Tamilnadu State Board New Syllabus Samacheer Kalvi 12th Accountancy Guide Pdf Chapter 7 Company Accounts Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 12th Accountancy Solutions Chapter 7 Company Accounts

12th Accountancy Guide Company Accounts Text Book Back Questions and Answers

I Multiple Choice Questions

Choose the correct answer

Question 1.

A preference share is one

(i) which carries preferential right with respect to payment of dividend at fixed rate

(ii) which carries preferential right with respect to payment of capital on winding up

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Both (i) and (ii) are correct

(d) Both (i) and (ii) are incorrect

Answer:

(c) Both (i) and (ii) are correct

![]()

Question 2.

That part of share capital which can be called up only on the winding up of a company is called:

(a) Authorised capital

(b) Called up capital

(c) Capital reserve

(d) Reserve capital

Answer:

(d) Reserve capital

Question 3.

At the time of forfeiture, share capital account is debited with

(a) Face value

(b) Nominal value

(c) Paid up amount

(d) Called up amount

Answer:

(d) Called up amount

Question 4.

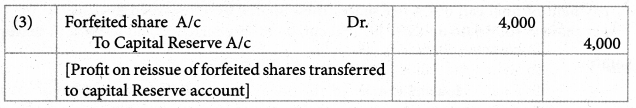

After the forfeited shares are reissued, the balance in the forfeited shares account should be transferred to

(a) General reserve account

(b) Capital reserve account

(c) Securities premium account

(d) Surplus account

Answer:

(b) Capital reserve account

![]()

Question 5.

The amount received over and above the par value is credited to

(a) Securities premium account

(b) Calls in advance account

(c) Share capital account

(d) Forfeited shares account

Answer:

(a) Securities premium account

Question 6.

Which of the following statement is false?

(a) Issued capital can never be more than the authorised capital

(b) In case of under subscription, issued capital will be less than the subscription capital

(c) Reserve capital can be called at the time of.winding up

(d) Paid up capital is part of called up capital

Answer:

(b) In case of under subscription, issued capital will be less than the subscription capital

Question 7.

When shares are issued for purchase of assets, the amount should be credited to

(a) Vendors A/c

(b) Sundry assets A/c

(c) Share capital A/c

(d) Bank A/c

Answer:

(c) Share capital A/c

![]()

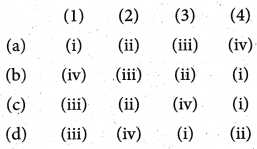

Question Match the pair and identify the correct option

(1) Under subscription – (i) Amount prepaid for calls

(2) Over subscription – (ii) Subscription above the offered shares

(3) Calls in arrear – (iii) Subscription below the offered shares

(4) Calls in advance -(iv) Amount unpaid on calls

Answer:

C

Question 9.

If a share ₹ 10 on the which ₹ 8 has been paid up is forfeited. Minimum reissue price is

(a) ₹ 10 per share

(b) ₹ 8 per share

(c) ₹ 5 per share

(d) ₹ 2 per share

Answer:

(d) ₹ 2 per share

Hint:

One share Rs. 10

(-) Paid up value Rs. 8 Each

Minimum Reissue Price 2 Each

![]()

Question 10.

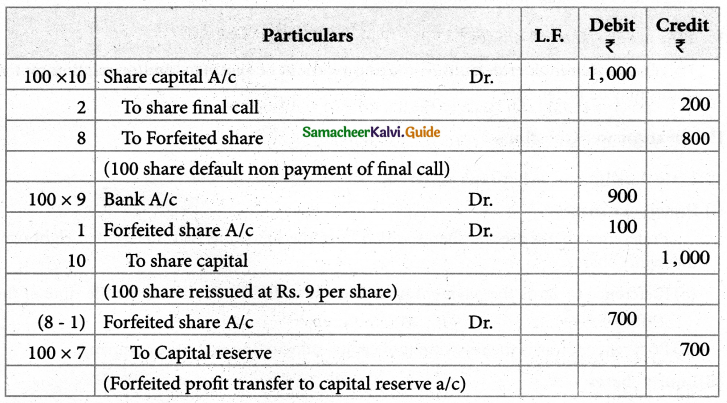

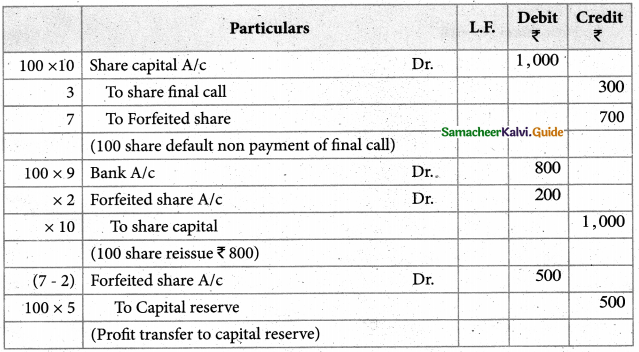

Supreme Ltd. forfeited 100 shares of ₹ 10 each for non-payment of final call of ₹ 2 per share. All these shares were re-issued at ₹ 9 per share. What amount will be transferred to capital reserve account?

(a) ₹ 700

(b) ₹ 800

(c) ₹ 900

(d) ₹ 1,000

Answer:

(a) ₹ 700

II Very Short Answer Questions

Question 1.

What is a share?

Answer:

The capital of a company is divided into small units of a fixed amount. These units are called shares. There are two types

- Preference shares and

- Equity shares.

Question 2.

What is Over-Subscription?

Answer:

When the number of shares applied for is more than the number of shares offered for subscription, it is said to be oversubscription.

![]()

Question 3.

What is meant by calls in arrears?

Answer:

When a shareholder fails to pay the amount due on the allotment or on calls, the amount remaining unpaid is known as calls in arrears.

Question 4.

Write a short note on the securities premium account.

Answer:

When a company issues shares at a price more than the face value (nominal value), the shares are said to be issued at a premium. The excess is called a premium amount and is transferred to a securities premium account.

Securities premium account is shown under reserves and surplus as a separate head in the Note to Account to the balance sheet.

Question 5.

Why are the shares forfeited?

Answer:

When a shareholder defaults in making payment of allotment/call money, the shares may be forfeited. On forfeiture, the share allotment is cancelled and to that extent, paid-up share capital reduced.

III Short Answer Questions

Question 1.

State the differences between preference shares and equity shares.

Answer:

(i) Preference shares

Preference shares are the shares which have the following two preferential right over, the equity shares:

- Preference towards the payment of dividend at a fixed rate during the lifetime of the company and.

- Preference towards the repayment of capital on winding up of the company.

(ii) Equity shares

Equity shares are those shares which do not preference shares. These shares do not enjoy any preferential rights. The rate of dividend is not fixed on equity shares and it depends upon the profits earned by the company. In case of winding up of a company equity shareholders are paid after the payment are made to preference shareholders. Equity shares are also known as ordinary shares.

![]()

Question 2.

Write a brief note on calls in advance.

Answer:

The excess amount paid over the called up value of a share is known as calls in advance. It is the excess money paid on application or allotment or calls. Such excess amounts can be returned or adjusted towards future payments. If the company decides to adjust such amount towards future payment, the excess amount is transferred to a separate account called a calls-in advance account.

Question 3.

What is a reissue of forfeited shares?

Answer:

Shares forfeited can be reissued by the company. The shares can be reissued at any price.

But, the reissue price cannot be less than the amount unpaid on forfeited shares.

When forfeited shares are reissued at a loss, such loss is to be debited to the forfeited shares account.

when forfeited shares are reissued at a premium, the amount of such premium will be credited to the securities premium account.

Question 4.

Write a short note on

- Authorized capital

- Reserve capital

Answer:

1. Authorised Capital: According to Sec 2(8) of the Companies Act, “It means such capital as is authorized by the memorandum of a company to be the maximum amount of share capital of the company”.

2. Reserve Capital: Sec 65 of Companies Act 2013, only an unlimited company having share capital while converting into a limited company, may have a reserve capital. The company reserve a part of its subscribed capital to be called up only at the time of winding up. It is called reserve capital.

![]()

Question 5.

