Students can Download Tamil Nadu 12th Economics Model Question Paper 1 English Medium Pdf, Tamil Nadu 12th Economics Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 12th Economics Model Question Paper 1 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3.00 Hours

Maximum Marks: 90

PART – I

Choose the correct answer. Answer all the questions: [20 × 1 = 20]

Question 1.

Indicate the contribution of J M Keynes to economics……..

(a) Wealth of Nations

(b) General Theory

(c) Capital

(d) Public Finance

Answer:

(b) General Theory

Question 2.

Per capita income is obtained by dividing the National income by………..

(a) Production

(b) Population of a country

(c) Expenditure

(d) GNP

Answer:

(b) Population of a country

Question 3.

Assertion (A): The Expenditure method is called outlay method.

Reason (R): This method is used only private sector.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is true but ‘R’ is false

Answer:

(c) ‘A’ is true but ‘R’ is false

![]()

Question 4.

The component of aggregate demand is………..

(a) Personal demand

(b) Government expenditure

(c) Only export

(d) Only import

Answer:

(b) Government expenditure

Question 5.

If the Keynesian consumption function is C= 10 + 0.8 Y then, if disposable income is Rs 1000, what is amount of total consumption?

(a) Rs 0.8

(b) Rs 800

(c) Rs 810

(d) Rs 0.81

Answer:

(c) Rs 810

Question 6.

Which of the following is correctly matched:

(a) J.M. Clark – Ceteris Paribus

(b) J.M. Keynes – Psychological law of consumption

(c) R.F. Khan – Accelerator model

(d) Duesenberry – Laissez-faire

Answer:

(b) J.M. Keynes – Psychological law of consumption

Question 7.

………. inflation is in no way dangerous to the economy.

(a) Walking

(b) Running

(c) Creeping

(d) Galloping

Answer:

(a) Walking

Question 8.

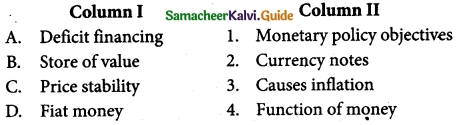

Match the following and choose the correct answer by using codes given below:

Codes

Answer:

(a) A-3, B-4, C-1, D-2

Question 9.

Expansions of ATM.

(a) Automated Teller Machine

(b) Adjustment Teller Machine

(c) Automatic Teller mechanism

(d) Any Time Money

Answer:

(a) Automated Teller Machine

Question 10.

Commercial Banks create credit in favour of the……..

(a) consumers

(b) business men

(c) customers

(d) agriculturists

Answer:

(c) customers

Question 11.

Net export equals ………

(a) Export x Import

(b) Export + Import

(c) Export – Import

(d) Exports of services only

Answer:

(c) Export – Import

Question 12.

Assertion (A): Price of a commodity is measured by the amount of labour required to produce it.

Reason (R): Trade is one of the Demerit.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Question 13.

Which of the following is not the member of SAARC?

(a) Pakistan

(b) Sri Lanka

(c) Bhutan

(d) China

Answer:

(d) China

Question 14.

IBRD otherwise called the………..

(a) IMF

(b) SDR

(c) SAF

(d) World Bank

Answer:

(d) World Bank

![]()

Question 15.

Finance Commission determines …………

(a) The finances of Government of India

(b) The resources transfer to the states

(c) The resources transfer to the various departments

(d) None of the above

Answer:

(b) The resources transfer to the states

Question 16.

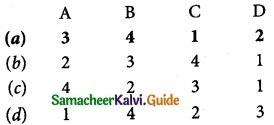

Match the following and choose the correct answer by using codes given below:

codes

Answer:

A-2, B-4. C-1, D-3

Question 17.

………. is the current increase in temperature of the Earth’s surface as well as its atmosphere.

(a) Globe warming

(b) Global warming

(c) Globe spoiled

(d) Temperature warming

Answer:

(b) Global warming

Question 18.

The supply side vicious circle of poverty suggests that poor nations remain poor because

(a) Saving remains low

(b) Investment remains low

(c) There is a lack of effective government

(d) a and b above

Answer:

(d) a and b above

Question 19.

