Students can Download Tamil Nadu 11th Accountancy Model Question Paper 2 English Medium Pdf, Tamil Nadu 11th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus, helps students complete homework assignments and to score high marks in board exams.

TN State Board 11th Accountancy Model Question Paper 2 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3:00 Hours

Maximum Marks: 90

PART – I

Answer all the questions. Choose the correct answer: [20 × 1 = 20]

Question 1.

Which one of the following is not a branch of accounting?

(a) Financial accounting

(b) Management accounting

(c) Human resources accounting

(d) None of the above

Answer:

(d) None of the above

![]()

Question 2.

Financial position of a business is ascertained on the basis of ……………………….

(a) Journal

(b) Trial balance

(c) Balance sheet

(d) Ledger

Answer:

(c) Balance sheet

Question 3.

The profounder of double entry system of book – keeping?

(a) J.R. Batli boi

(b) Luca Pacioli

(c) Old Kesal

(d) Menhar

Answer:

(b) Luca Pacioli

![]()

Question 4.

The concept which assumes that a business will last indefinitely is ………………………..

(a) Business entity

(b) Going concern

(c) Periodicity

(d) Conservation

Answer:

(b) Going concern

Question 5.

A firm has assets of ₹1,00,000 and the external liabilities of ₹60,000. Its capital would be ………………………….

(a) ₹1,60,000

(b) ₹60,000

(c) ₹1,00,000

(d) ₹40,000

Answer:

(d) ₹40,000

Question 6.

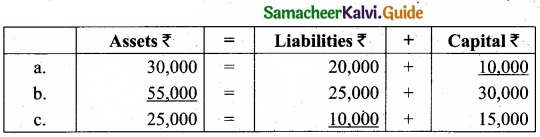

The incorrect accounting equation is ………………………

(a) Assets = Liabilities + Capital

(b) Assets = Capital + Liabilities

(c) Liabilities = Assets + Capital

(d) Capital = Assets – Liabilities

Answer:

(c) Liabilities = Assets + Capital

![]()

Question 7.

J.F means ………………………….

(a) Ledger page number

(b) Journal page number

(c) Voucher number

(d) Order number

Answer:

(b) Journal page number

Question 8.

The process of finding the net amount from the totals of debit and credit columns in a ledger is known as ……………………….

(a) Casting

(b) Posting

(c) Journalising

(d) Balancing

Answer:

(d) Balancing

Question 9.

The trial balance contains the balances of ………………………..

(a) Only personal accounts

(b) Only real account

(c) Only nominal accounts

(d) All accounts

Answer:

(d) All accounts

![]()

Question 10.

Which of the following is/are the objective(s) of preparing trial balance?

(a) Serving as the summary of all the ledger accounts.

(b) Helping in the preparation of final accounts.

(c) Examining arithmetical accuracy of accounts.

(d) (a), (b) and (c)

Answer:

(d) (a), (b) and (c)

Question 11.

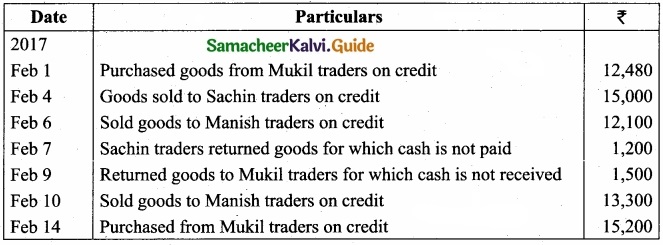

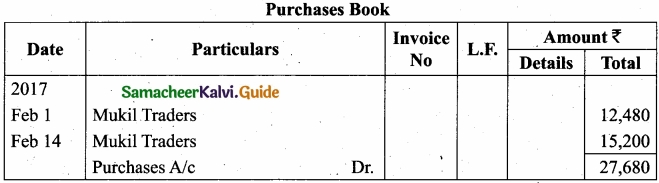

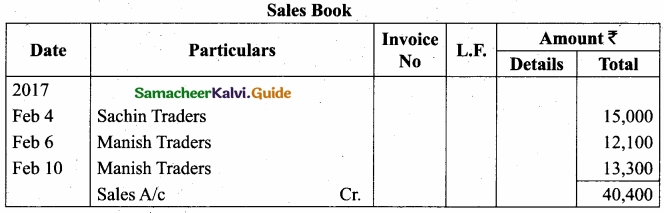

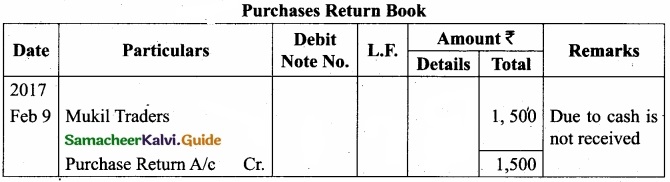

Sales book is used to record ……………………..

(a) All sales of goods

(b) All credit sales of assets

(c) All credit sales of goods

(d) All sales of assets and goods

Answer:

(c) All credit sales of goods

Question 12.

The total of the sales book is posted periodically to the credit of ………………………

(a) Sales account

(b) Cash account

(c) Purchases account

(d) Journal proper

Answer:

(a) Sales account

![]()

Question 13.

When a firm maintains a simple cash book, it need not maintain ………………………..

(a) Sales a/c in the ledger

(b) Purchases a/c in the ledger

(c) Capital a/c in the ledger

(d) Cash a/c in the ledger

Answer:

(d) Cash a/c in the ledger

Question 14.

Debit balance in the bank column of the cash book means …………………………

(a) Credit balance as per bank statement

(b) Debit balance as per bank statement

(c) Overdraft as per cash book

(d) None of the above

Answer:

(a) Credit balance as per bank statement

![]()

Question 15.

The difference in trial balance is taken to ……………………….

(a) The capital a/c

(b) The trading a/c

(c) The suspense a/c

(d) The Profit and loss a/c

Answer:

(c) The suspense a/c

Question 16.

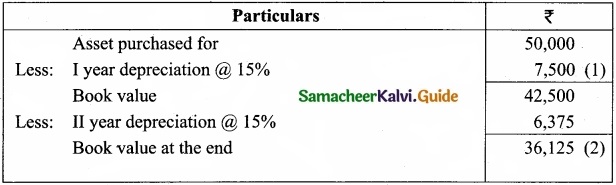

Under the written down value method of depreciation, the amount of depreciation is …………………………

(a) Uniform in all the years

(b) Decreasing every year

(c) Increasing every year

(d) None of the above

Answer:

(b) Decreasing every year

![]()

Question 17.

Interest on bank deposits is ………………………..

(a) Capital receipt

(b) Revenue receipt

(c) Capital expenditure

(d) Revenue expenditure

Answer:

(b) Revenue receipt

Question 18.

Net profit of the business increases the …………………………

(a) Drawings

(b) Receivables

(c) Debts

(d) Capital

Answer:

(d) Capital

Question 19.

Closing stock is valued at ………………………

(a) Cost price

(b) Market price

(c) Cost price or market price whichever is higher

(d) Cost price or net realisable value whichever is lower

Answer:

(d) Cost price or net realisable value whichever is lower

![]()

Question 20.

Which one is not a component of computer system?

(a) Input unit

(b) Output unit

(c) Data

(d) CPU

Answer:

(c) Data

PART – II

Answer any seven questions in which question No. 21 is compulsory. [7 × 2 = 14]

Question 21.

