Students can download 11th Economics Chapter 8 Indian Economy Before and After Independence Questions and Answers, Notes, Samcheer Kalvi 11th Economics Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

Tamilnadu Samacheer Kalvi 11th Economics Solutions Chapter 8 Indian Economy Before and After Independence

Samacheer Kalvi 11th Economics Indian Economy Before and After Independence Text Book Back Questions and Answers

PART – A

Multiple Choice Questions:

Question 1.

The arrival of Vasco da Gama in Calicut, India ………………………

(a) 1498

(b) 1948

(c) 1689

(d) 1849

Answer:

(a) 1498

![]()

Question 2.

In 1614 Sir Thomas Roe was successful in getting permission from ……………………

(a) Akbar

(b) Shajahan

(c) Jahangir

(d) Noorjahan

Answer:

(c) Jahangir

Question 3.

The power for governance of India was transferred from the East India Company (EIC) to the British crown in ………………………..

(a) 1758

(b) 1858

(c) 1958

(d) 1658

Answer:

(b) 1858

Question 4.

Ryotwari system was initially introduced in …………………….

(a) Kerala

(b) Bengal

(c) Tamil Nadu

(d) Maharashtra

Answer:

(c) Tamil Nadu

![]()

Question 5.

First World War started in the year ……………………..

(a) 1914

(b) 1814

(c) 1941

(d) 1841

Answer:

(a) 1914

Question 6.

When did the Government of India declared its first Industrial Policy?

(a) 1956

(b) 1991

(c) 1948

(d) 2000

Answer:

(c) 1948

Question 7.

The objective of the Industrial Policy 1956 was ………………………..

(a) Develop heavy industries

(b) Develop agricultural sector only

(c) Develop private sector only

(d) Develop cottage industries only

Answer:

(a) Develop heavy industries

![]()

Question 8.

The industry which was de-reserved in 1993.

(a) Railways

(b) Mining of copper and zinc

(c) Atomic energy

(d) Atomic minerals

Answer:

(b) Mining of copper and zinc

Question 9.

The father of Green Revolution in India was

(a) M.S. Swaminathan

(b) Gandhi

(c) Visweswaraiah

(d) N.R. Viswanathan

Answer:

(a) M.S. Swaminathan

![]()

Question 10.

How many commercial banks were nationalised in 1969?

(a) 10

(b) 12

(c) 14

(d) 16

Answer:

(c) 14

Question 11.

The main objective of nationalisation of banks was …………………………

(a) Private social welfare

(b) Social welfare

(c) To earn

(d) Industries monopoly

Answer:

(b) Social welfare

Question 12.

The Planning Commission was setup in the year ………………………….

(a) 1950

(b) 1955

(c) 1960

(d) 1952

Answer:

(a) 1950

![]()

Question 13.

In the first five year plan, The top priority was given to ……………………… Sector.

(a) Service

(b) Industrial

(c) Agriculture

(d) Bank

Answer:

(c) Agriculture

Question 14.

Tenth Five year plan period was ……………………….

(a) 1992 – 1997

(b) 2002 – 2007

(c) 2007 – 2012

(d) 1997 – 2002

Answer:

(b) 2002 – 2007

Question 15.

According to HDR (2016), India ranked …………………….. out of 188 coutries.

(a) 130

(b) 131

(c) 135

(d) 145

Answer:

(b) 131

![]()

Question 16.

Annual Plans formed in the year ………………………

(a) 1989 – 1991

(b) 1990 – 1992

(c) 2000 – 2001

(d) 1981 – 1983

Answer:

(b) 1990 – 1992

Question 17.

The Oldest large scale industry in India ………………………

(a) Cotton

(b) Jute

(c) Steel

(d) Cement

Answer:

(a) Cotton

Question 18.

Human Development Index (HDI) was developed by …………………………

(a) Jawaharlal Nehru

(b) M.K. Gandhi

(c) Amartiya Sen

(d) Tagore

Answer:

(c) Amartiya Sen

![]()

Question 19.

The main theme of the Twelth Five Year Plan ………………………..