……….planning pertains to the allocation of resources in terms of men, materials and machinery.

(a) Financial

(b) Physical

(c) Functional

(d) Structural

Answer:

(b) Physical

Question 20.

The word ‘statistics’ is used as……….

(a) Singular

(b) Plural

(c) Singular and Plural

(d) None of above

Answer:

(c) Singular and Plural

PART – II

Answer any seven question in which Question No. 30 is compulsory. [7 x 2 = 14]

Question 21.

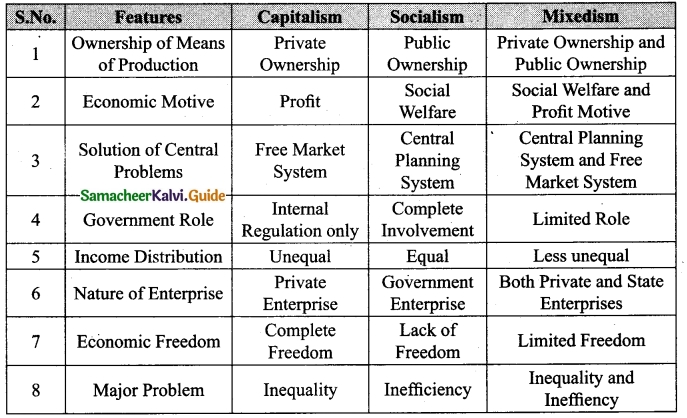

What do you mean by Capitalism?

Answer:

Capitalism, is total freedom and private ownership of means of production. Capitalistic economy is also termed as a free economy (Laissez faire, in Latin) or market economy where the role of the government is minimum and market determines the economic activities.

Question 22.

Write the formula for calculating GNP.

Answer:

GNP at market prices means the gross value of final goods and services produced annually in a country plus net factor income from abroad

(C + I + G + (X – M) + (R – P)

Question 23.

Write the headlines of difficulties in Measuring National Income.

Answer:

Difficulties in Measuring National Income:

- Transfer payments

- Difficulties in assessing depreciation allowance

- Unpaid services

- Income from illegal activities

- Production for self-consumption and changing price

- Capital Gains

- Statistical problems.

Question 24.

What is effective demand?

Answer:

The starting point of Keynes theory of employment and income is the principle of effective demand. Effective demand denotes money actually spent by the people on products of industry. The money which entrepreneurs receive is paid in the form of rent, wages, interest and profit. Therefore effective demand equals national income.

![]()

Question 25.

Define “Unemployment”.

Answer:

Unemployment: When there are people, who are willing to work and able to work but cannot find suitable jobs.

Question 26.

Define average propensity to save (APS).

Answer:

Average Propensity to Save (APS):

The average propensity to save is the ratio of saving to income. APS is the quotient obtained by dividing the total saving by the total income. In other words, it is the ratio of total savings to total income. It can be expressed algebraically in the form of equation as under

APS = \(\frac{S}{Y}\)

Where, S = Saving; Y = Income

Question 27.

Define “Ceteris paribus”.

Answer:

Ceteris paribus (constant extraneous variables): The other variables such as income distribution, tastes, habits, social customs, price movements, population growth, etc. do not change and consumption depends on income alone.

Question 28.

State briefly the functions of SAARC.

Answer:

Functions of SAARC:

The main functions of SAARC are as follows.

- Maintenance of the co operation in the region

- Prevention of common problems associated with the member nations.

- Ensuring strong relationship among the member nations.

- Removal of the poverty through various packages of programmes.

- Prevention of terrorism in the region.

Question 29.

What are the components of GST?

Answer:

Components of GST:

The component of GST are of 3 types. They are: CGST, SGST & IGST.

- CGST: Collected by the Central Government on an intra-state sale (e.g. Within state/ union territory)

- SGST: Collected by the State Government on an intra-state sale (e.g. Within state/ union territory)

- IGST: Collected by the Central Government for inter-state sale (e.g. Maharashtra to Tamil Nadu)

Question 30.

What are environmental goods? Give examples.