Mention two objectives of Accounting?

Answer:

- To keep a systematic record of financial transactions and events.

- To ascertain the profit or loss of the business enterprise.

![]()

Question 22.

What is Compound entry?

Answer:

Compound entry is an entry in which more than two accounts are involved. Either more than one account is debited or more than one account is credited or both.

Question 23.

What is Balance method?

Answer:

In this method, the balance of every ledger account either debit or credit, as the case may be, is recorded in the trial balance against the respective accounts. The balance method is widely used, as it helps in the preparation of financial statements.

Question 24.

Who is drawee?

Answer:

The person who has to make the payment or who accepts to make the payment is called the drawee, i.e., a debtor.

![]()

Question 25.

What are the types of petty cash book?

Answer:

- Simple petty cash book

- Analytical petty cash book.

Question 26.

Write two examples for error of principle?

Answer:

- Sale of old furniture on credit for ₹500 was entered in the sales book.

- Wages of ₹600 paid for installation of a new machine is debited to wages account,

![]()

Question 27.

Write any two objectives of providing depreciation?

Answer:

- To find out the true profit or loss.

- To present the true and fair view of financial position.

Question 28.

Write any two examples of revenue receipt?

Answer:

- Rent received

- Proceeds from sale of goods.

Question 29.

What is outstanding expenses?

Answer:

Expenses which have been incurred in the accounting period but not paid till the end of the accounting period are called outstanding expenses.

![]()

Question 30.

Write any four features of computerised accounting system (CAS)?

Answer:

- Simple and integrated

- Speed

- Accuracy

- Reliability

PART – III

Answer any seven questions in which question No. 31 is compulsory. [7 × 3 = 21]

Question 31.

Explain the meaning of accounting?

Answer:

Accounting is the systematic process of identifying, measuring, recording, classifying, summarising, interpreting and communicating financial information. Accounting gives information on;

- The resources available

- How the available resources have been employed, and

- The results achieved by their use.

![]()

Question 32.

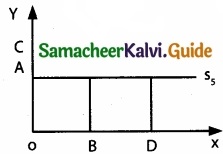

Show accounting equation from the following information:

- Started business with cash ₹80,000.

- Goods bought on credit from Raj ₹10,000.

- Purchased furniture for cash ₹6,000.

Answer:

Question 33.

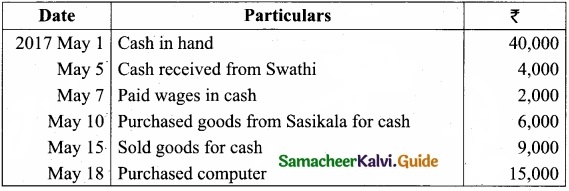

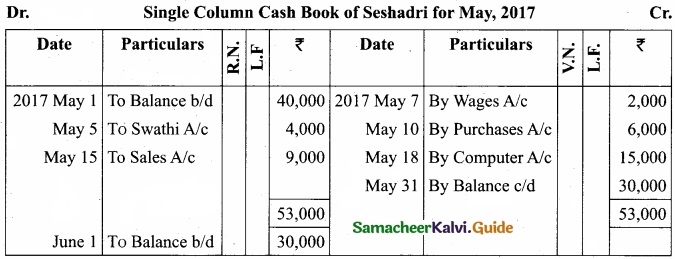

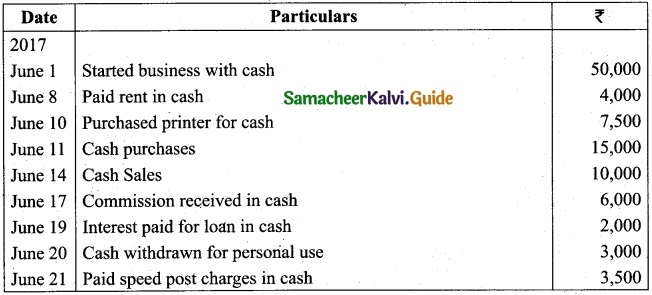

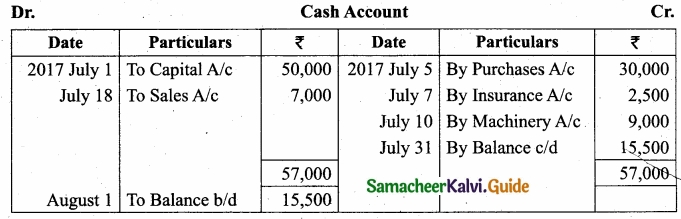

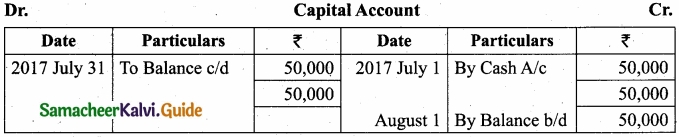

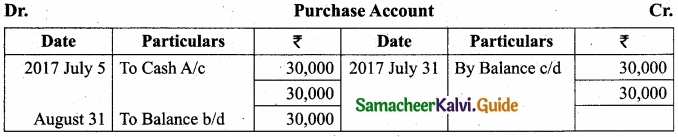

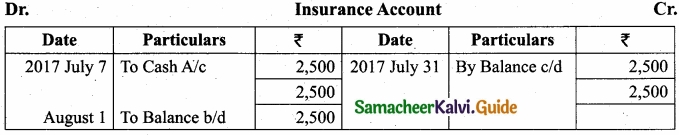

Enter the following transactions in a single column cash book of Pandeeswari for the month of June, 2017?

Answer:

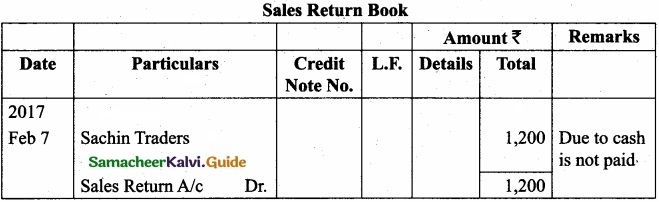

![]()

Question 34.

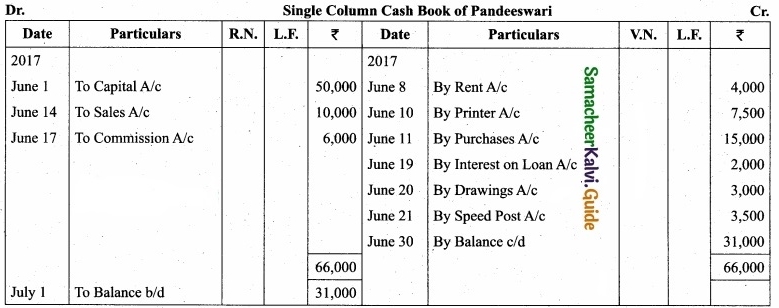

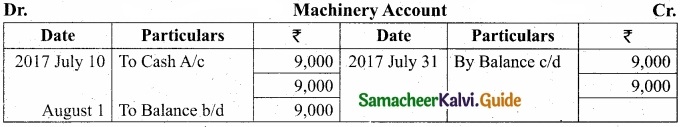

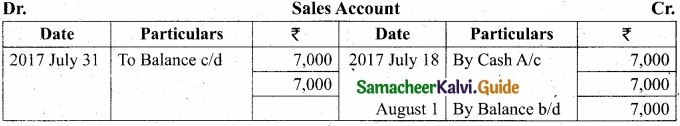

Prepare a Sales Account from the following transactions?

