Students can Download Tamil Nadu 12th Economics Model Question Paper 4 English Medium Pdf, Tamil Nadu 12th Economics Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 12th Economics Model Question Paper 4 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3.00 Hours

Maximum Marks: 90

PART – I

Choose the correct answer. Answer all the questions: [20 × 1 = 20]

Question 1.

An economic system where the economic activities of a nation are done both by the private and public together is termed as……….

(a) Capitalistic Economy

(b) Socialistic Economy

(c) Globalisic Economy

(d) Mixed Economy

Answer:

(d) Mixed Economy

Question 2.

In a socialist economy, all decisions regarding production and distribution are taken by

(a) market forces

(b) central planning authority

(c) customs and traditions

(d) private sector

Answer:

(b) central planning authority

Question 3.

State whether the statements are true or false.

(i) Capitalism and Socialism are same approaches.

(ii) Capitalism and Socialism are two extreme and opposite approaches.

(a) Both (i) and (ii) are true

(b) Both (ii) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(d) (i) is false but (ii) is true

![]()

Question 4.

Net National product at factor cost is also known as………….

(a) National Income

(b) Domestic Income

(c) Per capita Income

(d) Salary

Answer:

(a) National Income

Question 5.

……….. helps to build economic models both in short run and long run.

(a) National Income

(b) Personal Income

(c) Per Capita Income

(d) State Income

Answer:

(d) State Income

Question 6.

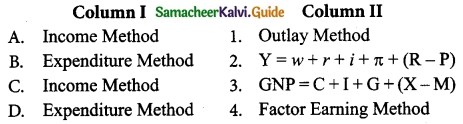

Match the following and choose the correct answer by using codes given below:

Code:

Answer:

(a) A-2, B-1, C-4, D-3

Question 7.

Assertion (A): The Income method is called Factor Earning Method.

Reason (R): This method approaches National Income from the distribution side.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 8.

Keynes theory pursues to replace, laissez faire by……….

(a) No government intervention

(b) Maximum intervention

(c) State intervention in certain situation

(d) Private sector intervention

Answer:

(c) State intervention in certain situation

Question 9.

……….. defines “Full employment as that level of employment at which any further increase in spending would resort in an inflationary spiral of wages and prices”

(a) Lerner

(b) J.M. Keynes

(c) J.B. Say

(d) Adam Smith

Answer:

(a) Lerner

Question 10.

State whether the statements are true or false.

(i) The function of money is a medium of exchange on the one side and a store of value on the other side is called Keynesianism. ‘

(ii) Macro approach to national problems.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are true

Question 11.

The multiplier tells us how much……….changes after a shift in………..

(a) Consumption, income

(b) investment, output

(c) savings, investment

(d) output, aggregate demand

Answer:

(d) output, aggregate demand

Question 12.

Accelerator Model was made by………..

(a) J.M. Keynes

(b) J.M. Clark

(c) R.F. Khan

(d) Marshall

Answer:

(b) J.M. Clark

Question 13.

Which of the following is correctly matched:

(a) Aggregate Income – C

(b) Consumption expenditure – IA

(c) Autonomous Investment – Y

(d) Induced Private Investment – IP

Answer:

(d) Induced Private Investment – IP

Question 14.

During depression the level of economic activity becomes extremely………..

(a) high

(b) bad

(c) low

(d) good

Answer:

(c) low

Question 15.

Online Banking is also known as …………

(a) E-Banking

(b) Internet Banking

(c) RTGS

(d) NEFT

Answer:

(b) Internet Banking

Question 16.

Fixed Deposits are otherwise known as

(a) Bank Deposits

(b) Customer’s Deposits

(c) Time Deposits

(d) Money Deposits

Answer:

(c) Time Deposits

![]()

Question 17.

IMF is a prerequisite to become a member of

(a) SDR

(b) SAF

(c) World Bank

(d) SAF

Answer:

(c) World Bank

Question 18.

Environmental goods are ………….