Answer:

Environmental goods are typically non-market goods, including clear air, clean water, landscape, green transport infrastructure (footpaths, cycle ways, greenways, etc.), public parks, urban parks, rivers, mountains, forests, and beaches.

Concerns with environmental goods focus on the effects that the exploitation of ecological systems have on the economy, the well-being of humans and other species, and on the environment.

PART – III

Answer any seven question in which Question No. 40 is compulsory. [7 x 3 = 21]

Question 31.

Describe the socialistic econonomy.

Answer:

Socialistic Economy (Socialism):

- The Father of Socialism is Karl Marx. Socialism refers to a system of total planning, public ownership and state control on economic activities.

- Socialism is defined as a way of organizing a society in which major industries are owned and controlled by the government.

- A Socialistic economy is also known as ‘Planned Economy’ or ‘Command Economy’.

- In a socialistic economy, all the resources are owned and operated by the government.

- Public welfare is the main motive behind all economic activities. It aims at equality in the distribution of income and wealth and equal opportunity for all.

- Russia, China, Vietnam, Poland and Cuba are the examples of socialist economies. But, now there are no absolutely socialist economies.

Question 32.

Discuss the limitations of Macro Economics.

Answer:

Macro economics suffers from certain limitations. They are:

- There is a danger of excessive generalisation of the economy as a whole.

- It assumes homogeneity among the individual units.

- There is a fallacy of composition. What is good of an individual need not be good for nation and vice versa. And, what is good for a country is not good for another country and at another time.

- Many non-economic factors determine economic activities; but they do not find place in the usual macroeconomic books.

Question 33.

Give short note on Expenditure method.

Answer:

The Expenditure Method (Outlay method):

- The total expenditure incurred by the society in a particular year is added together.

- To calculate the expenditure of a society, it includes personal consumption expenditure, net domestic investment, government expenditure on consumption as well as capital goods and net exports.

![]()

Question 34.

Describe the types of unemployment.

Answer:

The following are the types of unemployment.

Types of unemployment:

- Cyclical Unemployment

- Frictional Unemployment

- Technical Unemployment

- Disguised Unemployment

- Seasonal Unemployment

- Educated Unemployment

- Structural Unemployment

1. Cyclical Unemployment:

- This unemployment exists during the downturn phase of trade cycle in the economy.

- In a business cycle during the period of recession and depression, income and output fall leading to widespread unemployment.

- It is caused by deficiency of effective demand.

- Cyclical unemployment can be cured by public investment or expansionary monetary policy.

2. Seasonal Unemployment:

- This type of unemployment occurs during certain seasons of the year.

- In agriculture and agro based industries like sugar, production activities are carried out only in some seasons.

- These industries offer employment only during that season in a year. Therefore people may remain unemployed during the off season.

- Seasonal unemployment happens from demand side also; for example ice cream industry, holiday resorts etc.

3. Frictional Unemployment (Temporary Unemployment):

- Frictional unemployment arises due to imbalance between supply of labour and demand for labour.

- This is because of immobility of labour, lack of necessary skills, break down of machinery.

- shortage of raw materials etc.

- The persons who lose jobs and in search of jobs are also included under frictional unemployment.

4. Educated Unemployment:

- Sometimes educated people are underemployed or unemployed when qualification does

not match the job. - Faulty education system, lack of employable skills, mass student turnout and preference for white collar jobs are highly responsible for educated unemployment in India.

5. Technical Unemployment:

- Modem technology being capital intensive requires less labourers and contributes to technological unemployment.

- Now a days, invention and innovations lead to the adoption of new techniques there by the existing workers are retrenched.

- Labour saving devices are responsible for technological unemployment.

6. Structural Unemployment:

- Structural unemployment is due to drastic change in the structure of the society.

- Lack of demand for the product or shift in demand to other products cause this type of unemployment.

- For example rise in demand for mobile phones has adversely affected the demand for cameras, tape recorders etc.

- So this kind of unemployment results from massive and deep rooted changes in economic structure.

7. Disguised Unemployment:

- Disguised unemployment occurs when more people are than what is actually required.

- Even if some workers are withdrawn, production does not suffer.