Answer:

Question 35.

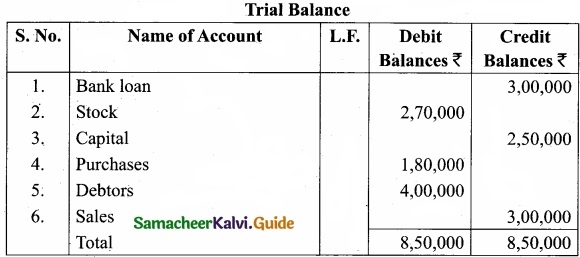

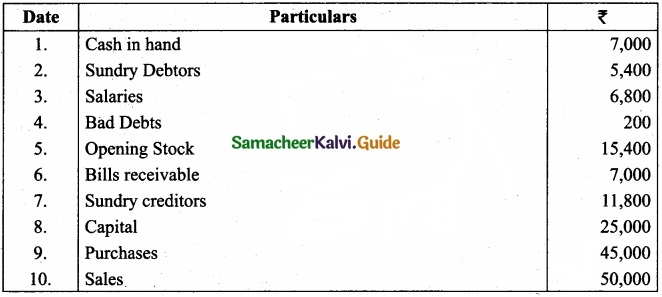

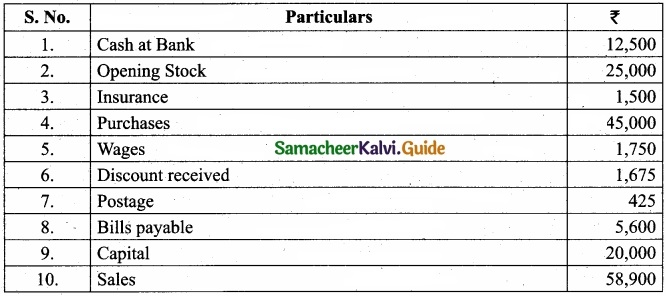

From the following balances of Arjun, prepare the Trial Balance as on 31st March, 2018?

Answer:

![]()

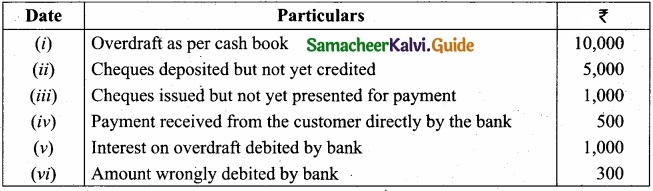

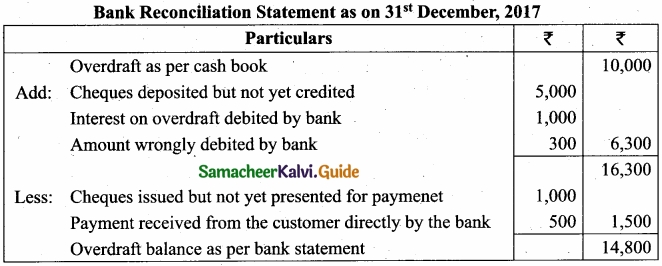

Question 36.

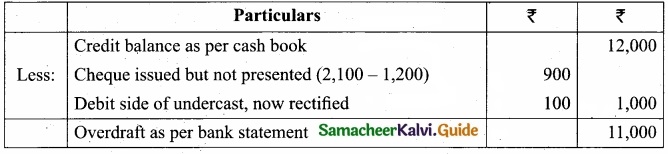

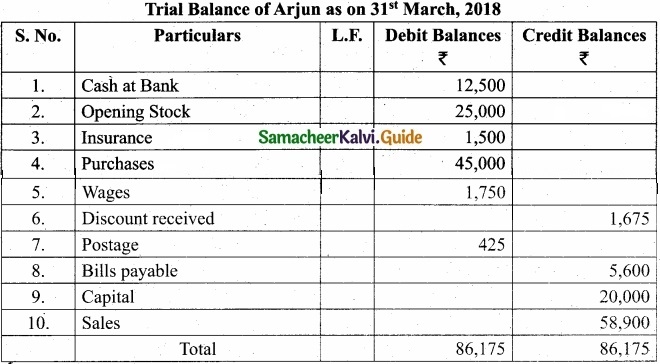

From the following particulars of Siva and Company, prepare a bank reconciliation statement as on 31st December, 2017?

- Credit balance as per cash book ₹12,000.

- A cheque of ₹1,200 issued and presented for payment to the bank, wrongly credited in the cash book as ₹2,100.

- Debit side of bank statement was undercast by ₹100.

Answer:

Question 37.

The following errors was detected before preparation of trial balance. Rectify them?

- The total of rent received account is carried forward ₹900 short.

- The total of salary account is carried forward ₹1,100 short.

- Sales returns book is over cast ₹800.

Answer:

- Rent received account is to be credited with ₹900.

- Salary account is to be debited with ₹1,100.

- Sales returns account should be credited with ₹800.

![]()

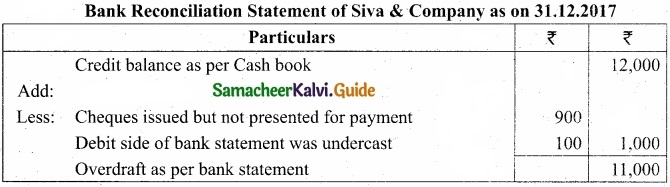

Question 38.

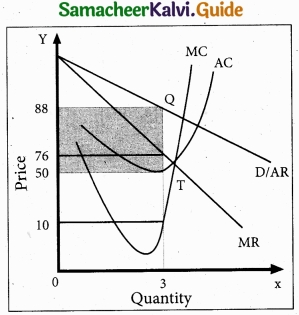

Find out the rate of depreciation under straight line method from the following details: Original cost of the asset ₹10,000; Estimated life of the asset 10 years; Estimated scrap value at the end ₹2,000?

Answer:

Question 39.

State whether they are capital and revenue:

- Construction of buildings ₹10,00,000.

- Repairs to furniture ₹50,000.

- White – washing the building ₹80,000.

Answer:

- Capital expenditure

- Revenue expenditure

- Revenue expenditure

![]()

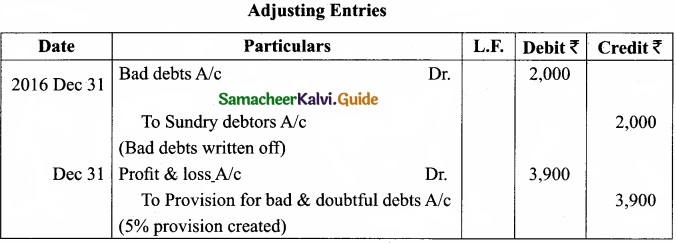

Question 40.

