Students can Download Tamil Nadu 12th Economics Model Question Paper 5 English Medium Pdf, Tamil Nadu 12th Economics Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 12th Economics Model Question Paper 5 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3.00 Hours

Maximum Marks: 90

PART – I

Choose the correct answer. Answer all the questions:

Question 1.

Macro economics is a study of …………

(a) Individuals

(b) firms

(c) nations

(d) aggregates

Answer:

(d) aggregates

Question 2.

State whether the statements are true or false.

(i) Profit Motive of Capitalist Economy.

(ii) Basic problems are solved by customs and traditions.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(c) (i) is true but (ii) is false

Question 3.

………. is also known as Disposable Personal Income.

(a) Personal Income

(b) Disposable Income

(c) Consumer Income

(d) Product Income

Answer:

(b) Disposable Income

Question 4.

Assertion (A): National Income is a measure of the total value of the goods and services produced in an economy for a year.

Reason (R): GNP – is the total value of output produced and income received in a year by domestic residence of a country.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

![]()

Question 5.

The basic concept used in Keynes Theory of Employment and Income is

(a) Aggregate demand

(b) Aggregate supply

(c) Effective demand

(d) Marginal Propensity Consume

Answer:

(c) Effective demand

Question 6.

State whether the statements are true or false.

(i) Keynesian theory is – Aggregate demand – Aggregate supply approach. Saving – Investment approach.

(ii) This approach explained the determination level of Income and employment.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

Question 7.

It the MPC is 0.5, the multiplier is……..

(a) 2

(b) 1/2

(c) 0.2

(d) 20

Answer:

(a) 2

Question 8.

Which of the following is correctly matched:

(a) Aftalion – 1909

(b) Hawtrey – 1914

(c) Bickerdike – 1915

(d) J.M. Clark – 1916

Answer:

(a) Aftalion – 1909

Question 9.

MV stands for………….

(a) demand for money

(b) supply of legal tender money

(c) supply of bank money

(d) total supply of money

Answer:

(b) supply of legal tender money

Question 10.

The modern economy is described as………….

(a) Demand Economy

(b) Supply Economy

(c) Money Economy

(d) Wage Economy

Answer:

(c) Money Economy

Question 11.

EXIM bank was established in……………

(a) June 1982

(b) April 1982

(c) May 1982

(d) March 1982

Answer:

(d) March 1982

Question 12.

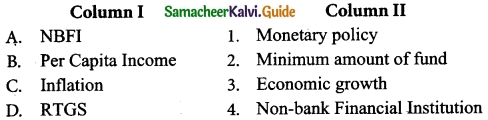

Match the following and choose the correct answer by using codes given below:

Code:

Answer:

(b) A-4, B-3, C-1, D-2

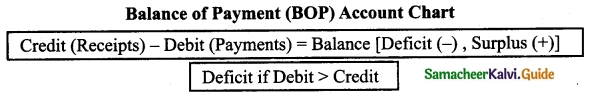

Question 13.

Balance of Trade means:……….

(a) Import and export of invisible items only

(b) Import and export of both visible and invisible items

(c) Import of visible items only

(d) Import and export of visible items only

Answer:

(d) Import and export of visible items only

Question 14.

Which of the following is correctly matched:

(a) SDR – Special Drawing Rights

(b) IMF – India Monetary Fund

(c) BOP – Balance of Price

(d) BOT – Balance of Technology

Answer:

(a) SDR – Special Drawing Rights

Question 15.

The word budget has been derived from the French word “bougette” which means:……….

(a) A small bag

(b) An empty box

(c) A box with papers

(d) None of the above

Answer:

(a) A small bag

Question 16.

Assertion (A): Canons of Taxation are Economical, Equitable, Convenient, Certain Efficient and Flexible.

Reason (R): Adam Smiths four canons of taxation are Canon of Ability, Canon of Certainty, Canon of Convenience, Canon of Economy.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

![]()

Question 17.

Which one of the following causes of global warming?

(a) Earth gravitation force

(b) Oxygen

(c) Centripetal force

(d) Increasing temperature

Answer:

(d) Increasing temperature

Question 18.

