TN State Board 12th Commerce Important Questions Chapter 22 The Negotiable Instruments Act, 1881

Question 1.

What is meant by Negotiable Instrument?

Answer:

According to section 13 of the Negotiable Instrument Act 1881, a Negotiable Instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer.

Question 2.

Define Bill of Exchange.

Answer:

According to section 5 of the Negotiable Instrument Act, “a bill of exchange is an instrument in writing containing an unconditional order, signed by the maker directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument”.

![]()

Question 3.

List three characteristics of a Promissory Note.

Answer:

- A Promissory note must be in writing an oral promise to pay does not constitute a promissory note.

- It must containing a promise or undertaking to pay a mere acknowledgement of indebtedness will not make it a promissory note.

- It must be signed by the maker the signature must be in any part of the instrument and it need not be at the bottom.

Question 4.

What is meant by a cheque?

Answer:

According to section 6 of the Negotiable Instrument Act 1881 defines a cheque as a “bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand”.

Question 5.

Define Endorsement.

Answer:

Section 15 of the Negotiable Instrument Act 1881 defines endorsement as follows, “when the maker or holder of a negotiable instrument signs the name, otherwise that as such maker for the purpose of negotiation on the back or face thereof, or on a slip of paper annexed thereto or so signs for the purpose a stamped paper intended to be completed as a negotiable instrument; he is said to endorse the same and is called the endorsee”.

![]()

Question 6.

Explain the nature of a Negotiable Instrument.

Answer:

(i) Transferability:

Anegotiable instrument is transferable from one person to another without any formality, such as affixing stamp, registration etc.

(ii) Title of the holders free from all defects:

A person taking the instrument in good faith and for the value is known as holder in due course. When the instrument is held by holder in due course in the process of negotiation, it is cured of all defects in the instrument with respect to ownership.

(iii) Right of the transferee to sue:

Though a bill a promissory note or a cheque represents debt, the transferee is entitled to sue on the instrument in his own name in case of dishonour, without giving notice to the debtor that he has become its holder.

Question 7.

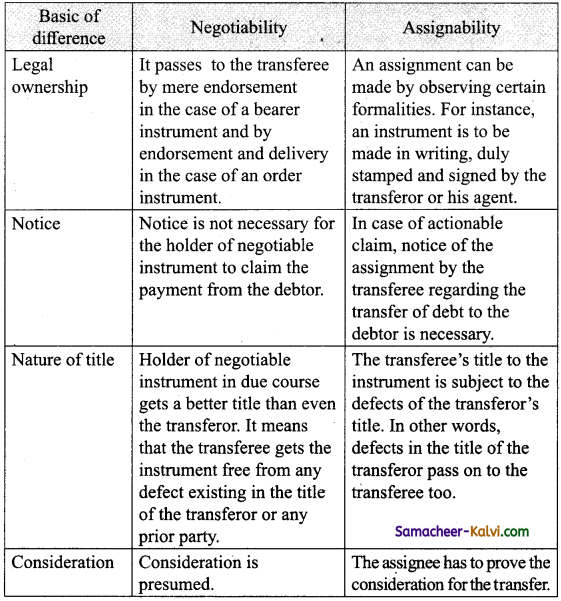

Distinguish between Negotiability and Assignability.

Answer:

![]()

Question 8.

What are the characteristics of a bill of exchange?

Answer:

- A bill of exchange is a document in writing.

- The document must contain an order to pay.

- The order must be unconditional.

- The instrument must be signed by the person who draws it.

- The name of the person on whom the bill is drawn must be specified in the bill itself.

- The amount that is required to be paid must also be specified in the bill.

- The bill may be payable on demand or after a specified period.

- It must comply with formalities regarding date, consideration, stamps etc.

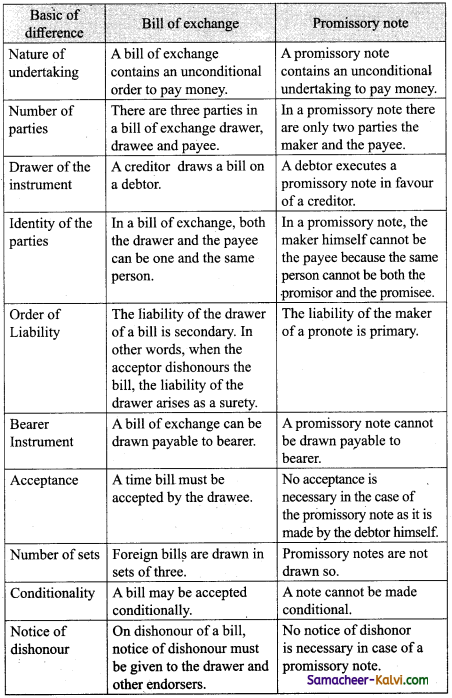

Question 9.