(a) Market goods

(b) Non-market goods

(c) Both

(d) None of the above

Answer:

(b) Non-market goods

Question 19.

Expansion of NITI Aayog?

(a) National Institute to Transform India

(b) National Institute for Transforming India

(c) National Institution to Transform India

(d) National Institution for Transforming India

Answer:

(d) National Institution for Transforming India

Question 20.

Which of the following is not correctly matched:

(a) Financial planning

(b) NITI Aayog

(c) Seven pillars of effective governance

(d) Physical planning

Answer:

(c) Seven pillars of effective governance

PART – II

Answer any seven question in which Question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

Explain the Expenditure Method (Outlay Method) precautions. Precautions

Answer:

- Second hand goods: The expenditure made on second hand goods should not be included.

- Purchase of shares and bonds: Expenditures on purchase of old shares and bonds in the secondary market should not be included.

- Transfer payments: Expenditures towards payment incurred by the government like old age pension should not be included.

- Expenditure on intermediate goods: Expenditure on seeds and fertilizers by farmers, cotton and yam by textile industries are not to be included to avoid double counting. That is only expenditure on final products are to be included.

Question 22.

Give short note on frictional unemployment.

Answer:

Frictional Unemployment (Temporary Unemployment) :

Frictional unemployment arises due to imbalance between supply of labour and demand for labour. This is because of immobility of labour, lack of necessary skills, break down of machinery, shortage of raw materials etc. The persons who lose jobs and in search of jobs are also included under frictional unemployment.

Question 23.

Define Marginal Propensity to Save (MPS).

Answer:

Marginal Propensity to Save (MPS):

Marginal Propensity to Save is the ratio of change in saving to a change in income. MPS is obtained by dividing change in savings by change in income. It can be expressed algebraically as

MPS = \(\frac{ΔS}{ΔY}\)

ΔS = Change in Saving;

ΔY = Change in Income

Since MPC + MPS = 1

MPS = 1 – MPC and MPC = 1 – MPS

![]()

Question 24.

What is the meaning of trade cycle?

Answer:

Meaning of Trade Cycle

A Trade cycle refers to oscillations in aggregate economic activity particularly in employment, output, income, etc. It is due to the inherent contraction and expansion of the elements which energize the economic activities of the nation. The fluctuations are periodical, differing in intensity and changing in its coverage.

Question 25.

What is the meaning of Open Market Operations?

Answer:

In narrow sense, the Central Bank starts the purchase and sale of Government securities in the money market. In Broad Sense, the Central Bank purchases and sells not only Government securities but also other proper eligible securities like bills and securities of private concerns.

Question 26.

What is credit creation?

Answer:

Credit Creation means the multiplication of loans and advances. Commercial banks receive deposits from the public and use these deposits to give loans: However, loans offered are many times more than the deposits received by banks. This function of banks is known as ‘Credit Creation’.

Question 27.

State any two merits of trade.

Answer:

- Trade is one of the powerful forces of economic integration.

- The term ‘trade’ means exchange of goods, wares or merchandise among people.

Question 28.

What is Secular Disequilibrium?

Answer:

Secular Disequilibrium: The secular or long-run disequilibrium in BOP occurs because of long-run and deep seated changes in an economy as it advances from one stage of growth to another. In the initial stages of development, domestic investment exceeds domestic savings and imports exceed exports, as it happens in India since 1951.

Question 29.

Who are “dialogue partners”?

Answer:

The ASEAN, there are six “dialogue partners” which have been participating in its deliberations. They are China, Japan, India, South Korea, New Zealand and Australia.

Question 30.

Mention the indicators of development.

Answer:

- Economic development is regarded as a process whereby there is an increase in the consumption of goods and services by individuals.

- From the welfare perspective, economic development is defined as a sustained improvement in health, literacy and standard of living.

PART – III

Answer any seven question in which Question No. 40 is compulsory. [7 x 3 = 21]

Question 31.

Enumerate the features of mixed economy.