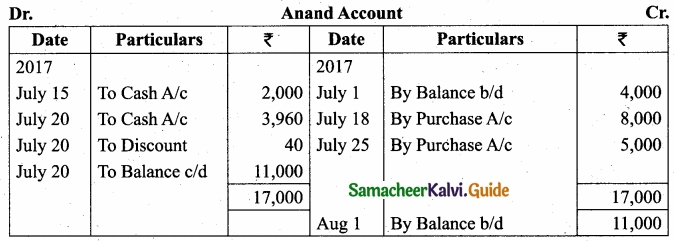

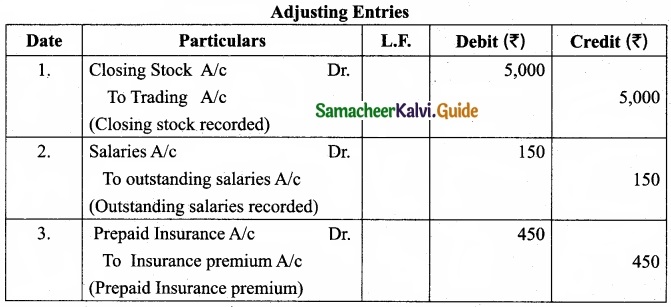

Pass adjusting entries for the following?

- The Closing stock was valued at ₹5,000;

- Outstanding salaries ₹150;

- Insurance prepaid ₹450;

Answer:

PART – IV

Answer all the questions. [7 × 5 = 35]

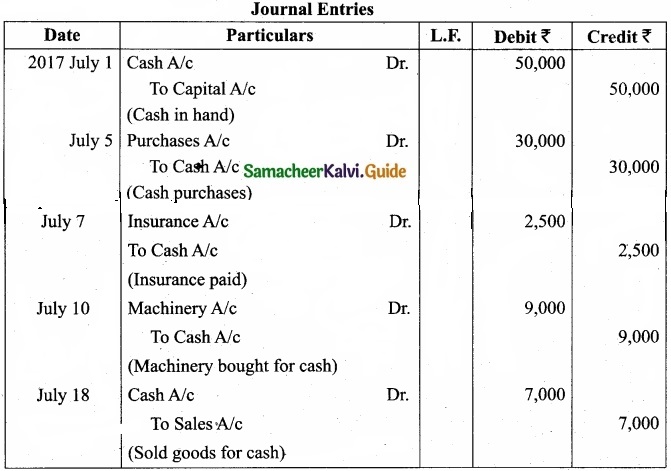

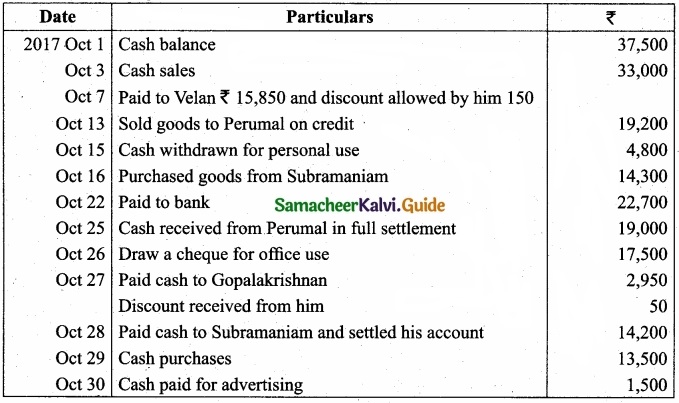

Question 41 (a).

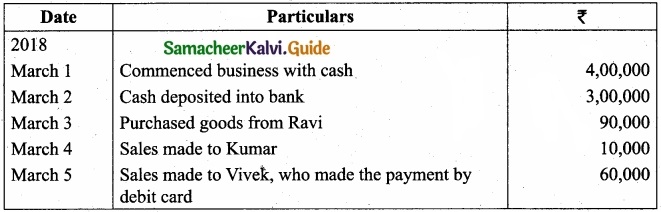

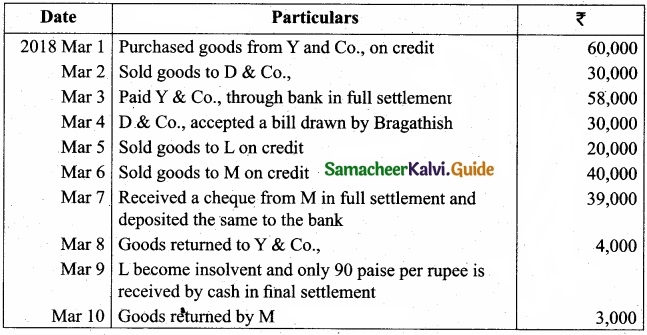

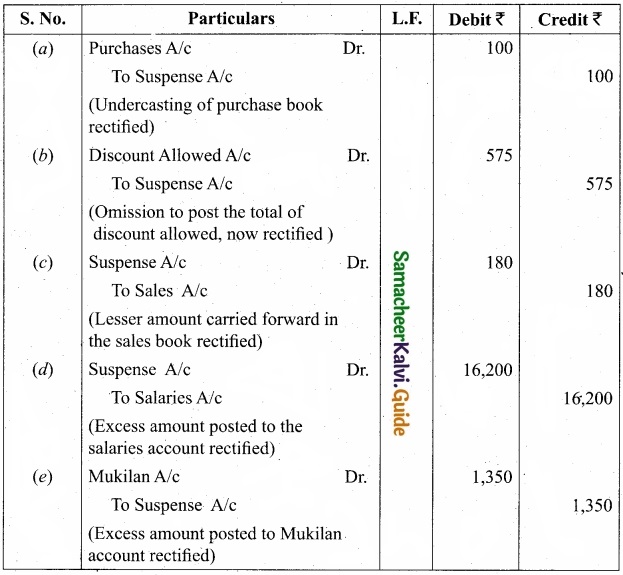

Bragathish is a trader dealing in electronic goods who commenced his business in 2015, for the following transactions took place in the month of March, 2018. Pass Journal entries?

Answer:

[OR]

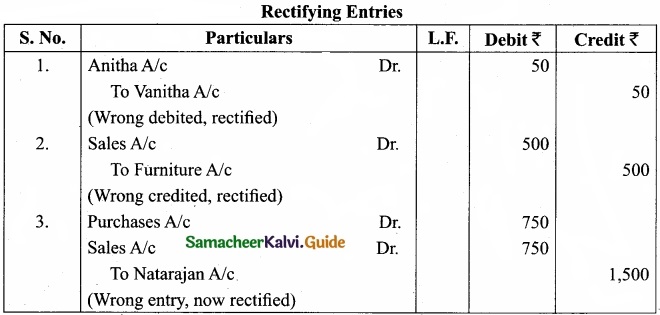

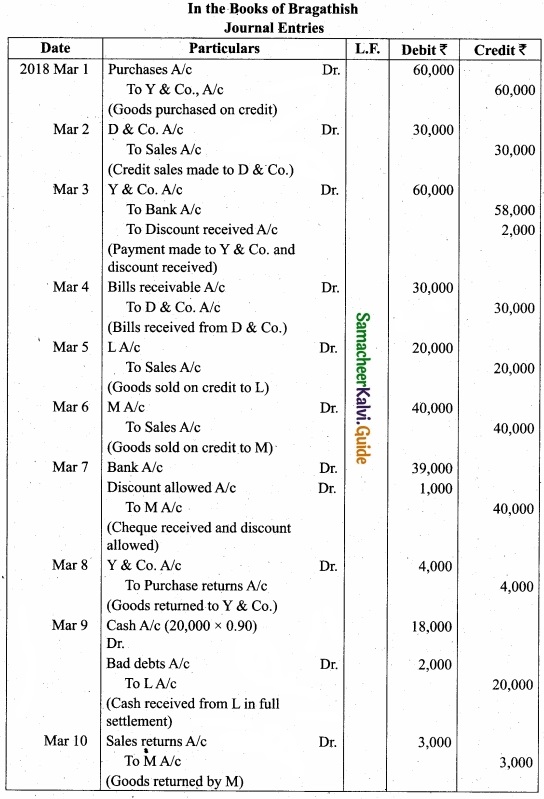

(b) The following errors were located after the preparation of the trial balance. Assume that there exists a suspense account. Pass journal entries to rectify them?

