TN State Board 12th Economics Important Questions Chapter 2 National Income

Question 1.

Define National Income.

Answer:

“The labour and capital of a country acting on its natural resources produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the true net annual income or revenue of the country or national dividend”. – Alfred Marshall.

(or)

“The net output of the commodities and services flowing during the year from the country’s productive system into the hands of the ultimate consumers or into net addition to the country’s stock of capital goods – Simon Kuznets.

Question 2.

Write the formula for calculating GNP.

Answer:

GNP at Market Prices = GDP at market prices + Net Factor Income from Abroad

Gross National Product = Gross Domestic Product + NFIA

![]()

Question 3.

What is the difference between NNP and NDP?

Answer:

|

NNP |

NDP |

| It is the value of the net output of the economy during the year. | It is the value of net output of the economy during the year. |

| It is the Net National Product. | It is the Net Domestic Product. |

| NNP = GNP – Depreciation | NDP = GDP – Depreciation |

Depreciation is also called as capital consumption allowance.

Question 4.

Trace the relationship between GNP and NNP.

Answer:

GNP is the total measure of the flow of final goods and services at market value resulting from current production in a country during a year, including net income from abroad, where as NNP is the net output of the economy during the year.

NNP is the replacement allowance of the capital assets from the GNP i.e., NNP = GNP – depreciation allowance (Depreciation is also called as capital consumption allowance).

Question 5.

What do you mean by the term ‘Personal Income’?

Answer:

Personal Income is the Total Income received by the Individuals before paying direct Taxes from all sources. It also includes Transfer Payments.

![]()

Question 6.

Define GDP deflator.

Answer:

It is an index of price changes of goods and services included in GDP.

GDP deflator = (Nominal GDP) / (Real GDP) × 100

Question 7.

Why is self consumption difficult in measuring national income?

Answer:

Measuring of National Income through product method is done by measuring the final goods and services. But farmers keep a large portion of food and other goods for self consumption. So, the unsold product remains undecided as whether to include or not

Question 8.

Write a short note on per capita income.

Answer:

Per Capita Income is an annual average Income of a person. It is income per head of population. Its the average income of person of a country in a particular year.

Per capita income = (National Income) / (Population)

![]()

Question 9.

Differentiate between personal and disposable income

Answer:

|

Personal income |

Disposable income |

| Total income received by the individual of a country from all sources before payment of direct taxes in a year. | It is also known as disposable personal income. It is the individual income after payment of income tax. |

| Personal Income = NI – Undistributed Corporate Profit + Transfer Payments. | Disposable Income = Personal Income – Direct Tax and Disposable Income = Consumption + saving |

Question 10.

Explain briefly NNP at factor cost.

Answer:

It is the cost of total income of payment made to the factors of production. The amount of indirect taxes are deducted and subsidies are added to the money value of NNP at market price to arrive at the NNP FC.

NNP at factor cost = NNP at Market prices – Indirect taxes + Subsidies.

Question 11.

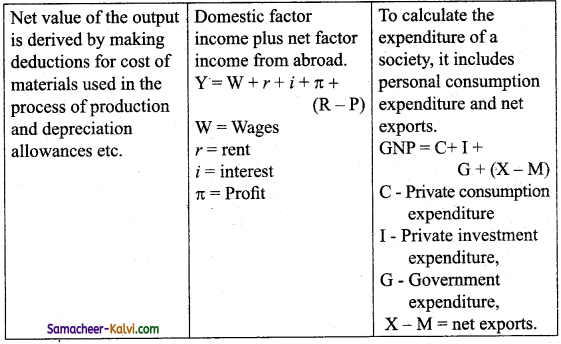

Give short note on Expenditure Method.

Answer:

In this method the total expenditure by the society in a year is added that is personal consumption expenditure, net domestic investment, government expenditure on consumption. Under expenditure method, National Income is measured at the point of actual expenditure. It measures the final expenditure on Gross domestic product at market price during a period of account.

![]()

Question 12.

What is the solution to the problem of double counting jn the estimation of national income?

Answer:

The problem of double counting can be solved by value added method. In this method instead of taking value of final products, value added by each firm at each stage of production is included, that is cost of raw materials is not included. So there is no scope for double counting in this method. Value added method is also known as Industry of origin method. This method is used to avoid double counting in calculating national income.

Question 13.

Write briefly about national income and welfare.

Answer:

National income is an indicator of the country’s Economic progress when the country’s GDP increases, then there is increase in standard of living of the people. But the rise in GDP need not always promote economic welfare because welfare is affected by a wide range of factors like economic and .non-economic factors.

Economic factors:

Eg: national income, consumption etc can be expressed in money.