- This type of unemployment is found in agriculture.

- A person is said to be disguisedly by unemployed if his contribution to output is less than what he can produce by working for normal hours per day.

- In this situation, marginal productivity of labour is zero or less or negative.

Question 35.

Differentiate autonomous and induced investment.

Answer:

| Sl.No | Autonomous Investment | Induced Investment |

| 1 | Independent | Planned |

| 2 | Income inelastic | Income elastic |

| 3 | Welfare motive | Profit Motive |

Question 36.

What is money supply?

Answer:

- Money supply means the total amount of money in an economy.

- It refers to the amount of money which is in circulation in an economy at any given time.

- Money supply plays a crucial role in the determination of price level and interest rates.

- Money supply viewed at a given point of time is a stock and over a period of time it is a flow.

Question 37.

Distinguish between money market and capital market.

Answer:

| S.No. | Money Market | Capital Market |

| 1. | Money market is the mechanism through which sthort term funds are loaned and borrowed. It designates financial instittutions which handle the purchase, sale and transfer of short term credit instruments. | Capital Market is a part of financial system which is concerned with raising capital by dealing in shares, bonds and other long term investments. |

| 2. | Commercial banks, acceptance houses, Non Banking Financial Institutions and the Central Bank are the institutions catering to the requirements of short term funds in the money Market. | The market where investment instruments like bonds, equities and mortgages are traded is known as the capital market. |

Question 38.

List out the achievements of ASEAN.

Answer:

The ASEAN Declaration states the aims and purposes of the Association as:

- To accelerate the economic growth, social progress and cultural development in the region;

- To promote regional peace and stability and adherence to the principles of the United Nations Charter;

- To promote cooperation among the members of ASEAN through the exchange of knowledge and experience in the field of public sector auditing.

- To provide a conducive environment and facilities for research, training, and education among the members

- To serve as a centre of information and as an ASEAN link with other international organizations.

Question 39.

Give two examples for direct tax.

Answer:

- Equity: Direct taxes are progressive i.e. rate of tax varies according to tax base. For example, income tax satisfies the canon of equity.

- Certainity: Canon of certainty can be ensured by direct taxes. For example, an income tax payer knows when and at what rate he has to pay income tax.

![]()

Question 40.

Define economic planning.

Answer:

Economic Planning is “collective control or suppression of private activities of production and exchange”. – Robbins

“Economic Planning in the widest sense is the deliberate direction by persons in-charge of large resources of economic activity towards chosen ends”. – Dalton

PART – IV

Answer all the questions. [7 x 5 = 35]

Question 41 (a).

Compare the feature among Capitalism, Secularism and Mixedism.

Answer:

[OR]

(b) What are the difficulties involved in the measurement of national income?

Answer:

Difficulties in Measuring National Income:

In India, a special conceptual problem is posed by the existence of a large, unorganised and non-monetised subsistence sector where the barter system still prevails for transacting goods and services. Here, a proper valuation of output is very difficult.

Transfer payments:

- Government makes payments in the form of pensions, unemployment allowance, subsidies, etc. These are government expenditure.

- But they are not included in the national income.

- Because they are paid without adding anything to the production processes.

- During a year, Interest on national debt is also considered transfer payments because it is paid by the government to individuals and firms on their past savings without any productive work.

Difficulties in assessing depreciation allowance:

- The deduction of depreciation allowances, accidental damages, repair and replacement charges from the national income is not an easy task.

- It requires high degree of judgment to assess the depreciation allowance and other charges.

Unpaid services:

- A housewife renders a number of useful services like preparation of meals, serving, tailoring, mending, washing, cleaning, bringing up children, etc.

- She is not paid for them and her services are not directly included in national income.

Income from illegal activities:

- Income earned through illegal activities like gambling, smuggling, illicit extraction of . liquor, etc., is not included in national income.

- Such activities have value and satisfy the wants of the people but they are not considered as productive from the point of view of society.

Production for self-consumption and changing price:

- Farmers keep a large portion of food and other goods produced on the farm for self consumption.

- The problem is whether that part of the produce which is not sold in the market can be included in national income or not.