Answer:

Features of Mixed Economy:

1. Ownership of Property and Means of Production: The means of production and properties are owned by both private and public. Public and Private have the right to purchase, use or transfer their resources.

2. Coexistence of Public and Private Sectors: In mixed economies, both private and public sectors coexist. Private industries undertake activities primarily for profit. Public sector firms are owned by the government with a view to maximize social welfare.

3. Economic Planning: The central planning authority prepares the economic plAnswer: National plans are drawn up by the Government and both private and public sectors abide. In general, all sectors of the economy function according to the objectives, priorities and targets laid down in the plan.

4. Solution to Economic Problems: The basic problems of what to produce, how to produce, for whom to produce and how to distribute are solved through the price mechanism as well as state intervention.

5. Freedom and Control: Though private has freedom to own resources, produce goods and services and distribute the same, the overall control on the economic activities rests with the government.

![]()

Question 32.

What is the solution to the problem of double counting in the estimation of national income?

Answer:

- The value obtained is actually the GNP at market prices. Care must be taken to avoid double counting.

- The value of the final product is derived by the summation of all the values added in the productive process.

- To avoid double counting, either the value of the final output should be taken into the estimate of GNP or the sum of values added should be taken.

- Double counting is to be avoided under value added method.

- Any commodity which is either raw material or intermediate good for the final production should not be included.

- For example, value of cotton enters value of yam as cost, and value of yam in cloth and that of cloth in garments.

- At every stage value added only should be calculated.

Question 33.

Mention the expenditure method (or) out-lay method.

Answer:

The Expenditure Method (Outlay method): The total expenditure incurred by the society in a particular year is added together. To calculate the expenditure of a society, it includes personal consumption expenditure, net domestic investment, government expenditure on consumption as well as capital goods and net exports. Symbolically,

GNP = C + I + G + (X – M)

C – Private consumption expenditure

I – Private Investment Expenditure

G – Government expenditure

X – M = Net exports

Question 34.

Discuss the estimating the national income through the Income Method precautions.

Answer:

- Transfer payments are not to be included in estimation of national income as these payments are not received for any services provided in the current year such as pension, social insurance etc.

- The receipts from the sale of second hand goods should not be treated as part of national income as they do not create new flow of goods or services in the current year.

- Windfall gains such as lotteries are also not to be included as they do not represent receipts from any current productive activity.

- Corporate profit tax should not be separately included as it has been already included as a part of company profit.

Question 35.

Specify the limitations of the multiplier.

Answer:

- There is change in autonomous investment.

- There is no induced investment

- The marginal propensity to consume is constant.

- Consumption is a function of current income.

- There are no time lags in the multiplier process.

- Consumer goods are available in response to effective demand for them.

- There is a closed economy unaffected by foreign influences.

- There are no changes in prices.

- There is less than full employment level in the economy.

Question 36.

Explain the uses of multiplier.

Answer:

Uses of multiplier

- Multiplier highlights the importance of investment in income and employment theory.

- The process throws light on the different stages of trade cycle.

- It also helps in bringing the equality between S and I.

- It helps in formulating Government policies.

- It helps to reduce unemployment and achieve full employment.

Question 37.

Write a note on metallic money.

Answer:

- After the barter system and commodity money system, modem money systems evolved.

- Among these, metallic standard is the premier one.

- Under metallic standard, some kind of metal either gold or silver is used to determine the standard value of the money and currency.

- Standard coins made out of the metal are the principal coins used under the metallic standard.

- These standard coins are full bodied or full weighted legal tender.

- Their face value is equal to their intrinsic metal value.

Question 38.

What is the meaning of Crypto currency?

Answer:

Crypto Currency:

A digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a Central Bank,

Decentralised crypto currencies such as Bitcoin now provide an outlet for Personal Wealth that is beyond restriction and confiscation.

Question 39.

Write the TRIPs agreement.