(a) Faster and more inclusive growth

(b) Growth with social Justice

(c) Socialistic pattern of society

(d) Taster, more inclusive and sustainable growth

Answer:

(d) Taster, more inclusive and sustainable growth

Question 20.

The PQLI was developed by ……………………….

(a) Planning Commission

(b) Nehru

(c) Morris

(d) Morrisd.Biswajeet

Answer:

(c) Morris

PART – B

Answer the following questions in one or two sentences.

Question 21.

What are the Phases of colonial exploitation of India?

Answer:

The period of merchant capital, the period of industrial capital, the period of finance capital.

![]()

Question 22.

Name out the different types of land tenure that existed in India before independence?

Answer:

The three different types of land tenure existed in India before independence. They were:

- Zamindari System (or) Landlord-Tenant System

- Mahalwari System (or) Communal System of farming

- Ryotwari System (or) the Owner-Cultivator System

Question 23.

State the features that distinguish a land tenure system from another system?

Answer:

The land tenure system differs as

- Who owns the land?

- Who cultivates the land?

- Who is responsible for paying the land revenue to the government?

![]()

Question 24.

List out the weaknesses of the Green Revolution?

Answer:

Weaknesses of the Green Revolution:

- Indian Agriculture was still a gamble of the monsoons.

- This strategy needed heavy investment in seeds, fertilizers, pesticides, and water.

- The income gap between large, marginal, and small farmers had increased.

- The gap between irrigated and rain-fed areas had widened.

- Except in Punjab, and to some extent in Haryana, Farm mechanization had created widespread unemployment among agricultural labourers in the rural areas.

- Larger chemical use and inorganic materials reduced the soil fertility and spoiled human health. Now organic farming is encouraged.

Question 25.

What are the objectives of the Tenth Five Year plan?

Answer:

- Double the per capita income in the next 10 years.

- Aimed to reduce the poverty ratio to 15% by 2012.

- The growth target was 8.0% but it achieved only 7.2%

![]()

Question 26.

What is the difference between HDI and PQLI?

Answer:

|

HDI |

PQLI |

| 1. The Inclusion of Income. | The exclusion of Income |

| 2. Both Physical and financial attributes of development | Only the physical aspects of life. |

Question 27.

Mention the indicators which are used to calculate HDI?

Answer:

- Life expectancy index.

- Educational index.

- GDP per capita.

PART – C

Answer the following questions in one paragraph:

Question 28.

Explain the Period of Merchant Capital?

Answer:

- The period of merchant capital was from 1757 to 1813.

- The only aim of the East India Company was to earn profit by establishing monopoly trade in the goods with India and East India.

- During this period, India had been considered as the best hunting ground for capital by the East Indian company to develop industrial capitalism is Britain.

- When Bengal and South India came under the political shake of the East India company in 1750s and 1760s, the objective of monopoly trade was fulfilled.

- The company administration succeeded in generating huge surpluses which were repatriated to England, and the Indian leaders linked this problem of land revenue with that of the drain.

- Above all, the officers of the company were unscrupulous and corrupt.

![]()

Question 29.

The Handicrafts declined in India in British Period. Why?

Answer:

- Through discriminatory tariff policy, the British Government purposefully destroyed the handicrafts.

- With the disappearance of Nawabs and Kings, there was no one to protect Indian handicrafts.

- Indian products could not compete with machine-made products.

- The introduction of railways in India increased the domestic market for British goods.

![]()

Question 30.

Elucidate the different types of land tenure systems in colonial India?

Answer:

Land Tenure refers to the system of land ownership and management. The features that distinguish a land tenure system from the others relate to the following:

- Who owns the land

- Who cultivates the land.

- Who is responsible for paying the land revenue to the government.

Based on these questions, three different types of land tenure existed in India before Independence. They were:

- Zamindari System or the Landlord-Tenant System.

- Mahalwari System or Communal System of Farming.

- Ryotwari System or the Owner-Cultivator System.

Zamindari System or the Landlord-Tenant System:

- This system was created by the British East India Company when in 1793, Lord Cornwallis introduced the ‘Permanent Settlement Act’.