Non – Economic factors:

Eg: environmental hazards and law and order situation cannot be expressed in money. Therefore PQLI Physical Quality of Life Index is considered better indicator of economic welfare. It includes standard of living, life expectancy at birth and literacy.

Question 14.

List out the uses of national income.

Answer:

- It describes the economic or production performance of a country.

- The National Income data is used by the economists, planners, government, businessmen and International agencies like IMF, world bank etc., for various analytical purposes. ‘

- National Income Data helps to note the changes in standard of living of a country over a period of time and to compare with other countries.

- The National Income figures are used to measure the level of development of a country.

![]()

Question 15.

Explain the importance of national income.

Answer:

(i) National Income is known as the accounts of the economy. It helps to facilitate the task of measurement as it provides a set of procedures and techniques for measurement of income and output of aggregate level.

(ii) National Income provides:

(a) Model of Macro Economic Model and

(b) Enable us to learn few hall mark numbers which help characterize the economy.

(iii) Gives relative importance of the various sectors of the economy. It also enables us to know how income is produced, distributed, saved and spent.

(iv) It indicates performance of the Economy, Structural changes in the Economy, making comparison among Nations.

(v) The National Income data helps to formulate National Policies like monetary and Fiscal policies. It also helps to. build economic models.

(vi) It helps to formulate planning and evaluate progress, to know the distribution of income for various factors of production.

(vii) It enables us to arrive at Macro-economic variables namely Tax – GDP ratio, Current Account Deficit – GDP ratio etc.

(viii) It enables us to know a country’s per capita income which reflects the economic welfare of the country.

(ix) It is helpful to UNO which formulates welfare plans for different countries especially for underdeveloped countries.

(x) National Income data is manifestation of material results of human activity in an economy.

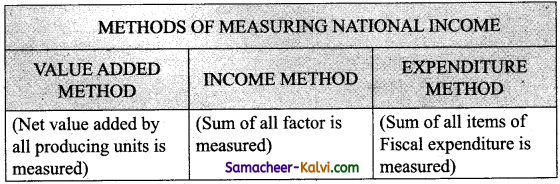

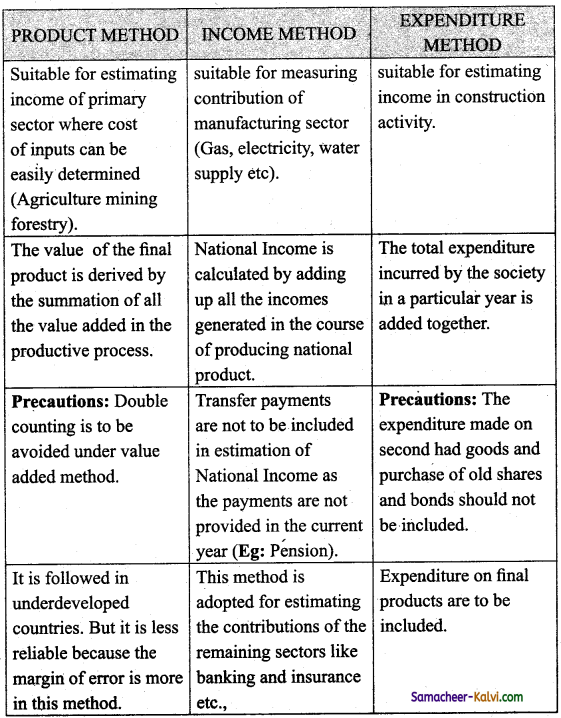

Question 16.

Discuss the various methods of estimating the national income of a country.

Answer:

All goods and services produced in the country must be counted and converted against money value during a year. Whatever is produced is used for consumption or saved. There are three methods that are used to measure National Income.

(i) Production or Value Added Method

(ii) Income or Factor Earning Method (Hi) Expenditure Method

The three methods originate from three different phases in circular flow of National Income.

National income may be measured by any method, the equation is

Output = income = expenditure

GDP: By sum of spending, Factor incomes or output in all methods, net flow of goods and services which is being looked at from three different angles. Each method provides different view of the economy and also provides a check in the accuracy of the other methods.

![]()

Question 17.

What are the difficulties involved in the measurement of national income?

Answer:

In India, because of unorganized and non-monetized subsistence sector where the barter system still prevails for transacting goods and services. So proper valuation of output is very difficult.

Difficulties:

(i) Transfer payments:

The government expenditures are not included in National Income because they are paid without adding anything to the production process.

(ii) Difficulties in assessing depreciation / allowence:

It is also difficult to deduct depreciation allowances like accidental damages because it is very difficult to judge.