- The total of purchases book was undercast by ₹100.

- The total of the discount column on the debit side of cash book ₹575 were not posted.

- The total of one page of the sales book for ₹5,975 were carried forward to the next page as ₹5,795.

- Salaries ₹1,800 were posted as ₹18,000.

- Purchase of goods on credit from Mukilan for ₹150 have been posted to his account as ₹1,500.

Answer:

![]()

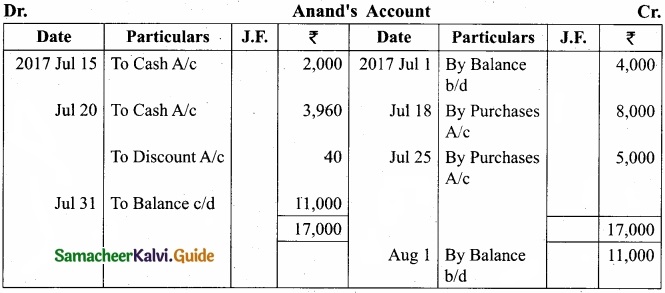

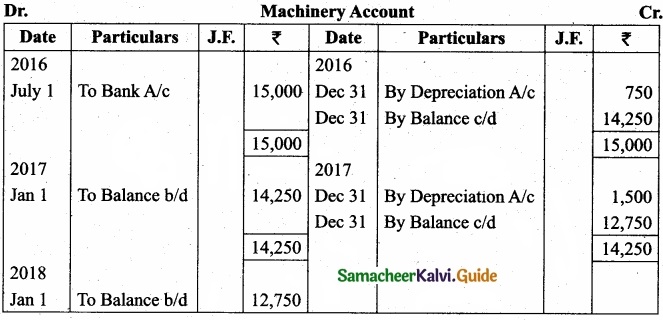

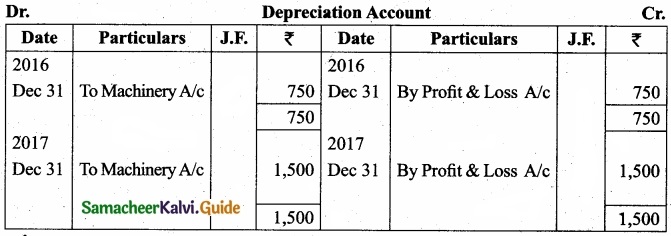

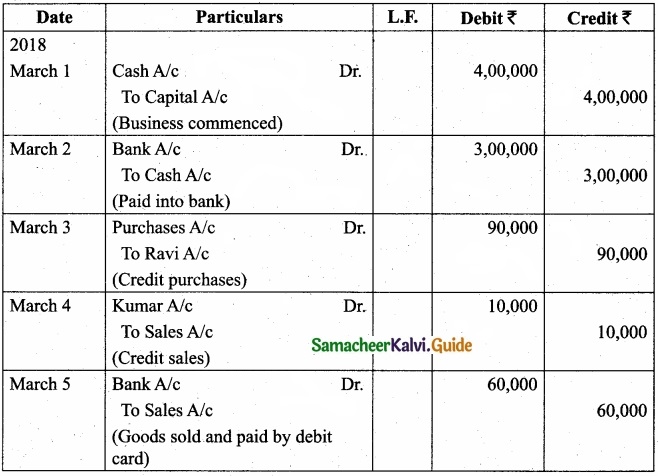

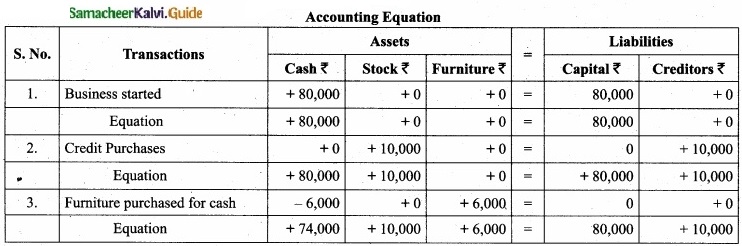

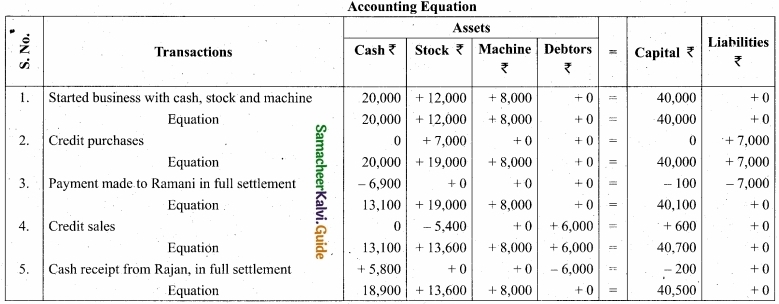

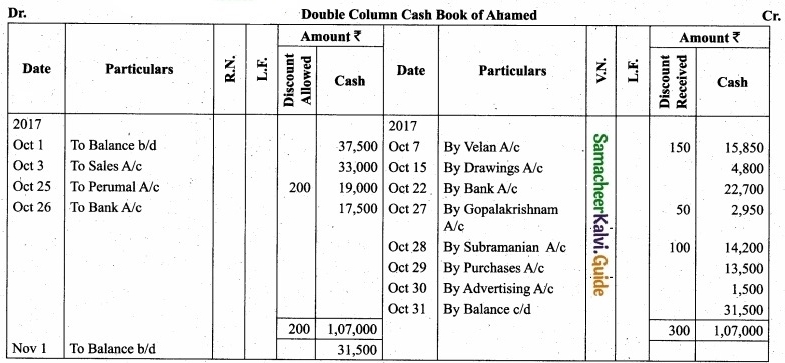

Question 42 (a).

Show the effect of following business transactions on the accounting equation:

- Anbu started business with cash ₹20,000; goods ₹12,000 and machine ₹8,000.

- Purchased goods from Ramani on credit ₹7,000.

- Payment made to Ramani in full settlement ₹6,900.

- Sold goods to Raj an on credit costing ₹5,400 for ₹6,000.

- Received from Raj an ₹5,800 in full settlement of his account.