- Under this system, the landlord or the Zamindars were declared as the owners of the land and they were responsible to pay the land revenue to the government.

- The share of the government in total rent collected was fixed as 10/11th, the balance going to the Zamindars as remuneration.

Mahalwari System or Communal System of Farming:

- After the introduction of this system, it was later extended to Madhya Pradesh and Punjab.

- The ownership of the land was maintained by the collective body usually the villagers which served as a unit of management.

- They distributed land among the peasants and collected revenue from them and pay it to the state.

Ryotwari System (or) the Owner-Cultivator System:

- This system was initially introduced in Tamil Nadu and later extended to Maharashtra, Gujarat, Assam, Coorg, East Punjab, and Madhya Pradesh.

- Under this system, the ownership rights of use and control of land were held by the tiller himself.

- There was a direct relationship between owners and tillers. This system was the least oppressive system before Independence.

![]()

Question 31.

State the reasons for the nationalization of commercial banks?

Answer:

- The main objective of economic planning aimed at social welfare.

- Before independence commercial banks were in the private sector.

- These commercial banks failed in helping the government to achieve social objectives of planning.

- Therefore, the government decided to nationalize 14 major commercial banks in 1969.

Question 32.

Write any three objectives of Industrial Policy 1991?

Answer:

- The economic development of a country particularly depends on the process of Industrialisation.

- At the time of Independence, India inherited a weak and shallow Industrial base.

- Therefore during the post-Independence period, the Government of India took the special emphasis on the development of a solid Industrial base.

![]()

Question 33.

Give a note on Twelfth Five Year Plan?

Answer:

Twelfth Five Year Plan [2012 – 2017]

- Twelfth five-year plan (2012 – 17).

- Its main theme is “Faster more inclusive and sustainable growth”

- Its growth rate target is 8%

Question 34.

What is PQLI?

Answer:

- “PQLI” – means Physical Quality of Life Index [PQLI].

Morris D Morris developed the Physical Quality of life Index ( PQLI). - The PQLI is a measure to calculate the quality of life (well being of a country) Three indicators are:

- Life expectancy

- Infant mortality rate

- Literacy rate

- A scale of each indicator ranges from the number 1 to 100.

- Number 1 represents the worst performance by any country.

- 100 is the best performance.

PART – D

Answer the following questions in about a page.

Question 35.

Discuss the Indian economy during the British Period?

Answer:

Britain had exploited India over a period of two centuries of its colonial rule. On the basis of the form of colonial exploitation, economic historians have divided the whole period into three phases namely the period of merchant capital, the period of industrial capital, and the period of finance capital.

1. Period of merchant capital (1757 to 1813):

The only aim of the East India company was to earn profit by establishing monopoly trade. India was considered as the best hunting ground for capital. By attaining political power the objective of monopoly trade was fulfilled. The company administration succeeded in generating huge surpluses which were repatriated to England.

2. Period of industrial capital (1813 to 1858):

India had become a market for British textiles. Indians were exploited by fixing low prices for exports and high price for imports. India’s traditional handicrafts were thrown out of gear.

3. Period of financial capital (Late 19th century – 1947) : Finance imperialism began to entrench. Britain decided to make massive investments in various fields by plundering Indian capital.

4. The land tenure system in India: Land tenure refers to the system of land ownership and management.

The Zamindari system, the Mahalwari system and the Ryotwari system were the systems of land tenure introduced by British.

5. Problems of British rule : Their profit motives led to drain of resources from India. The handicraft industries were collapsed.

The British rule stunted the growth of Indian enterprise. Capital formation in India was retarded.

![]()

Question 36.

Explain the role of SSIs in economic development?

Answer:

1. Provide Employment:

- SSIs use labor-intensive techniques. Hence, they provide employment opportunities to a large number of people. Thus, they reduce the unemployment problem to a great extent.

- SSIs provide employment to artisans, technically qualified persons and professionals, people engaged in traditional arts, people in villages and unorganized sectors.

- The employment-capital ratio is high for the SSIs.