Capital Gains:

- The problem also arises with regard to capital gains.

- Capital gains arise when a capital asset such as a house, other property, stocks or shares, etc. is sold at higher price than was paid for it at the time of purchase.

- Capital gains are excluded from national income.

Statistical problems:

- There are statistical problems, too. Great care is required to avoid double counting. Statistical data may not be perfectly reliable, when they are compiled from numerous sources.

- Skill and efficiency of the statistical staff and cooperation of people at large are also equally important in estimating national income.

Question 42 (a).

Write short note on the implications of Say’s law.

Answer:

Implications of Say’s Law:

- There is no possibility for over production or unemployment.

- If there exist unutilized resources in the economy, it is profitable to employ them up to the point of full employment. This is true under the condition that factors are willing to accept rewards on a par with their productivity.

- As automatic price mechanism operates in the economy, there is no need for government intervention. (However, J.M. Keynes emphasized the role of the State)

- Interest flexibility brings about equality between saving and investment.

- Money performs only the medium of exchange function in the economy, as people will not hold idle money.

![]()

[OR]

(b) State the propositions of Keynes’s Psychological Law of Consumption.

Answer:

Propositions of the Law:

This law has three propositions:

(i) When income increases, consumption expenditure also increases but by a smaller amount. The reason is that as income increases, we wants are satisfied side by side, so that the need to spend more on consumer goods diminishes. So, the consumption expenditure increases with increase in income but less than proportionately.

(ii) The increased income will be divided in some proportion between consumption expenditure and saving. This follows from the first proposition because when the whole of increased income is not spent on consumption, the remaining is saved. In this way, consumption and saving move together.

(iii) Increase in income always leads to an increase in both consumption and saving. This means that increased income is unlikely to lead to fall in either consumption or saving. Thus with increased income both consumption and saving increase.

Question 43 (a).

Bring out the methods of credit control.

Answer:

Methods of Credit Control:

1. Bank Rate Policy:

The bank rate is the rate at which the Central Bank of a country’ is prepared to re-discount the first class securities.

2. Open Market Operations:

- In narrow sense, the Central Bank starts the purchase and sale of Government securities in the money market.

- In Broad Sense, the Central Bank purchases and sells not only Government securities but also other proper eligible securities like bills and securities of private concerns.

3. Variable Reserve Ratio:

(i) Cash Reserves Ratio:

- Under this system the Central Bank controls credit by changing the Cash Reserves Ratio.

- For example, if the Commercial Banks have excessive cash reserves on the basis of which they are creating too much of credit,this will be harmful for the larger interest of the economy.

- So it will raise the cash reserve ratio which the Commercial Banks are required to maintain with the Central Bank.

(ii) Statutory Liquidity Ratio:

- Statutory Liquidity Ratio (SLR) is the amount which a bank has to maintain securities.

- The quantum is specified as some percentage of the total demand and time liabilities (i.e., the liabilities of the bank which are payable on demand anytime, and those liabilities which are accruing in one month’s time due to maturity) of a bank.

[OR]

(b) Briefly explain the gains from International Trade Categories.

Answer:

Gains from International Trade:

- International trade helps a country to export its surplus goods to other countries and secure a better market for it.

- Similarly, international trade helps a country to import the goods which cannot be produced at all or can be produced at a higher cost.

- The gains from international trade may be categorized under four heads.

I. Efficient Production:

International trade enables each participatory country to specialize in the production of goods in which it has absolute or comparative advantages. International specialization offers the following gains.

- Better utilization of resources.

- Concentration in the production of goods in which it has a comparative advantage.

- Saving in time.

- Perfection of skills in production.

- Improvement in the techniques of production.

- Increased production.

- Higher standard of living in the trading countries.

II. Equalization of Prices between Countries:

International trade may help to equalize prices in all the trading countries.

- Prices of goods are equalized between the countries (However, in reality it has not happened).

- The difference is only with regard to the cost of transportation.

- Prices of factors of production are also equalized (However, in reality it has not happened).

III. Equitable Distribution of Scarce Materials:

International trade may help the trading countries to have equitable distribution of scarce resources.

