally ERP 9

PART – II

Answer any seven questions in which question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

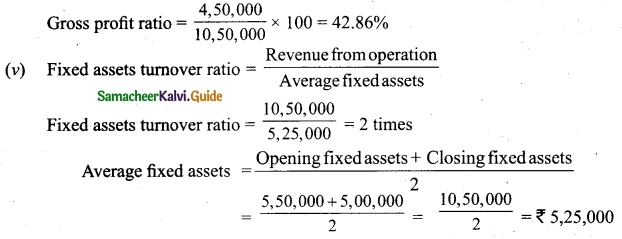

What shall be the profits of the concern? if,

Opening capital 3,20,000, Drawings 72,000

Closing capital 3,60,000, Additional capital 20,000

Statement of Profit or Loss

Answer:

Question 22.

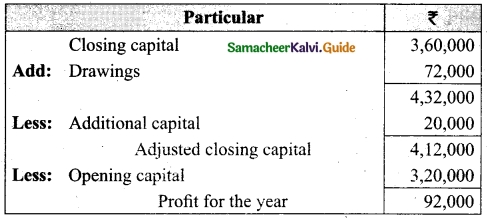

How will the following items appear in income and expenditure account?

| Stock of sport materials (1.4.2018) | 6,000 | Stock sports materials (31.3.2019) | 8,000 |

| Sports materials purchased | 18,000 | ||

| Sale of old sport materials | 1,000 |

Answer:

Question 23.

What is partnership deed?

Answer:

Partnership deed is a documents in writting that contains the terms of agreement among the partners. It is not compulsory for a partnership to have a partnership deed as per the Indian partnership Act 1932.

![]()

Question 24.

What is normal rate of return?

Answer:

Normal rate of return refers to the rate at which profit is earned by similar business entities in the Industry under normal circumstances.

Question 25.

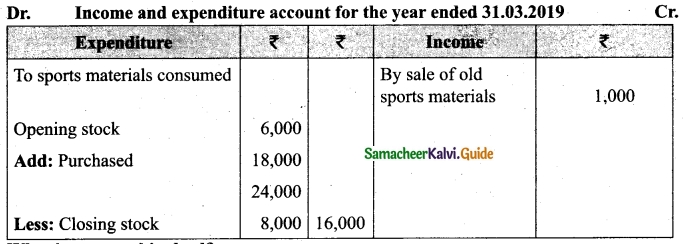

Give the Journal Entry for writing off existing goodwill at the time of admission of a new partner?

Answer:

Question 26.

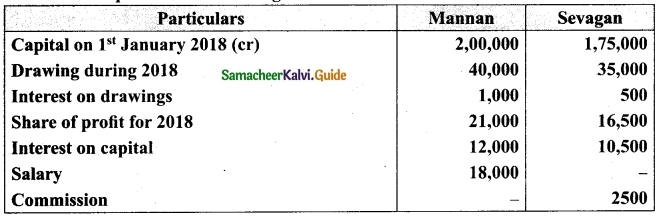

A, B and C are partners sharing profits in the ratio of 3:2:1. A retires and the new profit sharing ratio between B and C is 2:3. Calculate the gaining ratio.

Answer:

Share gained = New share – old share

∴ The gaining ratio of B, C = 2 : 13

Question 27.

What are the methods of issue of equity shares?

Answer:

A public company may raise capital by issue of equity shares through the following ways:

Public issue

Private placement

Rights issue

Bonus issue

Question 28.

What are “Financial Statements”?

Answer:

Financial statements are the statements prepared by the business concern at the end of the accounting period to ascertain the operating results and the financial position. The basic financial statements prepared by business concerns are income statement and balance sheet.

Question 29.

Calculate quick ratio; Total current liabilities Rs 2,40,000; Total current assets Rs 4,50,000; Inventories Rs 70,000; prepaid expenses Rs 20,000.

Answer:

Current liabilities

Quick ratio = \(\frac{Quick assets}{Current liabilities}\)

Quick assets = Current assets – Inventories – Prepaid expenses

Rs 4,50,000 – 70,000 – 20,000

= Rs 3,60,000

Quick ratio = \(\frac{360000}{240000}\)

= 1.5 : 1

![]()

Question 30.

What are accounting reports?

Answer:

Accounting report is a compilation of accounting information that are derived from the accounting records of a business concern. Accounting reports may be classified as routine reports and special purpose reports.

PART – III

Answer any seven questions in which question No. 40 is compulsory. [7 x 3 = 21]

Question 31.

What are the features of incomplete records?

Answer:

(i) Nature:

It is an unscientific and unsystematic way of recording transactions. Accounting principles and accounting standards are not followed properly.

(ii) Lack of uniformity:

There is no uniformity in recording the transactions among different organisations. Different organisations record their transactions according to their needs and conveniences.

(iii) Suitability:

Only the business concerns which have no legal obligation to maintain books of accounts under double entry system may maintain incomplete records. Hence it may be maintained by small sized sole traders and partnership firms.

Question 32.

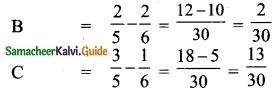

From the following particulars, show how the items “subscription” will appear in the income and expenditure account for the year ended 31.2.2018. Subscription received in 2018 is Rs 32,000; which includes Rs 3,000 for 2017 and Rs 5,000 for 2019. Subscription outstanding for the year 2018 is Rs 4,000; subscription of Rs 2,000 was received in advance for 2018 in the year 2017.

Answer:

Income and expenditure account for the year ended 31.12.2018

Question 33.