2. Bring Balanced Regional Development:

- SSIs promote decentralized development of industries as most of the SSIs are set up in backward and rural areas.

- They remove regional disparities by industrializing rural and backward areas and bring balanced regional development.

- They help to reduce the problems of congestion, slums, sanitation and pollution in cities. They are mostly found in outside city limits.

- They help in improving the standard of living of people residing in suburban and rural areas in India.

- The entrepreneurial talent is tapped in different regions and the income is also distributed instead of being concentrated in the hands of a few individuals or business families.

3. Help in Mobilization of Local Resources:

- SSIs help to mobilize and utilize local resources like small savings, entrepreneurial talent etc., of the entrepreneurs, which might otherwise remain idle and unutilized.

- They pave way for promoting traditional family skills and handicrafts. There is a great demand for handicraft goods in developed countries.

- They help to improve the growth of local entrepreneurs and self-employed professionals in small towns and villages in India

4. Pave for Optimisation of Capital:

- SSIs require less capital per unit of output. They provide quick return on investment due to shorter gestation period. The payback period is quite short in SSIs.

- SSIs function as a stabilizing force by providing high output-capital ratio as well as high employment – capital ratio.

- They encourage the people living in rural areas and small towns to mobilize savings and channelize them into industrial activities.

5. Promote Exports:

- SSIs do not require sophisticated machinery. Hence, import the machines from abroad is not necessary. On the other hand, there is a great demand for goods produced by SSIs.

- Thus they reduce the pressure on the country’s balance of payments. However, in the recent past large scale industries are able to borrow large funds with a low-interest rates and spend large sums on advertisements. Hence SSSs are gradually vanishing.

- SSIs earn valuable foreign exchange through exports from India.

6. Complement Large Scale Industries:

- SSIs play a complementary role to large scale sector and support large scale industries.

- SSIs provide parts, components, accessories to large scale industries and meet the requirements of large scale industries through setting up units near the large scale units.

- SSIs serve as ancillaries to large scale units.

7. Meet Consumer Demands:

- SSIs produce a wide range of products required by consumers in India.

- Hence, they serve as an anti-inflationary force by providing goods of daily use.

8. Develop Entrepreneurship:

- SSIs, help to develop a class of entrepreneurs in society. They help the job seekers to become job givers.

- They promote self-employment and a spirit of self-reliance in society.

- SSIs, help to increase the per capita income of India in various ways.

- They facilitate the development of backward areas and weaker sections of the society.

- SSIs are adept in distributing national income in a more efficient and equitable manner among the various participants of the society.

![]()

Question 37.

Explain the objectives of the nationalization of a commercial bank?

Answer:

- The main objective of nationalization was to attain social welfare. Sectors such as agriculture, small and village industries were in need of funds for their expansion and further economic development.

- It helped to curb private monopolies in order to ensure a smooth supply of credit to socially desirable sections.

- To encourage the banking habit among the rural population.

- To reduce the regional imbalances where the banking facilities were not available.

- After nationalization, new bank branches were opened in both rural and urban areas, and they created credit facilities mainly for the agriculture sector and its allied activities.

![]()

Question 38.

Describe the performance of the 12th Five Year Plans in India?

Answer:

First Five Year Plan – [1951 – 1956]

- It was based on the Harrod-Domar Model.

- Its main focus was on the agricultural development of the country.

- This plan was successful and achieved a GDP growth rate of 3.6%. [more than its target]

Second Five Year Plan – [1956 -1961]

- It was based on the P.C. Mahalanobis Model.

- Its main focus was on the industrial development of the country.

- This plan was successful and achieved a growth rate of 4.1%

Third Five Year Plan – [1961- 1966]

- This plan was called ‘Gadgil Yojana’.

- The main target of this plan was to make the economy independent and to reach self-prepared position or take off.

- Due to the Indo-China war, this plan could not achieve its growth target of 5.6%. Indian Economy Before and After Independence 137

Fourth Five Year Plan – [1969 – 1974]

- There are two main objectives of this plan (i.e) growth with stability and progressive achievement of self-reliance.

- This plan failed and could achieve a growth rate of 3.3% only against the target of 5.7%.