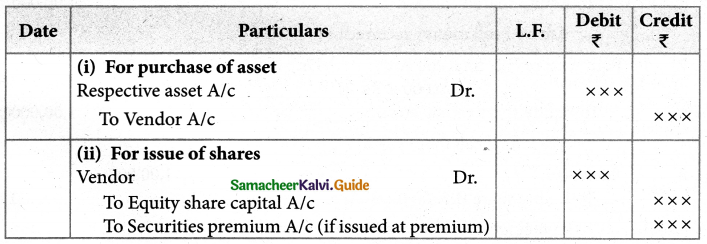

What is meant by the issue of shares for consideration other than cash?

Answer:

A company may issue shares for consideration other than cash when the company acquires fixed assets such as land and buildings, machinery, etc.

IV Exercises

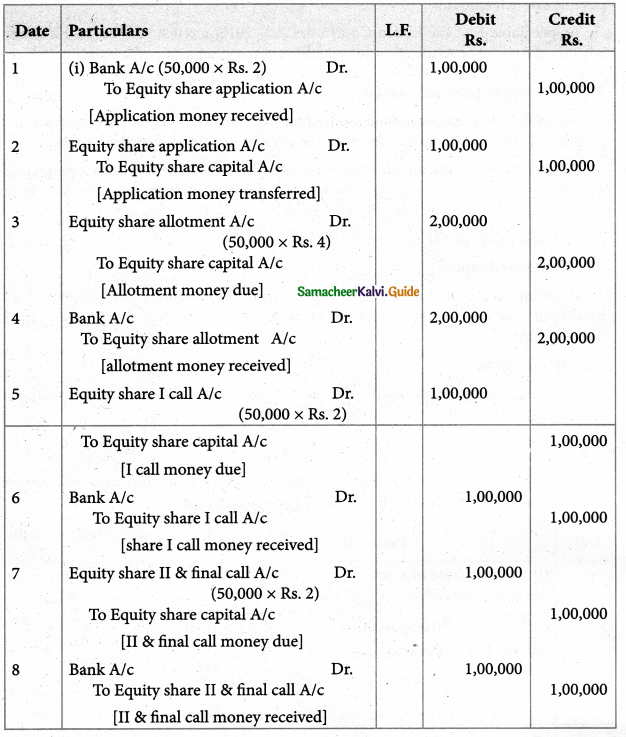

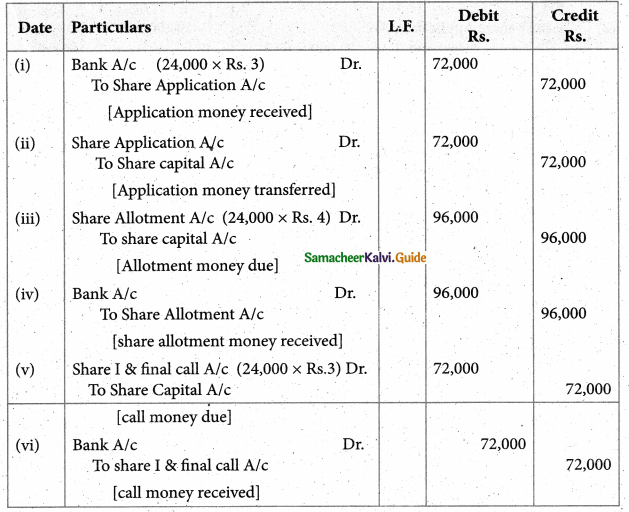

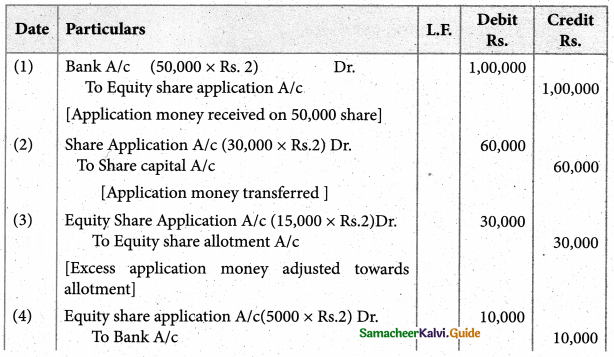

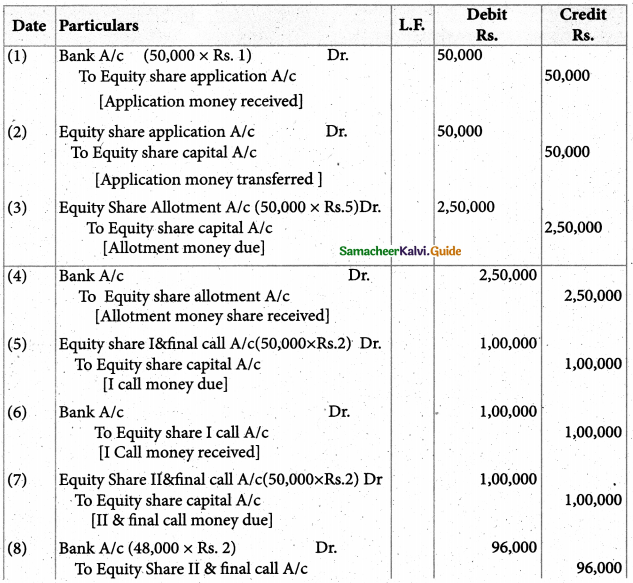

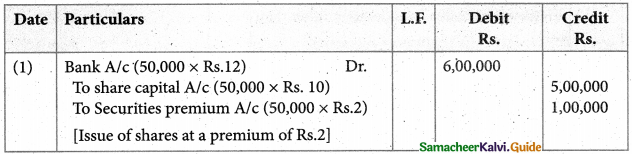

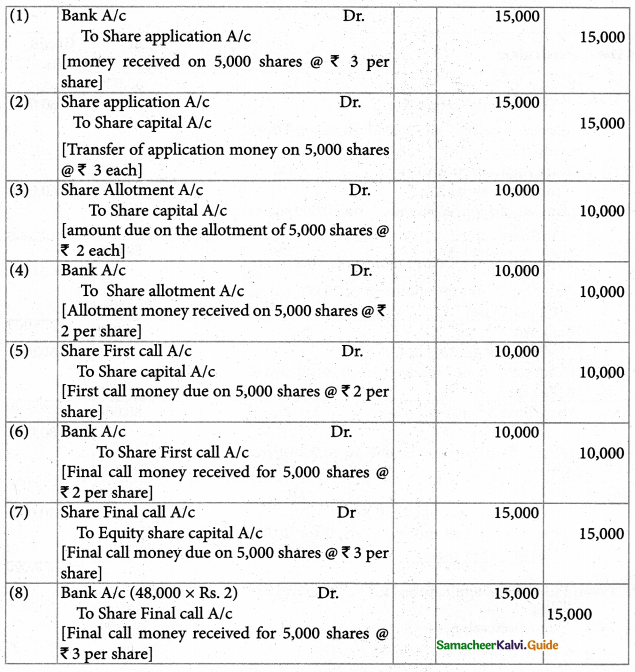

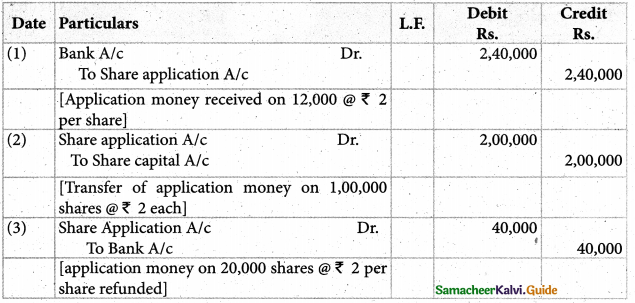

Question 1.

Progress Ltd. issued 50,000 ordinary shares of ₹ 10 each, payable ₹ 2 on the application, ₹ 4 on allotment ₹ 2 on first call and ₹ 2 on final call. All the shares are subscribed and the amount was duly received. Pass journal entries.

Solution :

![]()

Under Subscription

Question 2.

Sampath company issued 25,000 shares at ₹ 10 per share payable ₹ 3 on the application, ₹ 4 on allotment; ₹ 3 on first and final call. The public subscribed for 24,000 shares. The directors allotted all the 24,000 shares and received the money duly. Pass necessary journal entries.