Answer:

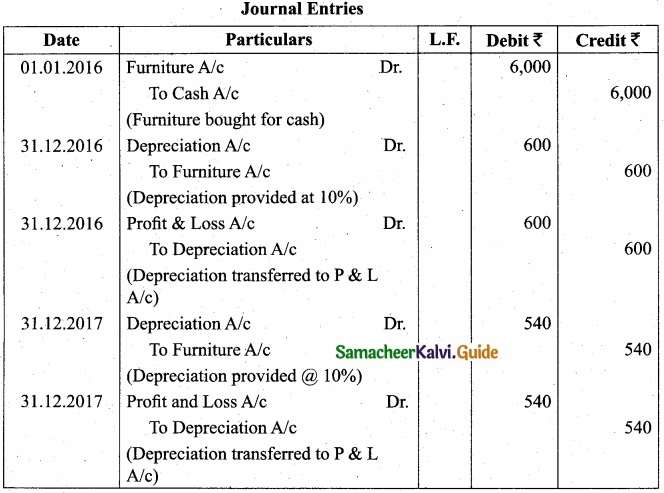

(b) A furniture costing ₹5,000 was purchased on 01.01.2016, the installation charges being ₹1,000. The furniture is to be depreciated @ 10% p.a. on the diminishing balance method. Pass Journal entries for the first two years?

Answer:

![]()

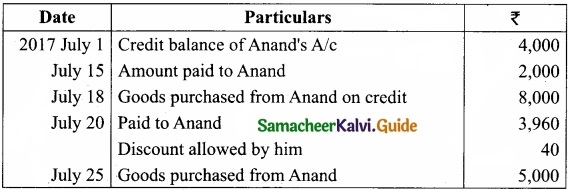

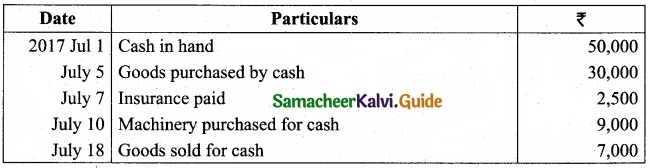

Question 43 (a).

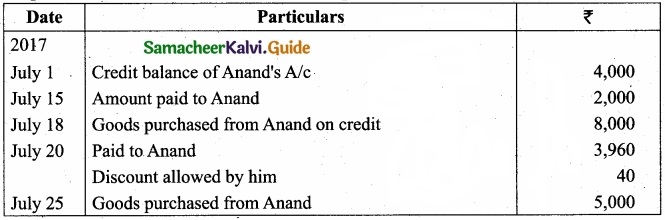

Journalise the following transactions and past them to the ledger?

Answer:

[OR]

(b) Classify the following receipts into capital or revenue?

- Sale proceeds of goods ₹75,000

- Loan borrowed from hank ₹2,50,000

- Sale of investment ₹1,20,000

- Commission received ₹30,000

- ₹1,400 wages paid in connection with the erection of new machinery

Answer:

- Revenue

- Capital

- Capital

- Revenue

- Capital

![]()

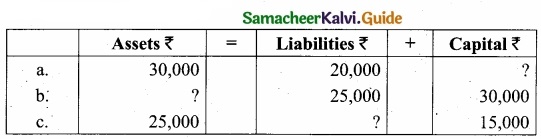

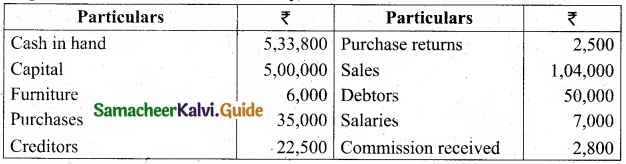

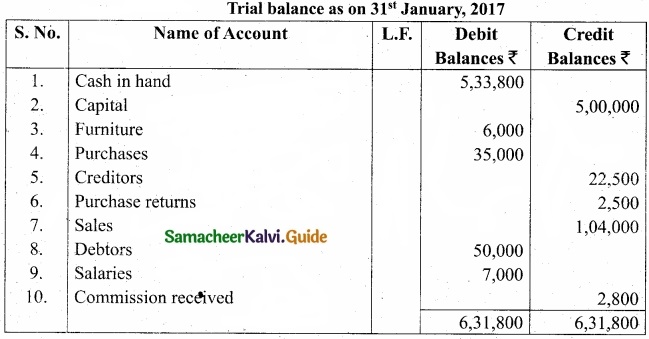

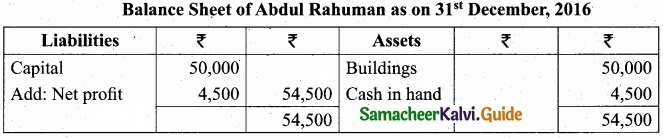

Question 44 (a).

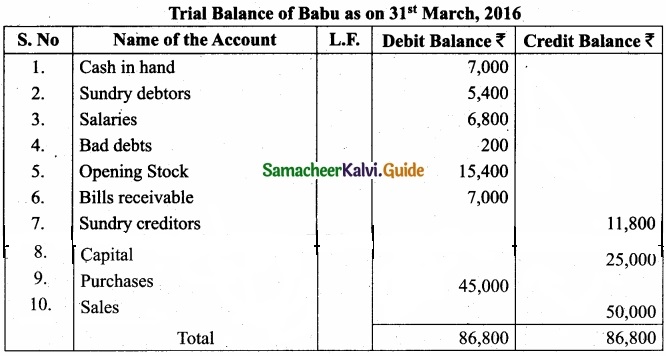

Prepare trail balance as on 31st January, 2017?

Answer:

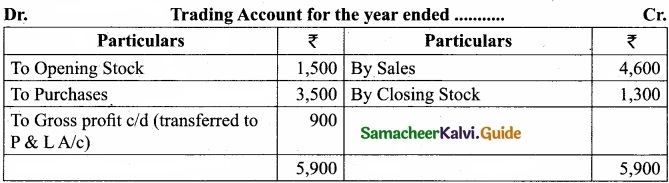

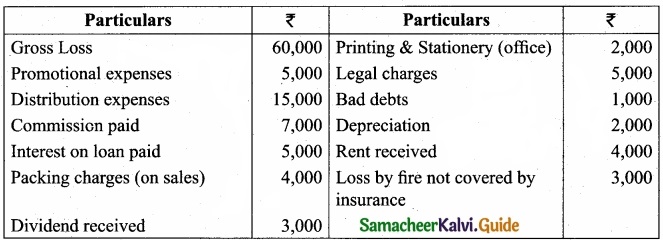

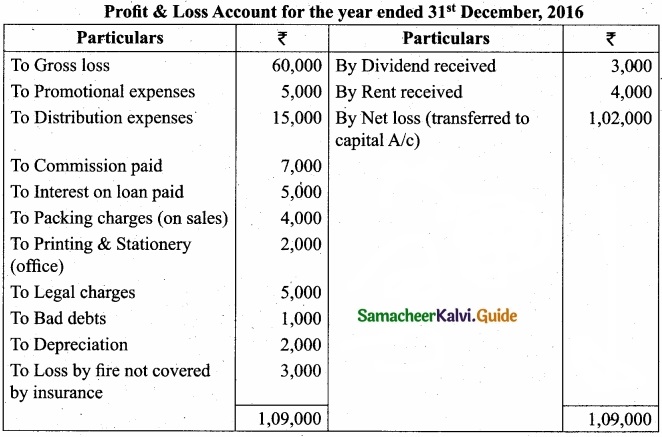

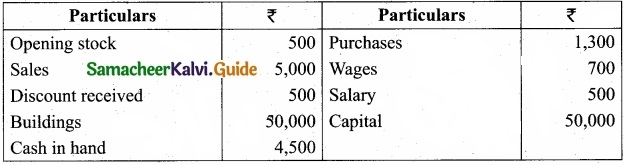

(b) From the following information, prepare Trading and Profit & Loss A/c of Abdul Rahuman for the year ending 31st December, 2016 and Balance Sheet as on that date. The closing stock on 31st December, 2016 was valued ₹2,000?