Fifth Five Year Plan – [1974 – 1979]

- In this plan top priority was given to agriculture, next came industry and mines.

- This plan achieved a growth rate of 4.8% against the target of 4.4%.

Sixth Five Year Plan – [1980 -1985]

- The basic objective of this plan was poverty eradication and technological self-reliance. GARIBI-HATAO was the motto. It was based on investment yojana.

- Its growth target was 5.2% but it achieved 5.7%

Seventh Five Year Plan – [1985 – 1990]

- This plan included the establishment of a self-sufficient economy, opportunities for productive employment.

- For the first time, due to the pressure from the private sector, the private sector got priority over the public sector.

- Its growth target was 5.0% but it achieved 6.0%

Eighth Five Year Plan – [1992- 1997]

- In this plan, the top priority was given to the development of human resources (i.e) employment, education, and public health.

- During this plan, the New Economic Policy of India was introduced.

- This plan was successful and got an annual growth rate of 6.8% against the target of 5.6%.

Ninth Five Year Plan – [1997 – 2002]

- The main focus of this plan was “growth with justice and equity”.

- This plan failed to achieve the growth target of 7% and the Indian economy grew only at the rate of 5.6%.

Tenth Five Year Plan – [2002 – 2007]

- This plan aimed to double the per capita income of India in the next 10 years.

- It aimed to reduce the poverty ratio by 15% by 2012.

- Its growth target was 8.0% but it achieved only 7.2%

Eleventh Five Year Plan – [2007 – 2012]

- Its main theme was “faster and more inclusive growth”.

- Its growth rate target was 8.1% but it achieved only 7.9%

Twelfth Five Year Plan – [2012 – 2017]

- Its main theme is “faster, more inclusive and sustainable growth”.

- Its growth rate target is 8%

- Since the Indian Independence, the five-year plans of India played a very prominent role in the economic development of the country.

These plans had guided the Government as to how it should utilize scarce resources so that maximum benefits can be gained. It is worthy to mention here that Indian Government adopted the concept of five-year plans from Russia.

Samacheer Kalvi 11th Economics Indian Economy Before and After Independence Additional Important Questions and Answers

PART – A

Multiple Choice Questions:

Question 1.

……………………… is the backbone of our economic system.

(a) Agriculture

(b) Industry

(c) Service

(d) Banking

Answer:

(a) Agriculture

![]()

Question 2.

Disguised unemployment is related to the sector.

(a) Industry

(b) Service

(c) Agriculture

(d) Insurance

Answer:

(c) Agriculture

Question 3.

India’s major ……………………. crops are sugarcane, jute, cotton, tea, coffee, etc.

(a) Food

(b) Cash

(c) Marketing

(d) Commercial

Answer:

(b) Cash

![]()

Question 4.

Most modem and rich countries have well developed through their early ………………………… revolution.

(a) Agriculture

(b) Industrial

(c) French

(d) Green

Answer:

(b) Industrial

Question 5.

The income elasticity of Industrial goods is very higher than that of ………………………… goods.

(a) Primary

(b) Secondary

(c) Industrial

(d) Manufacturing.

Answer:

(a) Primary

![]()

Question 6.

Which of the following is called as an important agro-based industry?

(a) Steel

(b) Cement

(c) Sugar

(d) Jute

Answer:

(c) Sugar

Question 7.

……………………… Industries normally do not use power.

(a) Small scale

(b) Large scale

(c) Cottage

(d) Manufacturing

Answer:

(c) Cottage

![]()

Question 8.

Planning is India is ……………………..

(a) Centralized planning

(b) Democratic planning

(c) Partial planning

(d) Indicative planning

Answer:

(b) Democratic planning

Question 9.

The rate of ………………………. formation indicates its rate of improvement.

(a) Human capital

(b) Money capital

(c) Physical capital

(d) Monetary capital

Answer:

(a) Human capital

![]()

Question 10.

Nowadays investment in ……………………… capital is very important.

(a) Money

(b) Physical

(c) Monetary

(d) Human

Answer:

(d) Human

PART – B

Answer the following questions in one or two sentences.