Solution:

Over Subscription

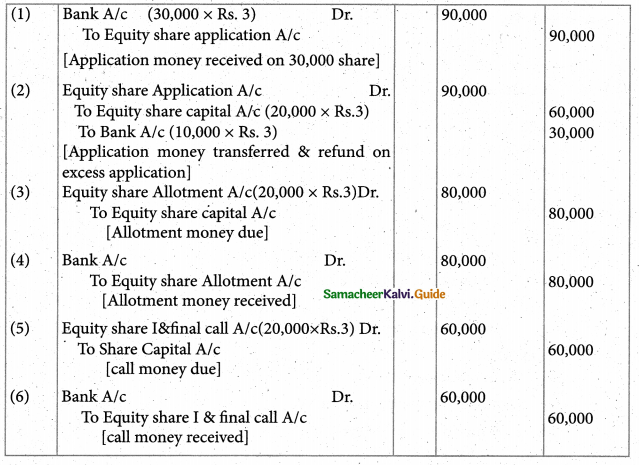

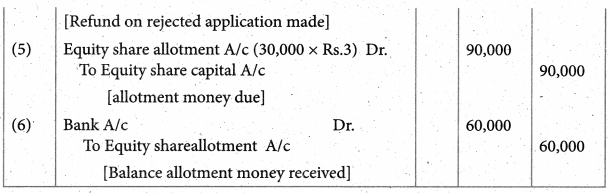

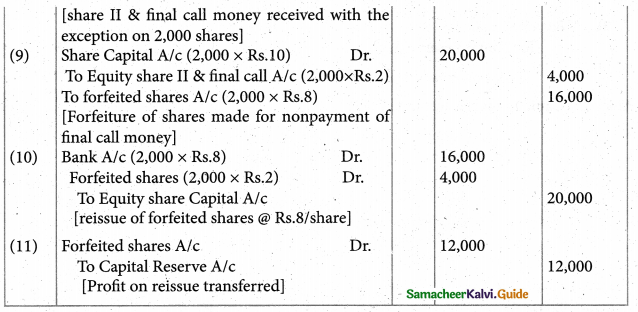

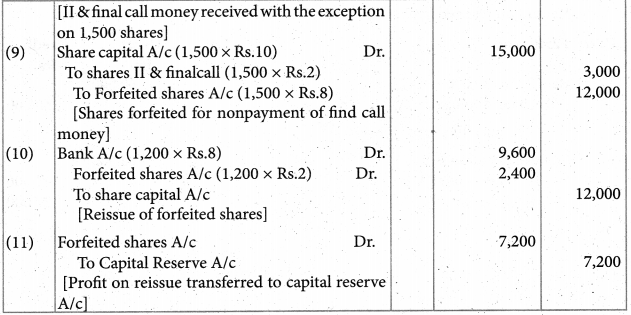

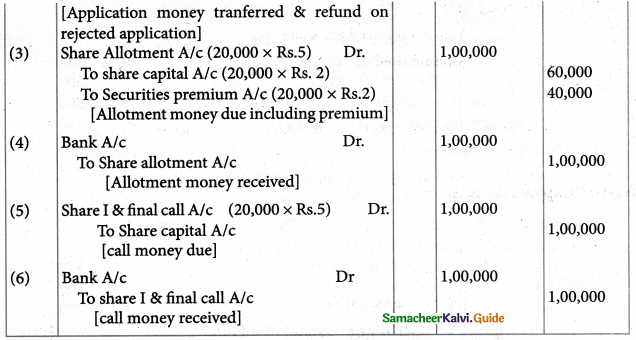

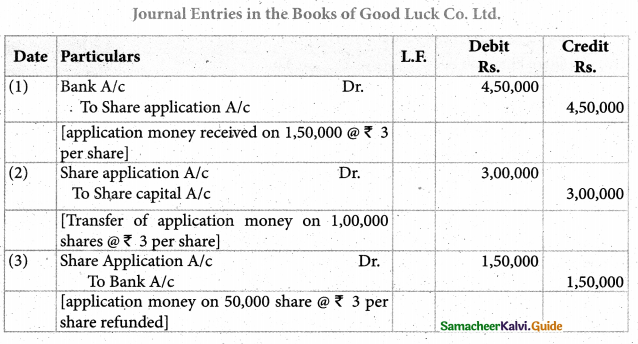

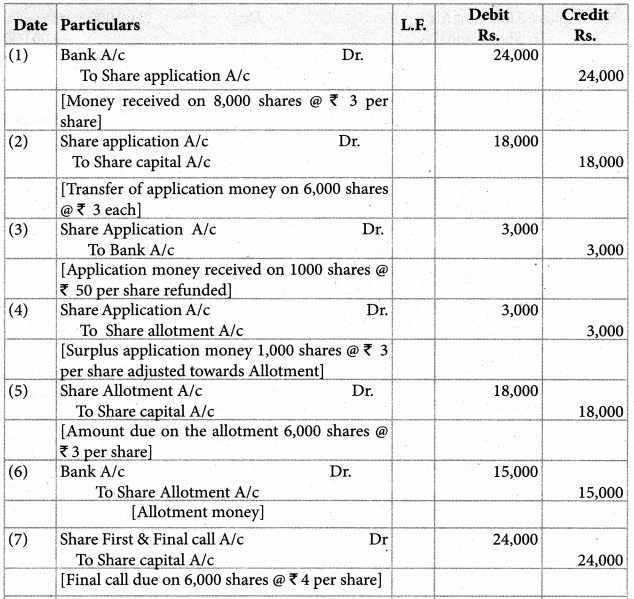

Question 3.

Saranya Ltd. issued 20,000 equity shares of ₹ 10 each to the public at par. The details of the amount payable on the shares are as follows:

On application – ₹ 3 per share

On allotment – ₹ 4 per share

On first and final call – ₹ 3 per share

Application money was received on 30,000 shares. Excess application money was refunded immediately. Pass journal entries are as follows:

Solution:

![]()

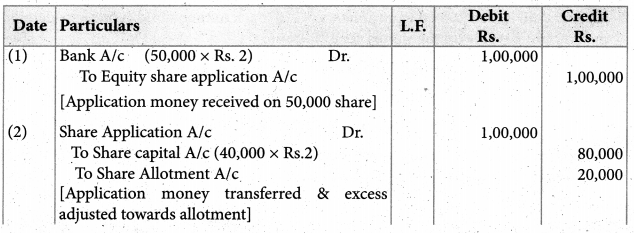

Question 4.

Gaja Lid issued 40,000 shares of ₹ 10 each of the public payable ₹ 2 on the application, ₹ 5 on the allotment, and ₹ 3 on the first and final call. The application was received for 50,000 shares. The Directors decided to allot 40,000 shares on a pro-rata basis and a surplus of application money was utilized for allotment. Pass journal entries assuming that the amount due was received.

Solution :

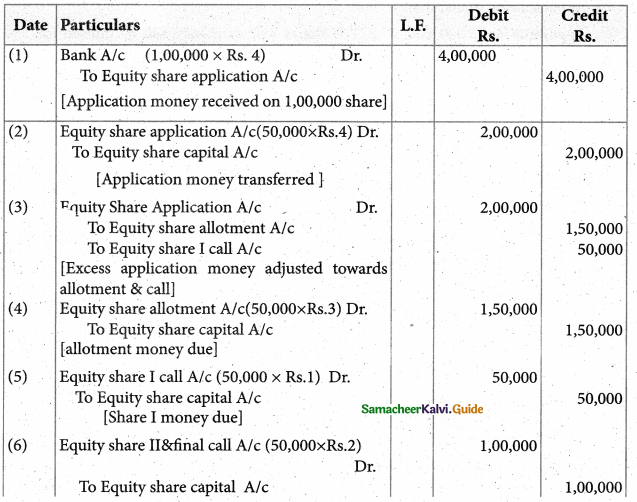

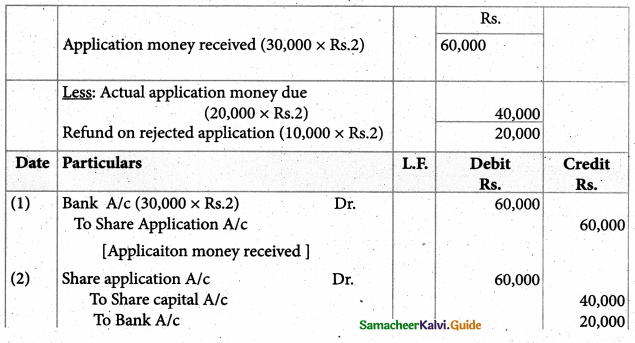

Question 5.

