Students get through the TN Board 12th Bio Botany Important Questions Chapter 3 Chromosomal Basis of Inheritance which is useful for their exam preparation.

TN State Board 12th Bio Botany Important Questions Chapter 3 Chromosomal Basis of Inheritance

Very short answer questions

Question 1.

Name the scientists, who proposed the theory of chromosomal inheritance.

Answer:

- T. Boveri

- W.S.Sutton

Question 2.

Write down the chromosome numbers of j rice and potato.

Answer:

- Rice – 24 Nos

Question 3.

Define fossil genes.

Answer:

Fossil genes are junk DNA made up of pseudogenes, which lost their ability to make proteins.

![]()

Question 4.

Define Linkage.

Answer:

Linkage is the type of tendency of the genes to stay together during the separation of chromosomes.

Question 5.

Explain synapsis.

Answer:

Synapsis is a phenomenon in which the homologous chromosomes are aligned side by side resulting in a pairing of a pair of homologous chromosomes.

Question 6.

What is meant Chiasmata?

Answer:

Chiasmata are the points of contact between non-sister chromatids of homologous chromosomes, forming X- shaped structures.

Question 7.

Define Terminalisation.

Answer:

Terminalisation is a process, in which the chiasma starts to move towards the terminal end of chromatids, after crossing over.

Question 8.

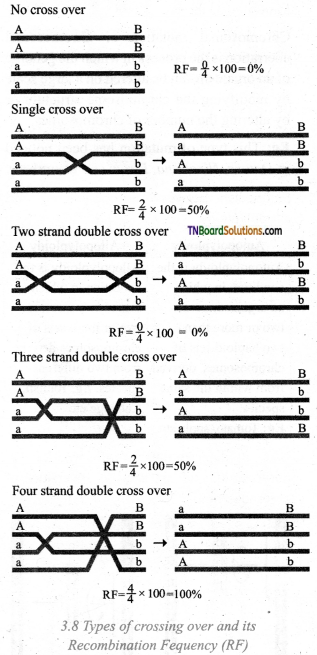

Define Recombination frequency (RF).

Answer:

Recombination frequency is the percentage of recombinant progeny in a cross.

![]()

Question 9.

What is meant by genetic mapping?

Answer:

Genetic mapping is the diagrammatic representation of the position of genes and related distance between the adjacent genes.

Question 10.

Does environment play a role in sex determination in plants? Explain it with an example.

Answer:

Yes. The plants grown under favorable conditions develop as female in the Horsetail plant whereas the plants under unfavorable conditions develop into males.

Question 11.

What are the two types of mutation?

Answer:

The broad types of mutation are point mutation and chromosomal mutation.

Question 12.

Define mutagen.

Answer:

Mutagens are agents which are responsible for changes in the genetic material.

Question 13.

Mention any two physical mutagens.

Answer:

- X-ray

- U.V – ray

Question 14.

What is Rharbati Sonora?

Answer:

Sharbati Sonora is a mutant variety of wheat.

This is developed by Dr. M.S.Swaminathan ! and his team, by irradiating the Mexican I variety of wheat (Sonora 64) with gamma rays.

![]()

Question 15.

Define hypoploidy.

Answer:

Hypoploidy is defined as a process in which the loss of one or more chromosomes from the diploid set of chromosomes in the cell takes place.

Question 16.

Name the type of polyploidy.

Answer:

The types of polyploidy are autopolyploidy and allopolyploidy.

Question 17.

Name the two organisms, in which the process of deletion is demonstrated.

Answer:

- Maize

- Drosophila

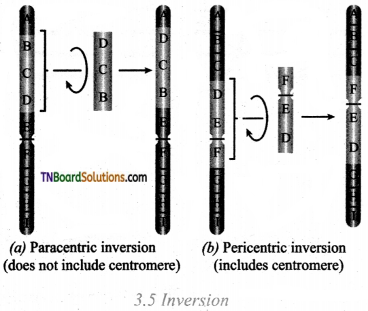

Question 18.

What are the two types of inversion?

Answer:

The two types of inversion are paracentric and pericentric inversion.

Question 19.