Question 1.

Define “Green Revolution”?

Answer:

- The term Green Revolution refers to the technological breakthrough in agricultural practices.

- During the 1960s the traditional agricultural practices were gradually replaced by modem technology and agricultural practices in India.

- Initially, the new technology was tried in 1960 – 1961 as a pilot project in Seven districts.

- It was called the High Yielding Varieties Programme [HYVP].

![]()

Question 2.

Define “Silk Industry”?

Answer:

- India is the second-largest [first being China] country in the world in producing natural silk.

- At present, India produces about 16% of the silk of the world.

- India enjoys the distinction of being the only country producing all the five known commercial varieties of silk viz Mulberry, Tropical Tussar, Oak Tussar, Eri, and Muga.

Question 3.

When did the petroleum and the natural gas commission was established?

Answer:

- The first successful oil well was dug in India in 1889 at Digboi, Assam.

- At present, a number of regions with oil reserves have been identified and oil is being extracted in these regions.

- For exploration purposes, the Oil and Natural Gas Commission [ONGC] was established in 1956 at Dehradun, Uttarkhand.

PART – C

Answer the following questions in one paragraph:

Question 1.

Explain the Micro, Small, and Medium manufacturing Enterprises?

Answer:

- Micro Manufacturing Enterprises: The investment in plant and machinery does not exceed ₹25 lakhs.

- Small Manufacturing Enterprises: The investment in plant and machinery is more than twenty-five lakh rupees but does not exceed ₹5 crores.

- Medium Manufacturing Enterprises: The investment in plant and machinery is more than ₹5 crores but not exceeding ₹10 crores.

![]()

Question 2.

Describe the Micro, Small, and medium service enterprises?

Answer:

- Micro Service Enterprises: The investment in equipment does not exceed ₹10 lakhs.

- Small Service Industries: The investment in equipment is more than ₹10 lakhs but does not exceed ₹2 crores.

- Medium Service Enterprise: The investment in equipment is more than ₹2 crores but does not exceed ₹5 crores.

Question 3.

Explain the Iron and Steel Industry?

Answer:

Iron and Steel Industry:

- First Steel Industry at Kulti, near Jharia, West Bengal – Bengal ironworks company in 1870.

- First large-scale steel plant TISCO at Jamshedpur in 1907 followed by IISCO at Bumper in 1919. Both belonged to the private sector.

- The first public sector unit was “Vishveshvaraya Iron and Steel Works” at Bhadrawati. All these are managed by SAIL (at present all-important steel plants except TISCO, are under the public sector).

- Steel Authority of India Ltd. [SAIL] was established in 1974 and was made responsible for the development of the steel industry.

- Presently India is the eighth largest steel producing country in the world.

PART – D

Answer the following questions in about a page.

Question 1.

Describe the Achievement of the Green Revolution?

Answer:

Achievement of the Green Revolution:

- The major achievement of the new strategy was to boost the production of major cereals viz., wheat and rice.

- The Green Revolution was confined only to High Yielding Varieties [HYV-] cereals, mainly rice, wheat, maize, and jowar.

- This strategy was mainly directed to increase the production of commercial crops or cash crops such as sugarcane, cotton, jute oilseeds, and potatoes.

- Per hectare productivity of all crops had increased due to better seeds.

- Green Revolution had a positive effect on the development of Industries, which manufactured agricultural tools like tractors, engines, thrashers, and pumping sets.

- Green Revolution had bought prosperity to rural people.

- Increased production had generated employment opportunities for rural masses.

- Due to this, their standard of living had increased.

- Due to multiple cropping and more use of chemical fertilizers, the demand for labour increased.

- Financial resources were provided by banks and co-operative societies.

- These banks provided loans to farmers on easy terms.

![]()

Question 2.

Explain the problems of British Rule?

Answer:

Problems of British Rule

- The British rule stunted the growth of Indian enterprise.

- The economic policies of the British checked and retarded capital formation in India.

- The drain of wealth financed capital development in Britain.