Distinguish between Bill of Exchange & Promissory Note.

Answer:

![]()

Question 10.

Discuss the two different types of crossing.

Answer:

Types of crossing:

(i) General crossing

(ii) Special crossing

(i) General crossing:

According to section 123 of the Negotiable Instrument Act 1881 “where a cheque bears across its face an addition of the words “and company” or any abbreviation thereof between to parallel transverse lines or of two parallel transverse line simply either with or without the words “not negotiable that addition shall be deemed a crossing and the cheque shall be deemed to be crossed generally”.

(ii) Special crossing:

Section 124 defines special crossing as follows: “Where a cheque bears across its face an addition of the name of a banker with or without the words “not negotiable” that addition shall be deemed a crossing and the cheque shall be deemed to be crossed specially and to be crossed to that banker”.

Question 11.

Mention the presumptions of Negotiable Instruments.

Answer:

Instrument: Certain presumptions as briefly mentioned below:

- Every negotiable instrument is presumed to have been drawn accepted etc., for consideration.

- A negotiable instrument is presumed to have been accepted.

- Every negotiable instrument bearing a date is presumed to have been made or drawn on such a date.

- It is presumed to have been accepted within a reasonable time after the date and before its maturity.

- It is presumed to have been accepted within a reasonable time after the date and before its maturity.

- When a negotiable instrument has been loss, it is presumed to have been duly stamped.

- The holder of a negotiable instrument is presumed to be a holder is due course.

![]()

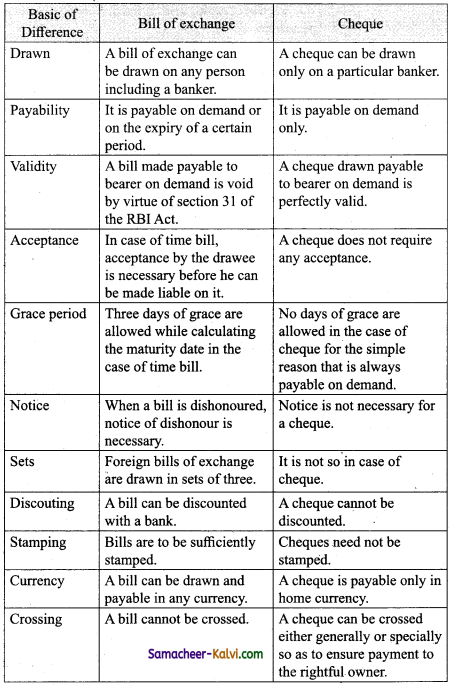

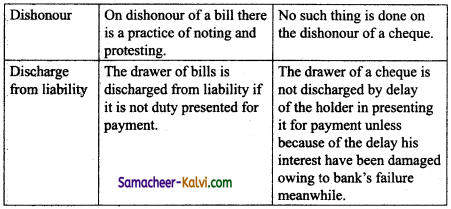

Question 12.

Distinguish a cheque and a bill of exchange.

Answer:

Question 13.

Discuss in detail the features of a cheque.

Answer:

(i) Instrument in writings:

A cheque or a bill or a promissory note must be an instrument in writing. Though the law does not prohibit a cheque being written in pencil, bankers never accept it because of risk involved.

(ii) Unconditional orders:

The instrument must contain an order to pay money. It is not necessary that the word “order” or its equivalent must be used to make the document a cheque. It does not cease to be a cheque just because the word “please” is used before the world pay.

(iii) Drawn on a specific banker only:

The cheque is always drawn on a specified banker. The customer of a banker can draw the cheque only on the particular branch of the bank where he has an account.

(iv) A certain sum of money only:

The order must be for payment of only money. If the banker is asked to deliver securities, the document cannot be called cheque. Further the sum of money must be certain.

(v) Payee to be certain:

The cheque must be made payable to a certain person or to the order of a certain person or to the bearer of the instrument.

(vi) Signed by drawer:

The cheque is to be signed by the drawer. Further it should tally with specimen signature furnished to the bank at the time of opening the account.

(vii) Payable always on demand:

A cheque is always payable on demand. The. words on demand are not used when the drawee bank is asked to pay and the time for its payment is not specified, it is considered to be payable on demand.

![]()

Question 14.

What are the requisites for a valid endorsement?

Answer:

If an endorsement is to be valid it must possess the following requisites.

- Endorsement is to be made on the face of the instrument or on its back. It is usually made on the back of a negotiable instrument.

- When there is no space for making further endorsements, a piece of paper can be attached to the negotiable instrument for this purpose. This piece of paper is called “Allonge”.

- If the endorsee’s name is wrongly spelt the endorsee should sign the same as spelt in the instrument and write the correct spelling within brackets after his endorsement.

- Endorsement for only a part of the amount of the instrument invalid. It can be made only for their entire amount.

- Endorsement is complete only when delivery of the instrument is made.

- Signing in block letter does not constitute regular endorsement.

- Endorsement must be in link.

- A person duly authorized to endorse a cheque or a bill must indicate that he is signing in it on behalf of his principal by using such word as “for”, “on behalf’ or “per pro”.

Question 15.

Explain the different kinds of endorsements.

Answer:

Endorsement in blank or general:

(i) Instrument:

When the endorser puts his mere signature on the back of an instrument without mentioning name of the person to whom the endorsement is made it is called general endorsement.

(ii) Endorsement in full or special endorsement:

Where the endorser in addition to his signature, specifies the person to whom or to whose order the instrument is payable, the endorsement is called endorsement in full.

(iii) Conditional or qualified endorsement:

Where the endorser of a negotiable instrument makes his liability dependent upon the happening of an event which may or may not happen, it is called conditional endorsement.

(iv) Restrictive endorsement:

When an endorsement restricts or prohibits further negotiability of the instrument, it is called restrictive endorsement

(v) Sans Recourse endorsement:

Ordinarily the endorser becomes liable to subsequent parties in the event of dishonour of the instrument. But if he makes it clear that the subsequent holders should not look to him for payment in case it is dishonoured, the endorsement is called Sans Recourse endorsement.

(vi) Facultative endorsement:

To make an endorser liable on the instrument, notice of dishonour must be given to him. But if the endorser waives this right by a writing “Notices of dishonour waived” at the time of endorsing. It is called facultative endorsement.

(vii) Partial endorsement:

Where the endorsement seeks to transfer only a part of amount payable under the instrument, the endorsement is called partial endorsement. Partial endorsement does not operate as a negotiation of the instrument.

![]()

Choose the correct answer:

Question 1.

Negotiable Instrument Act was passed in the year:

(a) 1981

(b) 1881

(c) 1994

(d) 1818

Answer:

(b) 1881

Question 2.

Negotiable Instrument is freely transferable by delivery if it is a _______ instrument.

(a) Order

(b) earer

(c) Both (a) & (b)

(d) None of the above

Answer:

(b) earer

Question 3.

The transferee of a Negotiable Instrument is the one:

(a) Who transfer the instrument

(b) On whose name it is transferred

(c) Who enchases it

(d) None of the above

Answer:

(b) On whose name it is transferred

![]()

Question 4.

Number of parties in a bill of exchange are:

(a) 2

(b) 6

(c) 3

(d) 4

Answer:

(c) 3

Question 5.

Section 6 of Negotiable Instruments Act 1881 deals with:

(a) Promissory Note

(b) Bills of exchange

(c) Cheque

(d) None of the above

Answer:

(c) Cheque

Question 6.

________ cannot be a bearer instrument.

(a) Cheque

(b) Promissory Note

(c) Bills of exchange

(d) None of the above

Answer:

(a) Cheque

![]()

Question 7.

When crossing restrict further negotiation:

(a) Not negotiable crossing

(b) General Crossing

(c) A/c payee crossing

(d) Special crossing

Answer:

(a) Not negotiable crossing

Question 8.

Which endorsement relieves the endorser from incurring liability in the event of dishonour?

(a) Restrictive

(b) Faculative

(c) Sans recourse

(d) Conditional

Answer:

(b) Faculative

Question 9.

A cheque will become stale after ______ months of its date.

(a) 3

(b) 4

(c) 5

(d) 1

Answer:

(a) 3

![]()

Question 10.

Document of title to the goods exclude:

(a) Lorry receipt

(b) Railway receipt

(c) Airway bill

(d) Invoice

Answer:

(d) Invoice