(iii) Unpaid services:

There are no. of goods and services which are difficult to be assessed in money terms.

Eg: services of house wife;

(iv) Income from illegal activities:

Income earned from gambling, smuggling etc are also not included.

(v) Production for self-consumption and changing price:

Farmers keep a large portion of food and other goods produced on the farm for self consumption and that is not included in the National Income.

(vi) Capital gains:

Capital gains are excluded from National Income. Eg: Property sold at higher price than the purchase price.

(vii) Statistical problems:

Statistical datas are not perfectly reliable co- operaion of people and efficiency of statistical staff is also needed.

Eg: Production in Animal husbandary.

National Income estimate in India are not accurate because of difficulties faced at different levels.

Question 18.

Discuss the importance of social accounting in economic analysis.

Answer:

Measuring National Income by social accounting method. The translations are recorded and the inter relationships are traced. It is very useful for economists and policy makers.

The economy is divided into several sectors in social accounting method.

(i) Firms:

These are organisations which employ the factors of production.

(ii) Households:

It receive payments for their services to the firms, so the firms make payment to households for their services.

(iii) Government sector:

The economic transactions of public bodies at all levels. The main function of the government is to provide social goods like defence, education etc.

(iv) Rest of the world sector:

It is international economic transactions of the country.

(v) Capital sector is saving and investment activities like transactions of banks, insurance etc. these agencies provide financial assistance to the firms activities.

When the sectoral contribution are assessed to GDP, the economy is divided into primary, secondary and tertiary sectors.

Social accounting method is important for economic analysis because it represents the major economic flows and statistical relationships among .various sectors of economic system and it is useful to forecast the trends of economy more accurately.

![]()

Multiple Choice Questions:

Question 1.

Net National product at factor cost is also known as:

(a) National Income

(b) Domestic Income

(c) Per capita Income

(d) Salary

Answer:

(a) National Income

Question 2.

Primary sector is:

(a) Industry

(b) Trade

(c) Agriculture

(d) Construction

Answer:

(c) Agriculture

Question 3.

National income is measured by using _________ methods.

(a) Two

(b) Three

(c) Five

(d) Four

Answer:

(b) Three

![]()

Question 4.

Income method is measured by summing up of all forms of:

(a) Revenue

(b) Taxes

(c) Expenditure

(d) Income

Answer:

(d) Income

Question 5.

Which is the largest figure?

(a) Disposable income

(b) Personal Income

(c) NNP

(d) GNP

Answer:

(d) GNP

Question 6.

Expenditure method is used to estimate national income in:

(a) Construction sector

(b) Agricultural Sector

(c) Service sector

(d) Banking sector

Answer:

(a) Construction sector

![]()

Question 7.

Tertiary sector is also called as ________ sector.

(a) Service

(b) Income

(c) Industrial

(d) Production

Answer:

(a) Service

Question 8.

National income is a measure of the ________ performance of an economy.

(a) Industrial

(b) Agricultural

(c) Economic

(d) Consumption

Answer:

(c) Economic

Question 9.

Per capita income is obtained by dividing the National income by:

(a) Production

(b) Population of a country

(c) Expenditure

(d) GNP

Answer:

(b) Population of a country.

![]()

Question 10.

GNP = ______ + Net factor income from abroad.

(a) NNP

(b) NDP

(c) GDP

(d) Personal income

Answer:

(c) GDP

Question 11.

NNP stands for:

(a) Net National Product

(b) National Net product

(c) National Net Provident

(d) Net National Provident

Answer:

(a) Net National Product

Question 12.

_______ is deducted from gross value to get the net value.

(a) Income

(b) Depreciation

(c) Expenditure

(d) Value of final goods

Answer:

(b) Depreciation

![]()

Question 13.

The financial year in India is:

(a) April 1 to March 31

(b) March 1 to April 30

(c) March 1 to March 16

(d) January 1 to, December 31

Answer:

(c) March 1 to March 16

Question 14.

When net factor income from abroad is deducted from NNP, the net value is:

(a) Gross National Product

(b) Disposable Income

(c) Net Domestic Product

(d) Personal Income

Answer:

(b) Disposable Income

Question 15.

The value of NNP at production point is called:

(a) NNP at factor cost

(b) NNP at market cost

(c) GNP at factor cost

(d) Per capita income

Answer:

(c) GNP at factor cost

![]()

Question 16.

The average income of the country is:

(a) Personal Income

(b) Per capita income

(c) Inflation Rate

(d) Disposal Income

Answer:

(b) Per capita income

Question 17.