What has displaced duplication?

Answer:

Displaced duplication is a phenomenon in which the duplicated segment of a chromosome is located in the same chromosome, but away from the normal segment.

![]()

Question 20.

Mention any two chemical mutagens.

Answer:

- Ethyl Methane Sulphonate (EMS).

- Formaldehyde.

Short answer questions

Question 1.

Distinguish between Mendelian factors and Chromosome behavior.

Answer:

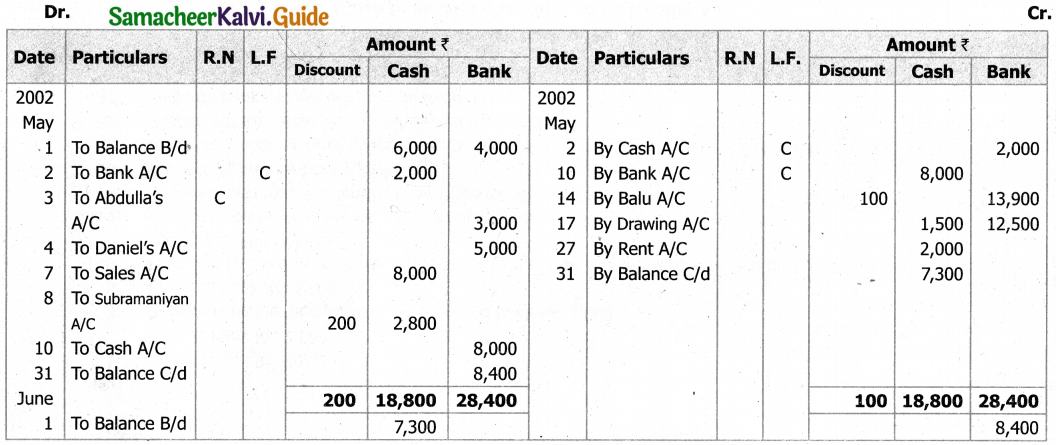

| Mendelian factors | Chromosome behaviour |

| Alleles of a factor occur in pairs. | Chromosomes occur in pairs. |

| During gamete formation, alleles of a factor separate from each other. | During meiosis the homologous chromosomes separate. |

| Mendelian factors assort independently. | Linked genes in the same chromosome normally do not assort independently, but paired chromosomes can separate independently. |

Question 2.

When a male heterozygous Drosophila is crossed with. double recessive female, only parental phenotype individuals are produced – Justify.

Answer:

- The crossing over is absent in male Drosophila.

- The recombination of alleles does not occur.

- The particular genes are linked and hence they are not assorted independently.

![]()

Question 3.

Explain the three types of synapsis.

Answer:

The three types of synapsis are as follows:

- Procentric synapsis: Pairing starts from the middle of the chromosome.

- Proterminal synapsis: Pairing starts from the telomeres.

- Random synapsis Pairing may start from anywhere in the chromosome.

Question 4.

List out any three importance of cross over.

Answer:

- Experiments on crossing over reveal that genes are placed linearly on the chromosomes. .

- The frequency of crossing over helps is a genetic map.

- The nature and mechanism of gene action can be understood through studies on crossing over.

Question 5.

Write down the uses of genetic mapping.

Answer:

- Dihybrid and trihybrid results can easily be predicted.

- It is used to determine the order of genes on the chromosome.

- It is useful to identify the locus of a gene and calculate the distance between genes.

- The overall genetic complexity of an organism can be understood by genetic mapping.

Question 6.

State the principles of sex determination in Melandrium album.

Answer:

- X chromosome specifies femaleness.

- Maleness is determined by the Y chromosome.

- X and Y show different segments of chromosomes.

Question 7.

Explain comutagens with an example.

Answer:

Comutagens are compounds that enhance the effects of known mutagen. They do not have mutagenic properties.

Eg: The damage caused by hydrogen peroxide can be increased by Ascorbic acid.

![]()

Question 8.

Distinguish between Gene mutation and Chromosomal Mutation.