Answer:

![]()

Question 45 (a).

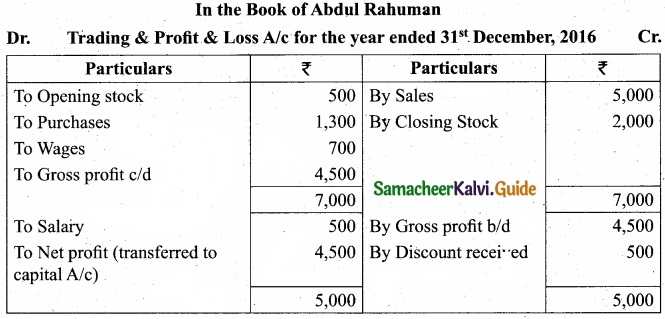

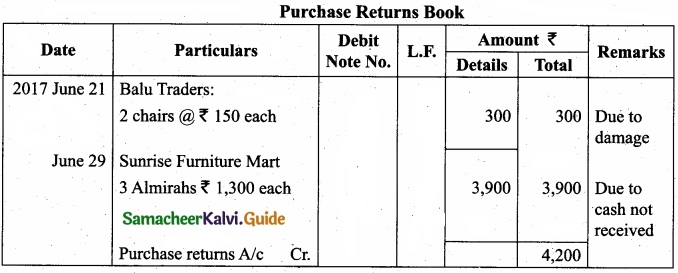

Prepare purchase book and Purchase returns book from the following of Robert Funiture Mart?

Answer:

[OR]

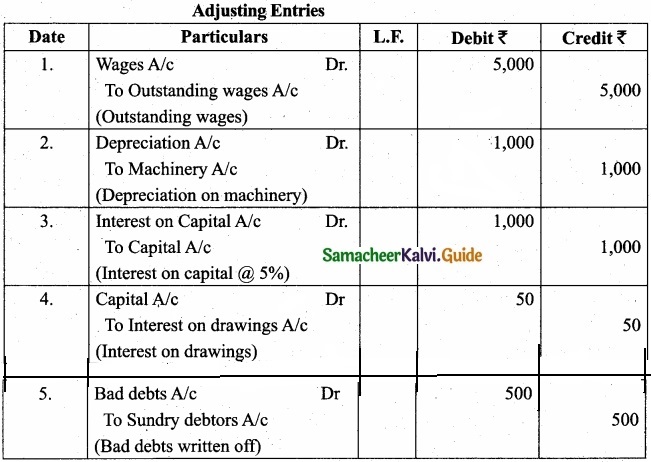

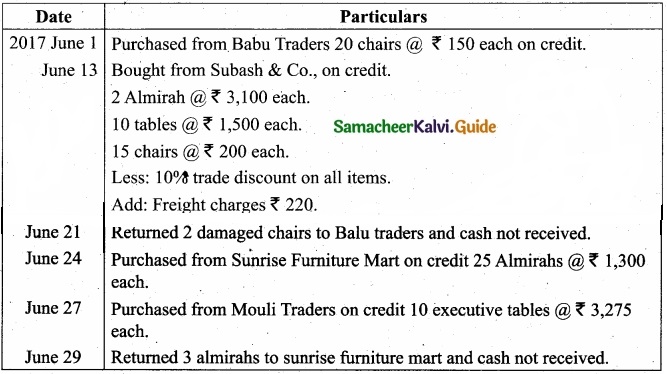

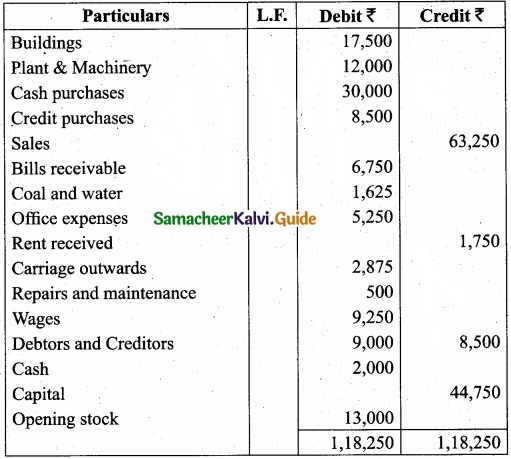

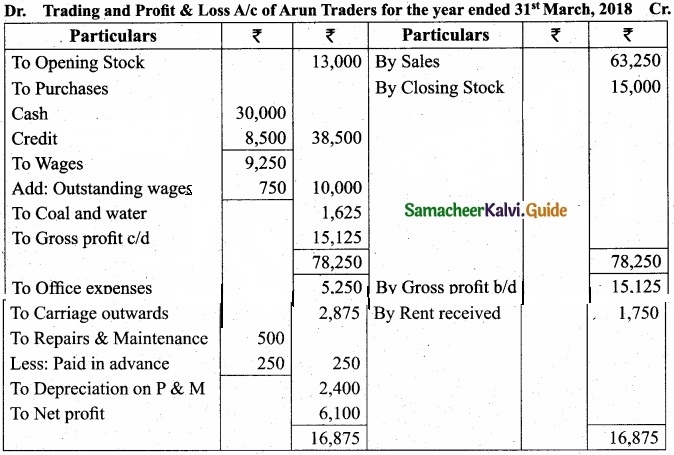

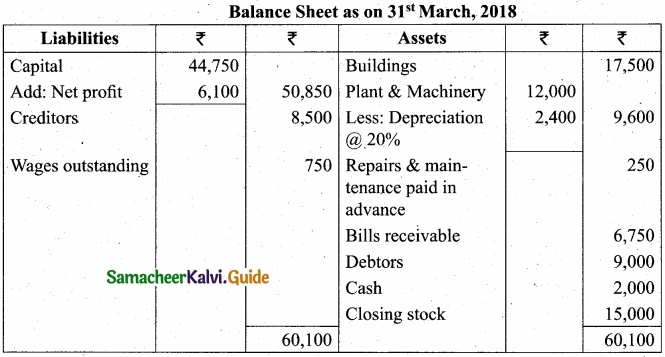

(b) The following trial balance was extracted from the books of Arun Traders as on 31st March, 2018?

Adjustments:

- Depreciate plant & machinery @ 20%.

- Wages outstanding amounts to ₹750.

- Half of repairs and maintenance paid is for the next year.

- Closing stock was valued at ₹15,000.

Prepare Trading and Profit and Loss A/c for the year ending 31st March, 2018 and Balance sheet as on that date.