- Indian agricultural sector became stagnant and deteriorated even when a large section of the Indian population was dependent on agriculture for subsistence.

- The British rule in India led to the collapse of handicraft industries without making any significant contribution to the development of any modem industrial base.

- Some efforts by the colonial British regime in developing the plantations, mines, jute mills, banking, and shipping, mainly promoted a system of capitalist firms that were managed by foreigners. These profit motives led to a further drain of resources from India.

ACTIVITY

Question 1.

To know the value of freedom, students can collect pictures of Places like Jallianwala Bagh, Meerut, Thandi, and photos of freedom fighters?

Answer:

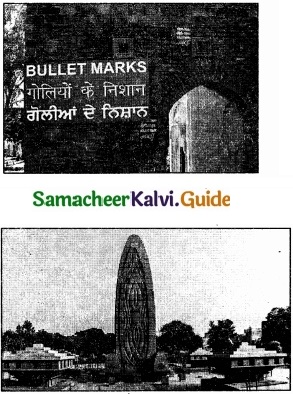

The Jallianwalabagh Massacre in Amritsar

- Jallianwala Bagh is one of the main tourist attractions around Amritsar.

- The tourists, as well as the neighboring people, visited here.

- Jallianwala bagh is situated at a throwaway distance from the Golden temple, a famous tourist spot in the Amritsar.

- Jallianwala Bagh in Amritsar is a good looking garden and contains a Sikh spiritual shrine.

- Jallianwala Bagh history was a well-liked ground for holding meetings and protests during the freedom movement in India.

- The massacre memorial one of the monuments in India was inaugurated on 13th April in 1961.

- Dr. Rajendra Prasad, the president of India, inaugurated the memorial in the Jallianwala Bagh, Amritsar at that time.

- The Bagh has a well that is also fine cosseted by the Jallianwala Bagh Massacre memorial.

- Jallianwala Bagh is connected with the most tragic day in the history of Indian Freedom.

- Jallianwala Bagh is a large garden like space extended over to an area of 6.5 acres and the most noticeable structure in this place is the memorial of the 1919 massacre victims.

- One can also witness the wall with gunshot marks.

- Jallianwala Bagh National Memorial Trust administrates the activities of this place.

The Jallianwala Bagh Massacre:

- Jallianwala Bagh reminds us about the great tragedy and it evokes a nationalistic feeling in every Indian.

- It is the place where the crudest massacre in the history of Indian freedom fight took place in the year 1919.

- To offer tribute to the innocent people who died in the massacre, this place was built at the spot of the horrible event.

- On 13th April 1919, a large crowd gathered to protect the take into custody of two Indian Freedom leaders.

- The crowd was defenseless and included women as well as children.

- The British General, Edward Dyer ordered his soldiers to fire on the unarmed and helpless crowd.

- The continuous firing went on targeting the crowd while the people were trapped inside the Jallianwala Bagh, which had only one narrow gate.

![]()

Question 2.

Display the demonstration effect of present Indians in culture, dressing, and lifestyle to emphasize the Swadhesi?

Answer:

Swadeshi Movement was a popular strategy for eradicating British rule and for improving the economic conditions of the country.

Mahatma Gandhi:

- The concept of swadeshi, as per Mahatma Gandhi was to attain self-sufficiency which included the employment of unemployed people by encouraging village Industries and towards building a non-violent society.

- The main policies of the swadeshi movement included boycotting all types of British products and the restoration of all domestic products.

Bal Gangadhar Tilak, Lala Lajpat Rai, Bipin chandra pal. [Bal, Lai, Pal].

- The chief forerunners of the swadeshi movement were Bal, Lai. Pal.

- The writings and speeches of Bal Gangadhar Tilak and his associates paved the initial way.

- Tilak reaches out to the masses through popular festivals.

- He transformed the traditional Ganapathi Utsav into a public celebration where patriotic ideas could be spread.

- Later he inaugurated a Shivaji festival for the same purpose.

- In 1906, Bengal honoured the great Maratha as a national hero.

= \(\frac{1,90,00-15,000}{5}\)

= \(\frac{1,90,00-15,000}{5}\)

`

`