Answer:

Agreement on Trade Related Intellectual Property Rights (TRIPs):

- Intellectual Property Rights include copy right, trade marks, patents, geographical indications, trade secrets, industrial designs, etc.

- TRIPS Agreement provides for granting product patents instead of process patents.

- The period of protection will be 20 years for patents, 50 years for copy rights, 7 years for trade marks and 10 years for layout designs.

- As a result of TRIPS, the dependence of LDCs on advanced countries for seeds, drugs, fertilizers and pesticides has increased.

- Farmers are depending on the industrial firm for their seeds.

![]()

Question 40.

What is Crony capitalism?

Answer:

Social Organization:

- People show interest in the development activity only when they feel that the fruits of development will be fairly distributed.

- Mass participation in development programs is a pre-condition for accelerating the ‘ development process.

- Whenever the defective social organization allows some groups to appropriate the benefits of growth.

- Majority of the poor people do not participate in the process of development.

- This is called crony capitalism.

PART – IV

Answer all the questions. [7 x 5 = 35]

Question 41 (a).

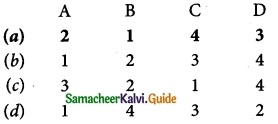

Explain the Aggregate Demand Function with Diagram.

Answer:

In the Keynesian model, output is determined mainly by aggregate demand. The aggregate demand is the amount of money which entrepreneurs expect to get by selling the output produced by the number of labourers employed.

Therefore, it is the expected income or revenue from the sale of output at different levels of employment.

Aggregate demand has the following four components:

- Consumption demand

- Investment demand

- Government expenditure and

- Net Export (export – import)

The desired or planned demand (spending) is the amount that households, firms, the governments and the foreign purchasers would like to spend on domestic output.

In other words, desired demand in the economy is the sum total of desired private consumption expenditure, desired investment expenditure, desired government spending and desired net exports (difference between exports and imports). Thus, the desired spending is called aggregate spending (demand), and can be expressed as:

AD = C + I + G + (X – M)

The diagram explains that aggregate demand price increases or decreases with an increase or decrease in the volume of employment. Aggregate demand curve increases at an increasing rate in the beginning and then increases at a decreasing rate.

This shows that as income increases owing to increase in employment, expenditure of the economy increases at a decreasing rate.

[OR]

(b) Describe the Effective demand.

Answer:

- The starting point of Keynes theory of employment and income is the principle of effective demand.

- Effective demand denotes money actually spent by the people on products of industry.

- The money which entrepreneurs receive is paid in the form of rent, wages, interest and profit.

- Therefore effective demand equals national income.

- An increase in the aggregate effective demand would increase the level of employment.

- A decline in total effective demand would lead to unemployment.

- Therefore, total employment of a country can be determined with the help of total demand of a country.

- According to the Keynes theory of employment, “Effective demand signifies the money spent on consumption of goods and services and on investment.

- The total expenditure is equal to the national income, which is equivalent to the national output”.

- The relationship between employment and output of an economy depends upon the level of effective demand which is determined by the forces of aggregate supply and aggregate demand.

ED = Y = C + I = Output = Employment - Effective demand determines the level of employment in the economy.

- When effective demand increases, employment will increase.

- When effective demand decreases, the level employment will decline.

- The effective demand will be determined by two determinants namely consumption and investment expenditures.

- The consumption function depends upon income of the people and marginal propensity to consume.

- According to Keynes, if income increases, consumption will also increase but by less than the increase in income.

![]()

Question 42 (a).

Illustrate the working of Multiplier.

Answer:

Working of Multiplier:

1. Suppose the Government undertakes investment expenditure equal to Rs 100 crore on some public works, by way of wages, price of materials etc.