The value of national income adjusted for inflation is called:

(a) Inflation Rate

(b) Disposal Income

(c) GNP

(d) Real national income

Answer:

(d) Real national income

Question 18.

Which is a flow concept?

(a) Number of shirts

(b) Total wealth

(c) Monthly income

(d) Money supply

Answer:

(c) Monthly income

![]()

Question 19.

PQLI stands for:

(a) Economic growth

(b) Economic welfare

(c) Economic progress

(d) Economic development

Answer:

(b) Economic welfare

Question 20.

The largest proportion of national income comes from:

(a) Private sector

(b) Local sector

(c) Public sector

(d) None of the above

Answer:

(a) Private sector

![]()

Samacheer Kalvi 12th Economics Notes Chapter 2 National Income

→ Depreciation: Fall in value of fixed assets due to normal wear and tear and foreseen obsolescene.

→ Intermediate products: Goods and services purchased by one unit from another, used or resold during the same year.

→ COE: Total remuneration in cash and in the form of social security contributions by employers to their employees.

→ Royalty: Amount payable to the landlord for granting the leasing rights of subsoil assets.

→ PFCE: The sum of final consumption expenditure by households and private non-profit institutions serving households.

→ GFCE: Expenditure incurred by general government on producing free services to the people.

→ GDCF: Addition to the stock of capital undertaken by the production units located within economic or domestic territory of the country.

→ Personal Disposable Income: Sum of factor and non-factor incomes occurring to the households after payment of direct taxes.

![]()

→ Private Income: Sum of factor and non-factor incomes before payment of direct-taxes occurring to houselholds.

→ Economic Welfare: Welfare affected by economic factors like Income and Consumption is called Economic Welfare.

→ GDP: Gross Domestic Product – Aggregate value of goods and services produced within the domestic territory of a country.

→ Gross Fiscal Deficit: The excess of total government expenditure over revenue receipts and capital receipts that do not create debt.

→ National Disposable Income: Net National Product at Market Price + other Current Transfers from the rest of the world.

→ Net Domestic Product (NDP): Aggregate value of goods and services produced within the domestic territory of a country which does not include the depreciation of capital stock.

→ NNP: (At factor cost) or National Income (NI)

NNP at market price – Indirect taxes + subsidies.

![]()

→ IC – Intermediate Consumption

→ D – Depreciation (or Consumption of Fixed Capital)

→ NFIA – Net Factor Income from Abroad.

→ NIT – Net Indirect Taxes (T-S)

→ COE – Compensation of Employees

→ R, I & P – Rent and Royalty, Interest and Profits.

→ MI – Mixed Income

→ PFCE – Private Final Consumption Expenditure

→ GFCE – Government Final Consumption Expenditure

→ GDCF – Gross Domestic Capital Formation

→ (X – M) – Net Exports

→ ∆S – (Delta) change in stock.

![]()

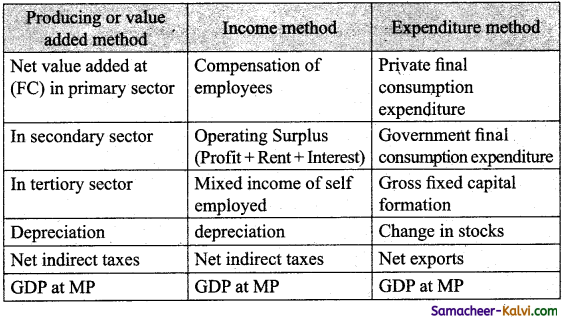

Chart showing Reconciliation of three methods of measuring:

→ Depreciation: (Gross = Net + Depreciation)

(Difference between Gross and Net)

(a) Net Product = Gross value added – Depreciation

(b) Net Value added = Gross value added – Depreciation.

(c) Net Investment = Gross Investment – Depreciation.

![]()

→ Net Indirect Taxes (Market Price = Factor Cost + NIT)

(Difference between Market Price and Factor Cost)

(a) Market Price = Factor Cost + Indirect Taxes – Subsidies.

(b) Market Price = Factor Price + Net Indirect Taxes

(c) Factor Cost = Market Price – Indirect Taxes

(d) GDP at Factor Cost = GDP at MP – Net Indirect-Taxes.

(e) Net Value added at Factor Cost = Net Value added at Market Price – Net Indirect Tax.

(f) GDP at MP = GNP at Factor Cost + Net Indirect Taxes.

(g) National Income = Domestic Income + Net Factor Income from Abroad

(h) Domestic Income = National Income – NFLA

GNP = GDP + NFIA

NDPMP = GDPMP – Depreciation

GNPMP = GDPMP – NFIA

NNPMP = GNPMP – Depreciation

TN Board 12th Economics Important Questions