Answer:

| Gene Mutation | Chromosomal Mutation |

| Gene mutations are the genetic changes within a gene. | Chromosomal mutations are the changes to chromosome region or number of chromosomes. |

| Gene mutation cannot be detectable microscopically. | Chromosomal mutations can be detected by microscopic examination. |

Question 9.

Explain chromosomal mutation with an example.

Answer:

Chromosomal mutation or chromosomal aberration is the process in which the genome of an organism can be altered on a large scale by modifying the chromosome structure or by altering the number of chromosomes.

Eg: This type of mutation has been noticed in Datura, Nicotiana, Pisum, and Oenothera.

Question 10.

Distinguish between autopolyploidy and allopolyploidy.

Answer:

| Autopolyploidy | Allopolyploidy |

| Autopolyploidy is the condition in which an organism posses two or more than two haploid sets of chromosomes, derived from within the same species. Eg: Tomato, apple etc. |

Allopolyploidy is the condition in which an organism possesses two or more sets of chromosomes derived from two different species. Eg: Radish, Cabbage etc. |

Question 11.

Give a diagrammatic representation of paracentric and pericentric inversion of chromosomes.

Answer:

![]()

Question 12.

Differentiate between Aneuploidy and Euploidy.

Answer:

| Aneuploidy | Euploidy |

| Aneuploidy involves individual chromosomes within a diploid set. | Euploidy involves entire set of chromosomes. |

| Diploid number is altered either by addition or by deletion of one or more chromosomes. | Euploidy is the condition in which the organism possess one or more basic sets of chromosomes. |

Long answer questions

Question 1.

Given an account of the historic development of chromosome theory.

Answer:

The important scientific findings on the chromosome theory of inheritance are given below:

- Wilhelm Roux in 1883 found out that chromosomes of a cell are responsible for transferring heredity.

- Montgomery in 1901 suggested the occurrence of distinct pairs of chromosomes. He also postulated that during meiosis maternal chromosomes pair with paternal chromosomes.

- T.Boveri in 1902 confirmed that genetic determiners are present in the chromosomes and suggested the chromosomal theory of inheritance.

- W.S.Sutton in 1902 recognized a similarity between the mendelian factors and the behavior of chromosomes during gamete formation.

- Sutton and Boveri in 1903 independently proposed the chromosome theory of inheritance.

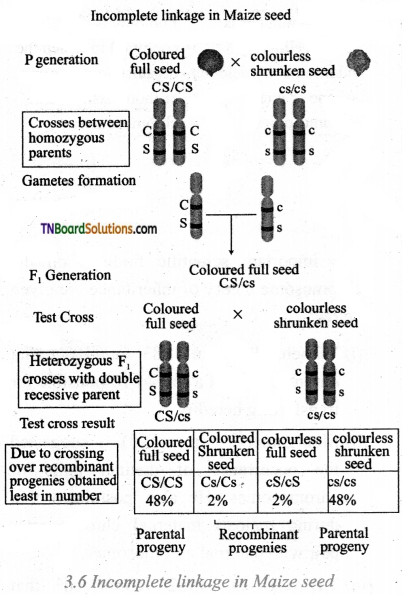

Question 2.

Explain the complete linkage of genes in maize with a diagram.

Answer:

The phenomenon of incomplete linkage was first reported by Hutchinson in maize. The chances of separation of genes are possible if the two linked genes are placed sufficiently apart. As a result potential and non-potential combinations are noticed. These linked genes show some crossing over and this phenomenon is called incomplete linkage.

![]()

Question 3.

Give the schematic representation of the eye color inheritance in Drosophila.

Answer:

Question 4.

Draw the schematic diagram of types of crossing over with its Recombination

Answer:

![]()

Question 5.

Describe the types of point mutations.

Answer:

Point mutation refers to the changes in single base pairs of DNA or in a small number of adjacent base pairs. There are two types of point mutations namely base-pair substitution and base-pair insertion or deletion.

the substitution of base pair in the DNA is the type of mutation in which one base pair is replaced by another base pair. This can be divided into two subtypes namely transition and transversion type.

Addition or deletion mutations in which addition or deletion of nucleotide pair takes place. This is called either base pair addition or base pair deletion. They are collectively termed indel mutations.