2. Thus income of labourers and suppliers of materials increases by Rs 100 crore. Suppose the MPC is 0.8 that is 80 %.

3. A sum of Rs 80 crores is spent on consumption (A sum of Rs 20 Crores is saved).

4. As a result, suppliers of goods get an income of Rs 80 crores.

5. They intum spend Rs 64 crores (80% of Rs 80 cr).

In this manner consumption expenditure and increase in income act in a chain like manner. The final result is ΔY = 100 + 100 × 4/5 + 100 × [4/5]² + 100 × [4/5]³ or,

ΔY = 100 + 100 × 0.8 + 100 × (0.8)² + 100 × (0.8)³

= 100 + 80+ 64 + 51.2… = 500

that is 100 × 1/1 – 4/5

100 × 1/1/5

100 × 5 = Rs 500 crores

For instance if C = 100 + 0.8Y, I = 100,

Then Y = 100+ 0.8Y + 100

0. 2Y = 200

Y = 200/0.2 = 1000 → Point B

If I is increased to 110, then

0. 2Y = 210

Y = 210/0.2 = 1050 → Point D

For Rs 10 increase in I, Y has increased by Rs 50.

This is due to multiplier effect.

At point A, Y = C = 500

C = 100 + 0.8 (500) = 500; S = 0

At point B, Y = 1000

C = 100 + 0.8 (1000) = 900; S = 100 = I

At point D, Y = 1050

C = 100 + 0.8 (1050) = 940; S = 110 = I

When I is increased by 10, Y increases by 50.

This is multiplier effect (K = 5)

K = \(\frac{1}{0.2}\) = 5

[OR]

(b) Explain about Marginal Efficiency of Capital [MEC] short run factors and long run factors.

Answer:

(a) Short – Run Factors

(i) Demand for the product:

- If the market for a particular good is expected to grow and its costs are likely to fall, the rate of return from investment will be high.

- If entrepreneurs expect a fall in demand for goods and a rise in cost, the investment will decline.

(ii) Liquid assets:

- If the entrepreneurs are holding large volume of working capital, they can take advantage of the investment opportunities that come in their way.

The MEC will be high.

(iii) Sudden changes in income:

- The MEC is also influenced by sudden changes in income of the entrepreneurs.

- If the business community gets windfall profits, or tax concession the MEC will be high and hence investment in the country will go up.

- On the other hand, MEC falls with the decrease in income.

(iv) Current rate of investment:

- Another factor which influences MEC is the current rate of investment in a particular industry.

- If in a particular industry, much investment has already taken place and the rate of investment currently going on in that industry is also very large, then the marginal efficiency of capital will be low.

(v) Waves of optimism and pessimism:

- The marginal efficiency of capital is also affected by waves of optimism and pessimism in the business cycle.

- If businessmen are optimistic about future, the MEC will be likely to be high.

- During periods of pessimism the MEC is under estimated and so will be low.

(b) Long – Run Factors

The long run factors which influence the marginal efficiency of capital are as follows:

(i) Rate of growth of population:

- Marginal efficiency of capital is also influenced by the rate of growth of population.

- If population is growing at a rapid speed, it is usually believed that the demand of various types of goods will increase.

- So a rapid rise in the growth of population will increase the marginal efficiency of capital and a slowing down in its rate of growth will discourage investment and thus reduce marginal efficiency of capital.

(ii) Technological progress:

- If investment and technological development take place in the industry, the prospects of increase in the net yield brightens up.

- For example, the development of automobiles in the 20th century has greatly stimulated the rubber industry, the steel and oil industry etc.

- So we can say that inventions and technological improvements encourage investment in various projects and increase marginal efficiency of capital.

(iii) Monetary and Fiscal policies:

Cheap money policy and liberal tax policy pave the way for greater profit margin and so MEC is likely to be high.

(iv) Political environment:

Political stability, smooth administration, maintenance of law and order help to improve MEC.

(v) Resource availability:

Cheap and abundant supply of natural resources, efficient labour and stock of capital enhance the MEC.

![]()

Question 43 (a).

Briefly explain the Monetary Economics and money.

Answer:

Monetary Economics is a branch of economics that provides a framework for analyzing money and its functions as a medium of exchange, store of value and unit of account. It examines the effects of monetary systems including regulation of money and associated financial institutions.

