Students can Download Tamil Nadu 12th Economics Model Question Paper 2 English Medium Pdf, Tamil Nadu 12th Economics Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 12th Economics Model Question Paper 2 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3.00 Hours

Maximum Marks: 90

PART – I

Choose the correct answer. Answer all the questions: [20 x 1 = 20]

Question 1.

The country following Capitalism is……….

(a) Russia

(b) America

(c) India

(d) China

Answer:

(a) Russia

Question 2.

The value of NNP at production point is called……….

(a) NNP at factor cost

(b) NNP at market cost

(c) GNP at factor cost

(d) Per capita income

Answer:

(a) NNP at factor cost

Question 3.

The basic concept used in Keynes Theory of Employment and Income is……….

(a) Aggregate demand

(b) Aggregate supply

(c) Effective demand

(d) Marginal Propensity Consume

Answer:

(c) Effective demand

![]()

Question 4.

The aggregate effective demand would increase the level of……….

(a) unemployment

(b) employment

(c) cyclical unemployment

(d) open unemployment

Answer:

(b) employment

Question 5.

The term super multiplier was first used by……….

(a) J.R.Hicks

(b) R.G.D. Allen

(c) Kahn

(d) Keynes

Answer:

(a) J.R.Hicks

Question 6.

Paper currency system is managed by the………..

(a) Central Monetary authority

(b) State Government

(c) Central Government

(d) Banks

Answer:

(a) Central Monetary authority

Question 7.

What is the name of inflation without a rise in price level?

(a) Repressed Inflation

(b) Hyper Inflation

(c) Galloping Inflation

(d) Cost-Push Inflation

Answer:

(a) Repressed Inflation

Question 8.

Moral suasion refers…………

(a) Optimization

(b) Maximization

(c) Persuasion

(d) Minimization

Answer:

(c) Persuasion

Question 9.

Current account deposits are operated by……….

(a) agriculturists

(b) business men

(c) government servants

(d) labourers

Answer:

(b) business men

Question 10.

Terms of Trade of a country show………..

(a) Ratio of goods exported and imported

(b) Ratio of import duties

(c) Ratio of prices of exports and imports

(d) Both (a) and (c)

Answer:

(c) Ratio of prices of exports and imports

Question 11.

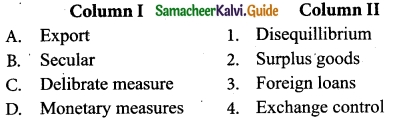

Match the following and choose the correct answer by using codes given below:

Codes

Answer:

(a) A-2, B-1, C-3, D-4

Question 12.

International Development Association is an affiliate of…………

(a) IMF

(b) World Bank

(c) SAARC

(d) ASEAN

Answer:

(b) World Bank

Question 13.

International Monetary Fund headquarters are present in……….

(a) Geneva

(b) Washington DC

(c) England

(d) China

Answer:

(b) Washington DC

Question 14.

The difference between total expenditure and total receipts including loans and other liabilities is called……….

(a) Fiscal deficit

(b) Budget deficit

(c) Primary deficit

(d) Revenue deficit

Answer:

(a) Fiscal deficit

![]()

Question 15.

Adam Smith classified public expenditure on the basis of Production Functions, Commercial Functions and……….. Functions.

(a)’ Defence

(b) Growth

(c) Development

(d) Government

Answer:

(c) Development

Question 16.

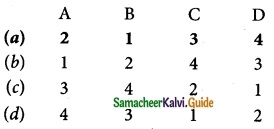

Match the following and choose the correct answer by using codes given below:

Code:

Answer:

(d) A-4, B-1, C-2, D-3

Question 17.

The process of nutrient enrichment is termed as

(a) Eutrophication

(b) Limiting nutrients

(c) Enrichment

(d) Schistosomiasis

Answer:

(b) Limiting nutrients

Question 18.

Types of Noise pollution. (Pick the odd one out.)

(a) Atmospheric noise pollution

(b) Industrial noise pollution

(c) Man made noise pollution

(d) Acid rain pollution

Answer:

(d) Acid rain pollution

Question 19.

A process by which we estimate the value of dependent variable on the basis of one or more independent variables is called………….

(a) Correlation

(b) Regression

(c) Residual

(d) Slope

Answer:

(b) Regression

Question 20.

CSO Director Generals are (Pick the odd one out.)

(a) National Accounts Division [NAD]

(b) Sample Statistics Division [SSD]

(c) Economic Statistics Division [ES]

(d) Co-ordination and Publication Division [CPD]

Answer:

(b) Sample Statistics Division [SSD]

PART – II

Answer any seven question in which Question No. 30 is compulsory. [7 x 2 = 14]

Question 21.

Define Mixed Economy (or) Mixedism.

Answer:

In a mixed economy system both private and public sectors co-exist and work together towards economic development. It is a combination of both capitalism and socialism. It tends to eliminate the evils of both capitalism and socialism. In these economies, resources are owned by individuals and the government. India, England, France and Brazil are the examples of mixed economy.

Question 22.

Write the Factor Incomes group.

Answer:

Factor incomes are grouped under labour income, capital income and mixed income.

- Labour income – Wages and salaries, fringe benefits, employer’s contribution to social security.

- Capital income – Profit, interest, dividend and royalty

- Mixed income – Farming, sole proprietorship and other professions.

Question 23.

Give reasons for labour retrenchment at present situation.

Answer:

- Modem technology being capital intensive requires less labourers and contributes to technological unemployment.

- Now a days, invention and innovations lead to the adoption of new techniques there by the existing workers are retrenched.

- Labour saving devices are responsible for technological unemployment.

Question 24.

Write two approaches of the equilibrium level of Income in Keynesian theory?

Answer:

There are two approaches to determination of the equilibrium level of income in Keynesian theory. These are:

- Aggregate demand – Aggregate supply approach

- Saving – Investment approach

![]()

Question 25.

Define average propensity to consume (APC).

Answer:

Average Propensity to Consume:

The average propensity to consume is the ratio of consumption expenditure to any particular level of income.” Algebraically it may be expressed as under:

APC = \(\frac{C}{Y}\)

Where, C = Consumption; Y = Income

Question 26.

Define inflation.

Answer:

- Inflation is a consistent and appreciable rise in the general price level.

- In other words, inflation is the rate at which the general level of prices for goods and services is rising and consequently the purchasing power of currency is falling.

- “Too much of Money chasing too few goods” – Coulbourn

- “A state of abnormal increase in the quantity of purchasing power” – Gregorye

Question 27.

Write the meaning of Open market operations.

Answer:

- In narrow sense, the Central Bank starts the purchase and sale of Government securities in the money market.

- In Broad Sense, the Central Bank purchases and sells not only Government securities but also other proper eligible securities like bills and securities of private concerns.

- When the banks and the private individuals purchase these securities they have to make payments for these securities to the Central Bank.

Question 28.

What do you mean by public debt?

Answer:

The state has to supplement the traditional revenue sources with borrowing from individuals, and institutions within and outside the country. The amount of borrowing is huge in the under developed countries to finance development activities. The debt burden is a big problem and most of the countries are in debt trap.

Question 29.

What do you mean by ecosystem?

Answer:

An ecosystem includes all living things (plants, animals and organisms) in a given area, interacting with each other, and also with their non-living environments (weather, earth, sun, soil, climate, atmosphere). Ecosystems are the foundations of the Biosphere and they determine the health of the entire earth system.

Question 30.

What are the social indicators of economic development?

Answer:

Social Indicators:

Social indicators are normally referred to as basic and collective needs of the people. The direct provision of basic needs such as health, education, food, water, sanitation and housing facilities check social backwardness.

PART – III

Answer any seven question in which Question No. 40 is compulsory. [7 x 3 = 21]

Question 31.

Outline the major merits of capitalism.

Answer:

Merits of Capitalism

- Automatic Working: Without any government intervention, the economy works automatically.

- Efficient Use of Resources: All resources are put into optimum use.

- Incentives for Hard work: Hard work is encouraged and entrepreneurs get more profit for more efficiency.

- Economic Progress: Production and productivity levels are very high in capitalistic economies.

- Consumers Sovereignty: All production activities are aimed at satisfying the consumers.

- Higher Rates of Capital Formation: Increase in saving and investment leads to higher rates of capital formation.

- Development of New Technology: As profit is aimed at, producers invest on new technology and produce quality goods.

Question 32.

Write briefly about national income and welfare.

Answer:

National Income is considered as an indicator of the economic wellbeing of a country.

The per capita income as an index of economic welfare suffers from limitations which are stated below:

- The economic welfare depends upon the composition of goods and services provided. The greater the proportion of capital goods over consumer goods, the improvement in economic welfare will be lesser.

- Higher GDP with greater environmental hazards such as air, water and soil pollution will be little economic welfare.

- The production of war goods will show the increase in national output but not welfare.

- An increase in per capita income may be due to employment of women and children or forcing workers to work for long hours. But it will not promote economic welfare.

Question 33.

Give short note on Expenditure method.

Answer:

List out the assumptions of Say’s law.

The Say’s Law of market is based on the following assumptions:

- No single buyer or seller of commodity or an input can affect price.

- Full employment.

- People are motivated by self interest and self – interest determines economic decisions.

- The laissez faire policy is essential for an automatic and self adjusting process of full employment equilibrium. Market forces determine everything right.

- There will be a perfect competition in labour and product market.

- There is wage-price flexibility.

- Money acts only as a medium of exchange.

- Long – run analysis.

- There is no possibility for over production or unemployment.

![]()

Question 34.

Explain any three subjective and objective factors influencing the consumption function.

Answer:

Subjective Factors:

- The motive of precaution: To build up a reserve against unforeseen contingencies. e.g. Accidents, sickness.

- The motive of foresight: The desire to provide for anticipated future needs. e.g. Old age.

- The motive of calculation: The desire to enjoy interest and appreciation.

Objective Factors:

- Income Distribution: If there is large disparity between rich and poor, the consumption is low because the rich people have low propensity to consume and high propensity to save.

- Price level: Price level plays an important role in determining the consumption function. When the price falls, real income goes up; people will consume more and propensity to save of the society increases.

- Wage level: Wage level plays an important role in determining the consumption function and there is positive relationship between wage and consumption. Consumption expenditure increases with the rise in wages. Similar is the effect with regard to windfall gains.

Question 35.

Explain the Evolution Of money.

Answer:

- The introduction of money as a medium of exchange was one of the greatest inventions of mankind.

- Before money was invented, exchange took place by Barter, that is, commodities and services were directly exchanged for other commodities and services.

- Under the barter system, buyers and sellers of commodities had to face a number of difficulties.

- Surplus goods were exchanged for money which in turn was exchanged for other needed goods.

- Goods like furs, skins, salt, rice, wheat, utensils, weapons, etc. were commonly used as money.

- Such exchange of goods for goods was known as “Barter Exchange” or “Barter System”.

Question 36.

What is E-Banking?

Answer:

Online banking, also known as internet banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution’s website.

The online banking system typically connects to or be part of the core banking system operated by a bank and is in contrast to branch banking which was the traditional way customers accessed banking services.

Question 37.

Explain the objectives of WTO.

Answer:

- To ensure reduction of tariff and other barriers.

- To eliminate discrimination in trade.

- To facilitate higher standard of living.

- To facilitate optimal use of world’s resources.

- To enable the LDCs to secure fair share in the growth of international trade.

- To ensure linkages between trade policies, environmental policies and sustainable development.

Question 38.

What are the functions of finance commission of India.

Answer:

- The distribution between the Union and the States of the net proceeds of taxes, which may be divided between them and the allocation among the states of the respective shares of such proceeds;

- To determine the quantum of grantsin- aid to be given by the Centre to states [Article 275 (1)] and to volve the principles governing the eligibility of the state for such grant-in-aid;

- Any other matter referred to the Commission by the President of India in the interest of sound finance. Several issues like debt relief, financing of calamity relief of states, additional excise duties, etc. have been referred to the Commission invoking this clause.

Question 39.

Explain the limitations of statistics.

Answer:

1. Statistics is not suitable to the study of qualitative phenomenon: Since statistics is basically a science and deals with a set of numerical data. It is applicable to the study of quantitative measurements. As a matter of fact, qualitative aspects like empowerment, leadership, honesty, poverty, intelligence etc., cannot be expressed numerically and statistical analysis cannot be directly applied on these qualitative phenomena.

2. Statistical laws are not exact: It is well known that mathematical and physical sciences are exact. But statistical laws are not exact and statistical laws are only approximations. Statistical conclusions are not universally true. They are true only on an average.

3. Statistics table may be misused: Statistics must be used only by experts; otherwise, statistical methods are the most dangerous tools on the hands of the inexpert. The use of statistical tools by the inexperienced and untrained persons might lead to wrong conclusions.

4. Statistics is only one of the methods of studying a problem: Statistical method does not provide complete solution of the problems because problems are to be studied taking the background of the countries culture, philosophy, religion etc., into consideration. Thus the statistical study should be supplemented by other evidences.

Question 40.

Briefly explain the kinds of measures of dispersion.

Answer:

There are two kinds of measures of dispersion, namely

- Absolute measure of dispersion

- Relative measure of dispersion

1. Absolute measure of dispersion indicates the amount of variation in a set of values in terms of units of observations.

2. Relative measures of dispersion are free from the units of measurements of the observations. They are pure numbers. They are used to compare the variation in two or more sets, which are having different units of measurements of observations.

3. Standard Deviation is one of the methods of Absolute measure of dispersion. Karl Pearson introduced the concept of standard deviation in 1893. Standard deviation is also called Root- Mean Square Deviation. The reason is that it is the square-root of the mean of the squared deviation from the arithmetic mean. It provides accurate result. Square of standard deviation is called Variance.

![]()

PART – IV

Answer all the questions. [7 x 5 = 35]

Question 41 (a).

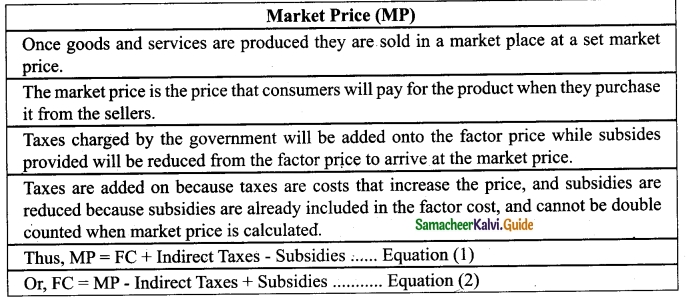

What is Market price and Equations?

Answer:

[OR]

(b) Narrate the equilibrium between ADF and ASF with diagram.

Answer:

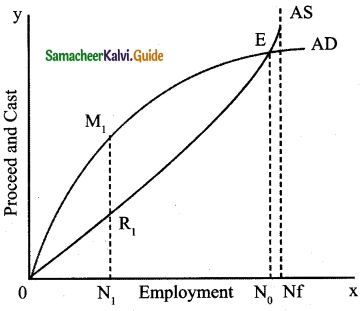

Equilibrium between ADF and ASF

- Under the Keynes theory of employment, a simple two sector economy consisting of the household sector and the business sector is taken to understand the equilibrium between ADF and ASF.

- All the decisions concerning consumption expenditure are taken by the individual households, while the business firms take decisions concerning investment.

- It is also assumed that consumption function is linear and planned investment is autonomous.

- There are two approaches to y determination of the equilibrium level of income in Keynesian theory. These are :1. Aggregate demand – Aggregate supply approach, 2. Saving – Investment approach

- In this chapter, out of these two, aggregate Tg demand and aggregate supply approach is alone explained to understand the determination of equilibrium level of income and employment.

- The concept of effective demand is more Q clearly shown in the figure.

- In the figure, the aggregate demand and aggregate supply reach equilibrium at point E. The employment level is N<sub>0</sub> at that point.

- At ON<sub>1</sub> employment, the aggregate supply is N<sub>1</sub> R<sub>1</sub>. But they are able to produce M<sub>1</sub> N<sub>1</sub>. The expected level of profit is M<sub>1</sub>R<sub>1</sub>.

- To attain this level of profit, entrepreneurs will employ more labourers.

- The tendency to employ more labour will stop once they reach point E.

- At all levels of employment beyond, ON<sub>0</sub>, the aggregate demand curve is below the aggregate supply curve indicating loss to the producers.

- Hence they will never employ more than ON<sub>0</sub> labour.

- Thus effective demand concept becomes a crucial point in determining the equilibrium level of output in the capitalist economy or a free market economy in the Keynesian system.

- It is important to note that the equilibrium level of employment need not be the full employment level (N<sub>1</sub>) from the Figure, it is understood that the difference between N<sub>0</sub> – N<sub>1</sub> is the level of unemployment.

- Thus the concept of effective demand becomes significant in explaining the under employment equilibrium.

Question 42 (a).

Explain Keynes psychological law of consumption function with diagram.

Answer:

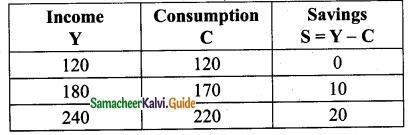

The three propositions of the law

Proposition (1):

Income increases by Rs 60 crores and the increase in consumption is by Rs 50 crores.

Proposition (2):

The increased income of Rs 60 crores in each case is divided in some proportion between consumption and saving respectively, (i.e., Rs 50 crores and Rs 10 crores).

Proposition (3):

As income increases consumption as well as saving increase. Neither consumption nor saving has fallen.

Diagrammatically, the three propositions are explained in figure. Here, income is measured horizontally and consumption and saving are measured on the vertical axis. C is the consumption function curve and 45° line represents income consumption equality.

Proposition (1):

When income increases from 120 to 180 consumption also increases from 120 to 170 but the increase in consumption is less than the increase in income, 10 is saved.

Proposition (2):

When income increases to 180 and 240, it is divided in some proportion between consumption by 170 and 220 and saving by 10 and 20 respectively.

Proposition (3):

Increases in income to 180 and 240 lead to increased consumption 170 and 220 and increased saving 20 and 10 than before. It is clear from the widening area below the C curve and the saving gap between 45° line and C curve.

![]()

[OR]

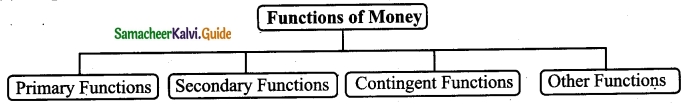

(b) Explain the functions of money.

Answer:

1. Primary Functions:

(i) Money as a medium of exchange: This is considered as the basic function of money. Money has the quality of general acceptability, and all exchanges take place in terms of money.

(ii) Money as a measure of value: The second important function of money is that it measures the value of goods and services. In other words, the prices of all goods and services are expressed in terms of money. Money is thus looked upon as a collective measure of value.

2. Secondary Functions:

(i) Money as a Store of value: Savings done in terms of commodities were not permanent. But, with the invention of money, this difficulty has now disappeared and savings are now done in terms of money. Money also serves as an excellent store of wealth, as it can be easily converted into other marketable assets, such as, land, machinery, plant etc.

(ii) Money as a Standard of Deferred Payments: Borrowing and lending were difficult problems under the barter system. In the absence of money, the borrowed amount could be returned only in terms of goods and services. But the modem money-economy has greatly facilitated the borrowing and lending processes.

(iii) Money as a Means of Transferring Purchasing Power: The field of exchange also went on extending with growing economic development. The exchange of goods is now extended to distant lands.

3. Contingent Functions:

(i) Basis of the Credit System: Money is the basis of the Credit System. Business transactions are either in cash or on credit.

(ii) Money facilitates distribution of National Income: The task of distribution of national income was exceedingly complex under the barter system.

(iii) Money helps to Equalize Marginal Utilities and Marginal Productivities: Consumer can obtain maximum utility only if he incurs expenditure on various commodities in such a manner as to equalize marginal utilities accruing from them. Now in equalizing these marginal utilities, money plays an important role, because the prices of all commodities are expressed in money.

(iv) Money Increases Productivity of Capital: Money is the most liquid form of capital. In other words, capital in the form of money can be put to any use.

4. Other Functions:

(i) Money helps to maintain Repayment Capacity: Money possesses the quality of general acceptability. To maintain its repayment capacity, every firm has to keep assets in the form of liquid cash. The firm ensures its repayment capacity with money.

(ii) Money represents Generalized Purchasing Power: Purchasing power kept in terms of money can be put to any use. It is not necessary that money should be used only for the purpose for which it has been served.

(iii) Money gives liquidity to Capital: Money is the most liquid form of capital. It can be put to any use.

![]()

Question 43 (a).

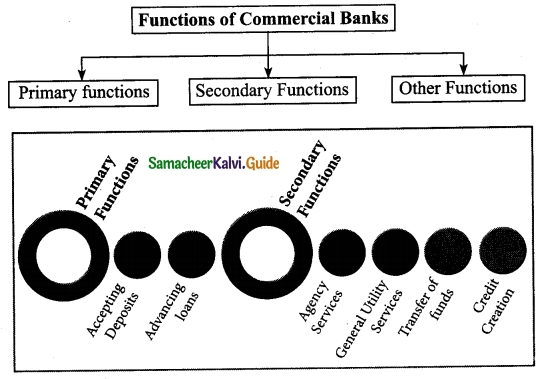

Elucidate the functions of Commercial Banks.

Answer:

The functions of commercial banks are broadly classified into primary functions and secondary functions.

Functions of Commercial Banks

I. Primary Functions:

1. Accepting Deposits: It implies that commercial banks are mainly dependent on public deposits.

There are two types of deposits

(i) Demand Deposits: It refers to deposits that can be withdrawn by individuals without any prior notice to the bank. In other words, the owners of these deposits are allowed to withdraw money anytime by writing a withdrawal slip or a cheque at the bank counter or from ATM centres using debit card.

(ii) Time Deposits: It refers to deposits that are made for certain committed period of time. Banks pay higher interest on time deposits. These deposits can be withdrawn only after a specific time period by providing a written notice to the bank.

2. Advancing Loans: It refers to granting loans to individuals and businesses. Commercial banks grant loans in the form of overdraft, cash credit, and discounting bills of exchange.

II. Secondary Functions:

The secondary functions can be classified under three heads, namely, agency functions, general utility functions, and other functions.

1. Agency Functions: It implies that commercial banks act as agents of customers by performing various functions.

- Collecting Cheques: Banks collect cheques and bills of exchange on the behalf of

their customers through clearing house facilities provided by the central bank. - Collecting Income: Commercial banks collect dividends, pension, salaries, rents, and interests on investments on behalf of their customers. A credit voucher is sent to customers for information when any income is collected by the bank.

- Paying Expenses: Commercial banks make the payments of various obligations of customers, such as telephone bills, insurance premium, school fees, and rents.

2. General Utility Functions: It implies that commercial banks provide some utility services to customers by performing various functions.

- Providing Locker Facilities: Commercial banks provide locker facilities to its customers for safe custody of jewellery, shares, debentures, and other valuable items. This minimizes the risk of loss due to theft at homes. Banks are not responsible for the items in the lockers.

- Issuing Traveler’s Cheques: Banks issue traveler’s cheques to individuals for traveling outside the country. Traveler’s cheques are the safe and easy way to protect money while traveling.

- Dealing in Foreign Exchange: Commercial banks help in providing foreign exchange to businessmen dealing in exports and imports. However, commercial banks need to – take the permission of the Central Bank for dealing in foreign exchange.

3. Transferring Funds: It refers to transferring of funds from one bank to another. Funds are transferred by means of draft, telephonic transfer, and electronic transfer.

4. Letter of Credit: Commercial banks issue letters of credit to their customers to certify their creditworthiness.

- Underwriting Securities: Commercial banks also undertake the task of underwriting securities. As public has full faith in the credit worthiness of banks, public do not hesitate in buying the securities underwritten by banks.

- Electronic Banking: It includes services, such as debit cards, credit cards, and Internet banking.

III. Other Functions:

- Money Supply: It refers to one of the important functions of commercial banks that help in increasing money supply.

- Credit Creation: Credit Creation means the multiplication of loans and advances. Commercial banks receive deposits from the public and use these deposits to give loans:

![]()

[OR]

(b) Describe the Merger of Banks.

Answer:

Merger of Banks:

- Union Cabinet decided to merge all the remaining five associate banks of State Bank Group with State Bank of India in 2017.

- After the Parliament passed the merger Bill, the subsidiary banks have ceased to exist.

- Five associates and the Bharatiya Mahila Bank have become the part of State Bank of India (SBI) beginning April 1, 2017.

- This has placed State Bank of India among the top 50 banks in the world.

- The five associate banks that were merged are State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Mysore (SBM), State Bank of Patiala (SBP) and State Bank of Travancore (SBT).

- The other two Associate Banks namely State Bank of Indore and State Bank of Saurashtra had already been merged with State Bank of India.

- After the merger, the total customer base of SBI increased to 37 crore with a branch network of around 24,000 and around 60,000 ATMs across the country.

Question 44 (a).

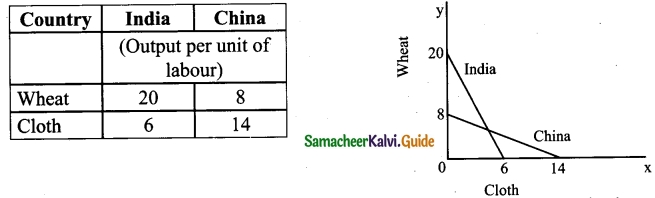

Explain the Adam Smith’s Theory of Absolute Cost Advantage Theory and Assumptions with diagram.

Answer:

Adam Smith’s Theory of Absolute Cost Advantage:

Adam Smith argued that all nations can be benefitted when there is free trade and specialisation in terms of their absolute cost advantage.

The Theory:

According to Adam Smith, the basis of international trade was absolute cost advantage.

Trade between two countries would be mutually beneficial when one country produces a commodity at an absolute cost advantage over the other country which in turn produces another commodity at an absolute cost advantage over the first country.

Assumptions:

- There are two countries and two commodities (2×2 model).

- Labour is the only factor of production.

- Labour units are homogeneous.

- The cost or price of a commodity is measured by the amount of labour required to produce it.

- There is no transport cost.

Illustration:

Absolute cost advantage theory can be illustrated with the help of the following example.

Absolute Cost Advantage:

- From the illustration, it is clear that India has an absolute advantage in the production of wheat over China and China has an absolute advantage in the production of cloth over India.

- Therefore, India should specialize in the production of wheat and import cloth from China.

- China should specialize in the production of cloth and import wheat from India.

- This kind of trade would be mutually beneficial to both India and China.

![]()

[OR]

(b) Bring out the functions of World Bank.

Answer:

Functions of IBRD (or) World Bank:

The World Bank performs the major role of providing loans for development works to member countries, especially to underdeveloped countries. The World Bank provides long¬term loans for various development projects. Article 1 of the Agreement states the functions performed by the world bank as follows.

(i) Investment for productive purposes: The World Bank performs the function of assisting in the reconstruction and development of territories of member nations through facility of investment for productive purposes. It also encourages the development of productive facilities and resources in less developed countries.

(ii) Balanced growth of international trade: Promoting the long range balanced growth of trade at international level and the maintaining equilibrium in BOPs of member nations by encouraging international investment.

(iii) Provision of loans and guarantees: Arranging the loans or providing guarantees on loans by various other channels so as to execute important projects.

(iv) Promotion of foreign private investment: The promotion of private foreign investment by means of guarantees on loans and other investment made by private investors. The Bank supplements private investment by providing finance for productive purpose out of its own resources or from borrowed funds.

(v) Technical services: The World Bank facilitates different kinds of technical services to the member countries through Staff College and experts.

Question 45 (a).

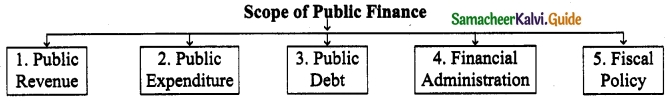

Explain the scope of public finance.

Answer:

Scope of Public Finance:

The subject ‘Public Finance’ includes five major sub-divisions, viz., Public Revenue, Public Expenditure, Public Debt, Financial Administration and Fiscal Policy.

(i) Public Revenue:

Public revenue deals with the methods of raising public revenue such as tax and non-tax, the principles of taxation, rates of taxation, impact, incidence and shifting of taxes and their effects.

(ii) Public Expenditure:

This part studies the fundamental principles that govern the Government expenditure, effects of public expenditure and control of public expenditure.

(iii) Public Debt:

- Public debt deals with the methods of raising loans from internal and external sources.

- The burden, effects and redemption of public debt fall under this head.

(iv) Financial Administration:

- This part deals with the study of the different aspects of public budget.

- The budget is the Annual master financial plan of the Government.

- The various objectives and steps in preparing a public budget, passing or sanctioning, allocation evaluation and auditing fall within financial administration.

(v) Fiscal Policy:

Taxes, subsidies, public debt and public expenditure are the instruments of fiscal policy.

![]()

[OR]

(b) Briefly explain causes for the increase in public debt.

Answer:

Causes for the Increase in Public debt:

The causes for enormous growth of public debt may be studied under the following sub-headings:

1. War and Preparation of war

Waging war has become one of the important causes for incurring debts by the governments. In modem times, the preparation for war and nuclear defence programmes take away the major share of the government’s revenue and so it incurs debt.

2. Social obligations

Modem states are considered to be ‘Welfare States and they have to undertake many social obligations like public health, sanitation, education,insurance, transport and communications, etc., besides providing the minimum necessaries of life to the citizens of the country. To finance these, the State has to incur a heavy public debt.

3. Economic Development and Deficit

The government has to undertake many projects for economic development of the country. Construction of railways, power projects, irrigation projects, heavy industries, etc., could be thought of only by means of mobilising resources in the form of public debt. Due to heavy public expenditure, the governments always face deficit budget. Such deficits have to be financed only through borrowings.

4. Employment

Most of the governments of modem days face the problem of unemployment and it has become the duty to solve this by making huge public expenditure. To solve the unemployment problem, and to fight recession, the government has to make huge expenditures. For this the States have to resort to public debt.

5. Controlling inflation

The Government can withdraw excess money from circulation, by raising public debt and thus prevent prices from rising.

6. Fighting depression

During the depression phase, private investment is lacking. The Government applies compensatory public spending by borrowing from internal and external sources.

Question 46 (a).

What is land pollution? Mention the causes of land pollution.

Answer:

The land pollution is defined as, “the degradation of land because of the disposal of waste on the land”. Any substance (solid, liquid or gaseous) that is discharged, emitted or deposited in the environment in such a way that it alters the environment causes land pollution.

Causes of Land Pollution:

(i) Deforestation and soil erosion:

- Deforestation carried out to create dry lands is one of the major concerns.

- Land that is once converted into a dry or barren land, can never be made fertile again, whatever the magnitude of measures to convert it.

(ii) Agricultural activities:

- With growing human and pet animal population, demand for food has increased considerably.

- Farmers often use highly toxic fertilizers and pesticides to get rid off insects, fungi and bacteria from their crops.

- However the overuse of these chemicals, results in contamination and poisoning of land.

(iii) Mining activities:

During extraction and mining activities, several land spaces are created beneath the surface.

(iv) Landfills:

- Each household produces tones of garbage each year due to changing economic lifestyle of the people.

- Garbage like plastic, paper, cloth, wood and hospital waste get accumulated.

- Items that cannot be recycled become a part of the landfills that cause land pollution.

(v) Industrialization:

- Due to increasing consumerism more industries were developed which led to deforestation.

- Research and development paved the way for modem fertilizers and chemicals that were highly toxic and led to soil contamination.

(vi) Construction activities:

- Due to urbanization, large amount of construction activities are taking place.

- This has resulted in large waste articles like wood, metal, bricks, plastic.

- These are dumped at the outskirts of urban areas that lead to land pollution.

(vii) Nuclear waste:

- The leftover radioactive materials, harmful and toxic chemicals affect human health.

- They are dumped beneath the earth to avoid any casualty.

![]()

[OR]

(b) What are the effects of Land pollution?

Answer:

Effects of Land Pollution:

(i) Soil pollution:

- Soil pollution is another form of land pollution, where the upper layer of the soil is damaged.

- This is caused by the ovemse of chemical fertilizers, and pesticides.

- This leads to loss of fertile land.

- Pesticides kill not only pests and also human beings.

(ii) Health Impact:

- The land when contaminated with toxic chemicals and pesticides lead to problem of skin cancer and human respiratory system.

- The toxic chemicals can reach our body through foods and vegetables.

(iii) Cause for Air pollution:

- Landfills and waste dumping lead to air pollution.

- The abnormal toxic substances spread in the atmosphere cause transmit respiratory diseases among the masses.

(iv) Effect on wildlife:

- The animal kingdom has suffered mostly in the past decades.

- They face a serious threat with regards to loss of habitat and natural environment.

- The constant human activity on land is leaving it polluted, forcing these species to move farther away.

- Sometimes several species are pushed to the verge of extinction or disappear due to no conducive environment.

Question 47 (a).

Trace the evolution of economic planning in India.

Answer:

The evolution of planning in India is stated below:

(i) Sir M. Vishveshwarya (1934): a prominent engineer and politician made his first attempt in laying foundation for economic planning in India in 1934 through his book, “Planned Economy of India”. It was a 10 year plan.

(ii) Jawaharlai Nehru (1938): set-up “National Planning Commission” by a committee but due to the changes in the political era and second World War, it did not materialize.

(iii) Bombay Plan (1940): The 8 leading industrialists of Bombay presented “Bombay Plan”. It was a 15 Year Investment Plan.

(iv) S.N Agarwal (1944): gave the “Gandhian Plan” focusing on the agricultural and rural economy.

(v) M.N. Roy (1945): drafted ‘People’s Plan”. It was aiming at mechanization of agricultural production and distribution by the state only.

(vi) J.P. Narayan (1950): advocated, “Sarvodaya Plan” which was inspired by Gandhian Plan and with the idea of Vinoba Bhave. It gave importance not only for agriculture, but encouraged small and cottage industries in the plan.

[OR]

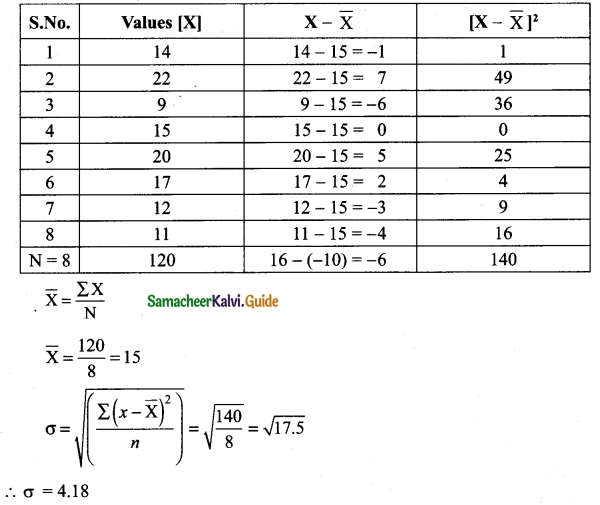

(b) Find the Standard Deviation of the following data:

14, 22, 9, 15, 20, 17, 12, 11

Answer:

![]()