Substitution or the indel mutations cause changes in the translation. Based on this, the mutations are classified as silent mutation, missense mutation, nonsense mutation, and frameshift mutation.

Silent mutation or synonymous mutation: It is a type of mutation in which changes in one codon for an amino acid into another codon for that same amino acid to occur.

In missense or non-synonymous mutation, the codon of one amino acid is changed into a codon of another amino acid.

A nonsense mutation is a DNA mutation in which the change of codon for one amino acid is modified into a termination or stop codon.

In frameshift mutations, the addition or deletion of single base pair of DNA changes the reading framework of the translation process. As a result, there is a complete loss of normal protein structure and function.

Question 6.

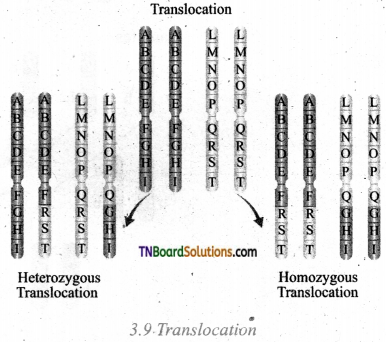

Explain different types of translocation in chromosomes with a suitable diagram.

Answer:

Translocation is a biological process in which the transfer of a segment of a chromosome to a non-homologous chromosome occurs.

There are three types of translocation namely:

- Simple translocation

- Shift translocation

- Reciprocal translocation

(i) Simple translocation: In this, a single break is made in only one chromosome and the broken segment gets to attach to one end of a non-homologous chromosome. In nature, it is very rare.

(ii) Shift translation: In this* the broken segment of a chromosome is inserted interstitially in a non-homologous chromosome.

(iii) Reciprocal translocation: In this, the mutual exchange of chromosomal segments between two non-homologous chromosomes. It is otherwise known as illegitimate crossing over. It is subdivided into two types namely homozygous translocation and heterozygous translocation.

(a) Homozygous translocation:

Translocation is involved between both the chromosomes of two pairs. In this, two homologous of each translocated chromosomes are identical.

(b) Heterozygous translocation:

In this type of translocation, only one of the chromosomes from each pair of two homologous chromosomes is involved in translation. The remaining chromosome is normal.

Translocation plays a vital role in the formation of new species.

![]()

Choose the correct answers.

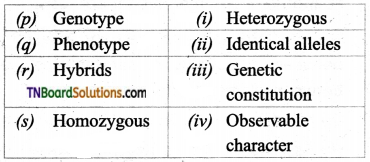

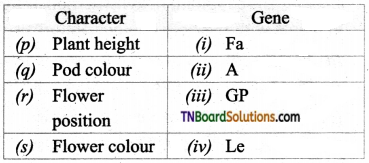

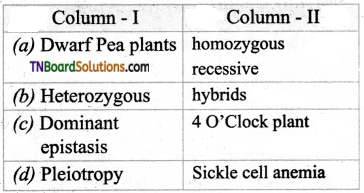

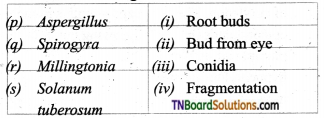

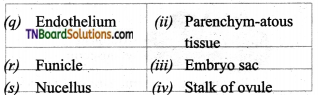

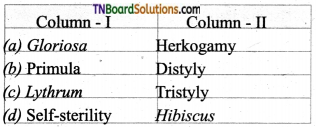

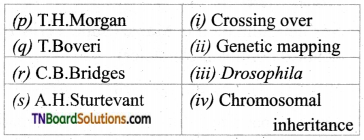

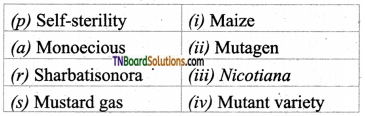

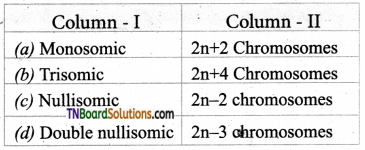

1. Match the following:

(a) (p)-(iv); (q)-(iii); (r)-(ii); (s)-(i)