Meaning

- Money is anything that is generally accepted as payment for goods and services and repayment of debts and that serves as a medium of exchange.

- A medium of exchange is anything that is widely accepted as a means of payments.

- In recent years, the importance of credit has increased in all the countries of the world.

- Credit instruments are used on an extensive scale.

- The use of cheques, bills of exchange, etc., has gone up.

- It should however, be remembered that money is the basis of credit.

[OR]

(b) What are the objectives of Monetary Policy? Explain.

Answer:

The specific objectives of monetary policy are Objectives of monetary policy:

- Neutrality of Money

- Stability of Exchange Rates

- Price Stability

- Full Employment

- Economic Growth

- Equilibrium in the Balance of Payments

1. Neutrality of Money:

- Economists like Wicksteed, Hayek and Robertson are the chief exponents of neutral money.

- They hold the view that monetary authority should aim at neutrality of money in the economy.

- Monetary changes could be the root cause of all economic fluctuations.

- According to neutralists, the monetary change causes distortion and disturbances in the proper operation of the economic system of the country.

2. Exchange Rate Stability:

- Exchange rate stability was the traditional objective of monetary authority.

- This was the main objective under Gold Standard among different countries.

- When there was disequilibrium in the balance of payments of the country, it was automatically corrected by movements.

3. Price Stability:

- Economists like Crustave Cassel and Keynes suggested price stabilization as a main objective of monetary policy.

- Price stability is considered the most genuine, objective of monetary policy.

- Stable prices repose public confidence,

- It promotes business activity and ensures equitable distribution of income and wealth.

4. Full Employment:

- During world depression, the problem of unemployment had increased rapidly.

- It was regarded as socially dangerous, economically wasteful and morally deplorable.

- Thus, full employment was considered as the main goal of monetary policy.

5. Economic Growth:

- Economic growth is the process whereby the real per capita income of a country increases over a long period of time.

- It implies an increase in the total physical or real output, production of goods for the satisfaction of human wants.

- Monetary policy should promote sustained and continuous economic growth by maintaining equilibrium between the total demand for money and total production capacity and further creating favourable conditions for saving and investment.

6. Equilibrium in the Balance of Payments:

Equilibrium in the balance of payments is another objective of monetary policy which emerged significant in the post war years.

Question 44 (a).

What do you mean by balance of payments?

Answer:

Balance of Payments (BOP):

1. BoP is a systematic record of a country’s economic and financial transactions with the rest of the world over a period of time.

2. When a payment is received from a foreign country, it is a credit transaction while a payment to a foreign country is a debit transaction.

3. The principal items shown on the credit side are exports of goods and services, transfer receipts in the form of gift etc., from foreigners, borrowing from abroad, foreign direct investment and official sale of reserve assets including gold to foreign countries and international agencies.

4. The principal items on the debit side include imports of goods and services, transfer payments to foreigners, lending to foreign countries, investments by residents in foreign countries and official purchase of reserve assets or gold from foreign countries and international agencies.

![]()

[OR]

(b) Explain the relationship between Foreign Direct Investment and economic development.

Answer:

Foreign Direct Investment (FDI) and Trade:

- FDI is an important factor in global economy.

- Foreign trade and FDI are closely related. In developing countries like India

- FDI in the natural resource sector, including plantations, increases trade volume.

- Foreign production by FDI is useful to substitute foreign trade. .

- FDI is also influenced by the income generated from the trade and regional integration schemes.

- FDI is helpful to accelerate the economic growth by facilitating essential imports needed for carrying out development programmes like capital goods, technical know-how, raw materials and other inputs and even scarce consumer goods.

- FDI may be required to fill the trade gap.

- FDI is encouraged by the factors such as foreign exchange shortage, desire to create employment and acceleration of the pace of economic development.

- Many developing countries strongly prefer foreign investment to imports.

- However, the real impact of FDI on different sections of an economy.

Question 45 (a).