IV. General Advantages of International Trade:

- Availability of variety of goods for consumption.

- Generation of more employment opportunities.

- Industrialization of backward nations.

- Improvement in relationship among countries (However, in reality it has not happened).

- Division of labour and specialisation.

- Expansion in transport facilities.

![]()

Question 44 (a).

Write a note on SAARC.

Answer:

South Asian Association For Regional Co-Operation (SAARC):

- The South Asian Association for Regional Co-operation (SAARC) is an organisation of South Asian nations, which was established on 8 December 1985 for the promotion of economic and social progress, cultural development within the South Asia region and also for friendship and co-operation with other developing countries.

- The SAARC Group (SAARC) comprises of Bangaladesh, Bhutan, India, The Maldives, Nepal, Pakistan and Sri Lanka.

- In April 2007, Afghanistan became its eighth member.

- The basic aim of the organisation is to accelerate the process of economic and social development of member states through joint action in the agreed areas of cooperation.

- The SAARC Secretariat was established in Kathmandu (Nepal) on 16th January 1987.

- The first SAARC summit was held at Dhaka in the year 1985.

- SAARC meets once in two years. Recently, the 20th SAARC summit was hosted by Sri Lanka in 2018.

[OR]

(b) Briefly explain facilities offered by IMF.

Answer:

Facilities offered by IMF:

The Fund has created several new credit facilities for its members. Chief among them are:

(i) Basic Credit Facility:

- The IMF provides financial assistance to its member nations to overcome their temporary difficulties relating to balance of payments.

- A member nation can purchase from the Fund other currencies or SDRs, in exchange for its own currency, to finance payment deficits.

- The loan is repaid when the member repurchases its own currency with other currencies or SDRs.

- A member can unconditionally borrow from the Fund in a year equal to 25% of its quota.

- This unconditional borrowing right is called the reserve tranche.

(ii) Extended Fund Facility:

- Under this arrangement, the IMF provides additional borrowing facility up to 140% of the member’s quota, over and above the basic credit facility.

- The extended facility is limited for a period up to 3 years and the rate of interest is low.

(iii) Compensatory Financing Facility:

- In 1963, IMF established compensatory financing facility to provide additional financial assistance to the member countries, particularly primary producing countries facing shortfall in export earnings.

- In 1981, the coverage of the compensatory financing facility was extended to payment problem caused by the fluctuations in the cost of cereal inputs.

(iv) Buffer Stock Facility:

- The buffer stock financing facility was started in 1969.

- The purpose of this scheme was to help the primary goods (food grains) producing countries to finance contributions to buffer stock arrangements for the stabilisation of primary product prices.

(v) Supplementary Financing Facility:

Under the supplementary financing facility, the IMF makes temporary arrangements to provide supplementary financial assistance to member countries facing payments problems relating to their present quota sizes.

(vi) Structural Adjustment Facility:

- The IMF established Structural Adjustment Facility (SAF) in March 1986 to provide additional balance of payments assistance on concessional terms to the poorer member countries.

- In December 1987, the Enhanced Structural Adjustment Facility (ESAF) was set up to augment the availability of concessional resources to low income countries.

- The purpose of SAF and ESAF is to force the poor countries to undertake strong macroeconomic and structural programmes to improve their balance of payments positions and promote economic growth.

![]()

Question 45 (a).

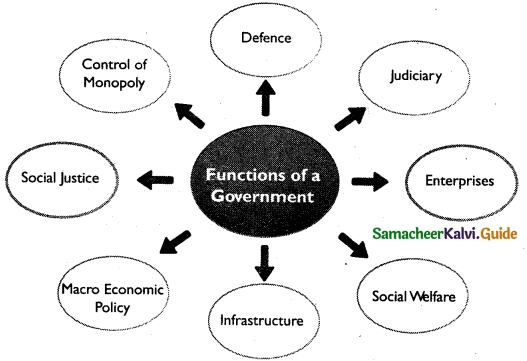

What are the functions of a modern state?

Answer:

Functions of Modern State:

The modem state is a welfare state and not just police state. The state assumes greater roles by creating economic and social overheads, ensuring stability both internally and externally, conserving resources for sustainable development and so on.

(i) Defence:

- The primary function of the Government is to protect the people from external aggression and internal disorder.

- The government has to maintain adequate police and military forces and render protective

services.

(ii) Judiciary:

- Rendering justice and settlement of disputes are the concern of the government.

- It should provide adequate judicial structure to render justice to all classes of citizens,

(iii) Enterprises:

- The regulation and control of private enterprise fall under the purview of the modem State.

- Ownership of certain enterprises and operating them successfully are the responsibilities of the government.

(iv) Social Welfare:

It is the duty of the state to make provisions for education, social security, social insurance, health and sanitation for the betterment of the people in the country.

(v) Infrastructure:

Modem States have to build the base for the economic development of the country by creating social and economic infrastructure.

(vi) Macro-economic policy:

The Government has to administer fiscal policy and monetary policy to achieve macro¬economic goals.

(vii) Social Justice:

- During the process of growth of an economy, certain sections of the society gain at the cost of others.

- The Government needs to intervene with fiscal measures to redistribute income.

(viii) Control of Monopoly:

Concentration of economic power is another evil to be corrected by the Government. So, the state intervenes through control of monopolies and restrictive trade practices to curb concentration of economic power.

[OR]

(b) What are the causes of water pollution?

Answer:

Water pollution is caused due to several reasons. Here are the few major causes of water pollution:

(i) Discharge of sewage and waste water:

- Sewage, garbage and liquid waste of households, agricultural runoff and effluents from factories are discharged into lakes and rivers.

- These wastes contain harmful chemicals and toxins which make the water poisonous for aquatic animals and plants.

(ii) Dumping of solid wastes:

The dumping of solid wastes and litters in water bodies cause huge problems.

(iii) Discharge of industrial wastes:

Industrial waste contains pollutants like asbestos, lead, mercury, grease oil and petrochemicals, which are extremely harmful to both people and environment.

(iv) Oil Spill:

Sea water gets polluted due to oil spilled from ships and tankers while travelling. The spilled oil does not dissolve in water and forms a thick sludge polluting the water.

(v) Acid rain:

- Acid rain is pollution of water caused by air pollution.

- When the acidic particles caused by air pollution in the atmosphere mix with water vapor, it results in acid rain.

(vi) Global warming:

Due to global warming, there is an increase in water temperature as a result aquatic plants and animals are affected.

(vii) Eutrophication:

- Eutrophication is an increased level of nutrients in water bodies.

- This results in bloom of algae in water.

- It also depletes the oxygen in water which negatively affects fish and other aquatic animal population.

![]()

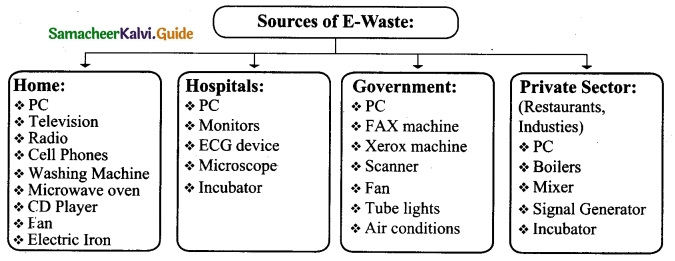

Question 46 (a).

Explain different sources of e-waste.

Answer:

[OR]

(b) What are the non-economic factors determining development?

Answer:

Non-Economic. Factors:

- Human Resource

- Technical Know-how

- Political Freedom

- Social Organization

- Corruption free administration

- Desire for Development

- Moral, ethical and social values

- Casino Capitalism

- Patrimonial Capitalism

Non-Economic Factors: ‘Economic Development has much to do with human endowments, social attitudes, political conditions and historical accidents. Capital is a necessary but not a sufficient condition of progress.

(i) Human Resources:

- Human resource is named as human capital because of its power to increase productivity and thereby national income.

- There is a circular relationship between human development and economic growth.

- A healthy, educated and skilled labour force is the most important productive asset.

- Human capital formation is the process of increasing knowledge, skills and the productive capacity of people.

(ii) Technical Know-how:

As the scientific and technological knowledge advances, more and more sophisticated techniques steadily raise the productivity levels in all sectors.

(iii) Political Freedom:

The process of development is linked with the political freedom.

(iv) Social Organization:

People show interest in the development activity only when they feel that the fruits of development will be fairly distributed.

(v) Corruption free administration:

- Corruption is a negative factor in the growth process.

- Unless the countries root-out corruption in their administrative system, the crony capitalists and traders will continue to exploit national resources.

(vi) Desire for development:

The pace of economic growth in any country depends to a great extent on people’s desire for development.

(vii) Moral, ethical and social values:

- These determine the efficiency of the market, according to Douglas C. North.

- If people are not honest, market cannot function.

(viii) Casino Capitalism:

If People spend larger proportion of their income and time on entertainment liquor and other illegal activities, productive activities may suffer, according to Thomas Piketty.

(ix) Patrimonial Capitalism:

If the assets are simply passed on to children from their parents, the children would not work hard, because the children do not know the value of the assets.

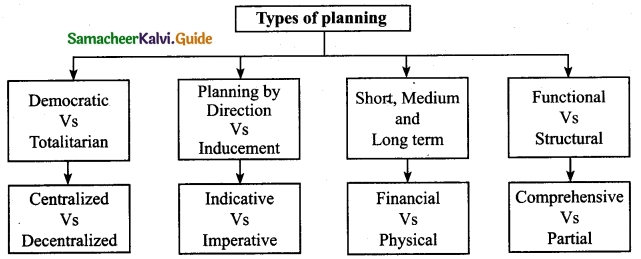

Question 47 (a).

Describe different types of Planning.

Answer:

(i) Democratic Vs Totalitarian:

A form of rule in which the government attempts to maintain ‘total’ control over society, including all aspects of the public and private lives of its citizens.

(ii) Centralized Vs Decentralized:

- Under centralized planning, the entire planning process in a country is under a central planning authority.

- This authority formulates a central plan, fixes objectives, targets and priorities for every sector of the economy.

- In other words, it is called ‘planning from above’.

(iii) Planning by Direction Vs Inducement:

Under planning by direction, there is a central authority which plans, directs and orders the execution of the plan in accordance with pre-determined targets and priorities.

(iv) Indicative Vs Imperative Planning:

- Indicative planning is peculiar to the mixed economies. It has been in practice in France since the Monnet Plan of 1947-50.

- In a mixed economy, the private sector and the public sector work together.

- Under this plan, the outline of plan is prepared by the Government.

- Then it is discussed with the representatives of private management, trade unions, consumer groups, finance institutions and other experts.

(v) Short, Medium and Long term Planning:

- Short-term plans are also known as ‘controlling plans’.

- They encompass the period of one year, therefore, they are also known as ‘annual plans’.

(vi) Financial Vs Physical Planning:

Financial planning refers to the technique of planning in which resources are allocated in terms of money while physical planning pertains to the allocation of resources in terms of men, materials and machinery.

(vii) Functional Vs Structural Planning:

Functional planning refers to that planning which seeks to remove economic difficulties by directing all the planning activities within the existing economic and social structure.

(viii) Comprehensive Vs Partial Planning:

General planning which concerns itself with the major issues for the whole economy is known as comprehensive planning whereas partial planning is to consider only the few important sectors of the economy.

![]()

[OR]

(b) Discuss the Economic planning of Democratic planning and Totalitarian planning.

Answer:

Democratic Vs Totalitarian:

- Democratic planning implies planning within democracy.

- People are associated at every step in the formulation and implementation of the plan.

- A democratic plan is characterized by the widest possible consultations with the various state governments and private enterprises at the stage of preparation.

- The plan prepared by the Planning Commission is not accepted as such.

- It can be accepted, rejected or modified by the Parliament of the country.

- Under totalitarian planning, there is central control and direction of all economic activities in accordance with a single plan.

- Consumption, production, exchange, and distribution are all controlled by the state. In authoritarian planning, the planning authority is the supreme body.

- It decides about the targets, schemes, allocations, methods and procedures of implementation of the plan.