(b) (p)-(iii); (q) -(iv); (r)-(i); (s)-(ii)

(c) (p)-(iii); (q)-(iv); (r)-(ii); (s)-(i)

(d) (p)-(ii); (q)-(i); (r)-(iv); (s)-(iii)

Answer:

(b) (p)-(iii); (q) -(iv); (r)-(i); (s)-(ii)

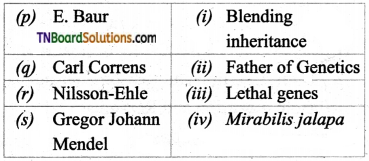

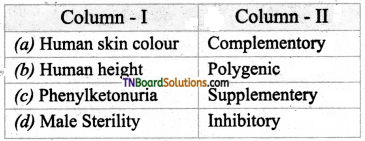

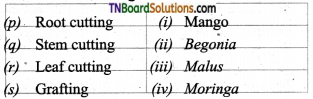

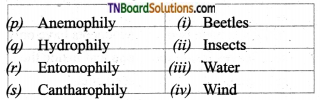

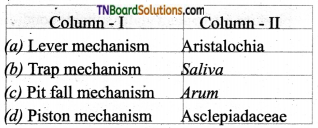

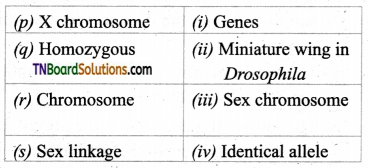

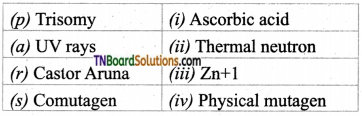

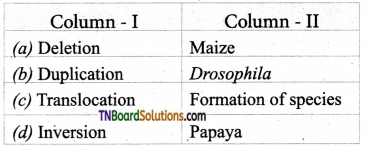

2. Match the following:

(a) (p)-(iii); (q)-(iv); (r)-(i); (s)-(ii)

(b) (p)-(iv); (q)-(iii); (r)-(ii); (s)-(i)

(c) (p)-(ii); (q)-(i); (r)-(iv); (s)-(iii)

(d) (p)-(iii); (q)-(iv); (r)-(ii); (s)-(i)

Answer:

(a) (p)-(iii); (q)-(iv); (r)-(i); (s)-(ii)

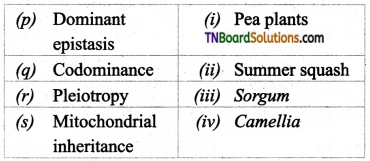

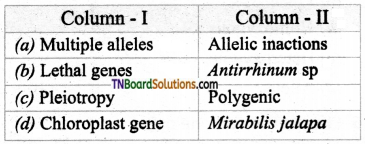

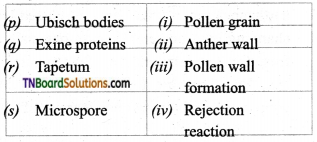

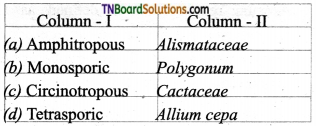

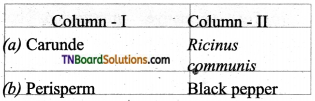

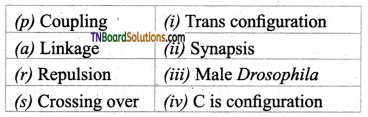

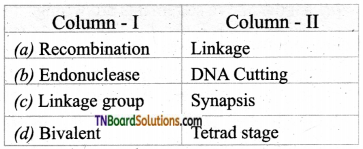

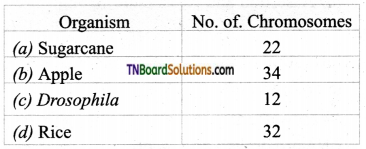

3. Match the following:

(a) (p)-(iv); (q)-(iii); (r)-(ii); (s)-(i)

(b) (p)-(iv); (q)-(iii); (r)-(i); (s)-(ii)

(c) (p)-(ii); (q)-(i); (r)-(iv); (s)-(iii)

(d) (p)-(iii); (q)-(iv); (r)-(i); (s)-(ii)

Answer:

(b) (p)-(iv); (q)-(iii); (r)-(i); (s)-(ii)

![]()

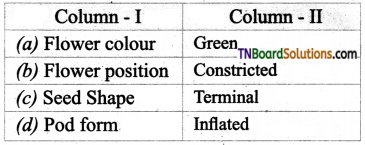

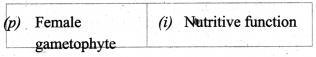

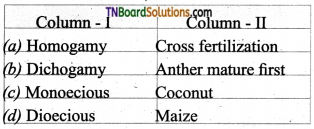

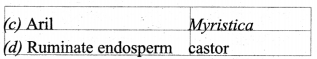

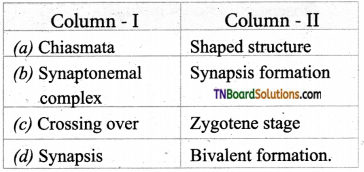

4. Match the following:

(a) (p)-(iv); (q)-(iii); (r)-(ii); (s)-(i)

(b) (p)-(iv); (q)-(iii); (r)-(i); (s)-(ii)

(c) (p)-(iii); (q)-(i); (r)-(iv); (s)-(ii)

(d) (p)-(ii); (q)-(i); (r)-(iv); (s)-(iii)

Answer:

(c) (p)-(iii); (q)-(i); (r)-(iv); (s)-(ii)

5. Match the following:

(a) (p)-(iv); (q)-(iii); (r)-(ii); (s)-(i)

(b) (p)-(U); (q)-(i); (r)-(iv); (s)-(iii)

(c) (p)-(iv); (q)-(iii); (r)-(i); (s)-(ii)

(d) (p)-(iii); (q)-(iv); (r)-(ii); (s)-(i)

Answer:

(d) (p)-(iii); (q)-(iv); (r)-(ii); (s)-(i)

6. Loss of a pair of chromosomes from the diploid set is called:

(a) Monosomy

(b) Nullisomy

(c) Double nullisomy

(d) Hypoploidy

Answer:

(b) Nullisomy

7. Chemical mutagenesis was first reported by:

(a) H.J.Muller

(b) T.H.Morgan

(c) C.Auerbaek

(d) M.S.Swaminathan

Answer:

(c) C.Auerbaek

8. Miller was the first to find out physical mutagen in:

(a) Maize

(b) Guineapig

(c) Nicotiana

(d) Drosophila

Answer:

(d) Drosophila

![]()

9. Multiple alleles associated with self- sterility was found in:

(a) Maize

(b) Nicotiana

(c) Wheat

(d) Papaya

Answer:

(b) Nicotiana

10. Incomplete linkage was observed is maize by:

(a) Punnet

(b) T.H.Morgan

(c) Hutchinson

(d) C.B.Bridges

Answer:

(c) Hutchinson

11. Choose the odd man out:

(a) T.H.Morgan

(b) C.B.Bridges

(c) H.J.Muller

(d) William Bateson

Answer:

(c) H.J.Muller

12. Find out the odd one:

(a) X-ray

(b) Gamma rays

(c) Cosmic rays

(d) Nitrous oxide

Answer:

(d) Nitrous oxide

13. Identify the odd one out:

(a) Caffeine

(b) Mustard gas

(c) Enthrosine

(d) Etsy urethane

Answer:

(a) Caffeine

![]()

14. Choose the odd man out:

(a) M.S.Swaminathan

(b) Alfred H. Sturtevant

(c) Muller

(d) Stadler

Answer:

(b) Alfred H. Sturtevant

15. Identify the odd one out:

(a) Insertion

(b) Deletion

(c) Translocation

(d) Terminalisation

Answer:

(d) Terminalisation

16. Which of the following in the correct pair?

Answer:

(b)

17. Identify the incorrect pair:

Answer:

(c)

18. Which of the following in the correct pair?

Answer:

(c)

19. Find out the incorrect pair:

Answer:

(d)

![]()

20. Which of the following is the correct pair?

Answer:

(b)

21. Assertion: Genes are hereditary units and they carry genetic information from one generation to the next generation.

Reason: The genes are arranged in chromosomes in linear order.

(a) Assertion is correct, Reason is the correct explanation of Assertion.

(b) Assertion is correct, Reason is not the correct explanation of Assertion.

(c) Assertion is not correct, Reason is the correct explanation of Assertion.

(d) Assertion and Reason are wrong.

Answer:

(b) Assertion is correct, Reason is not the correct explanation of Assertion.

22. Assertion: If two linked genes are sufficiently apart, the changes of their separation are possible.

Reason: If two linked genes are apart, the chances of crossing over is more.

(a) Assertion is correct, Reason is the correct explanation of Assertion.

(b) Assertion is correct, Reason is not the correct explanation of Assertion.

(c) Assertion is not correct, Reason is the correct explanation of Assertion.

(d) Assertion and Reason are wrong.

Answer:

(a) Assertion is correct, Reason is the correct explanation of Assertion.

23. Assertion: During synapsis, the homologous chromosomes are aligned side by side, resulting is pairing of homologous chromosomes.

Reason: Synaptonemal complex an organized structure of filaments are responsible for synapsis.

(a) Assertion is correct, Reason is the correct explanation of Assertion.

(b) Assertion is correct, Reason is not the correct explanation of Assertion.

(c) Assertion is not correct, Reason is the correct explanation of Assertion.

(d) Assertion and Reason are wrong.

Answer:

(a) Assertion is correct, Reason is the correct explanation of Assertion.

![]()

24. Assertion: Crossing over results in the formation of new combination of characters in an organism.

Reason: During crossing over segments of DNA are broken and recombined to produce new combination of alleles.

(a) Assertion is correct, Reason is the correct explanation of Assertion.

(b) Assertion is correct; Reason is not the correct explanation of Assertion.

(c) Assertion is not correct, Reason is the correct explanation of Assertion.

(d) Assertion and Reason are wrong.

Answer:

(a) Assertion is correct, Reason is the correct explanation of Assertion.

25. Assertion (A): In papaya, the sex determination is controlled by four alleles of genes.

Reason (R): Sex determination is a complex process determined by genes and the hormones.

(a) Assertion is correct, Reason is the correct explanation of Assertion.

(b) Assertion is correct, Reason is not the correct explanation of Assertion.

(c) Assertion is not correct, Reason is the correct explanation of Assertion.

(d) Assertion and Reason are wrong.

Answer:

(d) Assertion and Reason are wrong.

26. Which of the following statement is true?

(a) Somatic cells of organism are derived from the zygote by meiotic cell division.

(b) These consists of two non-identical sets of chromosomes.

(c) Somatic cells of organism are derived from the zygote by repeated mitotic cell division.

(d) None of the above.

Answer:

(c) Somatic cells of organism are derived from the zygote by repeated mitotic cell division.

27. Choose the incorrect statement:

(a) Alleles of a gene occur in pairs.

(b) Chromosomes do not occur in pairs.

(c) Homologous chromosomes separate during meiosis.

(d) Chromosomes can separate independently during meiosis.

Answer:

(b) Chromosomes do not occur in pairs.

![]()

28. Find out the correct statement.

(a) The crossing over does not take place in male Drosophila.

(b) The crossing over does not take place in female Drosophila.

(c) The crossing over frequency is more between linked genes.

(d) None of the above.

Answer:

(a) The crossing over does not take place in male Drosophila.

29. Indicate the incorrect statement.

(a) Multiple alleles of a series always occupy the same locus in the homologous chromosomes.

(b) No crossing over occurs within these alleles of a series.

(c) Multiple alleles of a series always occupy different locus of different chromosomes.

(d) All the above statements are wrong.

Answer:

(c) Multiple alleles of a series always occupy different locus of different chromosomes.

30. Indicate the correct statement.

(a) Spontaneous mutation occurs in the presence of known mutagen.

(b) Induced mutation occurs in the absence of known mutagen.

(c) Spontaneous mutation occurs in the absence of known mutagen.

(d) None of the above.

Answer:

(c) Spontaneous mutation occurs in the absence of known mutagen.