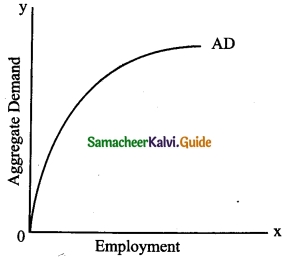

Describe the Types of Terms of Trades.

Answer:

Types of Terms of Trade:

The different concepts of terms of trade were classified by Gerald M.Meier into the following three categories:

Terms of Trade related to the Ratio of Exchange between Commodities:

1. Net Barter Terms of Trade:

This type was developed by Taussig in 1927. The ratio between the prices of exports and of imports is called the “net barter terms of trade’. It is named by Viner as the ‘commodity terms of trade’.

It is expressed as:

Tn = (Px / Pm) × 100

Where,

Tn = Net Barter Terms of Trade

Px = Index number of export prices

Pm = Index number of import prices

This is used to measure the gain from international trade. If ‘Tn’ is greater than 100, then it is a favourable terms of trade which will mean that for a rupee of export, more of imports can be received by a country.

2. Gross Barter Terms of Trade:

This was developed by Taussig in 1927 as an improvement over the net terms of trade. It is an index of relationship between total physical quantity of imports and the total physical quantity of exports.

Tg = (Qm / Qx) × 100

Where,

Qm = Index of import quantities

Qx = Index of export quantities

If for a given quantity of export, more quantity of import can be consumed by a country, then one can say that terms of trade are favourable.

3. Income Terms of Trade:

The income terms of trade was given by G.S.Dorrance in 1948. It is the index of the value of exports divided by the price index for imports multiplied by quantity index of experts. In other words, it is the net barter terms of trade of a country multiplied by its exports- volume index.

Ty = (Px / Pm ) Qx

Where,

Px = Price index of exports

Pm = Price index of imports

Qx = Quantity index of exports

[OR]

(b) Write a note on ‘BRICS’.

Answer:

BRICS:

- BRICS is the acronym for an association of five major emerging national economies: Brazil, Russia, India, China and South Africa.

- Since 2009, the BRICS nations have met annually at formal summits.

- South Africa hosted the 10th BRICS summit in July 2018.

- The agenda for BRICS summit 2018 includes Inclusive growth, Trade issues, Global governance, Shared Prosperity, International peace and security.

- It’s headquarters is at Shanghai, China.

- The New Development Bank (NDB) formerly referred to as the BRICS Development Bank was established by BRICS States.

- The first BRICS summit was held at Moscow and South Africa hosted the Tenth Conference at Johanesberg in July 2018.

- India had an opportunity of hosting fourth and Eighth summits in 2009 and 2016 respectively.

- The BRICS countries make up 21 percent of global GDP. They have increased their share of global GDP threefold in the past 15 years.

- The BRICS are home to 43 percent of the world’s population.

- The BRICS countries have combined foreign reserves of an estimated $4.4 trillion

![]()

Question 46 (a).

Bringout the objectives of SAARC.

Answer:

Objectives of SAARC:

According to Article I of the Charter of the SAARC, the objectives of the Association are as follows:

- To promote the welfare of the people of South Asia and improve their quality of life;

- To accelerate economic growth, social progress and cultural development in the region;

- To promote and strengthen collective self-reliance among the countries of South Asia;

- To contribute to mutual trust, understanding and appreciation of one another’s problems;

- To promote active collaboration and mutual assistance in the economic, social, cultural, technical and scientific fields;

- To strengthen co-operation with other developing countries;

- To strengthen cooperation among themselves in international forums on matters of common interest;

- To cooperate with international and regional organisations with similar aims and purposes.

[OR]

(b) Explain the principles of federal finance.

Answer:

Principles of Federal Finance:

In the case of federal system of finance, the following main principles must be applied:

- Principle of Independence.

- Principle of Equity.

- Principle of Uniformity.

- Principle of Adequacy.

- Principle of Fiscal Access.