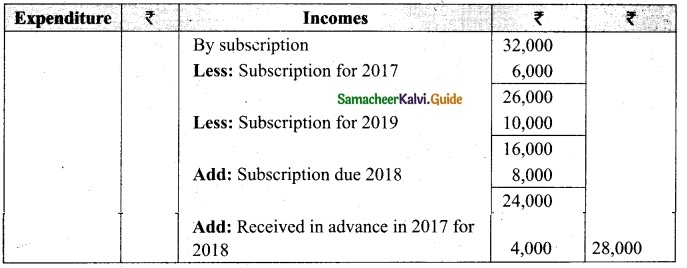

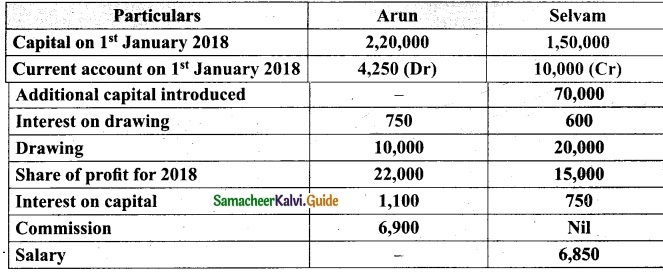

From the following information, prepare capital accounts of Mannan and Sevagan where their capitals and fluctuating.

Answer:

![]()

Question 34.

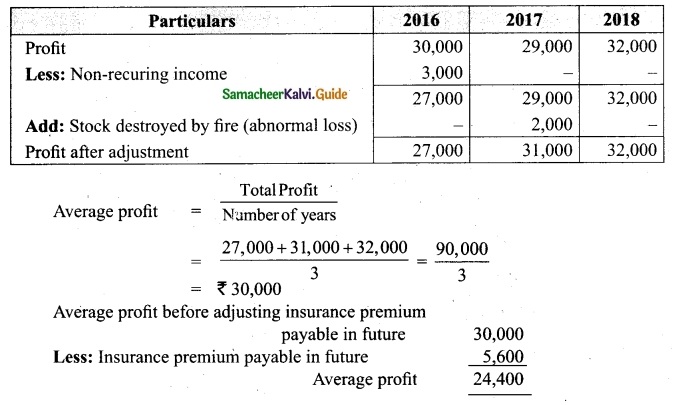

The following particulars are available in respect of a business carried on by a partnership firm.

a) Profits earned 2016 – 30,000; 2017 – 29,000; 2018 – 32,000.

b) Profit of 2016 includes a non-recurring income of Rs 3,000.

c) Profit of 2017 is reduced by Rs 2,000 due to stock destroyed by fire.

d) The stock is not insured. But it is decided to insure the stock in future. The insurance premium is estimated at Rs 5,600 p.a. You are required to calculate the value of goodwill on the basis of 2 years purchase of average profit of the last three years.

Answer:

Calculation of adjusted profit

Goodwill = Average profit × Number of years of purchase

= 24,400 × 2 = Rs 48,800

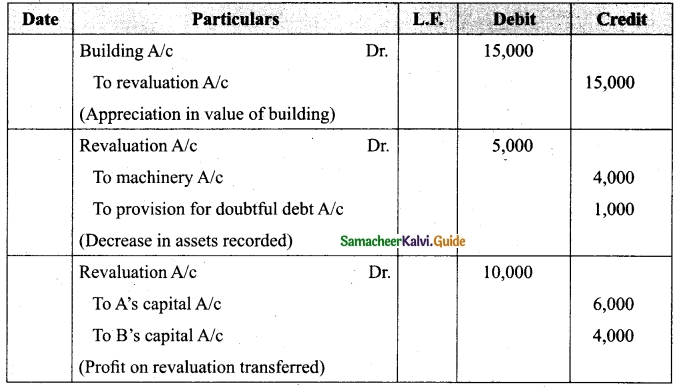

Question 35.

A and B are partners sharing profits in the ratio of 3 : 2. ‘C’ is admitted as a new partner and the new profit sharing ratio is decided as 5 : 3 : 2. The following revaluation are made. Pass journal entries.

(a) The value of building is increased by Rs 15,000

(b) The value of the machinery is decreased by Rs 4,000

(c) Provision for doubtful debtors is made for Rs 1,000

Answer:

Journal Entries

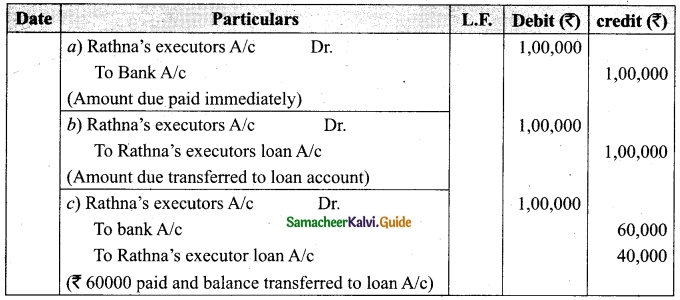

Question 36.

Rathna, Baskar and Ibrahim are partners sharing profit and losses in the ratio of 2 : 3 : 4, respectively. Rathna died on 31st December 2018. Final amount due to her showed a credit balance of 1,00,000. Pass journal entries, if

(а) The amount due is paid off immediately by cheque

(b) The amount due is not paid immediately

(c) Rs 60,000 is paid immediately by cheque.