Lalitha Ltd. offered 30,000 equity shares ₹10 each to the public payable ₹ 2 per share on the application, ₹ 3 on share allotment, and the balance when required. Applications for 50,0 shares were received on which directors allotted as:

Applicants for 10,000 shares Full

Applicants for 35,000 shares 20,000 shares (excess money will be utilized for allotment

Applicants for 5,000 shares Nil

All the money due was received. Pass journal entries upto the receipt of allotment.

Solution :

![]()

Calls In advance

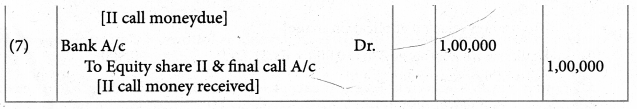

Question 6.

Das Ltd, offered 50,000 equity shares of ₹ 1 0 each to the public payable as follows: On applications were ₹ 4; on allotment ₹ 3; on first call 1 and on second and final call ₹ 2. Applications were received for 1,00,000 shares. All the applicants were allotted 1 share for every two shares applied. Excess application money was used for the amount due on allotment and call. Pass necessary journal entries.

Solution :

Question 7.

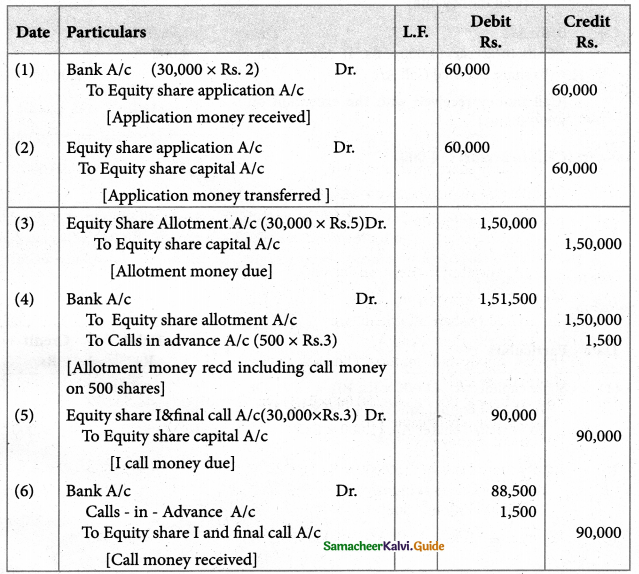

Anjali Flour Ltd. with a registered capital of ₹ 4,00,000 in equity shares of ₹ 10 each, issued 30,0 of such shares; payable ₹ 2 per share on the application, ₹ 5 per share on the allotment, and ₹ 3 shares on the first call. The issue was duly subscribed.

All the money payable was duly received but on the allotment, one shareholder paid the entire balance on his holding of 500 shares. Give journal entries to record the I transactions.

Solution :

Calls in Advance

Question 8.

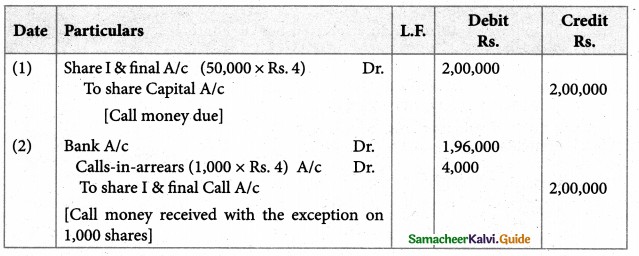

Muthu Ltd. issued 50,000 shares of ₹ 10 each payable as follows; ₹ 2 on the application; ₹ 4 on allotment; ₹ 4 on first and final, call.

All money payable was duly received except one shareholder holding 1,000 shares failed to pay the call money. Pass the necessary journal entries for calls by using calls in the arear account.

Solution :

Answer:

Calls in arrear: ₹ 4,000

![]()

Forfeiture os Shares

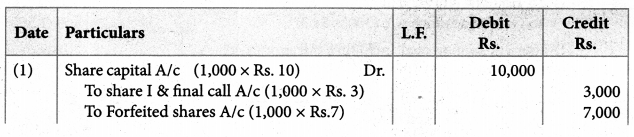

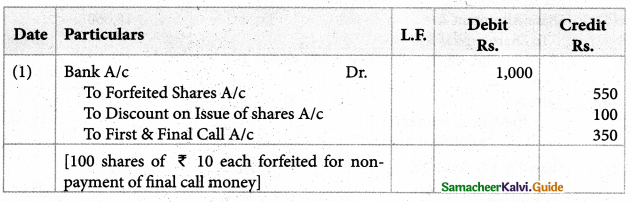

Question 9.

Arjun was holding 1,000 shares ₹ 10 each of Vanavill Electronics Ltd, issued at par. He paid ₹ 3 on the application, ₹ 4 on the allotment but could not pay the first and final call of ₹ 3. The directors forfeited the shares for nonpayment of call money. Give Journal entry for forfeiture of shares.

Solution :

Answer:

Forfeited shares account: ₹ 7,000

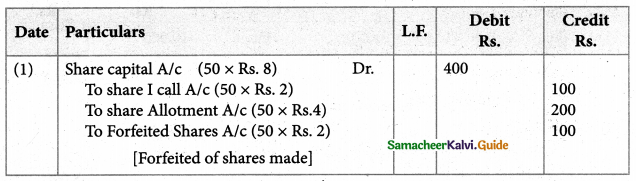

Question 10.

Lakshmi was holding 50 hares of ₹ 10 each on which he paid ₹ 2 on application but could not pay ₹ 4 on the allotment and ₹ 2 on first call. Directors forfeited the shares after the first call. Give journal entry for recording the forfeiture of shares.

Solution :

Answer:

Forfeited shares account: ₹ 100

Reissue of shares

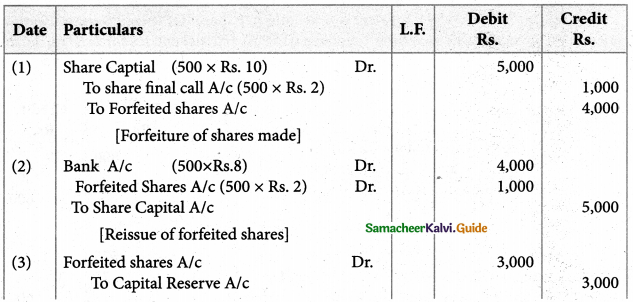

Question 11.

Goutham Ltd. forfeited 500 equity shares of ₹ 10 each issued at par held by Ragav for nonpayment of the final call of ₹ 2 per share. The shares were forfeited and reissued to Madhan at ₹ 8 per share. Show the journal entries for forfeiture and reissue.

Solution :

![]()

Answer:

Capital reserve account: ₹ 3,000

![]()

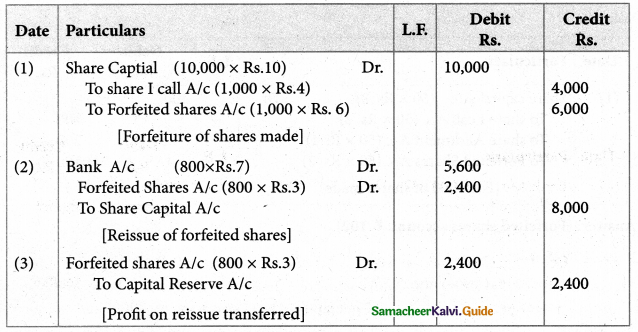

Question 12.

Nivetha Ltd. forfeited 1,000 equity shares of ₹ 10 each for non-payament of call of ₹ 4 per share. Of these 800 shares were reissued @ ₹ 7 per share. Pass journal entries for forfeiture and reissue?

Solution :

Answer:

Capital reserve account: ₹ 2,400

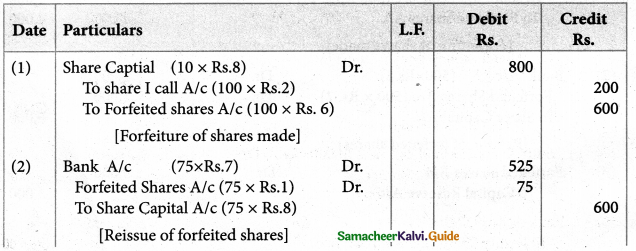

Question 13.

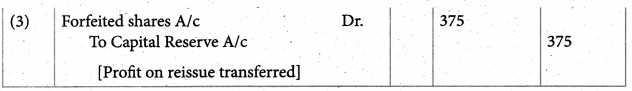

Nathiya Textiles Ltd. forfeited 100 shares of ₹ 10 each, ₹ 8 called up, on which Mayuri had paid application and allotment money of 6 per share. Of these 75 shares were reissued to soundayya by receiving ₹ 7 per share. Pass journal entries for forfeiture and reissue?