- Principle of Integration and coordination.

- Principle of Efficiency.

- Principle of Administrative Economy.

- Principle of Accountability.

1. Principle of Independence:

- Under the system of federal finance, a Government should be autonomous and free about the internal financial matters concerned.

- It means each Government should have separate sources of revenue, authority to levy taxes, to borrow money and to meet the expenditure.

- The Government should normally enjoy autonomy in fiscal matters.

2. Principle of Equity:

From the point of view of equity, the resources should be distributed among the different states so that each state receives a fair share of revenue.

3. Principle of Uniformity:

In a federal system, each state should contribute equal tax payments for federal finance.

4. Principle of Adequacy of Resources:

- The principle of adequacy means that the resources of each Government i.e. Central and State should be adequate to carry out its functions effectively.

- Here adequacy must be decided with reference to both current as well as future needs.

- Besides, the resources should be elastic in order to meet the growing needs and unforeseen expenditure like war, floods etc.

5. Principle of Fiscal Access:

- In a federal system, there should be possibility for the Central and State Governments to develop new source of revenue within their prescribed fields to meet the growing financial needs.

- In nutshell, the resources should grow with the increase in the responsibilities of the Government.

6. Principle of Integration and coordination:

- The financial system as a whole should be well integrated.

- There should be perfect coordination among different layers of the financial system of the country.

- Then only the federal system will survive.

- This should be done in such a way to promote the overall economic development of the country.

7. Principle of Efficiency:

- The financial system should be well organized and efficiently administered.

- Double taxation should be avoided.

8. Principle of Administrative Economy:

- Economy is the important criterion of any federal financial system.

- That is, the cost of collection should be at the minimum level and the major portion of revenue should be made available for the other expenditure outlays of the Governments.

9. Principle of Accountability:

Each Government should be accountable to its own legislature for its financial decisions i.e. the Central to the Parliament and the State to the Assembly.

Question 47 (a).

What are the similarities of Public and Private Finance?

Answer:

(i) Rationality:

- Both public finance and private finance are based on rationality.

- Maximization of welfare and least cost factor combination underlie both.

(ii) Limit to borrowing:

- Both have to apply restraint with regard to borrowing.

- The Government also cannot live beyond its means.

- There is a limit to deficit financing by the state also.

(iii) Resource utilisation:

- Both the private and public sectors have limited resources at their disposal.

- So both attempt to make optimum use of resources.

(iv) Administration:

- The effectiveness of measures of the Government as well as private depends on the administrative machinery.

- If the administrative machinery is inefficient and corrupt it will result in wastages and losses.

![]()

[OR]

(b) What are the functions of NITI Aayog?

Answer:

Functions of NITI Aayog:

- Cooperative and Competitive Federalism: To enable the States to have active participation in the formulation of national policy.

- Shared National Agenda: To evolve a shared vision of national development priorities and strategies with the active involvement of States.

- Decentralized Planning: To restructure the planning process into a bottom-up model.

- Vision and Scenario Planning: To design medium and long-term strategic frameworks towards India’s future.

- Network of Expertise: To mainstream external ideas and expertise into government policies and programmes through a collective participation.

- Harmonization: To facilitate harmonization of actions across different layers of government, especially when involving cross-cutting and overlapping issues across multiple sectors; through communication, coordination, collaboration and convergence amongst all the stakeholders.

- Conflict Resolution: To provide platform for mutual consensus to inter-sectoral, inter¬departmental, inter-state as well as centre-state issues for all speedy execution of the government programmes.

- Coordinating Interface with the World: It will act nodal point to harness global expertise and resources coming from International organizations for India’s developmental process.

- Internal Consultancy: It provides internal consultancy to Central and State governments on policy and programmes.

- Capacity Building: It enables to provide capacity building and technology up-gradation across government, benchmarking with latest global trends and providing managerial and technical know-how.

- Monitoring and Evaluation: It will monitor the implementation of policies and progammes and evaluate the impacts.