Students can Download Tamil Nadu 12th Accountancy Model Question Paper 2 English Medium Pdf, Tamil Nadu 12th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 12th Accountancy Model Question Paper 2 English Medium

Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II. III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each. These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer.

- Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about 50 words.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in about 150 words.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in about 250 words. Draw diagrams wherever necessary.

Time: 2.30 Hours

Max Marks: 90

PART-I

Answer all the questions. Choose the correct answer. [Answers are in bold] [20 × 1 = 20]

Question 1.

In case of net worth method of single entry system profit is ascertained by

(a) Comparing the capital in the beginning of the accounting period and the capital at the end of the accounting period

(b) Preparing profit and loss account

(c) Preparing a balance sheet

(d) Representative Personal Account

Answer:

(a) Comparing the capital in the beginning of the accounting period and the capital at the end of the accounting period

Question 2.

Profit = capital at the end + ? – capital introduced – capital in the beginning ………

(a) Sales

(b) Drawing

(c) Net purchases

(d) Revenue expenditure

Answer:

(b) Drawing

![]()

Question 3.

From the incomplete records, it is possible to prepare…………

(a) Ledger Accounts

(b) Trial Balance

(c) Statement of Affairs

(d) Personal Account

Answer:

(c) Statement of Affairs

Question 4.

Which of the following is to be recorded in an income and expenditure account?

(а) Purchase of a fixed asset

(б) Capital expenditure incurred in a fixed asset

(c) Profit on the sale of fixed asset

(d) Sale of a fixed assets

Answer:

(c) Profit on the sale of fixed asset

Question 5.

Subscription due but not yet earned is considered as an…………

(a) Asset

(b) Liability

(c) Income

(d) Expenditure

Answer:

(a) Asset

Question 6.

In India partnership firms are governed by the Indian Partnership act ………….

(a) 1932

(b) 1930

(c) 1992

(d) 1986

Answer:

(a) 1932

Question 7.

The maximum number of partners in a partnership firm is……….

(a) 25

(b) 10

(c) 30

(d) 50

Answer:

(d) 50

Question 8.

The monetary value of such advantage is termed as………..

(a) Goodwill

(b) Bank overdraft

(c) Capital

(d) Cash

Answer:

(a) Goodwill

Question 9.

Goodwill helps in earning more profit and attracts more…………

(a) Customers

(b) Producers

(c) Competitors

(d) Suppliers

Answer:

(a) Customers

Question 10.

When are unrecorded liabilities is brought into books is results in …………

(a) Profit

(b) loss

(c) income

(d) expense

Answer:

(b) loss

Question 11.

The revaluation profit or loss is transferred to the old partner’s capital accounts in their……..

(a) Old ratio

(b) New ratio

(c) Sacrifice ratio

(d) Gain ratio

Answer:

(a) Old ratio

![]()

Question 12.

A partner who retires from the firm is called an……….

(a) outgoing partner

(b) admitted partner

(c) death of a partner

(d) none of these

Answer:

(a) outgoing partner

Question 13.

Profits and loses of previous years which are not distributed to the partners are known as ………

(a) Accumulated profit and losses

(b) General reserve

(c) Reserve fund

(d) Workmen compensation fund

Answer:

(a) Accumulated profit and losses

Question 14.

The money raised by issuing shares is called………

(a) Share capital

(b) Dividend

(c) Equity capital

(d) Share application

Answer:

(a) Share capital

Question 15.

Profits are distributed among the shareholders in the form of………..

(a) Share

(b) Dividends

(c) Both

(d) None of these

Answer:

(b) Dividends

Question 16.

Which statements are involve personal judgements in certain cases?

(a) Financial statements

(b) Income statements

(c) Profit and loss account statements

(d) None of these

Answer:

(a) Financial statements

Question 17.

Different tools are used for analysing the…………

(a) Balance sheet

(b) Financial statement

(c) Income statement

(d) None of these

Answer:

(b) Financial statement

Question 18.

If the two items in a ratio are from income statement it is classified as ………….

(a) Balance sheet ratio

(b) Income statement ratio

(c) Inter-statement ratio

(d) None of these

Answer:

(b) Income statement ratio

Question 19.

If a ratio is computed with one item from income statement and another item from balance sheet it is called ……….

(a) Inter-statement ratio

(b) Balance sheet ratio

(c) Income statement ratio

(d) None of these

Answer:

(a) Inter-statement ratio

Question 20.

Transactions are to be recorded through………….

(a) Journal entries

(b) Voucher entries

(c) Accounting entries

(d) None of these

Answer:

(b) Voucher entries

PART – II

Answer any seven questions in which question no. 30 is compulsory. [7 × 2 = 14]

Question 21.

What are the possible reasons for keeping in complete records?

Answer:

(i) Simple method:

Proprietor, who do not have the proper knowledge of accounting principles. Find it much convenient and easier to maintain their business records under this system.

(ii) Less expensive:

It is an economical mode of maintaining records as there is no need to appoint specialised accountant.

![]()

Question 22.

What are the features of not- for-profit organisation?

Answer:

- They are the organisations which function without any profit motive.

- Their main aim is to provide services to a specific group or the public at large.

- They do not undertake business or trading activities.

Question 23.

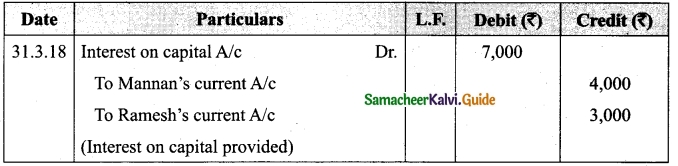

Mannan and Ramesh share profit and losses 3 : 1. The capital of Rs 80,000 and Rs 60,000 and their current accounts show a credit balance of Rs 10,000 and Rs 5,000 respectively. Calculate interest on capital at 5% p.a. for the year ending 31st march 2018 and show the journal entries.

Answer:

Interest on capital = amount of capital × rate of interest

Interest of Mannan’s capital = 80,000 × \(\frac{5}{100}\) = Rs 4,000

Interest of Ramesh’s capital = 60,000 × \(\frac{5}{100}\) = Rs 3,000

Note:

Balance of current account will not be considered for calculation of interest on capital.

Question 24.

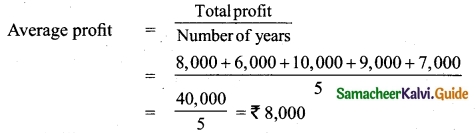

The following are the profit of a firm in the last five years 2014 – Rs 8,000, 2015 – Rs 6,000, 2016 – Rs 10,000, 2017 – Rs 9,000, 2018 – Rs 7,000. Calculate the value of goodwill at 3 years purchase of average profits of five year.

Answer:

Goodwill = Average profit × No. of years of purchase

Goodwill = Average profit × No. of years of purchase

= Rs 8,000 × 3

Goodwill = Rs 24,000

Question 25.

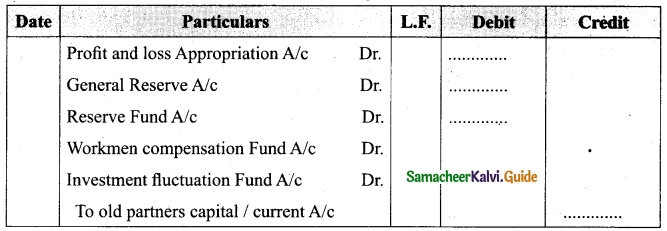

What is the journal entries of transferring of accumulated profit and reserves?

Answer:

Question 26.

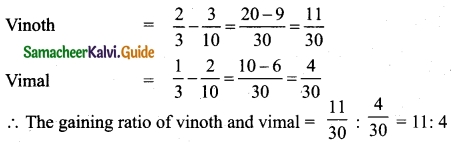

Kiran, vinoth and vimal are partners sharing profits in the ratio 5 : 3 : 2. Kiran retires and the new profit sharing ratio between vinoth and vimal is 2 : 1. Calculate the gaining ratio.

Answer:

Share gained = New share – Old Share

Question 27.

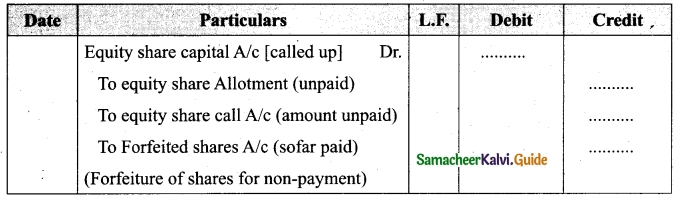

What is the journal entry forfeiture of shares?

Answer:

Journal Entry

Question 28.

What is analysis of Financial statement?

Answer:

- Methodical classification of the data given in the financial statement.

- Explaining the meaning and significance of the relationship between various financial factor,

- Comparison of these relationship.

Question 29.

Calculate quick ratio of Ananth construction ltd from the following given below. Total current liabilities Rs 1,00,000, Inventories Rs 50,000,

Total current assets Rs 25,000, prepaid expenses Rs 15,000.

Answer:

![]()

= Current assets – Inventories – Prepaid expenses

= 2,50,000 – 50,000 – 15,000

= Rs 1,85,000

![]()

Question 30.

What are accounting reports?

Answer:

Accounting report is a compilation of accounting information that are derived from the accounting records of a business concern. Accounting reports may be classified as routine reports and special purpose reports.

PART – III

Answer any seven questions in which question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

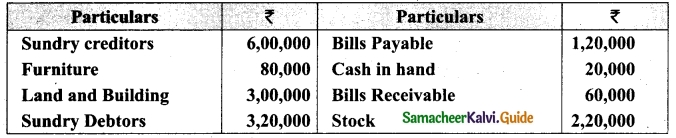

Following are the balances in the books of Thomas as on 31st march 2019.

Answer:

Question 32.

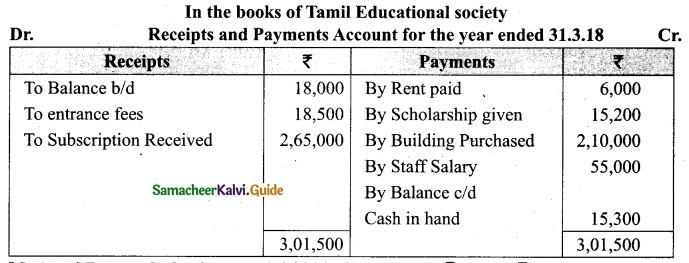

From the following particulars of Tamil Educational society. Prepare Receipts and payments account for year ended 31st march 2019.

Answer:

Question 33.

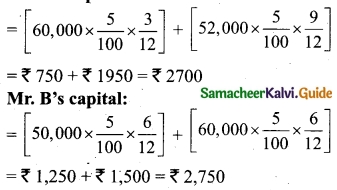

Mr A and B started a business on 1.4.2014 with capital of Rs 60,000, Rs 50,000 respectively. On 1st July 2014 Mr A withdrawal of Rs 8000 from his capital. Mr. B introduced additional capital Rs 10,000 on 30.9.2014. Calculate interest on capital at 5% p.a. for the year ending 31.03.2015.

Answer:

Question 34.

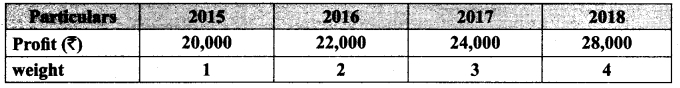

A firm has decided to value its goodwill at 3 years purchase of the average profits of 4 years using weighted average methods. Profits of past 4 years & respective weights are as follows.

compute the value of good will.

Answer:

Goodwill = Weighted Average profit × Number of years of purchase

= 24,800 × 3 = Rs 74,400

Question 35.

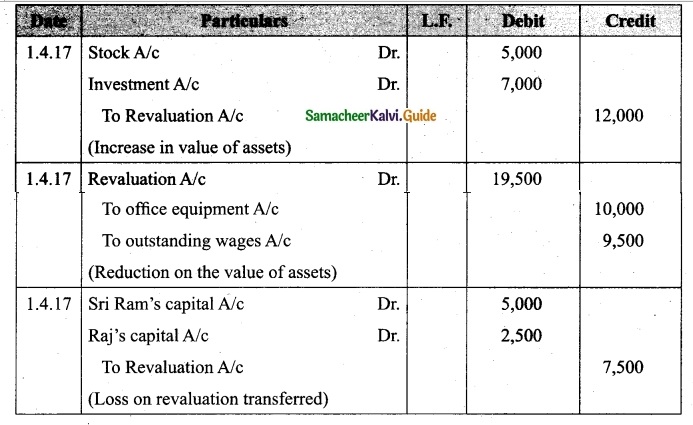

Sri Ram and Raj are partners sharing profit and losses in the ratio of 2 : 1. Nelson joins as a partner on 1.4.17.

The following adjustments are to be made.

(i) Increase the value of stock Rs 5,000

(ii) Bring into record investments of Rs 7,000, which had not been recorded in the books of the firm.

(iii) Reduce the value of office equipment by Rs 10,000.

(iv) A provision would also be made for outstanding wages for Rs 9,500. Give the journal entries.

Answer:

Journal Entries

Question 36.

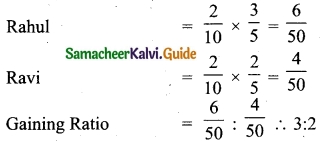

Rahul, Ravi and Rohit are partners, sharing profits and loss in the ratio of 5 : 3 : 2. Rohit retires and the share is taken by Rahul and Ravi in the ratio of 3 : 2. Find out the new profit sharing ratio and gaining ratio.

Answer:

Rohit share = \(\frac{2}{10}\)

Share gained = Retiring partner share × Proportion of share gained

New share of continuing partners = old share + share gained

![]()

Question 37.

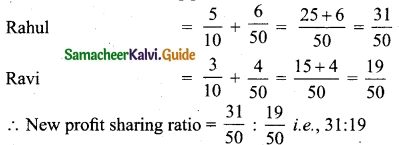

Anu company forfeited 200 equity shares of Rs 10 each issued at par held by thiyagu for non-payment of the final call of Rs 3 per share. The shares were reissued to laxman at Rs 6 per share, show the journal entries.

Answer:

In the books of Anu Company Journal entries

Question 38.

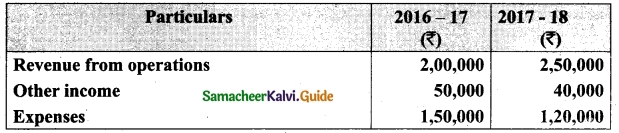

From the following prepare comparative income statement of Tharun & Co. Ltd.

Answer:

Comparative incomp statement of Tharun Co. Ltd. for the year ended 31st March 2017 and 31st March 2018

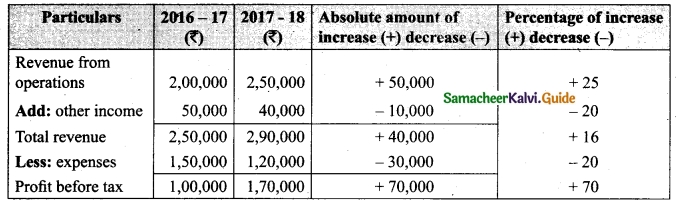

Tutorial note: Computation of percentage increase for revenue from operations.

Question 39.

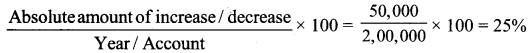

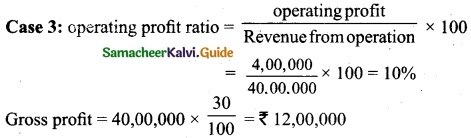

Calculate operating profit ratio under the following cases,

Case 1: Revenue from operation Rs 20,00,000 operating profit Rs 3,00,000

Case 2: Revenue from operation Rs 30,00,000 operating cost Rs 24,00,000

Case 3: Revenue from operation Rs 40,00,000 gross profit 30% on revenue from

operations expenses Rs 8,00,000.

Answer:

Operating profit = Revenue from operation – operating cost

= 30,00,000 – 24,00,000 = Rs 6,00,000

Operating profit = Gross profit – Operating expenses

= 12,00,000 – 8,00,000 = Rs 4,00,000

Question 40.

What are the salient features of computerised Accounting system?

Answer:

(i) Simplicity:

They are easy to set up and simple to us.

(ii) Speed:

They are capable to generation instant and accurate report.

(iii) Power:

They are capable of maintaining accounts of multiple companies and with unlimited levels of classification.

(iv) Flexibility:

They provide flexibility to generate instant reports for giving period.

PART – IV

Answer all the following questions. [7 × 5 = 35]

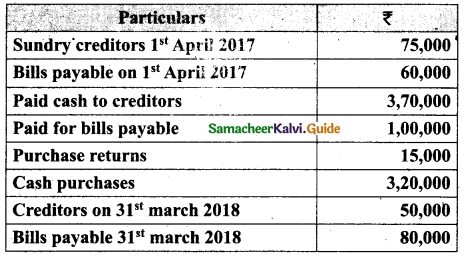

Question 41(a).

From the following particulars calculate total purchase.

Answer:

Bills payable account

Total Purchases = Cash purchases + credit Purchase

= 7 3,20,000 + 74,80,000 = 7 8,00,000

![]()

[OR]

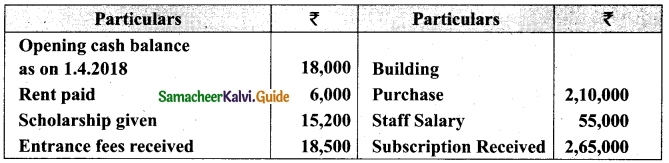

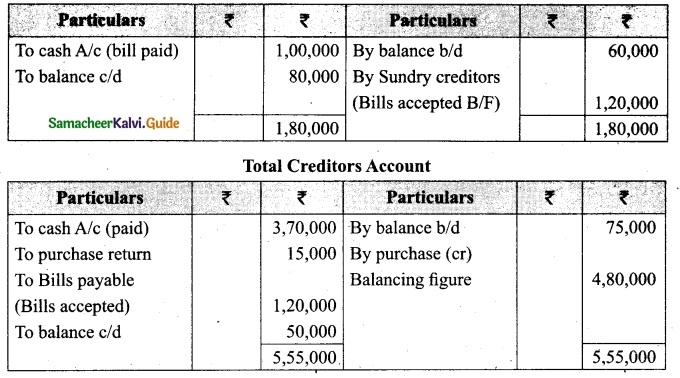

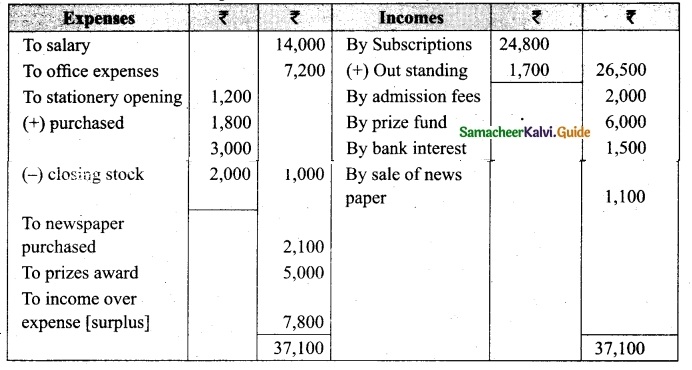

(b) From the following receipts and payments account of yercaud youth Association. Prepare income and expenditure Account for the year ended 31st march 2019 and the balance sheet as on that date.

Additional information:

(i) Opening capital fund Rs 20,000

(ii) Stock of books on 1.4.2018 Rs 9,200

(iii) Subscription due but not received Rs 1,700

(iv) Stock of stationery on 1.4.2018 Rs 1,200; stock of stationery on 31.3.2019 Rs 2,000.

Answer:

Income and Expenditure Account for the year ended 31.3.2019

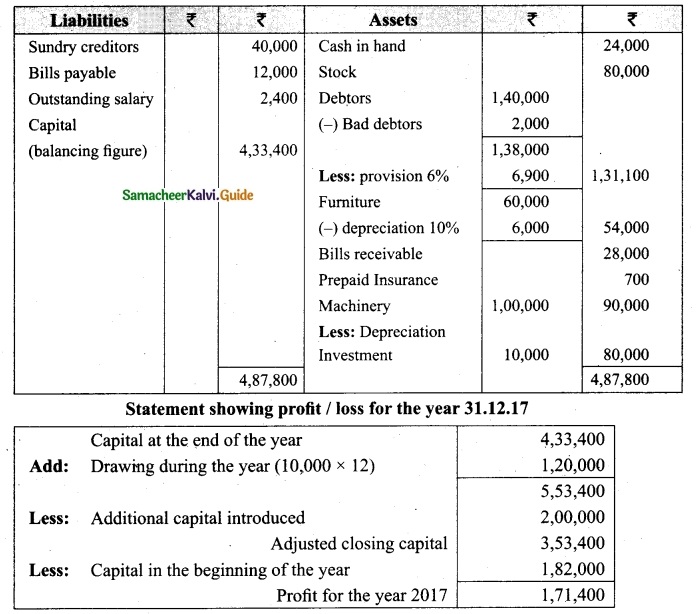

Question 42(a).

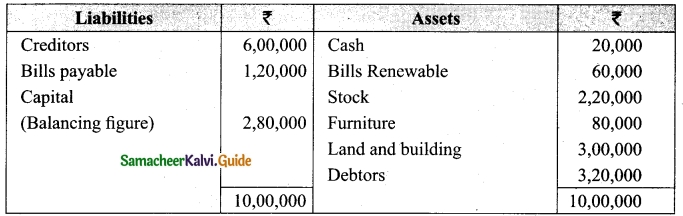

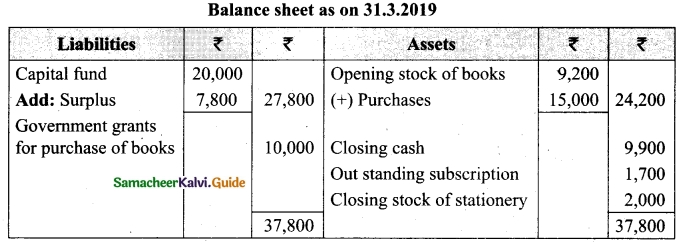

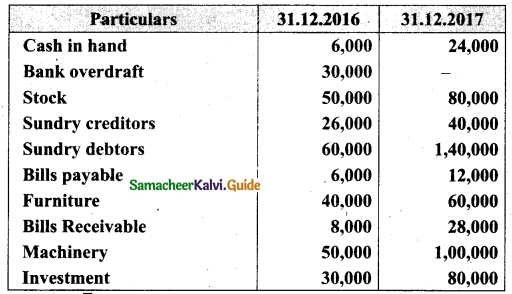

Miss. Soniya sport equipment does not keep proper records from the following informations. Find out profit or loss and also prepare balance sheet for the year ended 31st December 2017.

Drawing Rs 10,000 per month for personal use, additional capital introduced during the year Rs 2,00,000. A bad debts Rs 2,000 and a provision of 5% to be made in debtors. Outstanding salary Rs 2,600 prepaid insurance Rs 700 depreciation changed as furniture at 10% P.a.

Answer:

Statement of affairs as on 31st December 2016

Balance sheet as on 31.3.2017

![]()

[OR]

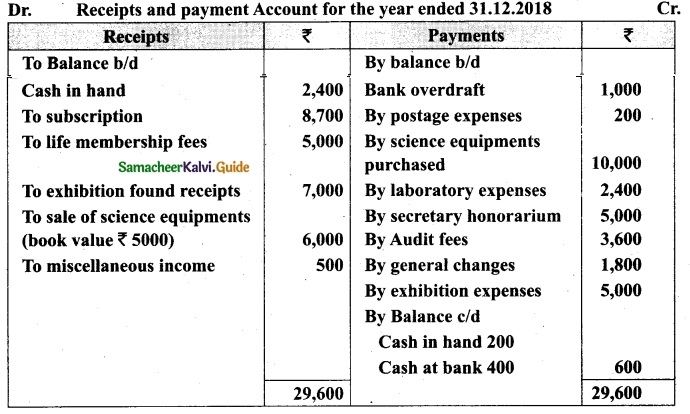

(b) From the following Receipts and Payment account of Neyveli Science Club for the year ended 31st December 2018.

Additional information:

(i) Opening capital fund Rs 6,400

(ii) Subscription includes Rs 600 for the year 2019

(iii) Science equipment as on 1.1.2018 Rs 5,000

(iv) Surplus on account of exhibition should be kept in reserve for new auditorium.

Prepare income and expenditure account for the year ended 31st December 2018 and the balance sheet as on that date.

Answer:

Income and Expenditure Account for the year ended 31st Dec. 2018

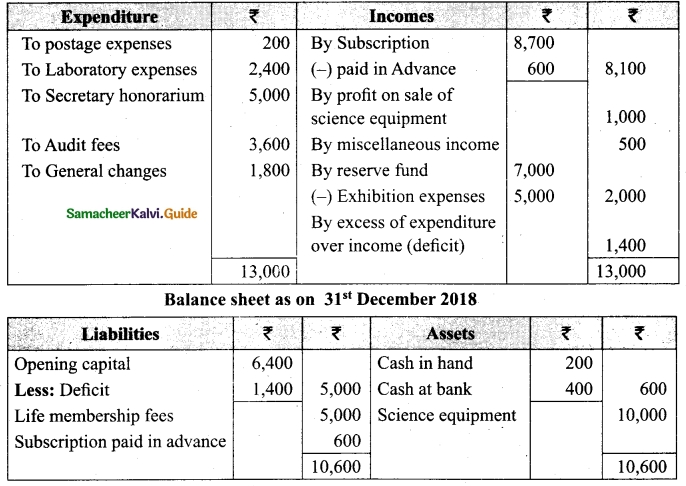

Question 43(a).

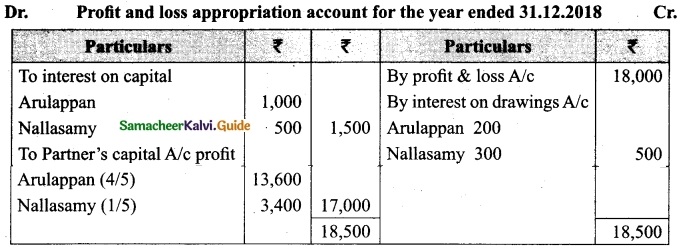

Arulappan and Nallasamy are partners sharing profit and losses in the ratio 4 : 1. On 1st January 2018 their capitals were Rs 20,000 and Rs 10,000 respectively. The partnership deed specifies the following.

(а) Interest on capital is to he allowed at 5%P.a

(b) Interest on drawings charged to Arulappan and Nallasamy are Rs 200 and Rs 300 respectively.

(c) The net profit of the firm before considering interest on capital and interest on drawings amounted to Rs 18,000.

Give the journal entries and prepare profit and loss appropriation account for the year ending 31st December 2018. Assume that the capitals are fluctuating.

Answer:

Journal Entries

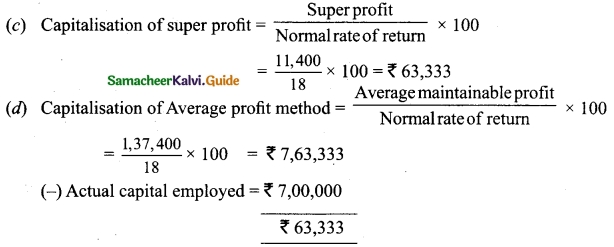

[OR]

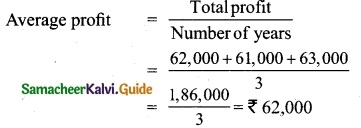

(b) From the following information compute the value of goodwill by super profit method & capitalising method

(i) Capital employed is Rs 4,00,000

(ii) Normal rate of return is 10%

(iii) Profit for 2016 : Rs 62,000; 2017 : Rs 61,000 and 2018 : Rs 63,000

(iv) Super profit method:

Answer:

Normal profit = capital employed × Normal rate of return

= 400000 × \(\frac{10}{100}\)

= 40000

Super profit = Average profit – Normal profit = Rs 62,000 – 40,000

= Rs 22,000

Goodwill = Total capitalised value of the average profit – Capital employed = Rs 6,20,000 – 4,00,000

= Rs 22,000

![]()

Question 44(a).

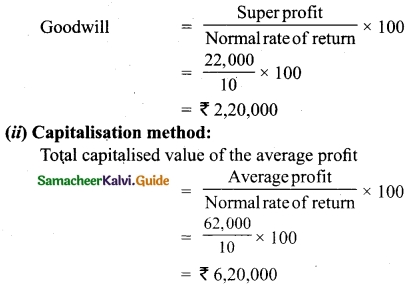

Calculate the value of goodwill of the partnership firm of 2 partners

(а) At the 3 years purchase of average profits

(b) At the 3 years purchase of super profits

(c) On the basis of capitalisation of super profits

(d) On the basis of capitalisation of average profits

(i) Average capital employed Rs 7,00,000

(ii) Net trading results of the firm 2014 – Rs 1,47,600, 2015 – Loss Rs 1,48,100, Profit for 2016 – Rs 4,48,700

(iii) Interest on capital @ 18%

(iv) Remuneration Rs 500 per month.

Answer:

Calculation of Average profit and super profit

Total profit = Rs 1,47,600 – Rs 1,48,100 + Rs 4,48,700 = Rs 4,48,200

Super profit = Average profit – Normal profit

= 1,37,400 – 1,26,000

Super profit = Rs 11,400

(a) Average profit method:

Average profit × No. of years purchase

= Rs 1,37,400 × 3 = Rs 4,12,200

(b) Super profit method:

Super profit × No. of years purchase

= Rs 11,400 × 3 = Rs 34,200

[OR]

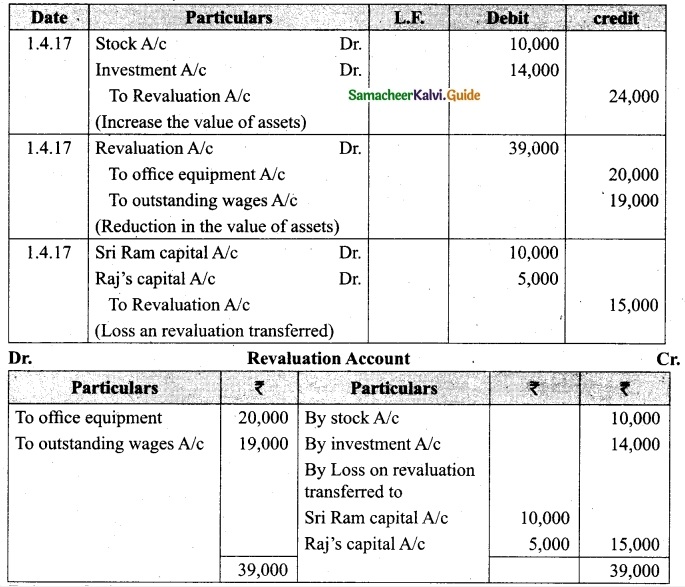

(b) Sri Ram and Raj are partners sharing profits in the ratio 2 : 1. Nelson joins as a partner on 1st April 2017. The following adjustments are to be made.

(i) Increase the value of Rs 10,000

(ii) Bring into record investment of Rs 14,000 which had not been recorded in the books of the firm.

(iii) Reduce the value of office equipment by Rs 20,000

(iv) A provision would also be made for outstanding wages for Rs 19,000. Give journal entries and prepare revaluation account.

Answer:

Journal Entries

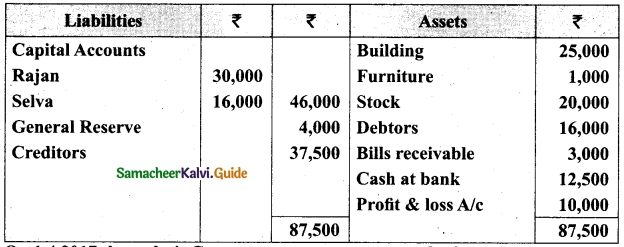

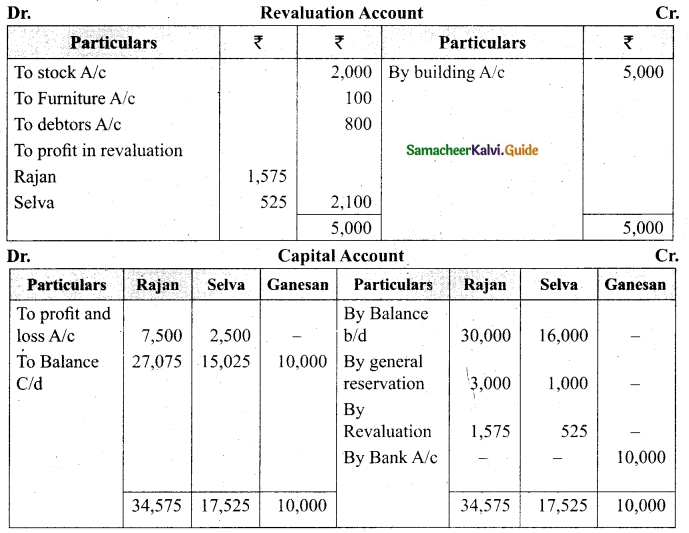

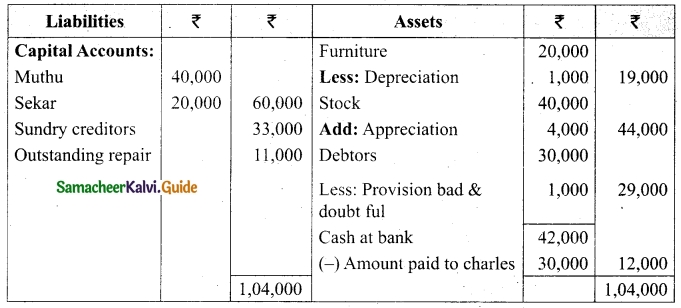

Question 45(a).

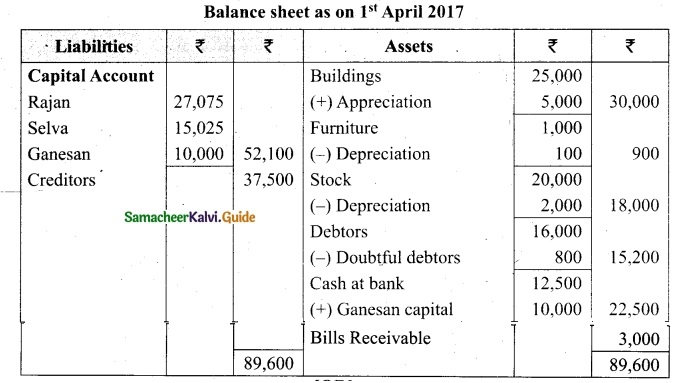

Raj an and selva are partners sharing profit and losses in the ratio of 3:1. sheet as on 31st march 2017.

On 1.4.2017 they admit Ganesan as a new partner on the following arrangements

(i) Ganesan brings 10,000 as capital for 1/5 share of profit.

(ii) Stock and furniture is to be reduced by 10% a reserve of 5% on debtors for doubtful debts is to be created.

(iii) Appreciate building by 20%

Prepare revaluation account, partners capital account and the balance sheet of the firm after admission.

Answer:

![]()

[OR]

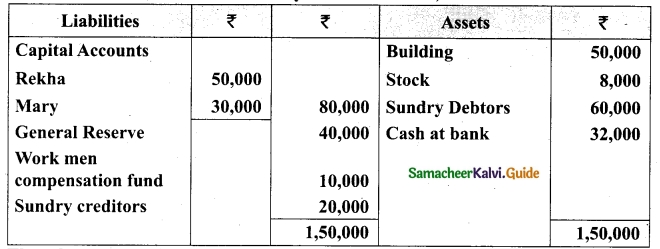

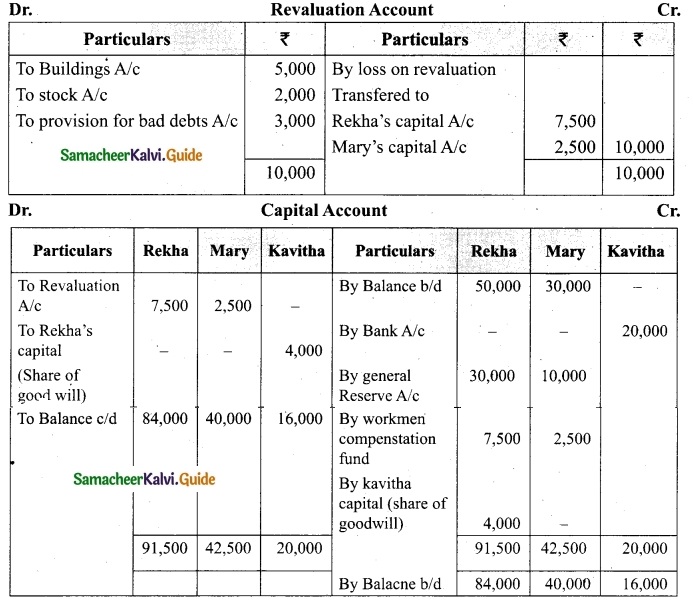

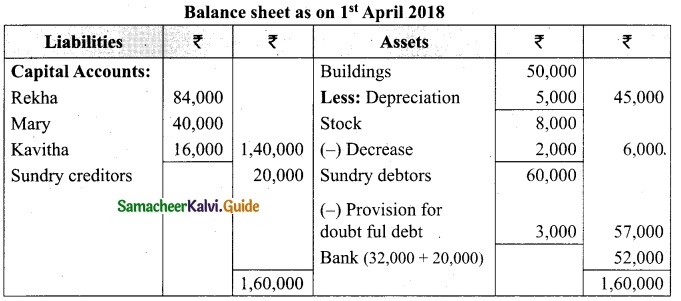

(b) The balance sheet of Rekha and mary on 31.12.2018 as

They share the profit and losses in the ratio 3 : 1. They agreed to admit kavitha into the partnership firm for 1/4 share of profits which she gets entirely gets from Rekha. Following are the conditions,

(i) Kavitha has to bring Rs 20,000 as capital. Her share of goodwill is valued at 4,000. She could not bring cash towards goodwill.

(ii) Depreciate buildings by 10%

(iii) Stock to be the revalued at Rs 6,000

(iv) Create provision for doubtful debts @ 5% on debito?

Prepare necessary ledger accounts and the balance sheet after admission.

Answer:

Question 46(a).

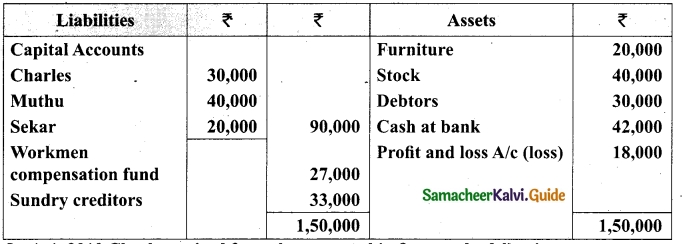

Charles, Muthu and sekar are partners sharing profits in the ratio 3 : 4 : 2. Their balance sheet as on 31st december 2018 is as under.

(i) On 1.1. 2019 Charles retired from the partnership firm on the following arrangements. Stock to be appreciated by 10%

(ii) Furniture to be depreciated by 5%

(iii) To provide Rs 1000 for bad debts

(iv) There is an outstanding repair of Rs 11,000 not yet recorded.

(v) The final amount due to Charles was paid.

Prepare revaluation account, capital account and the balance sheet of partner’s frim after the retirement.

Answer:

Balance sheet

![]()

[OR]

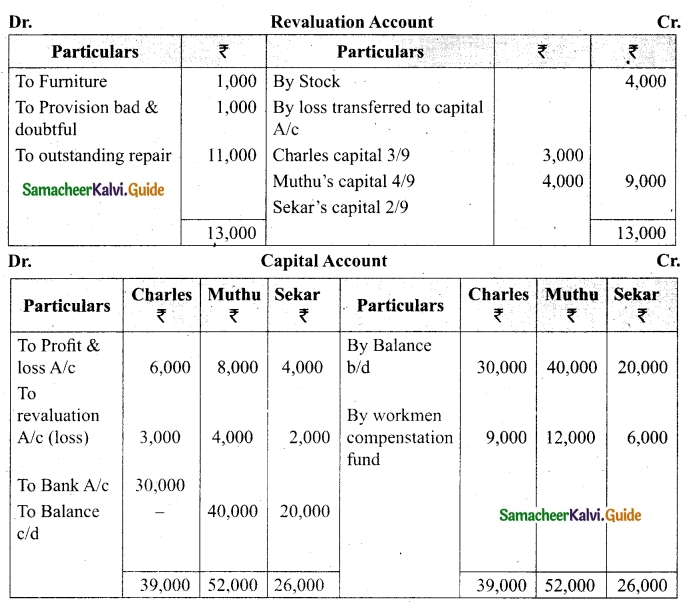

(b) Thangam Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share payable as follows.

On application Rs 5, on allotment Rs 5 (including premium) on first and final call Rs 2.

Issue was fully subscribed and the amounts due were received except priya to whom 500 shares were allotted who faded to pay the allotment money and first and final call money. Her shares were forfeited. All the forfeited shares were reissued to devi Rs 8 per share. Pass journal entries.

Answer:

Journal Entries

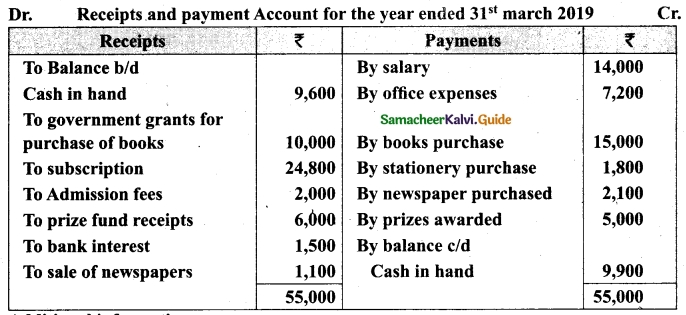

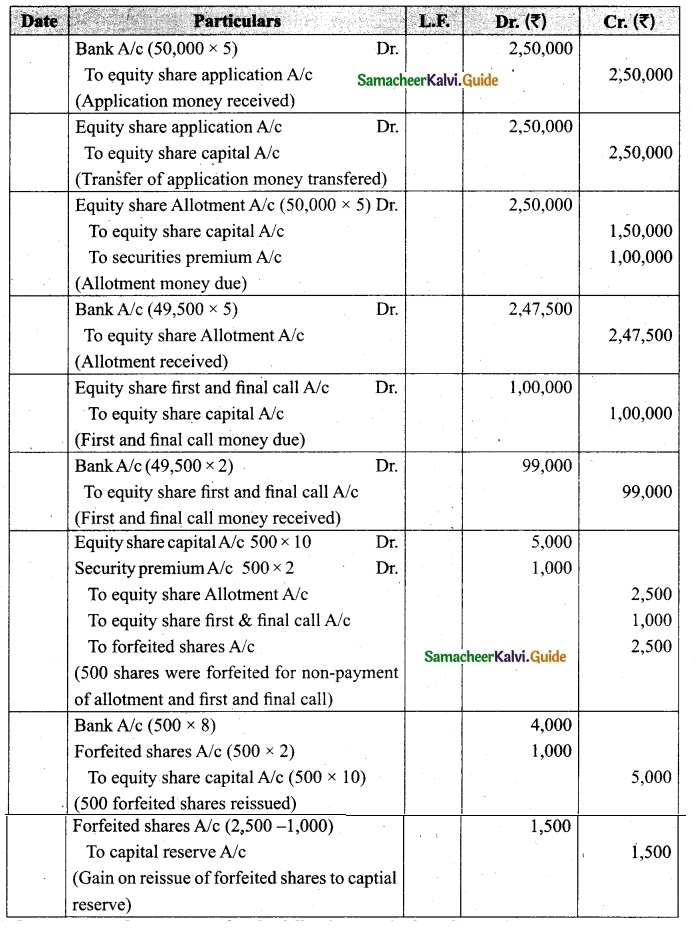

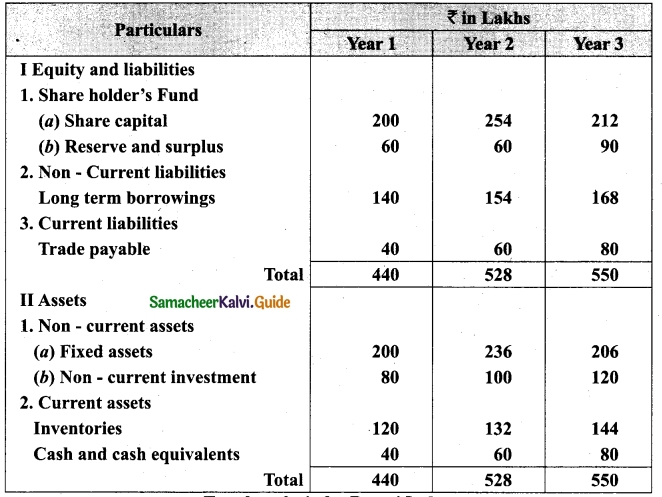

Question 47(a).

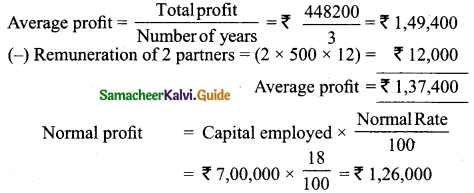

Compute trend percentage for the following particular of Boomi Ltd.

Answer:

![]()

[OR]]

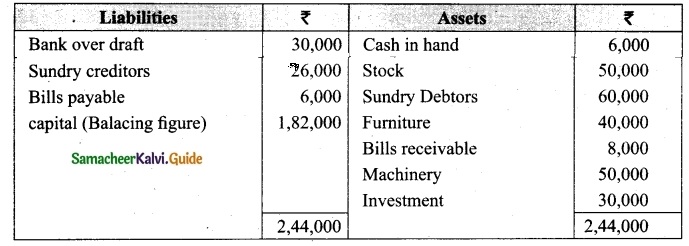

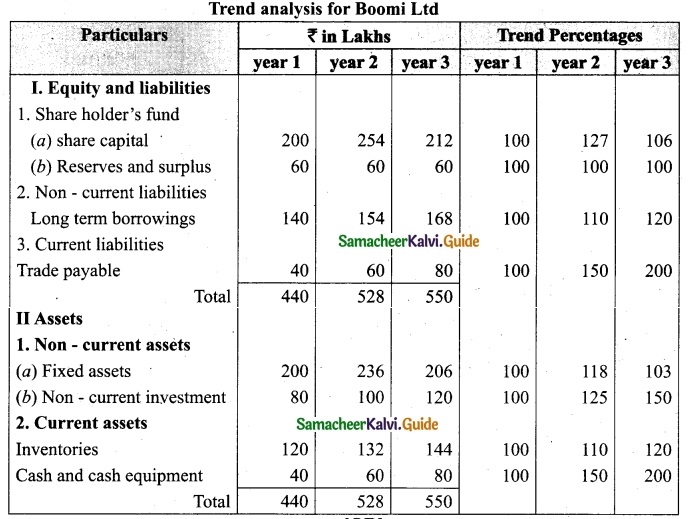

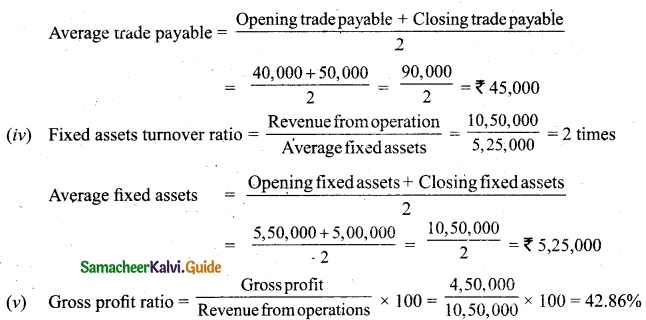

(b) Calculate-

(i) inventory turnover ratio

(ii) Trade receivable turnover

(iii) Trade payable turnover ratio

(iv) Fixed assets turnover ratio

(v) Gross profit ratio from the following,

Additional information:

Revenue from operations for the year Rs 10,50,000

Purchases for the year Rs 4,50,000

Cost of revenue from operations RS 6,00,000

Assume that sales and purchase are for credit

Answer:

Gross profit = Revenue from operations – Cost of revenue from operations

= 10,50,000 – 6,00,000

= 7 4,50,000