Answer:

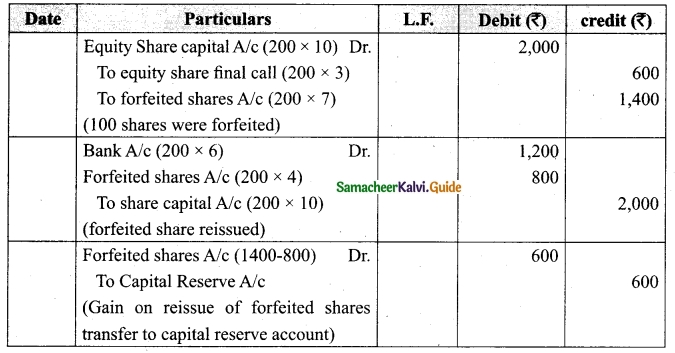

Question 37.

Anu company forfeited 200 equity shares of Rs 10 each issued at par held by Thiyagu for non-payment of the final call of Rs 3 per share. The shares were reissued to Laxman at Rs 6 per share. Show the journal entries for forfeiture and reissue.

Answer:

Journal entries

![]()

Question 38.

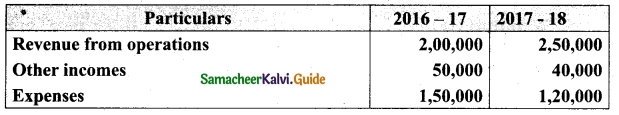

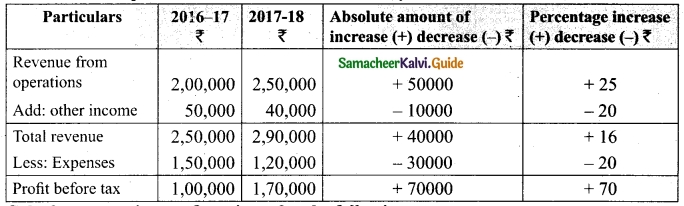

From the following particulars prepare comparative income statements of Tharun co Ltd.

Answer:

Question 39.

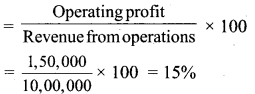

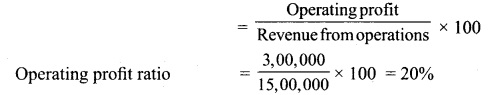

Calculate operating profit ratio under the following cases:

Case 1: Revenue from operations and Rs 10,00,000, operating profit Rs 1,50,000

Case 2: Revenue from operations and Rs 15,00,000, operating cost Rs 12,00,000

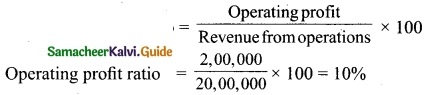

Case 3: Revenue from operations and Rs 20,00,000, gross profit 30%.

On revenue from operations, operating expenses Rs 4,00,000.

Answer:

case 1:

operating profit ratio =

case 2:

operating profit ratio =

Operating profit = Revenue from operation – operating cost

= 15,00,000 – 12,00,000

= Rs 3,00,000

case 3:

operating profit ratio =

Gross profit = 20,00,000 × \(\frac{30}{100}\) = Rs 6,00,000

Operating profit = Gross profit – operating expenses Operating profit

= 6,00,000 – 4,00,000

= Rs 2,00,000

Question 40.

Write a brief note on accounting vouchers?

Answer:

This type of a voucher basically analyses a business transactions from the accounting stand point and is used for recording purposes. These are commonly prepared by accountants on the basis of supporting voucher and approved by a different individual. They are further sub¬divided into two. Cash and non-cash voucher.

Example of cash type:

- Credit vouchers

- Debit vouchers

Example of Non-cash type:

- Debit Note

- Credit Note

- Invoice

![]()

PART – IV

Answer all the questions. [7 × 5 = 35]

Question 41(a)

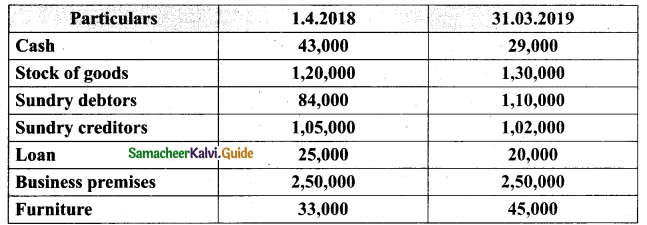

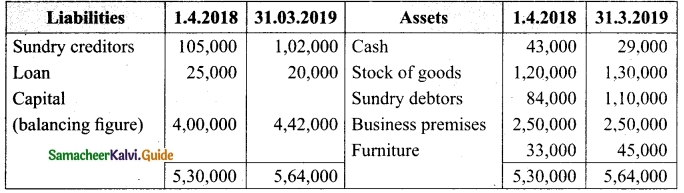

David does not keep proper books of accounts. Following details are given from his records.

During the year, he introduced further capital of Rs 45,000 and withdraw of Rs 2,500 per month from the business for his personal use. Prepare the statement of profit or loss with the above information.