Solution :

Answer:

Capital reserve account ₹ 375.

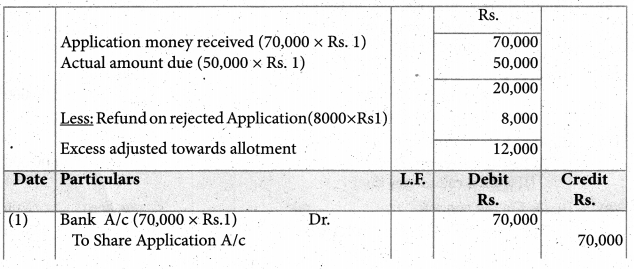

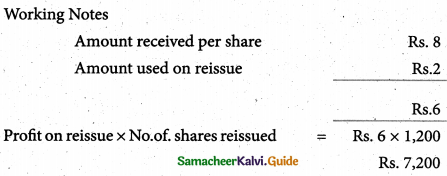

Question 14.

Simon Ltd issued 50,000 equity shares of ₹ 10 each at par payable on-application ₹ 1 per share, on allotment ₹ 5 per share, on first call ₹ 2 per share, and on second and final call ₹ 2 per share. The issue was fully subscribed and all the amounts were duly received with exception of 2,000 shares held by chezhian, who failed to pay the second and final call. His shares were forfeited and reissued to Elango at ₹ 8 per share. Journalise the above transactions?

Solution

Answer:

Capital reserve account: ₹ 12,000

![]()

Question 15.

Kanchana Ltd. issued 50,000 shares ₹ 10 each payable as under?

On application ₹ 1

On allotment ₹ 5

On first call ₹ 2

On final call ₹ 2

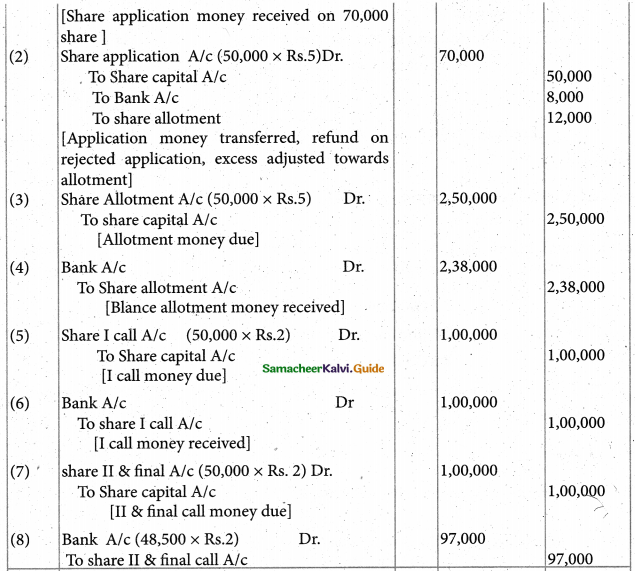

Applications were received for 70,000 shares. Applications for 8,000 shares were rejected and allotment was made proportionately towards the remaining applications. The directories made both the calls and all the amounts were received except the final call on 1,500 shares which were subsequently forfeited. Later 1.200 forfeited shares were reissued by receiving ₹ 8 per share. Give journal entries.

Solution :

Answer:

Capital reserve account: ₹ 7,200

Shares issued premium

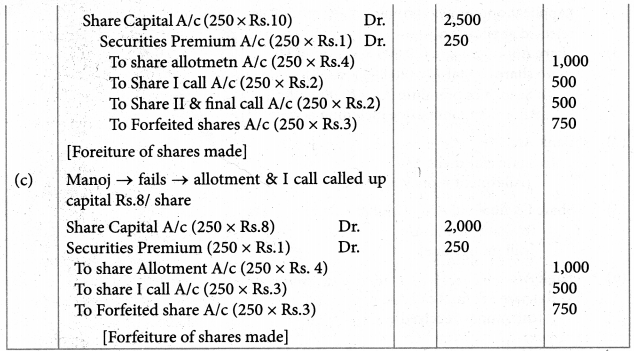

Question 16.

Viswanath Furniture Ltd. invited applications for 20,000 shares of ₹ 10 each at a premium of 2 per share payable?

₹ 2 On application

₹ 5 (including premium) on the allotment

₹ 5 On the first and final call

There were oversubscription and applications were received for 30,000 shares and the excess applications were rejected by the directors. Pass the journal entries.

Solution :

![]()

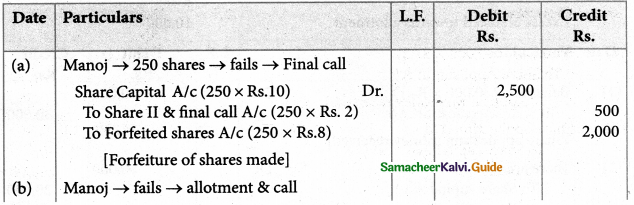

Question 17.

United Industries Ltd. issued shares of ₹ 10 each at 10% premium payable ₹ 3 on the application, ₹ 4 on the allotment (including premium), ₹ 2 on the first call, and ₹ 2 on the final call.

Journalise the transections relating to forfeiture of shares for the following situations: Manoj who holds 250 shares failed to pay the second and final call and his shares were forfeited.

Manoj who holds 250 shares field to pay the allotment money and first call and second and final call and his shares were forfeited.

Manoj who holds 250 shares failed to pay the allotment money and first call money and his shares were forfeited after the first call.

Solution:

Answer:

Forfeited shares account: (i) ₹ 2,000; (ii) ₹ 750; (iii) ₹ 750

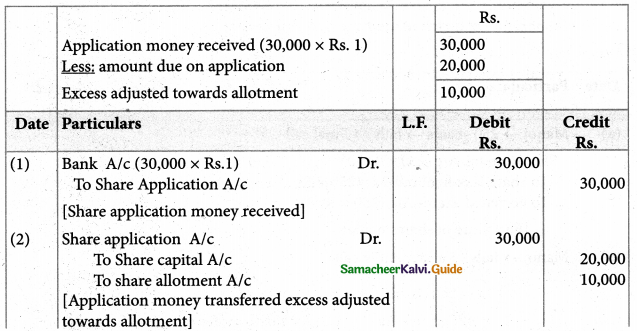

Question 18.

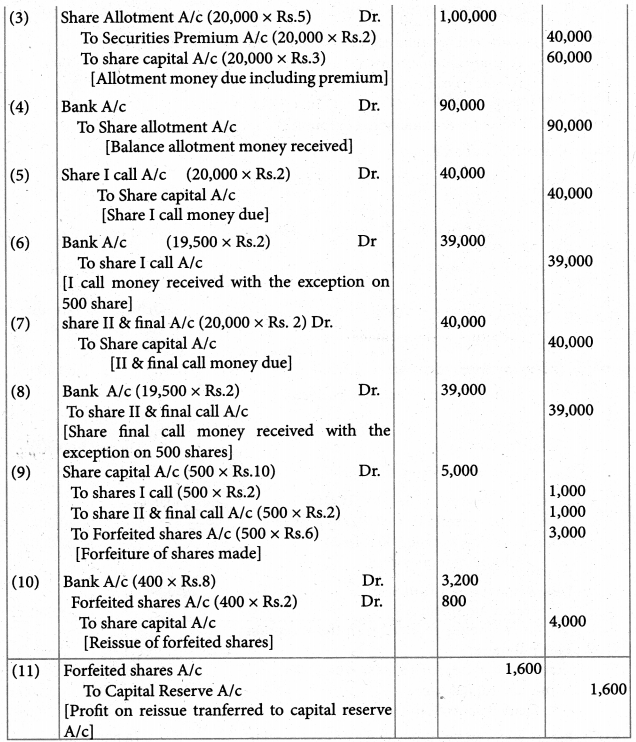

Kasthuri Ltd. had allotted 20,000 shares to applicants of 30,000 shares on a pro-rata basis. The amount payable was ₹ 1 on the application, ₹ 5 on the allotment (including a premium of ₹ 2 each), and ₹ 2 on the first call and ₹ 2 on final calls, Subin, a shareholder failed to pay the first call and final call on his 500 shares. All the shares were forfeited and out of the 400 shares were re-issued @ ₹ 8 per share. Pass necessary journal entries.

Solution :

Answer:

Capital reserve account: ₹ 1,600

![]()

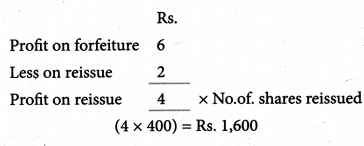

Question 19.

Vairam Ltd. issued 60,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as follows:

On application ₹ 6

On allotment ₹ 4 (including premium)

On the first and final call ₹ 2

The issue was fully subscribed and the amount due was received except Saritha to whom 1,000 shares were allotted who failed to pay the allotment money and first and final call money. Her shares were forfeited. All the forfeited shares were reissued to Parimala at ₹ 7 per share.

Solution :

Answer:

Capital reserve account: ₹ 3,000

Issue of shares for cash in lumpsum

Question 20.

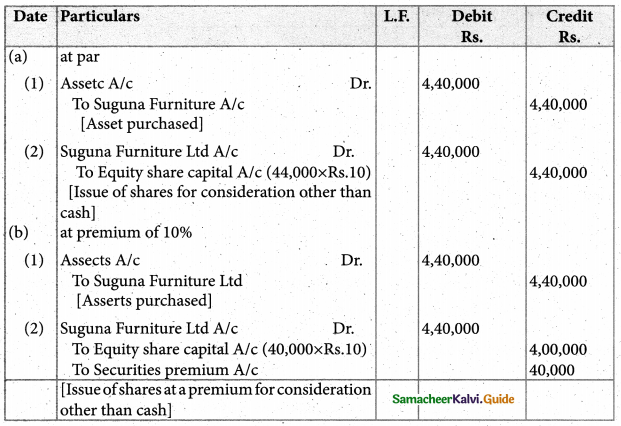

Abdul Ltd. issue 50,000 shares of ₹ 10 each at a premium of ₹ 2 per share. Pass journal entry if the amount is fully received along with a premium amount of ₹ 2 per share.

Solution :

Answer:

Share capital account ₹ 5,00,000; Securities premium account ₹ 1,00,000

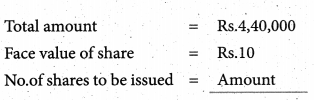

Issue of shares for consideration other than cash

Question 21.

Paradise Ltd. purchased assets of ₹ 4,40,000 from Suguna Furniture Ltd. It issued equity shares of ₹ 10 each fully paid in satisfaction of their claim. What entries will be made if such issue is: (a) at par and (b) a premium of 10%.’

Solution :

Calculation of the number of shares to be issued

![]()

Answer:

(a) Share capital account: ₹ 4,40,000;

(b) Share capital account ₹ 4,00,000; Securities premium account ₹ 40,000

12th Accountancy Guide Company Accounts Additional Important Questions and Answers

I Multiple Choice Questions

Question 1.

A company issued 3,00,000 shares of Rs.10 each to the public but only 1,50,000 shares were subscribed. It’s subscribed capital is

(a) Rs. 30,00,000

(b) Rs. 15,00,000

(c) Rs. 10,00,000

Hint:

issued No. of share = 3,00,000

Subscribed No. of share = 1,50,000

Each share Rs. 10

Now ask the Question

No. of Subscribed Capital × Each Share

= 1,50,000 × 10 = ₹ 15,00,000

Answer:

(b) Rs. 15,00,000

Question 2.

The directors of a company forfeited 100 shares of Rs.10 each on which the final call, money of Rs.3 was not paid Later these shares were reissued of Rs.800 capital reserve will be

(a) Rs. 700

(b) Rs.500

(c) Rs. 500

Answer:

(b) Rs.500

Question 3.

When more applications are received than that are offered to the public it is called.

(a) Under subscription

(b) Full subscription

(c) Oversubscription

Answer:

(c) Oversubscription

![]()

Question 4.

Captial reserve is shown on the ………….. ride of the B/s

(a) Liability

(b) Assets

(c) Both

Answer:

(a) Liability

Question 5.

The balance of forfeited shares A/c is ……………. is in the B/s

(a) Added to paid-up capital

(b) Added to the authorized capital

(c) deducted from paid to capital

Answer:

(a) Added to paid-up capital

Question 6.

Calls-in-arrears are shown in the B/s as

(a) Deduction from called up capital

(b) Addition to paid-up capital

(c) Addition to issued capital

Answer:

(a) Deduction from called up capital

![]()

Question 7.

A company issued 20,000 Es of Rs.100 each to the public, but only 18,000 shares were subscribed, its subscribed capital is Rs.

(a) Rs. 20,00,000

(b) Rs. 18,00,000

(c) Rs. 21,00,000

Hint:

issued No. of share = 20,000

Paid up No. of share = 18,000

Each share = ₹ 10

∴ Now

Paid up Capital is

= 18,000 x 100

= ₹ 18,00,000 .

Answer:

(b) Rs. 18,00,000

Question 8.

A company issued 50,000 shares of Rs. 10 each at a premium of Rs. 2 each …………… is the securities premium amount

(a) Rs. 50,000

(b) Rs. 1,00,000

(c) Rs. 1,50,000

Hint:

Premium – ₹ 2 Each

Securities premium = 50,000 × 2 = ₹ 1,00,000

Answer:

(b) Rs. 1,00,000

![]()

Question 9.

Securities premium will appear in the _

(a) Assets

(b) Liability

(c) Assets & Liability

Answer:

(b) Liability

Question 10.

A Company is an association of

(a) workers

(b) merchants

(c) persons

Answer:

(c) persons

III Short Answer Questions

Question 1.

Define Company.

Answer:

According to Lord Justice Lindsey, “A Company is an association of many persons who contribute money or money’s worth to common stock and employ it in some trade or business and who share the profit and loss arising therefrom. The common stock so contributed is denoted in money and is the capital of the company. The persons who contributed in it or from it, or to whom it belongs, are members. The proportion of capital to which each member is entitled is his share”.

Question 2.

What are the characteristic features of the company?

Answer:

Following are the characteristics of a company:

- Voluntary association: A Company is a voluntary association of persons. No law can compel persons to form a company.

- Separate legal entity: Company is an artificial person. It has a separate legal entity which is separate and distinct from its members.

- Common seal: A company may have a common seal which can be affixed on the documents.

- Perpetual succession: A company continues forever. Its continuity is not affected by the changes in its members. It can be wound up only by law.

- Limited liability: The liability of the shareholders of the company is limited to the extent of the face value of the shares held by the shareholders.

- Transferability of shares: The shares of a company are freely transferable except in case of a private company.

![]()

Question 3.

Write short notes on

- Issued capital

- Subscribed capital

- Called up capital

- Paid-up capital

Answer:

- Issued capital: This represents that part of authorized capital which is offered for subscription.

- Subscribed capital: It refers to that part of issued capital which has been applied for and also allotted by the company.

- Called up capital: It refers to that part of subscription capital which has been called up by the company for payment.

- Paid-up capital: It is that part of called up capital which has been actually paid by the shareholders.

Question 4.

What do you mean by under subscription?

Answer:

All the shares offered to the public may not be subscribed in full. When the number of shares subscribed is less than the number of shares offered, it is known as under subscription.

Question 5.

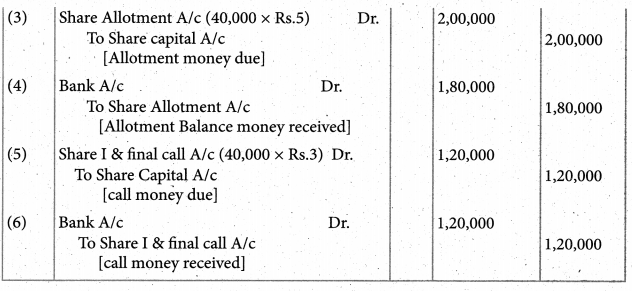

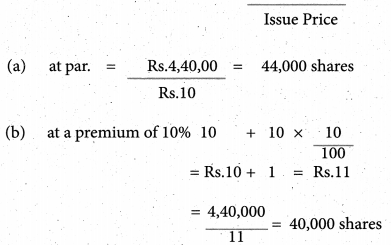

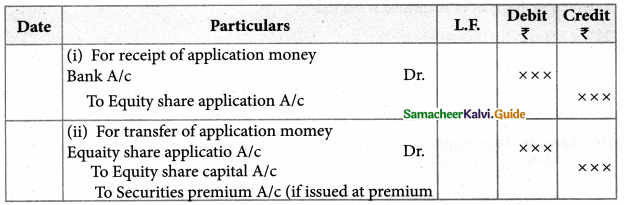

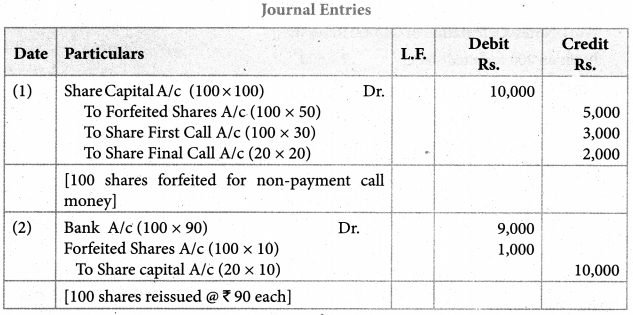

What are the journal entries passed when shares are issued for cash in lumpsum?

Answer:

![]()

IV Exercises

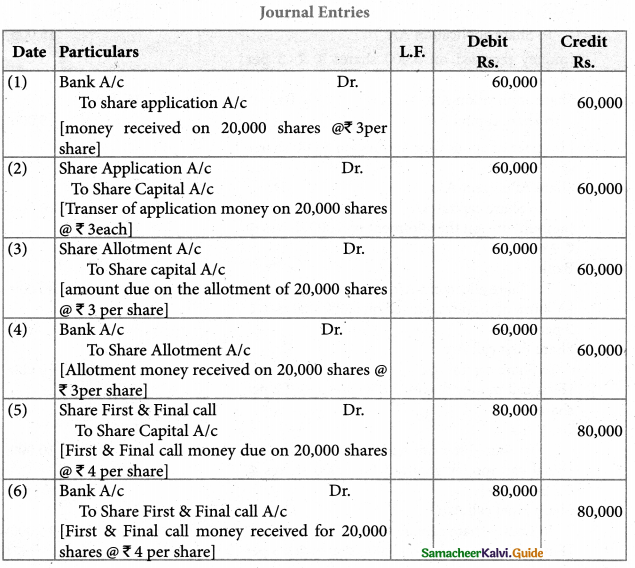

Question 1.

A company issued 20,000 shares of ₹ 10 each payable as follows:

₹ 3 on Application,

₹ 3 on Allotment,

₹ 4 on First and Final call.

All the shares were subscribed and duly paid for. Pass journal entries.

Solution :

Question 2.

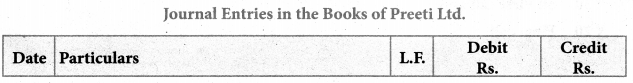

Preeti Ltd. invited applications for 5,000 shares of ₹ 10 each payable as follows:

₹ 3 on Application,

₹ 2 on Allotment,

₹ 2 on First call and

₹ 3 Final call

All these shares were subscribed and paid. Pass journal entries.

Solution:

![]()

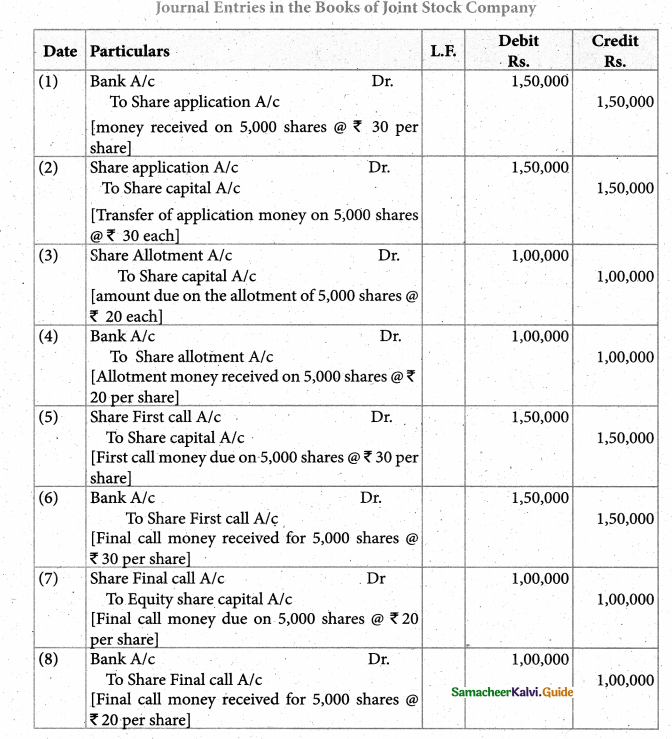

Question 3.

A Joint Stock Company had a Nominal Capital of 5,00,000 divided into 5,000 shares ₹ 100 each payable:

₹ 30 per share on Application,

₹ 20 per share on Allotment,

₹ 30 on First call and

₹ 20 Final call

All the shares were subscribed and fully paid for by the public. Pass journal entries.

Solution :

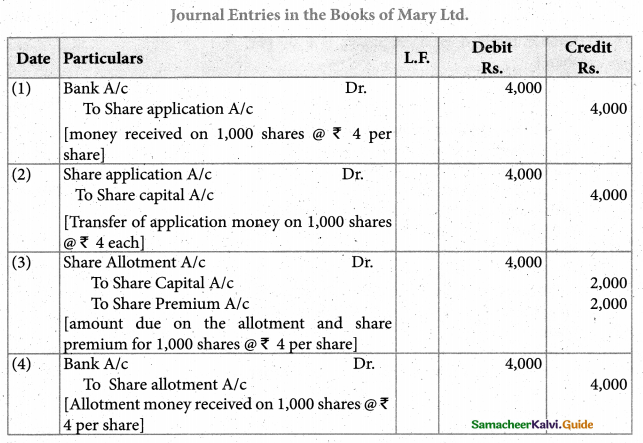

Question 4.

Mary Ltd. Issued 1,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as follows:

₹ 4 on Application,

₹ 4 on Allotment, (including premium

and the balance when required. All the shares were subscribed for and duly paid. Pass necessary Journal entries.

Solution :

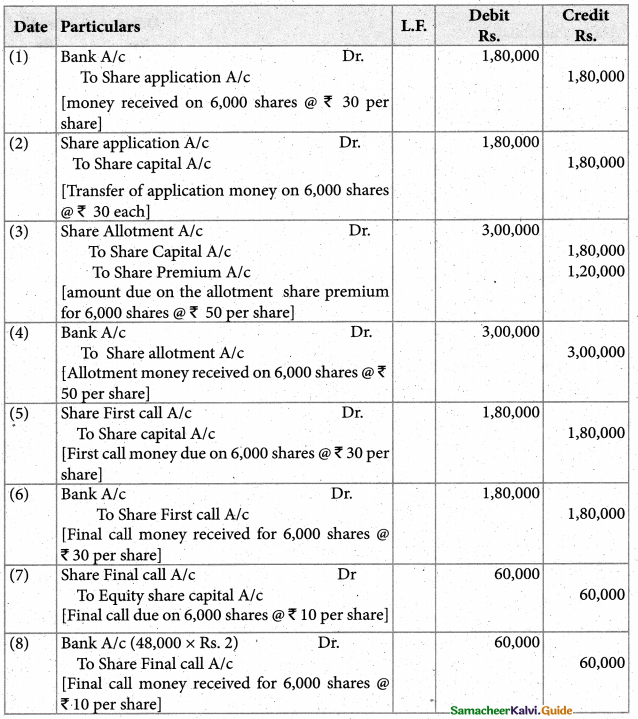

Question 5.

Global Ltd. issued 6,000 shares on ₹ 100 each at a premium of ₹ 20 per share payable as follows:

₹ 30 on Application,

₹ 50 Oon Allotment, (including premium)

₹ 30 on First call and

₹ 10 Final call

All shares were duly subscribed and money due was fully received. Pass journal entries.

Solution :

Journal Entries in the Books of Global Ltd

![]()

Question 6.

On 1.1.98 Alpha Ltd issued 1,00,000 shares of ₹ 10 each payable ₹ 2 on application. The company received applications for 1,20,000 shares. The excess applications were rejected. and money refunded Pass necessary entries.

Solution :

Journal Entries in the Books of Alpha Ltd

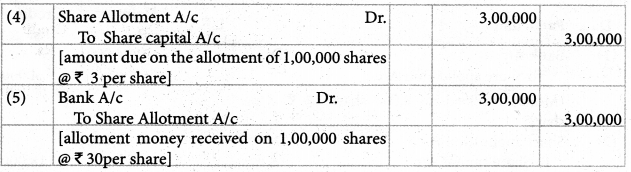

Question 7.

Good Luck Co. Ltd issued 1,00,000 shares @ 10 each payable:

₹ on Application,

₹ on Allotment,

and the balance when required. 1,50,000 shares were, applied for. The directors rejected the excess applications and refunded the application money. All money was received. Pass entries to record the transactions.

Solution :

Question 8.

Bhagavathi Ltd. issued 10,000 shares of ₹ 10 each at a discount of 10% payable as follows:

on Application, ₹2.50

on Allotment, ₹ 3.00

On the First and Final call ₹ 3.50

All money due was received except the final call on 100 shares which were forfeited by the company after giving due notice. Pass the forfeited entry.

Solution :

![]()

Question 9.

Ganthimathi Ltd. was registered with a nominal capital of ₹ 1,00,000 in equity shares of ₹ 10 each. It offered to the public 6,000 shares for subscripted The application was, however, received for 8,000 shares. The directors had to reject the application for 1,000 shares and to return the money received by Theron. The application money received on the other 1,000 shares was adjusted to the allotment account. The amount payable on shares was

₹ 3 per share on Application,

₹ 3 per share on Allotment and the balance on the first and final call

On shareholder holding, 100 shares failed to pay the call money and as a result, his shares were forfeited. Pass the necessary journal entries.

Solution :

Journal Entries in the Books of Ghandhimathi Ltd

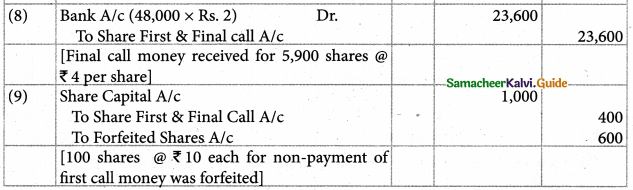

Question 10.

Gani Ltd. forfeited 20 shares of ₹ 10 each fully called up, held by Santha for nonpayment of final call of 4 per sháre. These shares were re-issued to Josephin for ₹ 8 per share as fully paid up. Give journal entries for the forfeited and re-issue of shares.

Solution :

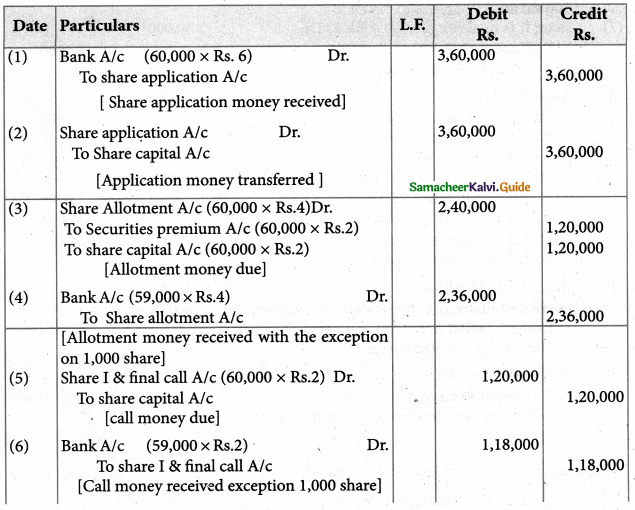

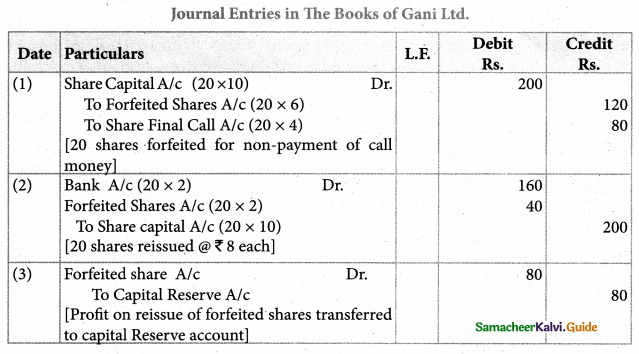

Question 11.

A Company forfeited 100 equity shares of ₹ 100 each issued at a premium of 10% (to be paid at the time of allotment) on which first call money of ₹ 30 per share and final call of ₹ 20 were not received. These shares were forfeited and subsequently re-issued at 90 per share. Give necessary journal entries regarding forfeited and re-issue of shares.

Solution :

![]()

Question 12.

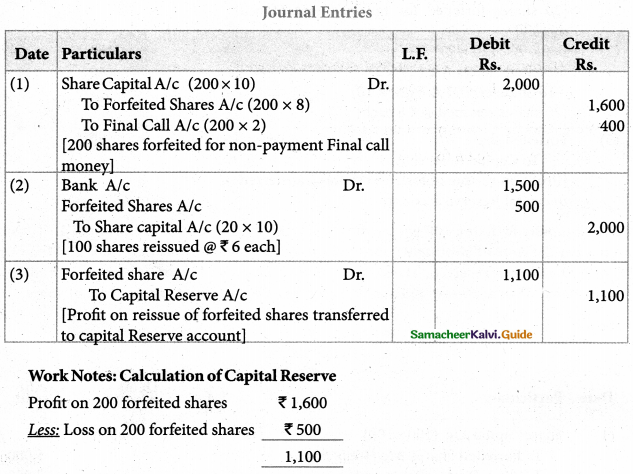

The Directors of a company forfeited 200 Equity shares of ₹ 10 each fully called upon which the final call of ₹ 2 has not been paid. The shares were re-issued upon payment of ₹ 1,500. Journalise the above transactions.

Solution :

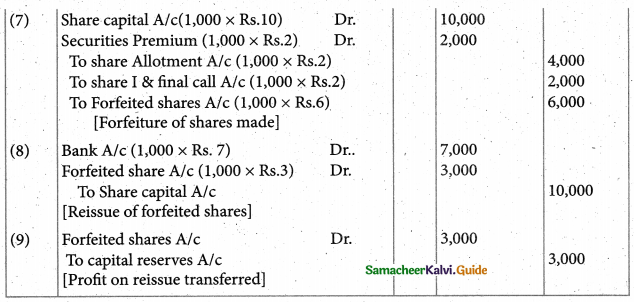

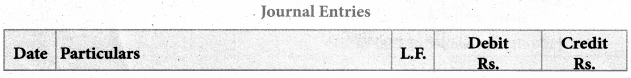

Question 13.

The Director of a company forfeited 100 shares of ₹ 10.each fully called up for non-payment of the First call of ₹ 2 per share and Final call of ₹ 3 per share. 60 of these shares were subsequently re-issued at 6 per share fully paid up. Pass necessary Journal entries to record the above.

Solution :

![]()

Question 14.

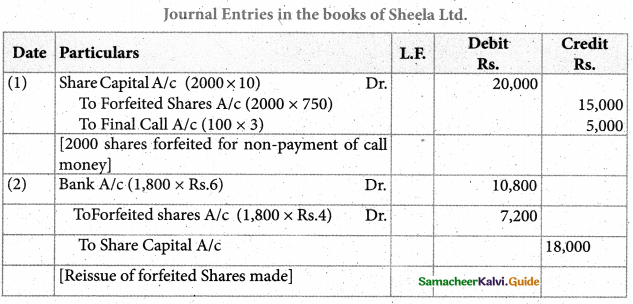

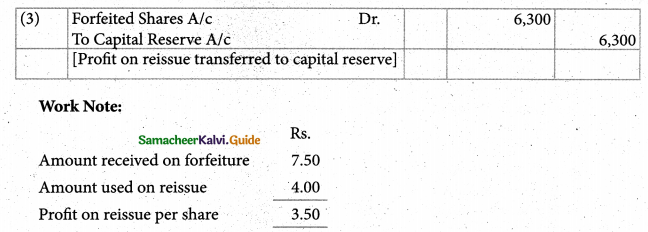

The directors of Sheeia Ltd. forfeited 2,000 shares ₹ 10 each for non-payment of final call of ₹ 2.50. 1,800 of these shares were re-issued for ₹ 6 per share fully paid up. Give the necessary Journal entries.

Solution :

Amount to be transferred to Capital reserve A/c = Profile on reissue × No.of share reissued

= 3.50 × 1,800

= Rs.6,300