Heavy machineries located inside big factories and industrial plants also emit pollutants into the ………..

(a) land

(b) soil

(c) air

(d) water

Answer:

(c) air

Question 19.

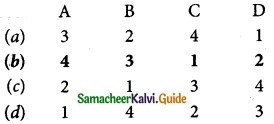

Match the following and choose the correct answer by using codes given below:

Code:

Answer:

(a) A-2, B-1, C-4, D-3

Question 20.

Econometrics is the amalgamation of

(a) 3 subjects

(b) 4 subjects

(c) 2 subjects

(d) 5 subjects

Answer:

(a) 3 subjects

PART – II

Answer any seven question in which Question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

Write the Disposable Income.

Answer:

- Disposable Income is also known as Disposable personal income.

- It is the individuals income after the payment of income tax.

- This is the amount available for households for consumption.

Question 22.

Write a short note on “Educational Unemployment”.

Answer:

- Sometimes educated people are underemployed or unemployed when qualification does not match the job.

- Faulty education system, lack of employable skills, mass student turnout and preference for white collar jobs are highly responsible for educated unemployment in India.

Question 23.

Write the Accelerator Assumptions.

Answer:

Assumptions:

- Absence of excess capacity in consumer goods industries.

- Constant capital – output ratio

- Increase in demand is assumed to be permanent

- Supply of funds and other inputs is quite elastic

- Capital goods are perfectly divisible in any required size.

Question 24.

Explain disinflation.

Answer:

Disinflation: Disinflation is the slowing down the rate of inflation by controlling the amount of credit (bank loan, hire purchase) available to consumers without causing more unemployment. Disinflation may be defined as the process of reversing inflation without creating unemployment or reducing output in the economy.

Question 25.

Write the meaning of Money supply.

Answer:

- In India, currency notes are issued by the Reserve Bank of India (RBI) and coins are issued by the Ministry of Finance, Government of India (GOI).

- Besides these, the balance is savings, or current account deposits, held by the public in commercial banks is also considered money.

- The currency notes are also called fiat money and legal tenders.

Question 26.

Define Commercial banks.

Answer:

Commercial bank refers to a bank, or a division of a large bank, which more specifically deals with deposit and loan services provided to corporations or large/middle-sized business – as opposed to individual members of the public/small business.

Question 27.

Define “Cash Reserve Ratio”.

Answer:

- Under this system the Central Bank controls credit by changing the Cash Reserves Ratio.

- For example, if the Commercial Banks have excessive cash reserves on the basis of which they are creating too much of credit,this will be harmful for the larger interest of the economy.

- So it will raise the cash reserve ratio which the Commercial Banks are required to maintain with the Central Bank.

Question 28.

Write a brief note on flexible exchange rate.

Answer:

Flexible Exchange Rates: Under the flexible exchange rate (also known as floating exchange rate) system, exchange rates are freely determined in an open market by market forces of demand and supply.

![]()

Question 29.

Define World Trade Organisation.

Answer:

- WTC headquarters located at New York, USA.

- It featured the landmark Twin Towers which was established on 4th April 1973.

- Later it was destroyed on 11th September 2001 by the craft attack.

- It brings together businesses involved in international trade from around the globe.

Question 30.

Define “Public Revenue”.

Answer:

- Public revenue occupies an important place in the study of public finance.

- The Government has to perform several functions for the welfare of the people.

- They involve substantial amount of public expenditure which can be financed only through public revenue.

- The amount of public revenue to be raised depends on the necessity of public expenditure and the people’s ability to pay.

PART – III

Answer any seven question in which Question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

Write a note on Mixed Economy.

Answer:

Mixed Economy (Mixedism):

- In a mixed economy system both private and public sectors co-exist and work together towards economic development.

- It is a combination of both capitalism and socialism. It tends to eliminate the evils of both capitalism and socialism.

- In these economies, resources are owned by individuals and the government.

- India, England, France and Brazil are the examples of mixed economy.

Question 32.

Define the term “Household sector”.

Answer:

- The household sector is the sole buyer of goods and services, and the sole supplier of factors of production, i.e., land, labour, capital and organisation.

- It spends its entire income on the purchase of goods and services produced by the business sector.

- The household sector receives income from firm sector by providing the factors of production owned by it.

Question 33.

List out the assumptions of Say’s law.

Answer:

The Say’s Law of market is based on the following assumptions:

- No single buyer or seller of commodity or an input can affect price.

- Full employment.

- People are motivated by self interest and self – interest determines economic decisions.

- The laissez faire policy is essential for an automatic and self adjusting process of full employment equilibrium. Market forces determine everything right.

- There will be a perfect competition in labour and product market.

- There is wage-price flexibility.

- Money acts only as a medium of exchange.

- Long – run analysis.

- There is no possibility for over production or unemployment.

Question 34.

Aggregate Supply Function meaning and components.

Answer:

Aggregate supply function is an increasing function of the level of employment. Aggregate supply refers to the value of total output of goods and services produced in an economy in a year. In other words, aggregate supply is equal to the value of national product, i.e., national income.

The components of aggregate supply are:

- Aggregate (desired) consumption expenditure (C)

- Aggregate (desired) private savings (S)

- Net tax payments (T) (Total tax payment to be received by the government minus transfer payments, subsidy and interest payments to be incurred by the government) and

- Personal (desired) transfer payments to the foreigners (Rf) (e.g. Donations to international relief efforts)

Question 35.

State the concept of super multiplier.

Answer:

Super Multiplier: (k and p interaction)

- The super multiplier is greater than simple multiplier which includes only autonomous investment and no induced investment, while super multiplier includes induced investment.

- In order to measure the total effect of initial investment on income, Hicks has combined the k and p mathematically and given it the name of the Super Multiplier.

- The super multiplier is worked out by combining both induced consumption and induced investment.

Question 36.

Explain the primary functions of money.

Answer:

(i) Money as a medium of exchange:

This is considered as the basic function of money. Money has the quality of general acceptability, and all exchanges take place in terms of money.

(ii) Money as a measure of value:

The second important function of money is that it measures the value of goods and services. In other words, the prices of all goods and services are expressed in terms of money. Money is thus looked upon as a collective measure of value.

![]()

Question 37.

Distinguish between CRR and SLR.

Answer:

| S.No. | CRR | SLR |

| 1. | The Central Bank controls credit by changing the Cash Reserv es Ratio. | Statutory Liquidity Ratio (SLR) is the amount which a bank has to maintain in the form of cash, gold or approved securities. |

| 2. | Commercial Banks have excessive cash reserves on the basis of which they are creating too much of credit, this will be harmful for the larger interest of the economy. | The quantum is specified as some percentage of the total demand and time liabilities. |

| 3. | So it will raise the cash reserve ratio which the Commercial Banks are required to maintain with the Central Bank. | The liabilities of the bank which are payable on demand anytime, and those liabilities which are accruing in one month’s time due to maturity. |

Question 38.

Write Adam Smith’s theory of Absolute Cost Advantage Assumptions.

Answer:

Assumptions:

- There are two countries and two commodities (2 × 2 model).

- Labour is the only factor of production.

- Labour units are homogeneous.

- The cost or price of a commodity is measured by the amount of labour required to produce it.

- There is no transport cost.

Question 39.

Explain the major achievements of WTO.

Answer:

The major achievements of WTO are as follows

- Use of restrictive measures for BoP problems has declined markedly;

- Services trade has been brought into the multilateral system and many countries, as in goods, are opening their markets for trade and investment;

- The trade policy review mechanism has created a process of continuous monitoring of trade policy developments.

Question 40.

State and explain instruments of fiscal policy.

Answer:

Fiscal Instruments:

Fiscal Policy is implemented through fiscal instruments also called ‘fiscal tools’ or fiscal levers: Government expenditure, taxation and borrowing are the fiscal tools.

(i) Taxation:

- Taxes transfer income from the people to the Government.

- Taxes are either direct or indirect.

- An increase in tax reduces disposable income.

- So taxation should be raised to control inflation.

- During depression, taxes are to be reduced.

(ii) Public Expenditure:

- Public expenditure raises wages and salaries of the employees and thereby the aggregate demand for goods and services.

- Hence public expenditure is raised to fight recession and reduced to control inflation

(iii) Public debt:

- When Government borrows by floating a loan, there is transfer of funds from the public to the Government.

- At the time of interest payment and repayment of public debt, funds are transferred from Government to public.

PART – IV

Answer all the questions. [7 × 5 = 35]

Question 41 (a).

Briefly explain the objective factors of consumption functions.

Answer:

Objective Factors:

(i) Income Distribution:

If there is large disparity between rich and poor, the consumption is low because the rich people have low propensity to consume and high propensity to save.

(ii) Price level:

- Price level plays an important role in determining the consumption function.

- When the price falls, real income goes up; people will consume more and propensity to save of the society increases.

(iii) Wage level:

- Wage level plays an important role in determining the consumption function and there is positive relationship between wage and consumption.

- Consumption expenditure increases with the rise in wages.

- Similar is the effect with regard to windfall gains.

(iv) Interest rate:

- Rate of interest plays an important role in determining the consumption function.

- Higher rate of interest will encourage people to save more money and reduces consumption.

(v) Fiscal Policy:

When government reduces the tax the disposable income rises and the propensity to consume of community increases.

(vi) Consumer credit:

- The availability of consumer credit at easy installments will encourage households to buy consumer durables like automobiles, fridge, computer.

- This pushes up consumption.

(vii) Demographic factors:

- Ceteris paribus, the larger the size of the family, the grater is the consumption.

- Besides size of family, stage in family life cycle, place of residence and occupation affect the consumption function.

(viii) Duesenberry hypothesis:

Duesenberry has made two observations regarding the factors affecting consumption.

- The consumption expenditure depends not only on his current income but also past income and standard of living.

- Consumption is influenced by demonstration effect. The consumption standards of low income groups are influenced by the consumption standards of high income groups..

(ix) Windfall Gains or losses:

Unexpected changes in the stock market leading to gains or losses tend to shift the consumption function upward or downward.

![]()

[OR]

(b) Explain the keynes psycological law of consumption asumptions.

Answer:

Keynes’s Law is based on the following assumptions:

(i) Ceteris paribus (constant extraneous variables):

The other variables such as income distribution, tastes, habits, social customs, price movements, population growth, etc. do not change and consumption depends on income alone.

(ii) Existence of Normal Conditions:

- The law holds good under normal conditions.

- If, however, the economy is faced with abnormal and extraordinary circumstances like war, revolution or hyperinflation, the law will not operate.

- People may spend the whole of increased income on consumption.

(iii) Existence of a Laissez-faire Capitalist Economy:

- The law operates in a rich capitalist economy where there is no government intervention.

- People should be free to spend increased income.

- In the case of regulation of private enterprise and consumption expenditures by the State, the law breaks down.

Question 42 (a).

What are the effects of Inflation on the Economy?

Answer:

The effects of inflation can be classified into two heads:

- Effects on Production and

- Effects on Distribution.

1. Effects on Production:

When the inflation is veiy moderate, it acts as an incentive to traders and producers. This is particularly prior to full employment when resources are not fully utilized. The profit due to rising prices encourages and induces business class to increase their investments in production, leading to generation of employment and income.

- However, hyper-inflation results in a serious depreciation of the value of money.

- When the value of money undergoes considerable depreciation, this may even drain out the foreign capital already invested in the country.

- With reduced capital accumulation, the investment will suffer a serious set-back which may have an adverse effect on the volume of production in the country.

- Inflation also leads to hoarding of essential goods both by the traders as well as the consumers and thus leading to still higher inflation rate.

- Inflation encourages investment in speculative activities rather than productive purposes.

2. Effects on Distribution:

- Debtors and Creditors: During inflation, debtors are the gainers while the creditors are losers.

- Fixed-income Groups: The fixed income groups are the worst hit during inflation because their incomes being fixed do not bear any relationship with the rising cost of living.

- Entrepreneurs: Inflation is the boon to the entrepreneurs whether they are manufacturers, traders, merchants or businessmen, because it serves as a tonic for business enterprise.

- Investors: The investors, who generally invest in fixed interest yielding bonds and securities have much to lose during inflation.

[OR]

(b) Describe the functions of IDBI.

Answer:

Functions of IDBI:

- The functions of IDBI fall into two groups (i) Assistance to other financial institutions; and (ii) Direct assistance to industrial concerns either on its own or in participation with other institutions.

- The IDBI can provide refinance in respect of term loans to industrial concerns given by the IFC, the SFCs, other financial institutions notified by the Government, scheduled banks and state cooperative banks.

- A special feature of the IDBI is the provision for the creation of a special fund known as the Development Assistance Fund.

- The fund is intended to provide assistance to industries which require heavy investments with low anticipated rate of return.

- Such industries may not be able to get assistance in the normal course.

- The financing of exports was also undertaken by the IDBI till the establishment of EXIM BANK in March, 1982.

Question 43 (a).

Describe the subject matter of International Economics.

Answer:

Subject Matter of International Economics:

The subject matter of International Economics includes large number of segments which are

classified into the following parts.

1. Pure Theory of Trade: This component explains the causes for foreign trade, composition, direction and volume of trade, determination of the terms of trade and exchange rate, issues related to balance of trade and balance of payments.

2. Policy Issues: Under this part, policy issues such as free trade vs. protection, methods of regulating trade, capital and technology flows, use of taxation, subsidies and dumping, exchange control and convertibility, foreign aid, external borrowings and foreign direct investment, measures of correcting disequilibrium in the balance of payments etc are covered.

3. International Cartels and Trade Blocs: This part deals with the economic integration in

the form of international cartels, customs unions, monetary unions, trade blocs, economic unions and the like. It also discusses the operation of Multi National Corporations (MNCs).

4. International Financial and Trade Regulatory Institutions: The financial institutions like International Monetary Fund IMF, IBRD, WTO etc which influence international economic transactions and relations shall also be the part of international economics.

![]()

[OR]

(b) Bring out the components of balance of payments account.

Answer:

Components of BOPs:

The credit and debit items are shown vertical lv in the BOP account of a country. Horizontally, they are divided into three categories, i.e.

- The current account,

- The capital account and

- The official settlements account or official reserve assets account.

1. The Current Account: It includes all international trade transactions of goods and services, international service transactions (i.e. tourism, transportation and royalty fees) and international unilateral transfers (i.e. gifts and foreign aid).

2. The Capital Account: Financial transactions consisting of direct investment and purchases of interest-bearing financial instruments, non-interest bearing demand deposits and gold fall under the capital account.

3. The Official Reserve Assets Account: Official reserve transactions consist of movements of international reserves by governments and official agencies to accommodate imbalances arising from the current and capital accounts.

The official reserve assets of a country include its gold stock, holdings of its convertible foreign currencies and Special Drawing Rights (SDRs) and its net position in the International Monetary Fund (IMF).

Question 44 (a).

What are trade blocks?

Answer:

1. Trade blocks cover different kinds of arrangements between or among countries for mutual benefit. Economic integration takes the form of Free Trade Area, Customs Union, Common Market and Economic Union.

2. A free trade area is the region encompassing a trade bloc whose member countries have signed a free-trade agreement (FTA). Such agreements involve cooperation between at least two countries to reduce trade barriers, e.g. SAFTA, EFTA.

3. A customs union is defined as a type of trade block which is composed of a free trade area with no tariff among members and (zero tariffs among members) with a common external tariff, e.g. BENELUX (Belgium, Netherland and Luxumbuarg).

4. Common market is established through trade pacts. A group formed by countries within a geographical area to promote duty free trade and free movement of labour and capital among its members, e.g. European Common Market (ECM).

5. An economic union is composed of a common market with a customs union. The participant countries have both common policies on product regulation, freedom of movement of goods, services and the factors of production and a common external trade policy, (e.g. European Economic Union).

[OR]

(b) Briefly explain the achievements of SAARC.

Answer:

Achievements of SAARC:

- The establishment of SAARC Preferential Trading Agreement (SAPTA) and reduction in tariff and non-tariff barriers on imports.

- The setting up of Technical Committees for economic cooperation among SAARC countries relating to agriculture, communications, education, health and population, rural development, science and technology, tourism, etc.

- SAARC has established a three-tier mechanism for exchanging information on poverty reduction programmes which is passed on to member countries.

- SAARC Agricultural Information Centre (SAIC) in 1988 works as a central information institution for agriculture related resources like fisheries, forestry, etc.

- South Asian Development Fund (SADF) for development projects, human resource development and infrastructural development projects. With all these tall claims, the inter- SAARC Trade has not gone beyond three percent in the last 30 years.

Question 45 (a).

Explain the methods of debt redemption.

Answer:

The process of repaying a public debt is called redemption. The Government sells securities to the public and at the time of maturity, the person who holds the security surrenders it to the Government. The following methods are adopted for debt redemption.

(i) Sinking Fund:

- Under this method, the Government establishes a separate fund known as “Sinking Fund”.

- The Government credits every year a fixed amount of money to this fund.

- By the time the debt matures, the fund accumulates enough amount to pay off the principal along with interest.

- This method was first introduced in England by Walpol.

(ii) Conversion:

- Conversion of loans is another method of redemption of public debt.

- It means that an old loan is converted into a new loan.

- Under this system a high interest public debt is converted into a low interest public debt.

- Dalton felt that debt conversion actually relaxes the debt burden.

(iii) Budgetary Surplus:

- When the Government presents surplus budget, it can be utilised for repaying the debt.

- Surplus occurs when public revenue exceeds the public expenditure.

- However, this method is rarely possible.

(iv) Terminal Annuity:

- In this method, Government pays off the public debt on the basis of terminal annuity in

equal annual installments. . - This is the easiest way of paying off the public debt.

(v) Repudiation:

- It is the easiest way for the Government to get rid of the burden of payment of a loan.

- In such cases, the Government does not recognise its obligation to repay the loan.

- It is certainly not paying off a loan but destroying it.

- However, in normal case the Government does not do so; if done it will lose its credibility.

(vi) Reduction in Rate of Interest:

Another method of debt redemption is the compulsory reduction in the rate of interest, during the time of financial crisis.

(vi) Capital Levy:

- When the Government imposes levy on the capital assets owned by an individual or any institution, it is called capital levy.

- This levy is imposed on capital assets above a minimum limit on a progressive scale.

- The fund so collected can be used by the Government for paying off war time debt obligations.

- This is the most controversial method of debt repayment.

![]()

[OR]

(b) Describe the various types of deficit in budget.

Answer:

The Indian Government budget, budget deficit is of four major types.

- Revenue Deficit

- Budget Deficit

- Fiscal Deficit, and

- Primary Deficit

1. Revenue Deficit:

It refers to the excess of the government revenue expenditure over revenue receipts. It does not consider capital receipts and capital expenditure. Revenue deficit implies that the government is living beyond its means to conduct day-to-day operations.

Revenue Deficit (RD) = Total Revenue Expenditure (RE) – Total Revenue Receipts (RR) When RE – RR > 0

2. Budget Deficit:

Budget deficit is the difference between total receipts and total expenditure (both revenue and capital)

Budget Deficit = Total Expenditure – Total Revenue

3. Fiscal Deficit:

Fiscal deficit (FD) = Budget deficit + Government’s market borrowings and liabilities

4. Primary Deficit:

Primary deficit is equal to fiscal deficit minus interest payments. It shows the real burden of the government and it does not include the interest burden on loans taken in the past. Thus, primary deficit reflects borrowing requirement of the government exclusive of interest payments.

Primary Deficit (PD) = Fiscal deficit (PD) – Interest Payment (IP)

Question 46 (a).

Briefly explain classification of Public expenditure.

Answer:

Classification of public expenditure are as follows:

(i) Classification on the Basis of Benefit:

Cohn and Plehn have classified the public expenditure on the basis of benefit into four classes:

- Public expenditure benefiting the entire society, e.g., the expenditure on general administration, defence, education, public health, transport.

- Public expenditure conferring a special benefit on certain people and at the same time common benefit on the entire community, e.g., administration of justice etc.

- Public expenditure directly benefiting particular group of persons and indirectly the entire society, e.g., social security, public welfare, pension, unemployment relief etc.

- Public expenditure conferring a special benefit on some individuals, e.g., subsidy granted to a particular industry.

(ii) Classification on the Basis of Function:

Adam Smith classified public expenditure on the basis of functions of government in the ‘ following main groups:

- Protection Functions: This group includes public expenditure incurred on the security of the citizens, to protect from external invasion and internal disorder, e.g., defence, police, courts etc.

- Commercial Functions: This group includes public expenditure incurred on the development of trade and commerce, e.g., development of means of transport and communication etc.

- Development Functions: This group includes public expenditure incurred for the development infrastructure and industry.

![]()

[OR]

(b) Explain Balanced and Unbalanced Budget.

Answer:

Balanced Budget

Balanced budget is a situation, in which estimated revenue of the government during the year is equal to its anticipated expenditure.

Unbalanced Budget

The budget in which Revenue & Expenditure are not equal to each other is known as Unbalanced Budget.

Unbalanced budget is of two types:

- Surplus Budget

- Deficit Budget

1. Surplus Budget

The budget is a surplus budget when the estimated revenues of the year are greater than anticipated expenditures.

2. Deficit Budget

Deficit budget is one where the estimated government expenditure is more than expected revenue.

Question 47 (a).

Write a note on

(a) Climate change and

(b) Acid rain.

Answer:

(a) Climate Change:

The climate change refers to seasonal changes over a long period with respect to the growing accumulation of greenhouse gases in the atmosphere.

Recent studies have shown that human activities since the beginning of the industrial revolution, have contributed to an increase in the concentration of carbon dioxide in the atmosphere by as much as 40%, from about 280 parts per million in the pre-industrial period, to 402 parts per million in 2016, which in turn has led to global warming.

Several parts of the world have already experienced the warming of coastal waters, high temperatures, a marked change in rainfall patterns, and an increased intensity and frequency of storms. Sea levels and temperatures are expected to be rising.

(b) Acid Rain:

- Acid rain is one of the consequences of air pollution.

- It occurs when emissions from factories, cars or heating boilers contact with the water in the atmosphere.

- These emissions contain nitrogen oxides, sulphur dioxide and sulphur trioxide which when mixed with water becomes sulfurous acid, nitric acid and sulfuric acid.

- This process also occurs by nature through volcanic eruptions.

- It can have harmful effects on plants, aquatic animals and infrastructure.

[OR]

(b) Discuss the economic determinants of economic development Economic Factors?

Answer:

Economic Factors:

1. Natural Resource: The principal factor affecting the development of an economy is the availability of natural resources. The existence of natural resources in abundance is essential for development.

2. Capital Formation: Capital formation is the main key to economic growth. Capital formation refers to the net addition to the existing stock of capital goods which are either tangible like plants and machinery or intangible like health, education and research.

3. Size of the Market: Large size of the market would stimulate production, increase employment and raise the National per capita income. That is why developed countries expand their market to other countries through WTO.

4. Structural Change: Structural change refers to change in the occupational structure of the economy. Any economy of the country is generally divided into three basic sectors: Primary sector such as agricultural, animal husbandry, forestry, etc; Secondary sector such as industrial production, constructions and Tertiary sector such as trade, banking and commerce.

5. Financial System: Financial system implies the existence of an efficient and organized banking system in the country.

6. Marketable Surplus: Marketable surplus refers to the total amount of farm output cultivated by farmers over and above their family consumption needs. This is a surplus that can be sold in the market for earning income.

7. Foreign Trade: The country which enjoys favorable balance of trade and terms of trade is always developed. It has huge forex reserves and stable exchange rate.

8. Economic System: The countries which adopt free market mechanism (laissez faire) enjoy better growth rate compared to controlled economies.

![]()