Answer:

Statement of affairs as on 1.4.2018 and 31.03.2019

[OR]

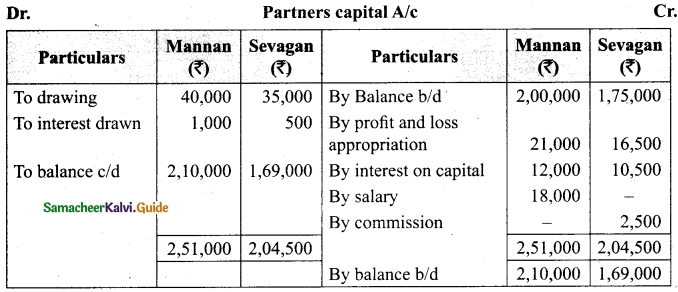

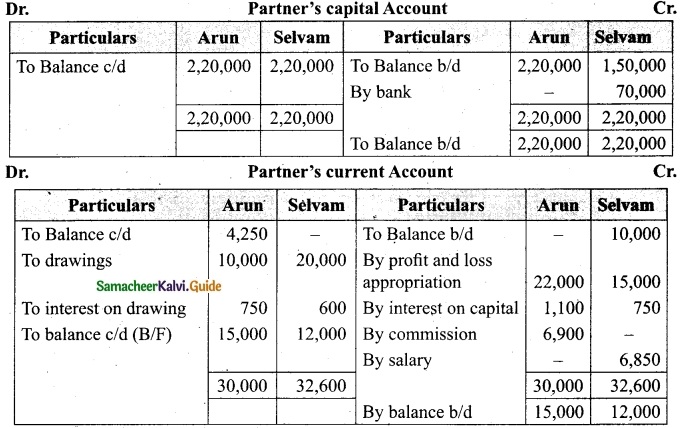

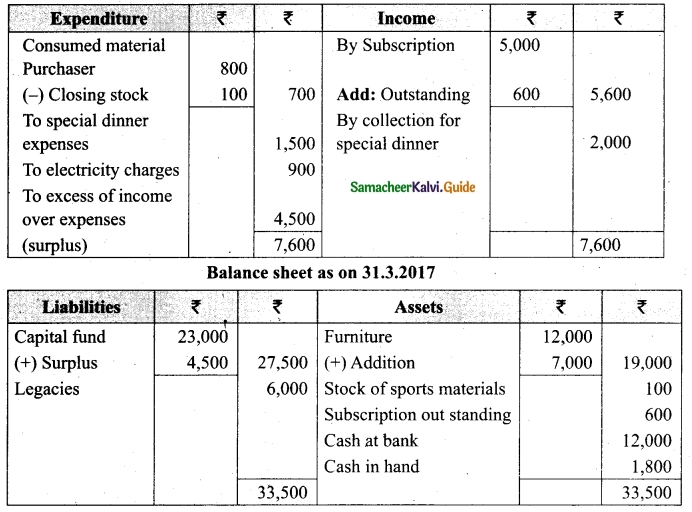

(b) Arun and Selvan are partners who maintain their capital accounts under fixed capital method. From the following particulars prepare capital accounts of partner

Answer:

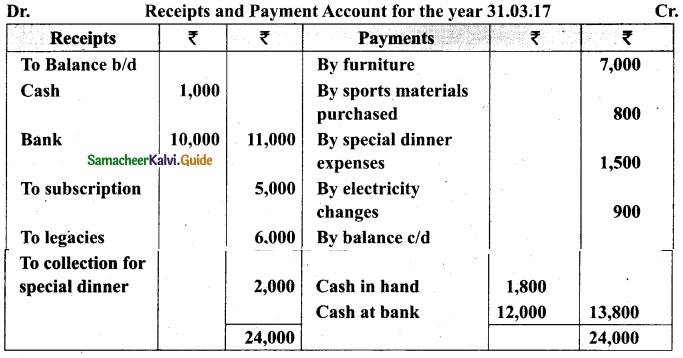

Question 42(a)

From the following receipts and payments account of friends football club for the year ending 31st March 2017. Prepare income and expenditure account for the year ending , 31st March 2017 and the balance sheet as on that date.

In the books of Friends Football Club

Additional information:

(i) The club had furniture of Rs 12,000 on 1st April 2016. Ignore depreciation on furniture.

(ii) Subscription outstanding for 2016-17 – Rs 600

(iii) Stock of sports materials on 31.3.2017 – Rs 100

(iv) Capital fund as on 1st April 2016 was Rs 23,000

Answer:

In the books of Friends Football Club

![]()

[OR]

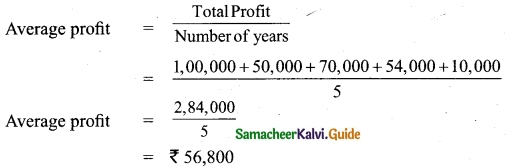

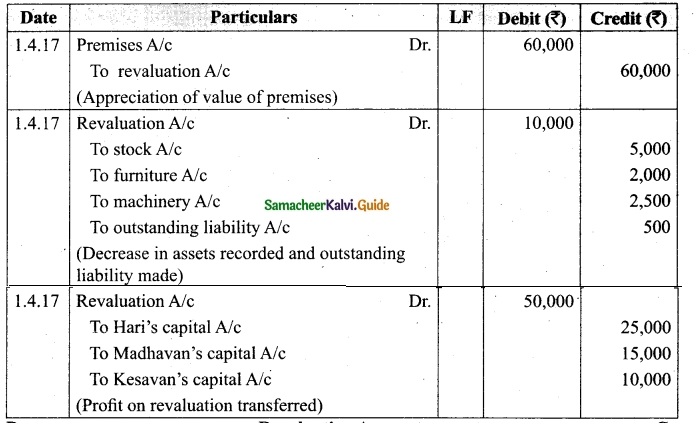

(b) Calculate the value of goodwill at 5 years purchase of super profit from the following information.

(i) Capital employed: Rs 60,000.

(ii) Normal rate of return: 20%

(iii) Net profit for 5 years: 2014 – 1,00,000; 2015 – Rs 50,000; 2016 – 70,000; 2017 – 54,000; 2018 – 10,000.

(iv) Fair remuneration to the partners Rs 3,600 p.a

Answer:

Normal profit = Capital employed × Normal rate of return

= 60000 × \(\frac{20}{100}\)

= Rs 12,000

super profit = Average profit – Normal profit

= 53,200 – 12,000

= 41,200

Goodwill = Super profit × Number of years of purchased R

= 41,200 × 5

= Rs 2,06,000

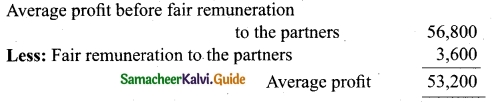

Question 43(a)

Hari, Madhavan and Kesavan are partners sharing ratio of 5 : 3 : 2. As from 1st April 2017. Vanmathi is admitted into the partnership and the new profit ratio is decided 4 : 3 : 2 : 1. The following adjustments are to be made.

(a) Increase the value of premises by Rs 60,000.

(b) Depreciate stock by Rs 5,000; furniture by Rs 2000 and machinery by Rs 2,500.

(c) Provide for an outstanding liability of Rs 500.

Pass journal entries and prepare revaluation.

Answer:

Journal Entries

[OR]

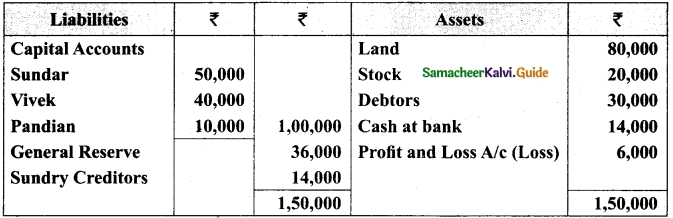

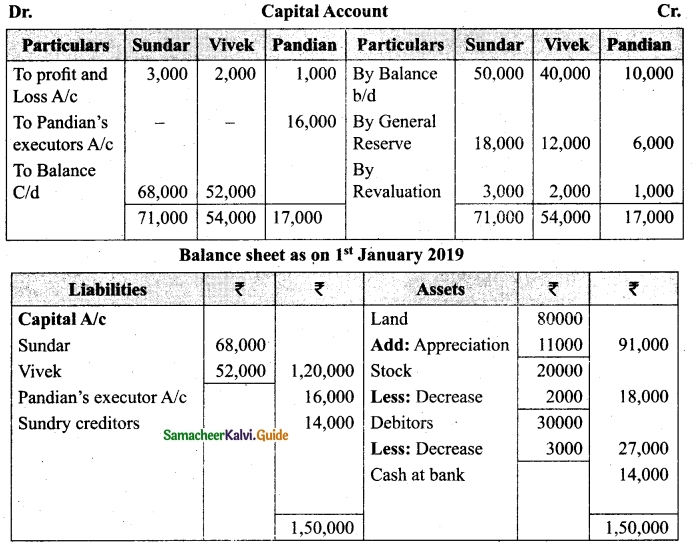

(b) Sundar, Vivek, and Pandian are partners sharing profits in the ratio of 3 : 2 : 1. Their balance sheet as on 31st Dec 2018 is as under.

On 1.1.2019 Pandian died and on his death the following arrangements are made,

(i) Stock to be depreciated by 10%.

(ii) Land is to be appreciated by Rs 11,000.

(iii) Reduce the value of debtors Rs 3,000.

(iv) The final amount due to Pandian was not paid. Prepare revaluation account, partner’s capital A/c and the balance sheet of the firm after death.

Answer:

![]()

Question 44(a)

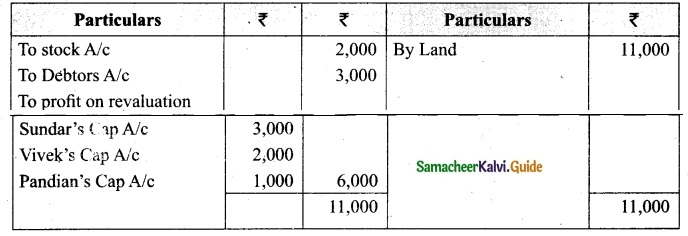

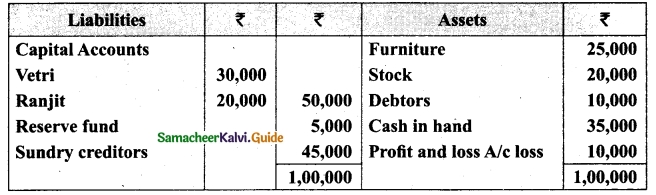

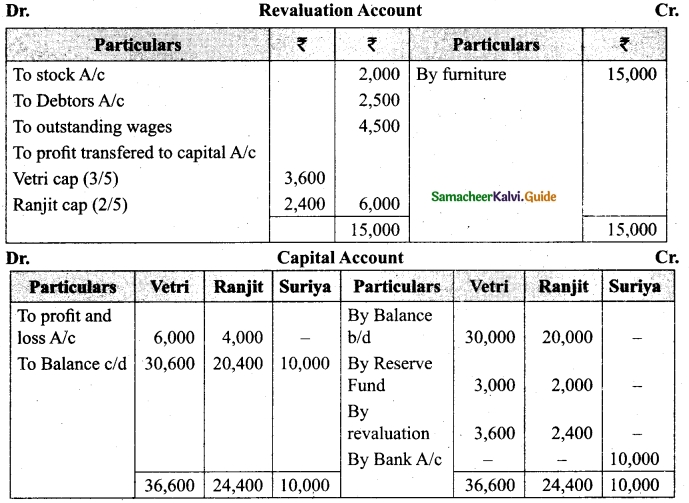

Vetri and Ranjit are partners sharing profit in the ratio of 3 : 2. Their balance sheet as on 31st December 2017 as under.

On 1.1.2018, they admit suriya into their firm as a partner on the following arrangements.

(i) Suriya brings Rs 10,000 as, capital for 1/4th share of profit

(ii) Stock to be depreciated by 10%

(iii) Debtors to be revalue at Rs 7,500

(iv) Furniture to be revaluted at Rs 40,000

(v) There is an outstanding wages Rs 4,500 not yet recorded. Prepare revaluation account, partner’s capital account and the balance sheet of the firm after admission.

Answer:

[OR]

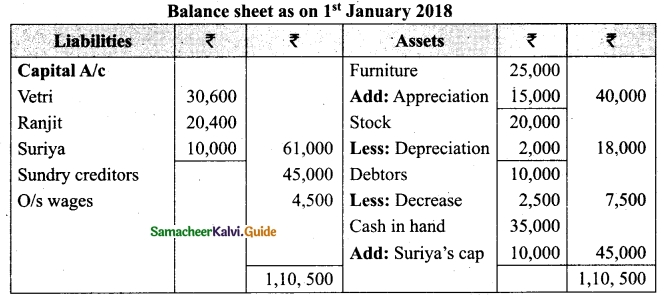

(b) Prabu, Raju and Siva are partners sharing profit and losses in the ratio of 3 : 2 : 1. Prabu retires from partnership on 1.4.2017.

The following adjustments are to be made:

(i) Increase the value of building by Rs 12,000

(ii) Reduce the value of furniture by Rs 8,500

(iii) A provision would also be made for outstanding salary for Rs 6500.

Answer:

Journal Entries

![]()

Question 45(a)

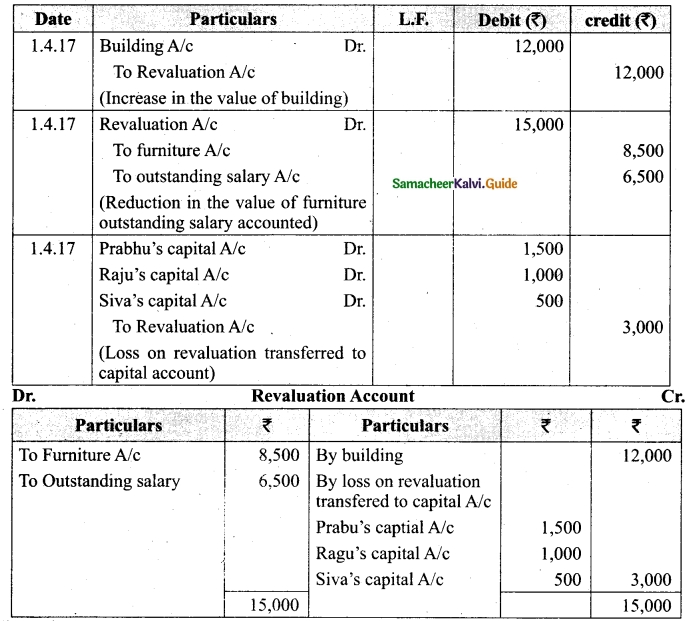

Mani, Rama and Devan are partners in a firm sharing profit and losses in the ratio of 4 : 3 : 3. Their balance sheet as on 31st March 2019 is as follows:

Vlani retired from the partnership firm on 31.03.2019 subject to the following

adjustments:

(i) Stock to be depreciated Rs 5,000.

(ii) Provision for doubtful debtors to be created for Rs 1,000.

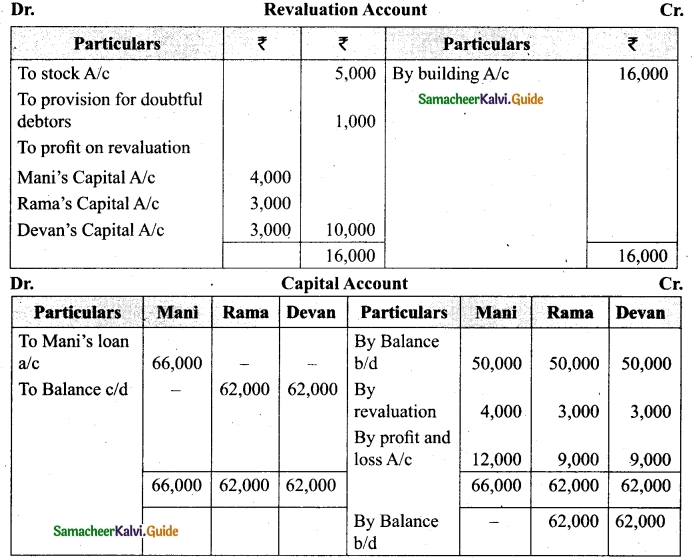

(ii) Buildings to be appreciated by Rs 16,000. The final amount due to Mani is not paid immediately. Prepare revaluation A/c and Capital Account of partners after retirement.

Answer:

[OR]

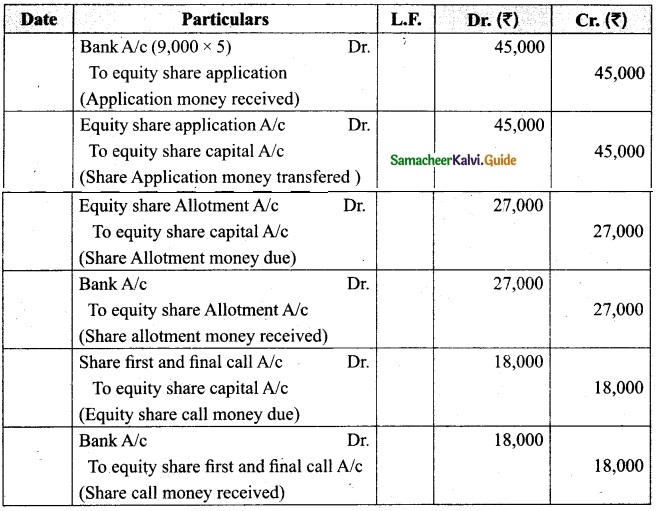

(b) Joy company issued 10,000 equity shares at Rs 10 per share payable Rs 5 on application, Rs 3 on allotment and Rs 2 on first and final call. The public subscribed for 9,000 shares. The directors allotted all the 9,000 shares and duly received the money. Pass the necessary journal entries.

Answer:

Journal Entries

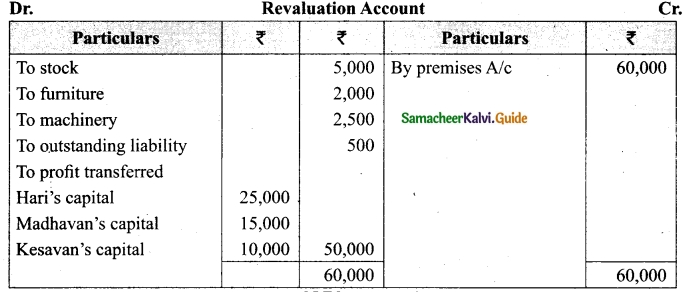

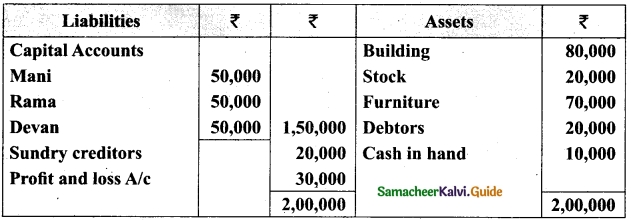

Question 46(a)

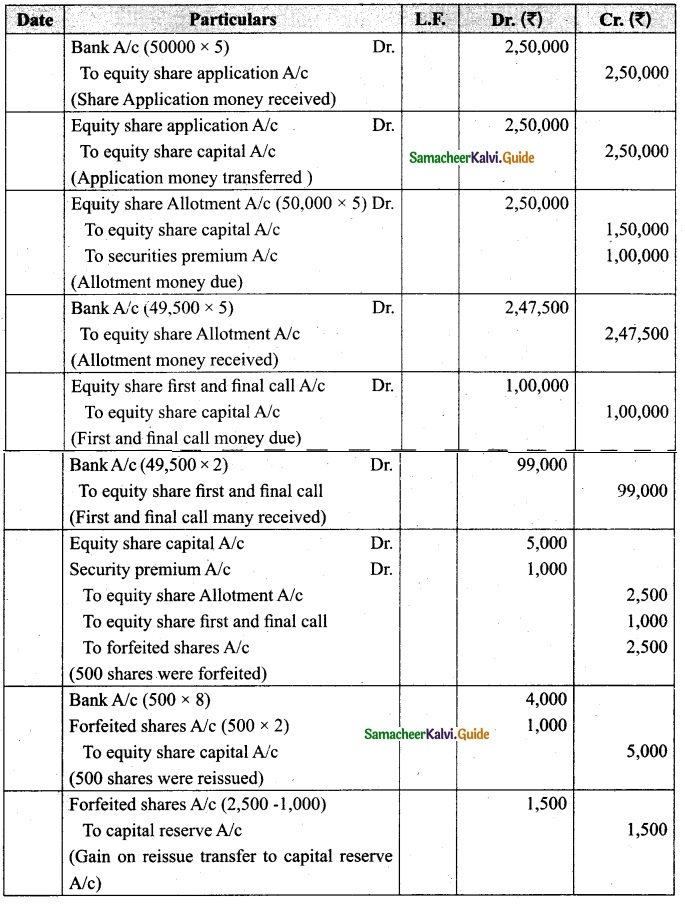

Thangam Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share payable as follows:

On application Rs 5, on allotment Rs 5 (including premium), on first and final call Rs 2. Issue was fully subscribed and the amount due were received except Priya to whom 500 shares were allotted who failed to pay the allotment money and first and final call money. Her shares were forfeited. All the forfeited share were reissued to devi Rs 8 per share.

Answer:

Journal Entries

![]()

[OR]

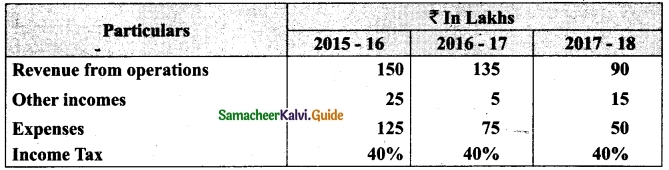

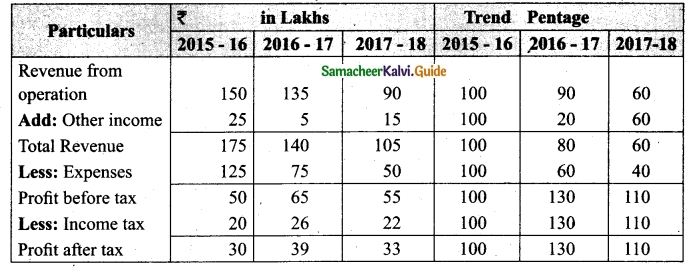

(b) From the following particulars of Neithal Ltd. Calculate trend percentage.

Answer:

Question 47 (a)

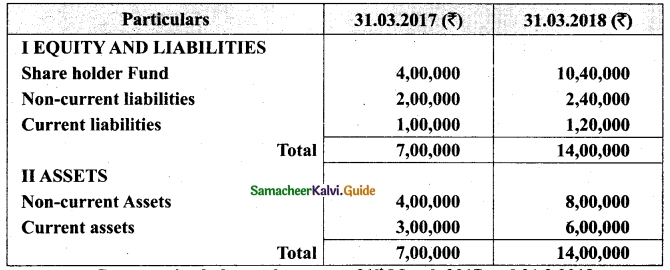

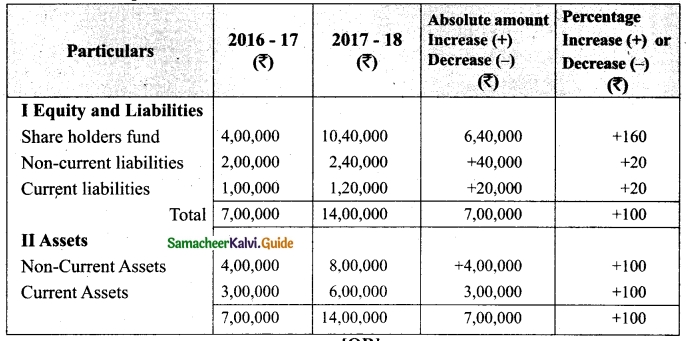

From the following balance sheet of Gupta Ltd, prepare comparative balance sheet as on 31st March 2017 and 31st March 2018.

Answer:

Comparative balance sheet as on 31st March 2017 and 31.3.2018

[OR]

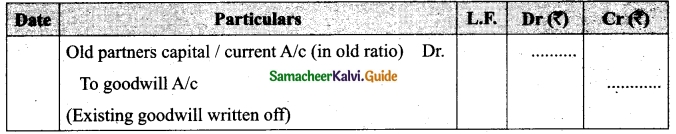

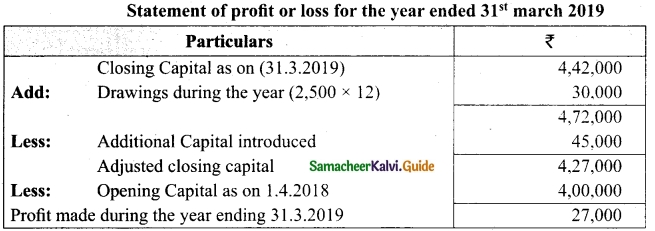

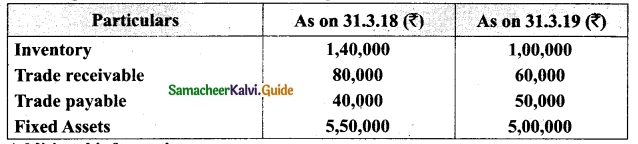

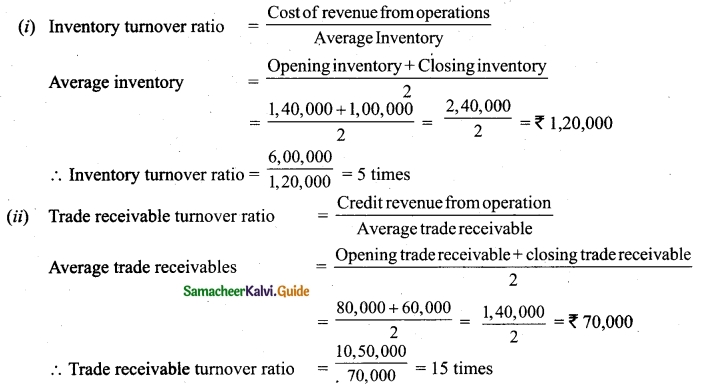

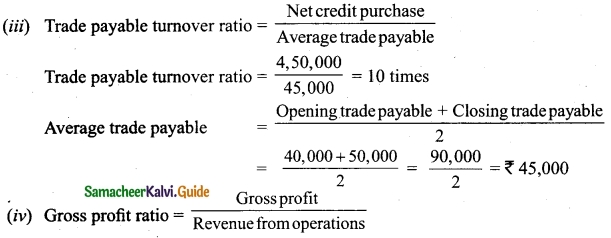

(b) Calculate

(i) inventory turnover ratio

(ii) Trade receivable (or) turnover ratio

(iii) Trade payable turnover ratio

(iv) Gross profit ratio

(v) Fixed assets turnover ratio.

From the following information obtained from Delphi Ltd.

Additional information:

Revenue from operations for the year – 10,50,000

Purchases for the year – 4,50,000

Cost of revenue from operations – 6,00,000

Assume that sales and purchases are for credit

Answer:

![]()

Gross profit ratio = Revenue from operation – Cost of revenue from operation

Gross profit ratio = 10,50,000 – 6,00,000 = Rs 4,50,000