Answer:

![]()

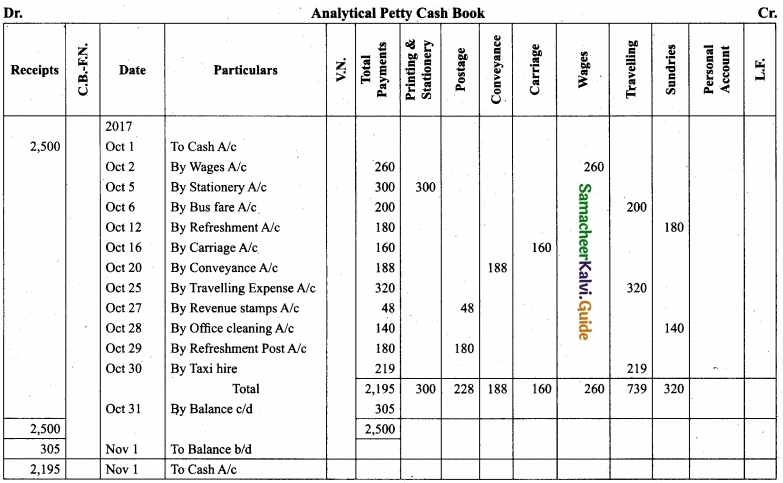

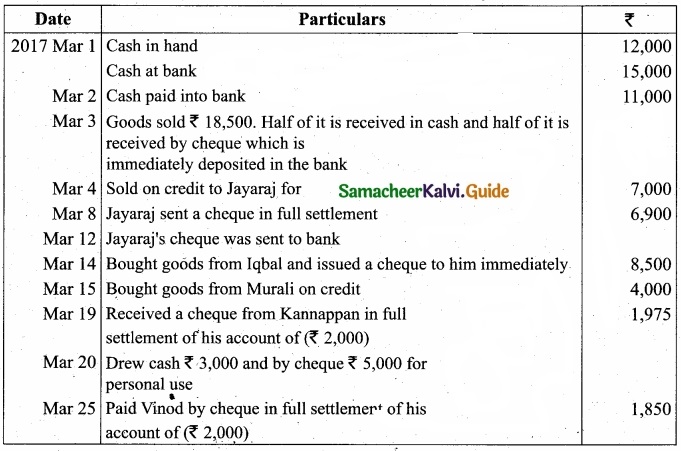

Question 46 (a).

Prepare Three Column Cash book in the books of Thiru Durairaj?

Answer:

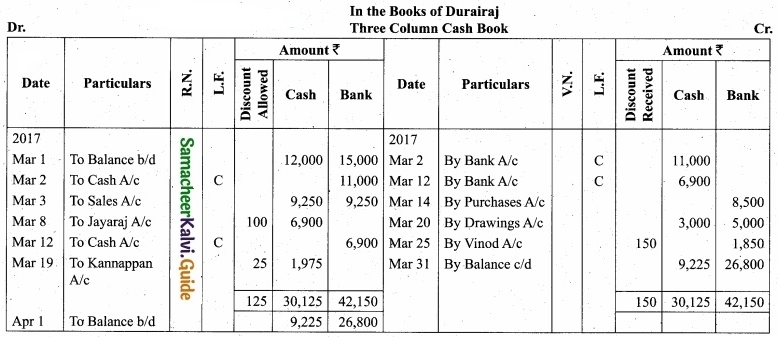

[OR]

(b) Enter the following transactions in Ahamed’s Cash book discount and Cash columns?

Answer:

![]()

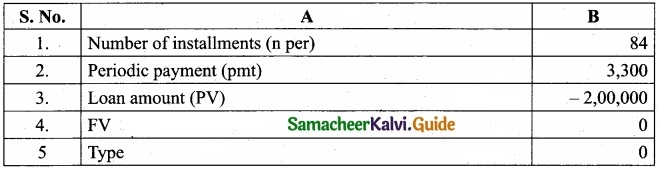

Question 47 (a).

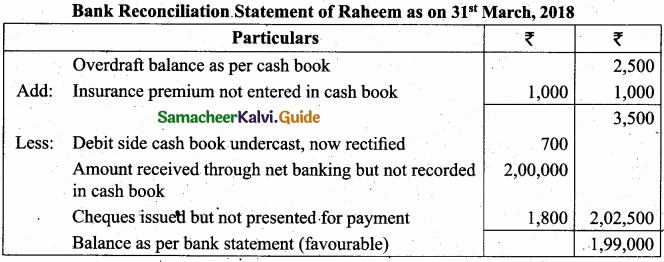

From the following particulars of Raheem traders, prepare a bank reconciliation statement as on 31st March, 2018?

- Overdraft as per cash book ₹2,500.

- Debit side of cash book was undercast by ₹700.

- Amount received by bank through RTGS amounting ₹2,00,000 omitted in the cash book.

- Two cheques issued for ₹1,800 and ₹2,000 on 29th March 2018. Only the second cheque is presented for payment,

- Insurance premium on car for ₹1,000 paid by the bank as per standing instructions not recorded in the cash book.

Answer:

[OR]

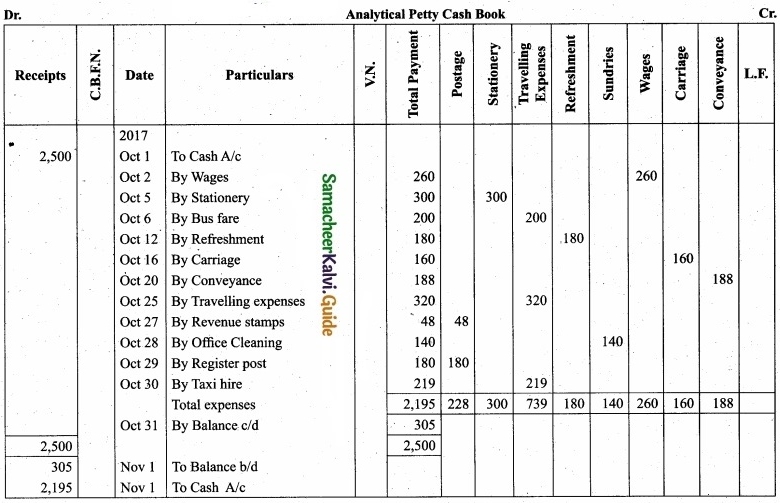

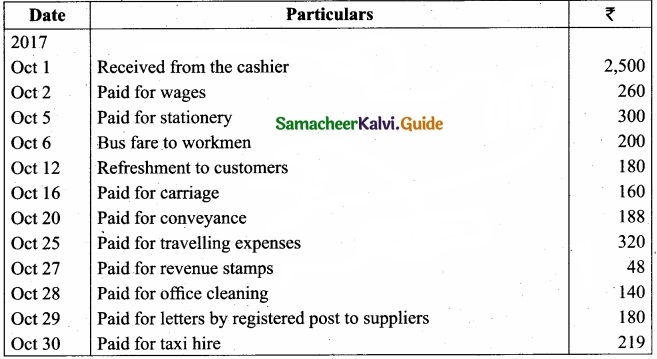

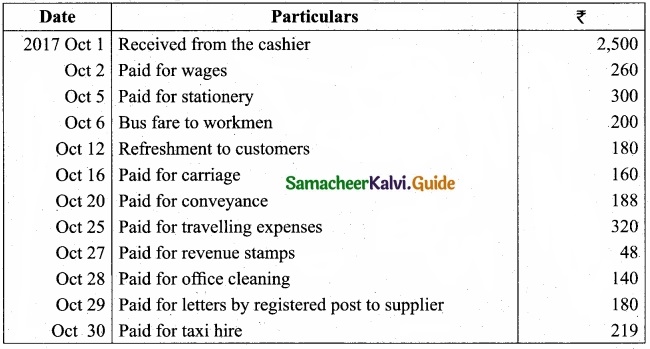

(b) Prepare an analytical petty cash book under imprest system?

Answer: