Tamilnadu State Board New Syllabus Samacheer Kalvi 11th Accountancy Guide Pdf Chapter 9 Rectification of Errors Text Book Back Questions and Answers, Notes.

Tamilnadu Samacheer Kalvi 11th Accountancy Solutions Chapter 9 Rectification of Errors

11th Accountancy Guide Bank Rectification of Errors Text Book Back Questions and Answers

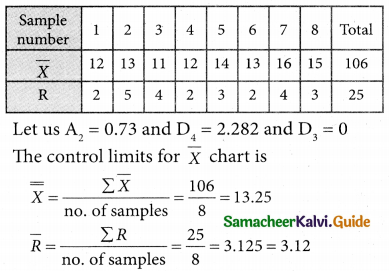

![]()

I. Multiple Choice Questions

Choose the correct answer.

Question 1.

Error of principle arises when ________.

a) There is complete omission of a transaction

b) There is partial omission of a transaction

c) Distinction is not made between capital and revenue items

d) There are wrong postings and wrong castings

Answer:

c) Distinction is not made between capital and revenue items

Question 2.

Errors not affecting the agreement of trial balance are ________.

a) Errors of principle

b) Errors of overcasting

c) Errors of undercasting

d) Errors of partial omission

Answer:

a) Errors of principle

Question 3.

The difference in trial balance is taken to ________.

a) The capital account

b) The trading account

c) The suspense account

d) The profit and loss account

Answer:

c) The suspense account

Question 4.

A transaction not recorded at all is known as an error of ________.

a) Principle

b) Complete omission

c) Partial omission

d) Duplication

Answer:

b) Complete omission

![]()

Question 5.

Wages paid for installation of machinery wrongly debited to wages account is ah error of ________.

a) Partial omission

b) Principle

c) Complete omission

d) Duplication

Answer:

b) Principle

Question 6.

Which of the following errors will not affect the trial balance?

a) Wrong balancing of an account

b) Posting an amount in the wrong account but on the correct side

c) Wrong totaling of an account

d) Carried forward wrong amount in a ledger account

Answer:

b) Posting an amount in the wrong account but on the correct side

Question 7.

Goods returned by Senguttuvan were taken into stock, but no entry was passed in the books. While rectifying this error, which^of the following accounts should be debited?

a) Senguttuvan account

b) Sales returns account

c) Returns outward account

d) Purchases returns account

Answer:

b) Sales returns account

Question 8.

A credit purchase of furniture from Athiyaman was debited tg purchases account. Which of the following accounts should be debited while rectifying this error?

a) Purchases account

b) Athiyaman account

c) Furniture account

d) None of these

Answer:

c) Furniture account

Question 9.

The total of purchases book was overcast. Which of the following accounts should be debited in the rectifying journal entry?

a) Purchases account

b) Suspense account

c) Creditor account

d) None of the above

Answer:

b) Suspense account

![]()

Question 10.

Which of the following errors will be rectified using suspense account?

a) Purchases returns book was undercast by ₹ 100

b) Goods returned by Narendran was not recorded in the books ;

c) Goods returned by Akila ₹ 900 was recorded in the sales returns book as ₹ 90

d) A credit sale of goods to Ravivarman was not entered in the sales book.

Answer:

a) Purchases returns book was undercast by ₹ 100

![]()

II. Very Short Answer Type Questions

Question 1.

What is meant by rectification of errors?

Answer:

Correction of errors in the books of accounts is not done by erasing, rewriting or striking the figures which are incorrect. Correcting the errors that has occurred is called Rectification of errors.

Question 2.

What is meant by error of principle?

Answer:

Error of principle means the mistake committed in the application of fundamental accounting principles in recording a transaction in the books of accounts.

Question 3.

What is meant by error of partial omission?

Answer:

When the accountant has failed to record a part of the transaction, it is known as error of partial omission. This error usually occurs in posting. This error affects only one account.

Question 4.

What is meant by error of complete omission?

Answer:

It means the failure to record a transaction in the journal or subsidiary book or failure to post both the aspects in ledger. This error’ affects two or more accounts. ‘

Question 5.

What are compensating errors?

Answer:

The errors that make up for each other or neutralise each other are known as compensating errors. These errors may occur in related or unrelated accounts. Thus, excess debit or credit in one account may be compensated by excess credit or debit in some other account. These are also known as offsetting errors.

![]()

III. Short Answer Questions

Question 1.

Write a note on error of principle by giving an example.

Answer:

It means the mistake committed in the application of fundamental accounting principles in recording a transaction in the books of accounts.

The following are the possibilities of error of principle

1) Entering the purchase of an asset in the purchases book

Example: Machinery purchased on credit for ₹ 10,000 by M/s. Anbarasi garments manufacturing company entered in the purchases book.

2) Entering the sale of an asset in the sales book

Example: Sale of old furniture on credit for ₹ 500 was entered in the sales book.

3) Treating a capital expenditure as a revenue expenditure

Examples: An amount of ₹ 3,000 spent on the construction of an additional room is debited to repairs account. Wages of ₹ 600 paid for installation of a new machine is debited to wages account.

4) Treating a revenue expenditure as a capital expenditure

Example: An amount of ₹ 2,000 paid for repairs to a machine is debited to machinery account.

Question 2.

Write a note on suspense account.

Answer:

1. When the trial balance does not tally, the amount of difference is placed to the debit (whenthe total of the credit column is higher than the debit column) or credit (when the total of thedebit column is higher than the credit column) to a temporary account known as ‘suspenseaccount’

2. Suspense account will remain in the books until the location and rectification of errors.

3. Afterrectifying the errors and posting the rectification entries to the respective ledger accounts, thesuspense account appearing in the ledger is to be balanced.

4. If all the errors are located andrectified, the suspense account gets closed.

Question 3.

What are the errors not disclosed by a trial balance?

Answer:

Certain errors will not affect the agreement of trial balance. Though such errors occur in thebooks of accounts, the total of debit and credit balance will be the same. The trial balance willtally. Errors of complete omission, error of principle, compensating error, wrong entry in thesubsidiary books are not disclosed by the trial balance.

Examples of such errors are as follows:

- Treating revenue expenditure as capital expenditure

- Omitting a transaction completely

- Entering a transaction in a wrong subsidiary book

- Entering a transaction twice in a subsidiary book or journal

- Entering the amount of a transaction wrongly in the journal

- Entering the amount of transaction wrongly in the subsidiary book.

Question 4.

What are the errors disclosed by a trial balance?

Answer:

Certain errors affect the agreement of trial balance. If such errors have occurred in the books of accounts, the total of debit and credit balances will not be the same. The trial balance willnottally. Error of partial omission and error of commission affect the agreement of trial balance. Examples of such errors are follows:

- Entered in the journal but posted to one account and omitted to be posted to the other.

- Posting an amount to the wrong side of a ledger account

- Posting twice in a ledger account.

- Over-casting or under-casting in a subsidiary book.

- Posting a wrong amount to the wrong side of an amount.

- Errors in carrying forward the page total from one page to the next page of an account or subsidiary book.

- Errors arising in the balancing of an account.

- Omission to post an entry from a subsidiary book.

![]()

Question 5.

Write a note on one-sided errors and two sided error.

Answer:

(a) Rectification of one-sided errors before preparing trial balance:

- When one-sided error is detected before preparing the trial balance, no journal entry isrequired to be passed in the books.

- In such cases, the error can be rectified by giving anexplanatory note in the account affected as to whether the concerned account is to bedebited or credited.

- Example: Sales book is under cast by ₹ 100.

- In this case, the sales book is under cast by ₹ 100.

- The total of sales book is posted to thecredit side of sales account in the ledger.

- The under casting has resulted in under-creditingof sales account by ₹ 100.

- This is an error of commission.

- The error is only in sales account.There is short credit in sales account by ₹ 100. Hence, it is rectified by crediting salesaccount by ₹ 100.

(b) Rectification of two-sided errors before preparing the trial balance:

1. When a two-sided error is detected before preparing the trial balance, it must be rectifiedby passing a rectifying journal entry in the journal proper after analyzing the error.

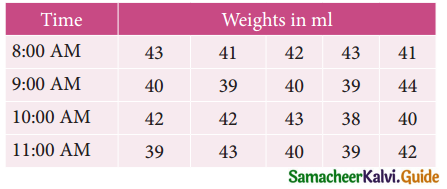

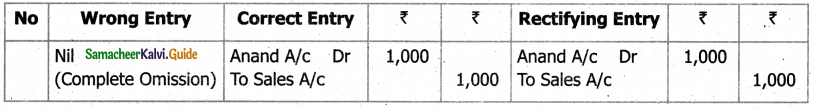

Example: Goods sold to Anand for ₹ 1,000 on credit was not entered in the sales book. The entry will be

Method of deriving the rectifying entries

IV. Exercises

Question 1.

State the account/s affected in each of the following errors

a) Goods purchased on credit from Saranya for ₹ 150 was posted to the debit side of her account.

b) The total of purchases book ₹ 4,500 was posted twice.

Solution:

a) Saranya account should be credit with ₹ 300

b) Purchases account should be credit with ₹ 4,500

Question 2.

State the account/s affected in each of the following errors

a) Goods sold to Vasu on credit for ₹ 1,000 was not recorded in the sales book.

b) The total of sales book ₹ 2,500 was posted twice.

Solution:

a) Sales account should be credit with ₹ 1,000

b) Sales account should be Debited with ₹ 2,500

Question 3.

Rectify the following errors discovered before the preparation of the trial balance

a) Sales book was undercast by ₹ 100

b) Purchases returns book was overcast by ₹ 200

Solution:

a) Sales account should be Credited with ₹ 100

b) Purchases returns account should be debited with ₹ 200

![]()

Question 4.

Rectify the following errors before the preparation of trial balance

a) Returns outward book was undercast by ₹ 2,000

b) Returns inward book total was taken as ₹ 15,000 instead of ₹ 14,000

c) The total of the purchases account was carried forward ₹ 100 less.

Solution:

a) Purchases return account should be Credited with ₹ 2,000

b) Sales returns account should be Debited with ₹ 1,000

c) Purchases accounts should be debited ₹ 100

Question 5.

Rectify the following errors assuming that the trial balance is yet to be prepared

a) Sales book was undercast by ₹ 400

b) Sales returns book was overcast by ₹ 500

c) Purchases book was undercast by ₹ 600

d) Purchases returns book was overcast by ₹ 700

e) Bills receivable book was undercast by ₹ 800

Solution:

a) Sales account should be credited with ₹ 400

b) Sales return accounts should be Credited with ₹ 500

c) Purchases account should be debited with ₹ 600

d) Purchases returns account should be debited with ₹ 700

e) Bills received account should be debited with ₹ 800

Question 6.

Rectify the following errors before preparing trial balance

a) The total of purchases book was carried forward ₹ 90 less.

b) The total of purchases book was carried forward ₹ 180 more.

c) The total of sales book was carried forward ₹ 270 less.

d) The total of sales returns book was carried forward ₹ 360 more.

e) The total of purchase returns book was carried forward ₹ 450 less.

Solution:

a) Purchases account is to be Debited with ₹ 90

b) Purchases account is to be Credited with ₹ 180

c) Sales account is to be Credited with ₹ 270

d) Sales returns account is to be Credited with ₹ 360

e) Purchases returns account is to be Credit with ₹ 450

Question 7.

The following errors were located by the accountant before preparation of trial balance. Rectify them.

a) The total of the discount column of ₹ 1,100 on the debit side of the cash book was not yet osted.

b) The total of the discount column on the credit side of the cash book was undercast by ₹ 500.

c) Purchased goods from Anbuchelvan on credit for ₹ 700 was posted to the debit side of his account.

d) Sale of goods to Ponmukil on credit for ₹ 78 was posted to her account as ₹ 87.

e) The total of sales returns book of ₹ 550 was posted twice.

Solution:

a) Discount account should be debited with ₹ 1,100

b) Discount account should be Credited with ₹ 500

c) Anbuchelvan account should be Credited with ₹ 1,400

d) Ponmuki account should be Credit with ₹ 9

e) Sales return account should be Credit with ₹ 550

Question 8.

The accountant of a firm located the following errors before preparing the trial balance. Rectify them.

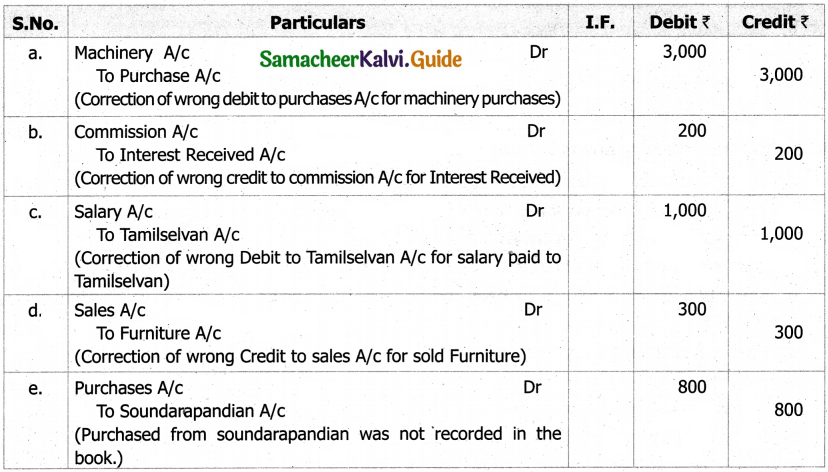

a) Machinery purchased for ₹ 3,000 was debited to purchases account.

b) Interest received ₹ 200 was credited to commission account.

c) An amount of ₹ 1,000 paid to Tamil selvan as salary was debited to his personal account.

d) Old furniture sold for ₹ 300 was credited to sales account.

e) Goods worth ₹ 800 purchased from Soundarapandian on credit was not recorded in the books of accounts.

Solution:

Journal Entries

Question 9.

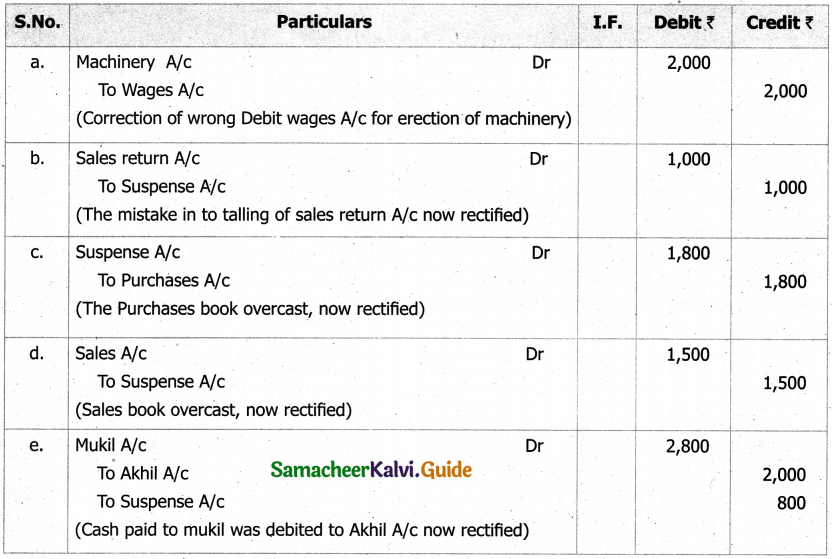

Rectify the following errors which were located before preparing the trial balance.

a) Wages paid ₹ 2,000 for the erection of machinery was debited to wages account.

b) Sales returns book was short totalled by ₹ 1,000.

c) Goods purchased for ₹ 200 was posted as ₹ 2,000 to purchases account.

d) The sales book was overcast by ₹ 1,500.

e) Cash paid to Mukil ₹ 2,800 which was debited to Akhil’s account as ₹ 2,000.

Solution:

Rectification of Errors:

Question 10.

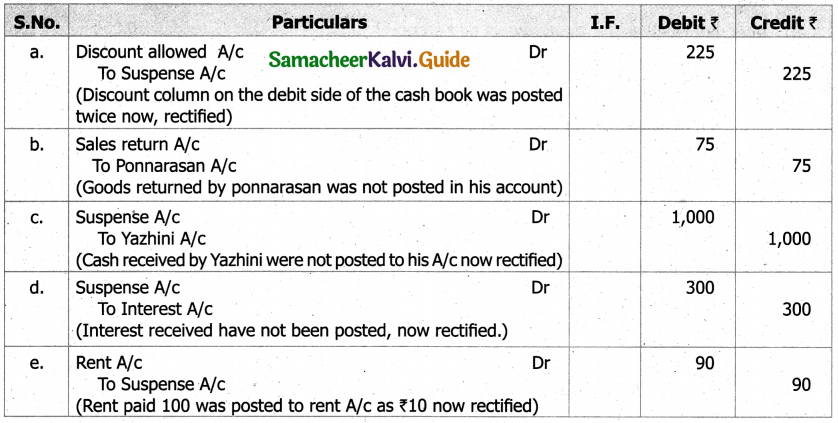

Rectify the following errors which were located at the time of preparing the trial balance

a) The total of the discount column on the debit side of the cash book of ₹ 225 was posted twice.

b) Goods of the value of ₹ 75 returned by Ponnarasan was not posted to his account.

c) Cash received from Yazhini ₹ 1,000 was not posted.

d) Interest received ₹ 300 has not been posted.

e) Rent paid ₹ 100 was posted to rent account as ₹ 10

Solution:

Rectification of Errors

Question 11.

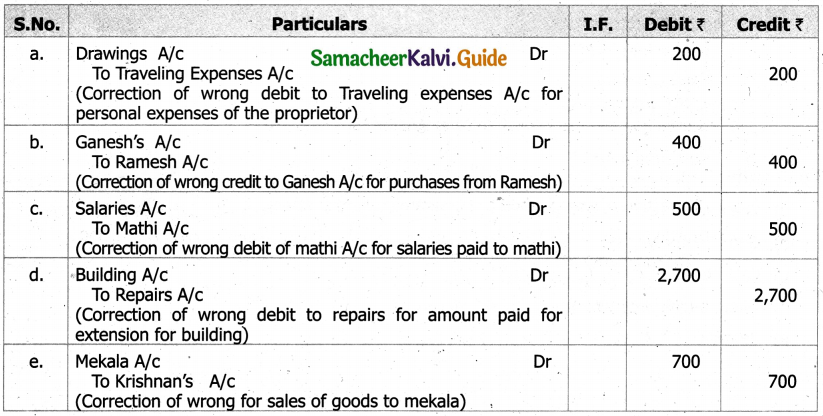

The following errors were located at the time of preparing trial balance. Rectify them.

a) A personal expense of the proprietor ₹ 200 was debited to traveling expenses account.

b) Goods of ₹ 400 purchased from Ramesh on credit was wrongly credited to Ganesh’s account.

c) An amount of ₹ 500 paid as salaries to Mathi was debited to his personal account.

d) An amount of ₹ 2,700 paid for extension of the building was debited to repairs account.

e) A credit sale of goods of ₹ 700 on credit to Mekala was posted to Krishnan’s account.

Solution:

Rectification of Errors

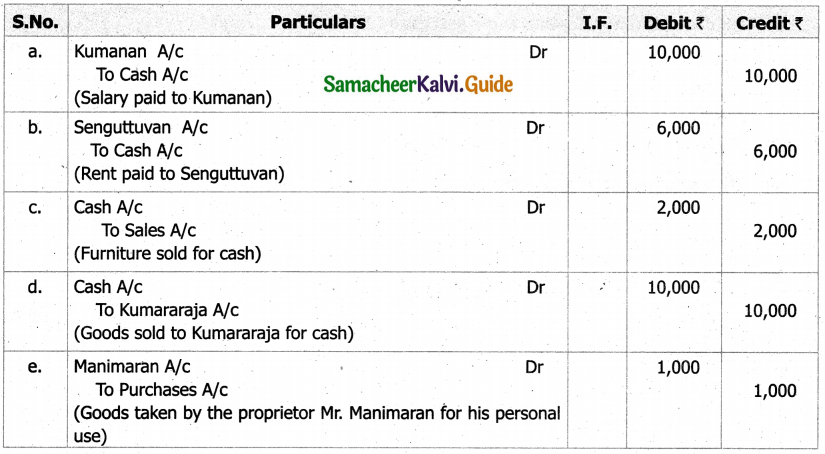

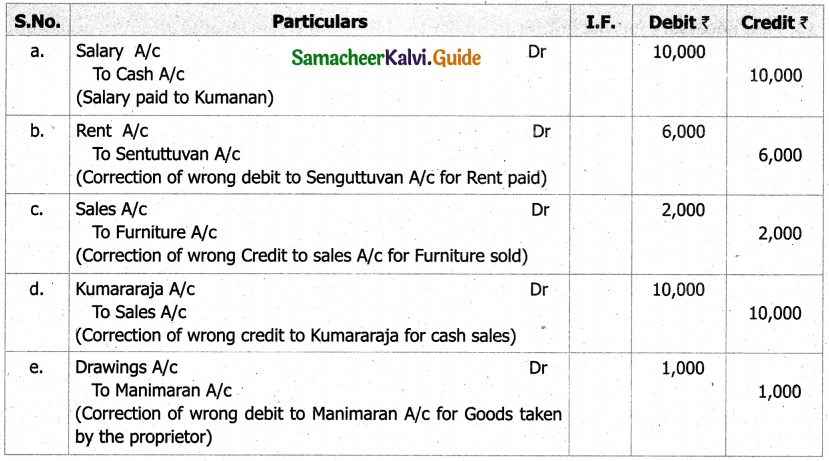

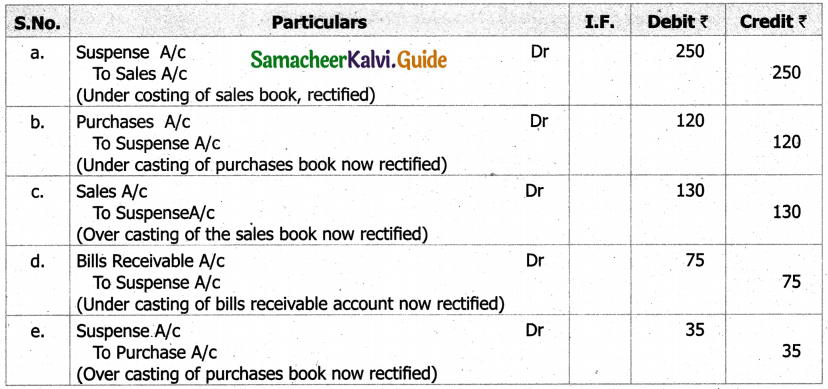

Question 12.

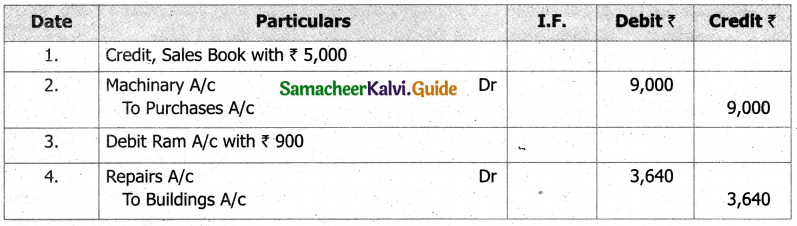

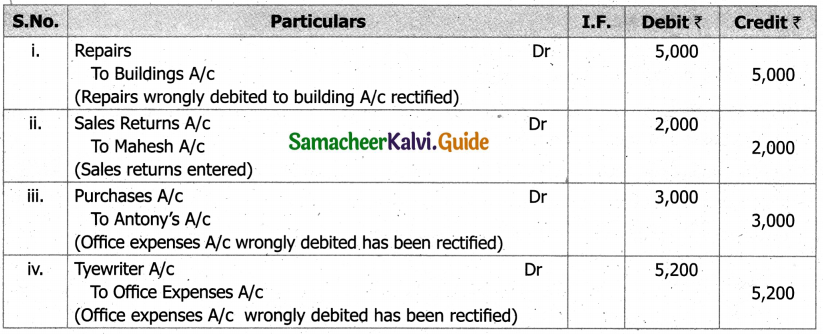

Rectify the following journal entries.

Solution:

Rectification of Errors

Question 13.

Rectify the following errors discovered after the preparation of the trial balance

a) Rent paid was carried forward to the next page ₹ 500 short.

b) Wages paid was carried forward ₹ 250 excess.

Solution:

a) Rent account should be debited with ₹ 500

b) Wages account should be Credited with ₹ 250

![]()

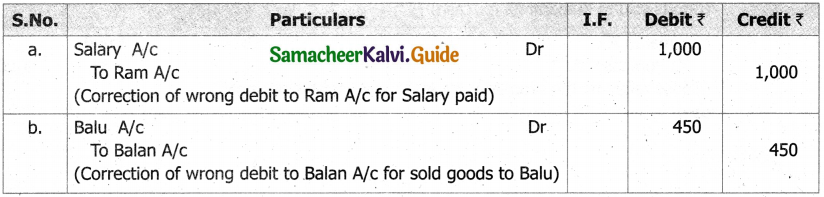

Question 14.

Rectify the following errors after preparation of trial balance

a) Salary paid to Ram ₹ 1,000 was wrongly debited to his personal account.

b) A credit sale of goods to Baiu for ₹ 450 was debited to Balan.

Solution:

Rectification of Errors

Question 15.

Pass necessary journal entries to rectify the following errors located after the preparation of trial balance

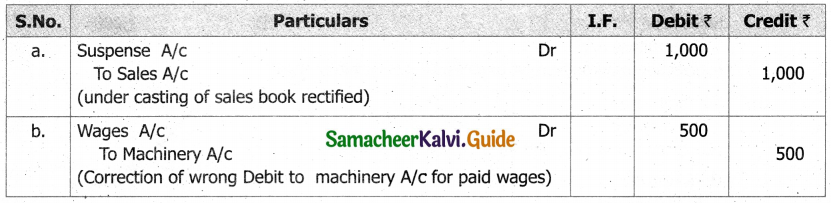

a) Sales book was undercast by ₹ 1,000.

b) A amount of ₹ 500 paid for wages was wrongly posted to machinery Account.

Solution:

Rectification of Errors

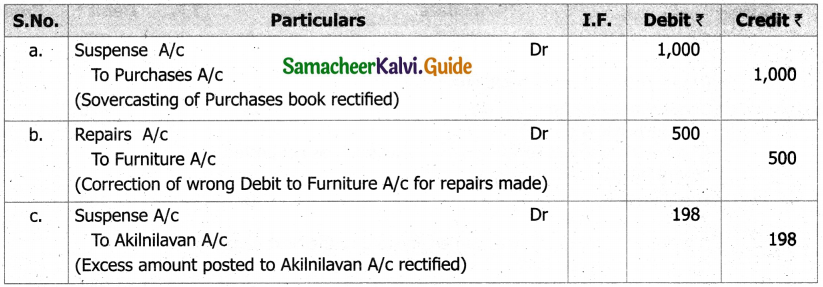

Question 16.

Give journal entries to rectify the following errors discovered after the preparation of trial balance

a) Purchases book was overcast by ₹ 10,000.

b) Repairs to furniture of ₹ 500 was debited to furniture account.

c) A credit sale of goods to Akilnilavan for ₹ 456 was credited to his account as ₹ 654.

Solution:

Rectification of Errors

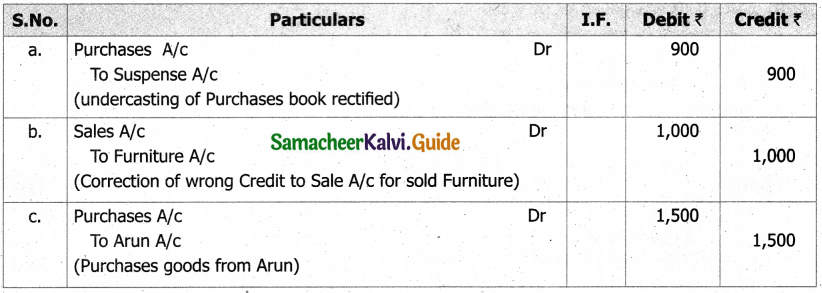

Question 17.

Rectify the following errors located after the preparation of trial balance

a) Purchases book was undercast by ₹ 900.

b) Sale of old furniture for ₹ 1,000 was credited to sales account.

c) Purchase of goods from Arul for ₹ 1,500 on credit was not recorded in the books.

Solution:

Rectification of Errors

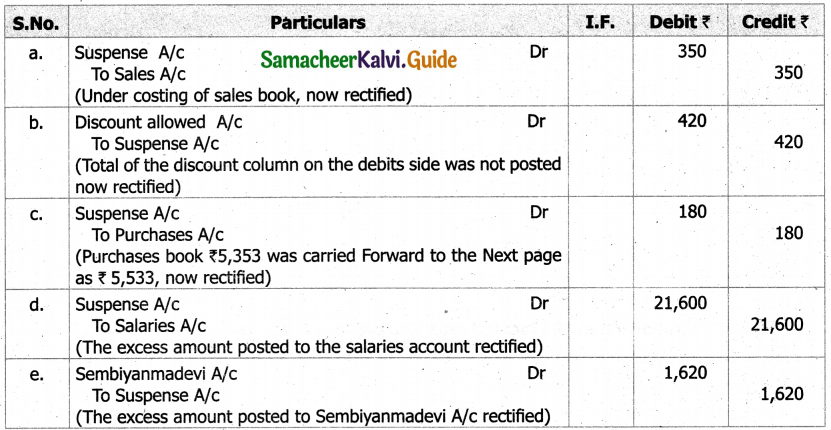

Question 18.

The following errors were located after the preparation of trial balance. Pass journal entries to rectify them. Assume that there exists a suspense account.

a) The total of sales book was undercast by ₹ 350.

b) The total of the discount column on the debit side of cash book ₹ 420 was not posted.

c) The total of one page of the purchases book of ₹ 5,353 was carried forward to the next page as ₹ 5,533.

d) Salaries ₹ 2,400 was posted as ₹ 24,000.

e) Purchase of goods from Sembiyanmadevi on credit for ₹ 180 was posted to her account as ₹ 1,800

Solution:

Rectification of Errors

Question 19.

Rectify the following errors assuming that the trial balance is already prepared and the difference was placed to suspense account

a) Saies book was undercast by ₹ 250

b) Purchases book was undercast by ₹ 120

c) Sales book was overcast by ₹ 130

d) Bills receivable book was undercast by ₹ 75

e) Purchases book was overcast by ₹ 35.’

Solution:

Rectification of Errors

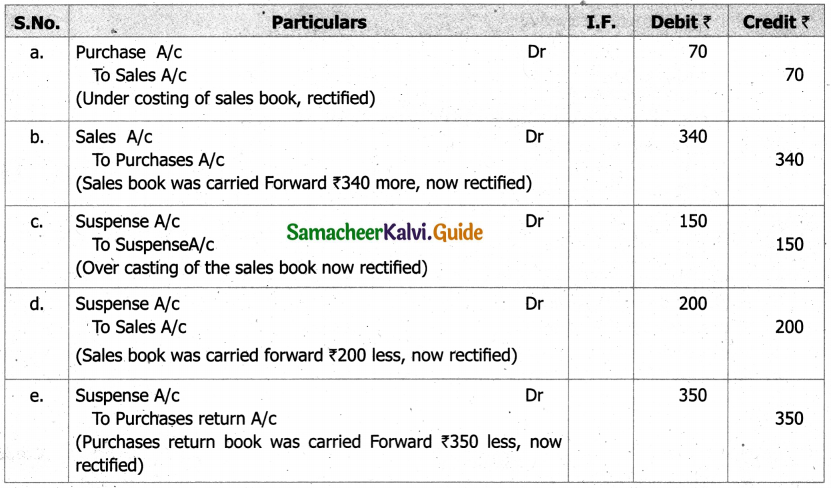

Question 20.

The following errors were located after the preparation of trial balance. The difference in trial balance has been taken to suspense account. Rectify them.

a) The total of purchases book was carried forward ₹ 70 less.

b) The total of sales book was carried forward ₹ 340 more.

c) The total of purchases book was carried forward ₹ 150 more.

d) The total of sales book was carried forward ₹ 200 less.

e) The total of purchase returns book was carried forward ₹ 350 less.

Solution:

Rectification of Errors

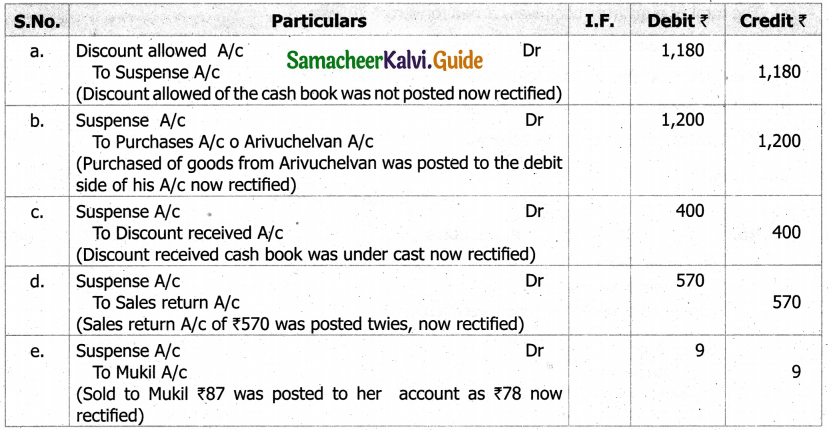

Question 21.

The following errors were located by the accountant after the preparation of trial balance. There exists a suspense account. Rectify them.

a) The total of the discount column of ₹ 1,180 on the debit side of the cash book was not posted.

b) Purchase of goods from Arivuchelvan on credit for ₹ 600 was posted to the debit side of his account.

c) The total of the discount column on the credit side of the cash book was undercast by ₹ 400.

d) The total of sales returns book of ₹ 570 was posted twice.

e) Sold goods to Mukil on credit for ₹ 87 was posted to her account as ₹ 78.

Solution:

Rectification of Errors

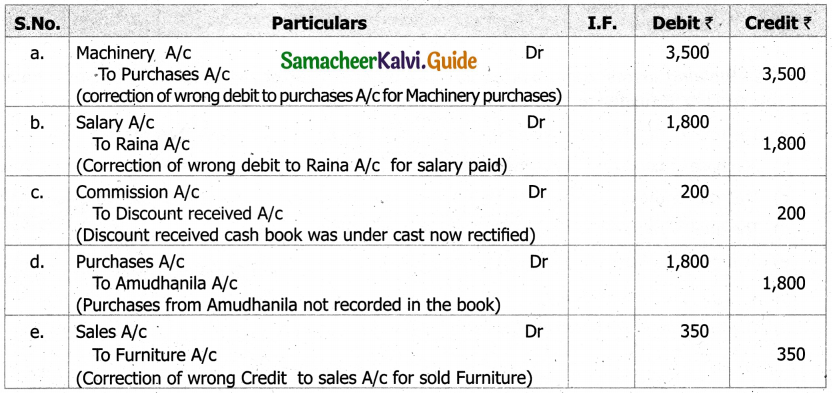

Question 22.

The accountant of a firm located the following errors after preparing the trial balance. Rectify them assuming that there is a suspense account.

a) Machinery purchased for ₹ 3,500 was debited to purchases account.

b) ₹ 1,800 paid to Raina as salary was debited to his personal account.

c) Interest received ₹ 200 was credited to commission account.

d) Goods worth ₹ 1,800 purchased from Amudhanila on credit was not recorded ip the books of accounts,

e) Used furniture sold for ₹ 350 was credited to sales account.

Solution:

Rectification of Errors

Question 23.

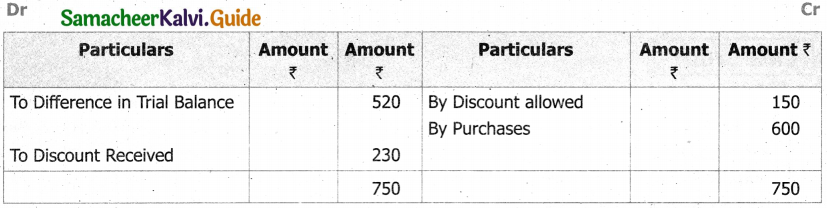

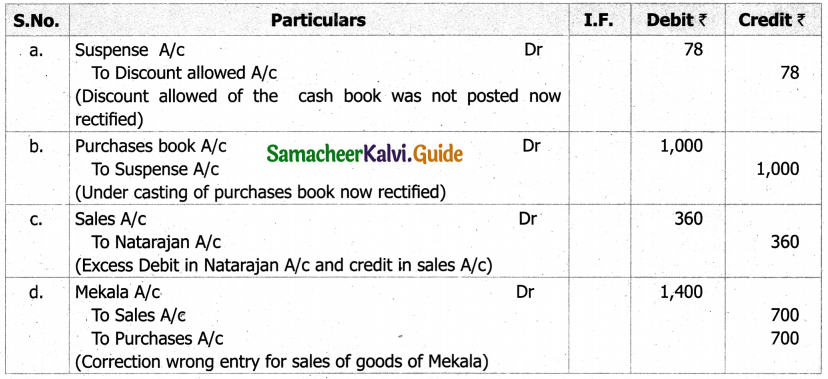

The book-keeper of a firm found that the trial balance was cut by ₹ 922 (excess credit). He placed the amount in the suspense account and subsequently found the following errors

a) The total of discount column on the credit side of the cash book ₹ 78 was not posted in the ledger.

b) The total of purchases book was short by ₹ 1,000.

c) A credit sale of goods to Natarajan for ₹ 375 was entered in the sales book as ₹ 735.

d) A credit sale of goods to Mekala for ₹ 700 was entered in the purchases book.

You are required to give rectification entries and prepare suspense account.

Solution:

Rectification of Errors

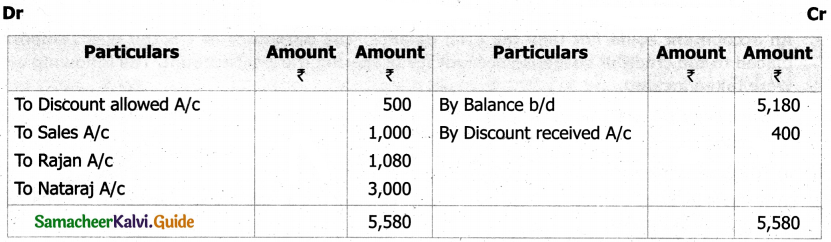

Suspense Account

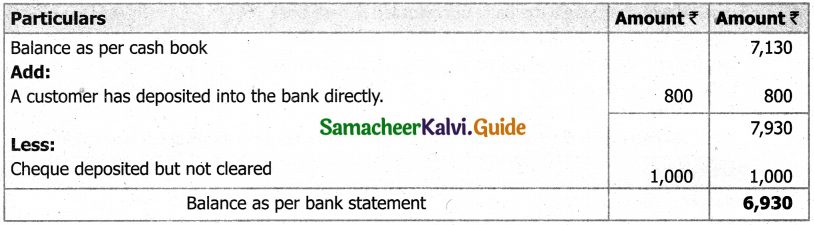

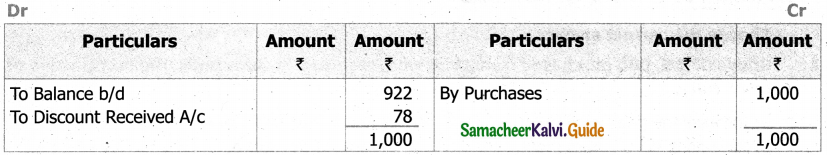

Question 24.

The books of Raman did not agree. The accountant placed the difference of ₹ 1,270 to the debit of suspense account. Rectify the following errors and prepare the suspense account

a) Goods taken by the proprietor for his personal use ₹ 75 was not entered in the books.

b) A credit sale of goods to Shanmugam for ₹ 430 was credited to his account as ₹ 340.

c) A purchase of goods on credit for ₹ 400 from Vivek was entered in the sales book. However, Vivek’s account was correctly credited.

d) The total of the purchases returns book ₹ 300 was not posted.

Solution:

Rectification of Errors

Suspense Account

![]()

11th Accountancy Guide Rectification of Errors Additional Important Questions and Answers

I. Choose the correct answer.

Question 1.

Goods of ₹ 5, 000 purchased from Mr.B were recorded in sales book, the rectification of this error will ________.

a) Increase the gross profit

b) Reduce the gross profit

c) Have no effect on gross profit

d) None of the above

Answer:

b) Reduce the gross profit

Question 2.

When one or both aspects of a transaction are recorded in the wrong category of an account, this is called ________.

a) Error of Principle

b) Error of Omission

c) Error of Commission

d) Error of original entry

Answer:

a) Error of Principle

Question 3.

Goods worth l 500 given as charity should be credited to ________.

a) Charity Account

b) Sales Account

c) Purchases Account

d) None of the above

Answer:

c) Purchases Account

Question 4.

₹ 60,000 paid on extension of building wrongly debited to Repairs account. This is called the error of ________.

a) Commission

b) Omission

c) Principle

d) None of these

Answer:

c) Principle

Question 5.

________ are those transactions which are not recorded as per the rules of debit and credit.

a) Error of principle

b) Error of Commission

c) Error of Omission

d) Compensating errors

Answer:

a) Error of principle

Question 6.

________ are those which cancel themselves out.

a) Error of principle

b) Error of Commission

c) Error of Omission

d) Compensating errors

Answer:

d) Compensating errors

![]()

Question 7.

________ errors can be located in the preparation of trial balance.

a) Error of principle

b) Error of Commission

c) Error of Omission

d) Compensating errors

Answer:

b) Error of Commission

Question 8.

An entry of ₹ 75 has been debited to Rajesh’s A/c as ₹ 57 is an error of ________.

a) Error of principle

b) Error of Commission

c) Error of Omission

d) Compensating errors

Answer:

b) Error of Commission

Question 9.

Casting errors are the result of ________.

a) Wrong totaling

b) Wrong Balancing

c) wrong carry forward

d) None of the above

Answer:

a) Wrong totaling

Question 10.

Suspense account is usually closed when ________.

a) Accounts are finalised

b) After the completion of auditing

c) All the errors are rectified

d) None of the above

Answer:

c) All the errors are rectified

![]()

II. Very Short Answer Questions

Question 1.

What do you mean by error?

Answer:

Error means recording or classifying or summarizing the accounting transactions wrongly or omissions to record them by a clerk or an accountant unintentionally.

Question 2.

At what stages the errors can occur?

The following types of errors may occur in various stages:

Answer:

- At the stage of journalizing

- At the stage of posting

- At the stage of balancing

- At the stage of preparing trial balance

Question 3.

What do you meaning of errors?

Answer:

Error means recording or classifying or summarising the accounting transactions wrongly or omissions to record them by a clerk or an accountant unintentionally.

Question 4.

What is error of omission?

Answer:

The failure of the accountant to record a transaction or an item in the books of accounts is known as an error of omission. It can be complete omission or partial omission.

Question 5.

What is error of commission?

Answer:

When a transaction is incorrectly recorded, it is known as error of commission. It usually occurs due to lack of concentration or carelessness of the accountant.

Question 6.

Write a note on one-sided errors.

Answer:

When one-sided error is detected before preparing the trial balance, no journal entry is required to be passed in the books. In such cases, the error can be rectified by giving an explanatory note in the account affected as to whether the concerned account is to be debited or credited.

Question 7.

Write a note on two sided errors.

Answer:

When a two-sided error is detected before preparing the trial balance, it must be rectified by passing a rectifying journal entry in the journal proper after analysing the error.

![]()

III. Short Answer Questions

Question 1.

What are the Steps to be followed to locate the errors after preparation of trial balance?

Answer:

While preparing trial balance, if it does not tally, it is an indication of presence of errors in the books.of accounts. The difference in trial balance is transferred to suspense account and then errors are to be located and rectified.

The following are the steps to be followed to locate errors after preparing trial balance

- The totals of debit and credit columns of trial balance are to be checked

- The balances of various ledger accounts shown in the trial balance are to be checked to ensure whether they are shown in the respective columns (debit or credit).

- The difference in the trial balance must be halved and compared with balances of ledger to verify whether any ledger balance is recorded on the wrong side of the trial balance.

- The totals of all the subsidiary books are to be checked, especially if the difference is ₹ 1, T 100 etc.

- If the difference is divisible by ‘9’, the difference may be due to transposition of figures in the books (Writing ₹ 127 as ₹ 172). Hence, the possibilities of transposition of figures shall be checked.

- The accounts of all the creditors and debtors are to be verified.

- The correctness of the balances of various ledger accounts is to be ensured.

- The correctness of the balances of various ledger accounts is to be ensured.

- All the amounts carried forward from one page to the next are to be verified. .

- If the difference still exists, as a final step all the entries in the journals should be verified.

Question 2.

What are the Steps to be followed to locate the errors before preparation of trial balance?

Answer:

Errors may be located before preparing the trial balance either spontaneously or by intentional scrutiny of books of accounts.

The following are the steps to be followed to locate errors before preparing trial balance:

- Scrutiny of entries made in the journal proper

- Scrutiny of entries made in the subsidiary books

- Checking the totals of the subsidiary books

- Scrutiny of postings made to the ledger accounts

- Scrutiny of balancing of ledger accounts

Question 3.

Spot out the location of errors before preparation of trial balance.

Answer:

Errors may be located before preparing the trial balance either spontaneously or by intentional scrutiny of books of accounts. The following are the steps to be followed to locate errors before preparing trial balance

- Scrutiny of entries made in the journal proper.

- Scrutiny of entries made in the subsidiary books.

- Checking the totals of the subsidiary books

- Scrutiny of balancing of ledger accounts.

- Scrutiny of postings made to the ledger accounts

Question 4.

Rectify the following errors

- Purchases Book is overcast by ₹ 3,500

- Sales Book is undercast by ₹ 2,000

- Purchases returns books has been over cast by ₹ 7,600

- Sales returns book has been undercast by ₹ 500

Solution:

Rectification:

- Credit Purchases Account with ₹ 3,500

- Credit Sales Account with ₹ 2,000

- Debit Purchases Returns account with ₹ 7,600

- Debit Sales returns account with ₹ 500

Question 5.

Rectify the following errors

1. Sales book undercast by ₹ 5,000

2. Machinery purchased for ₹ 9000 passed through purchases Book.

3. Sales to Ram for ₹ 11,000 debited to his account as ₹ 10,100.

4. Repairs to building ₹ 3,640 debited to buildings account.

Solution:

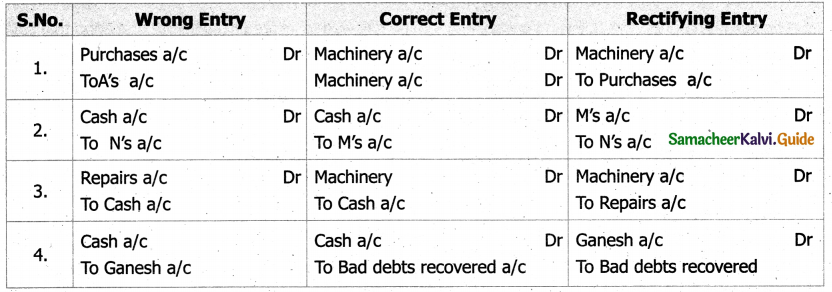

Question 6.

Rectify the following errors

1. The purchase of machinery from A for ₹ 3,000 has been entered in purchase day book.

2. Received ₹ 1,000 from M but credited to N’s account.

3. ₹ 800 paid as wages for erection of machine has been charged to Repairs account.

4. ₹ 250 received from Ganesh, previously written off, has been credited to Ganesh account

Solution:

Question 7.

Rectify the following Errors

1. Purchase book is overcast by ₹ 6,000

2. Sales book carried forward ₹ 630 instead of ₹ 360

3. Purchase from Sreesha ₹ 5, 000 has been posted to the debit side of her account.

4. Sale of old machinery for ₹ 50,000 has been entered in Sales book.

Solution:

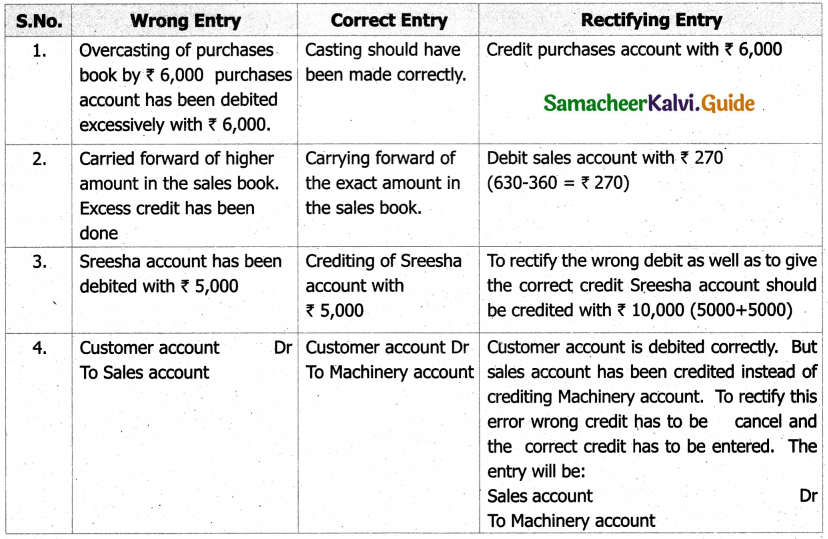

Question 8.

Rectify the following error

1. Salary paid to manager ₹ 8,000 debited to his personal account.

2. Total of discount column in the debit side of the cash book is wrongly cast short. ₹ 540.

3. Total of sales book has been added ₹ 2,400 excess

4. ₹ 230 received in respect of a book debt was posted to sales account

5. Goods sold for ₹ 3,873 to Raju were returned to us and recorded in sales book.

Solution:

Question 9.

When a Trial Balance failed to agree, ₹ 37,900 was transferred to the credit of suspense account. The following errors were discovered. Give journal entries and prepare suspense account.

1. Sales day book was under cast by ₹ 40,000

2. Purchase of machinery for ₹ 60,000 was passed through the purchase book.

3. Goods sold to Velu for ₹ 4,500 was posted to his account as ₹ 5,400.

4. Purchase returns book was overcast by ₹ 2,000

5. The total of sales book from one page was carried forward to the next page as ₹ 12,000 instead of ₹ 11,000.

Solution:

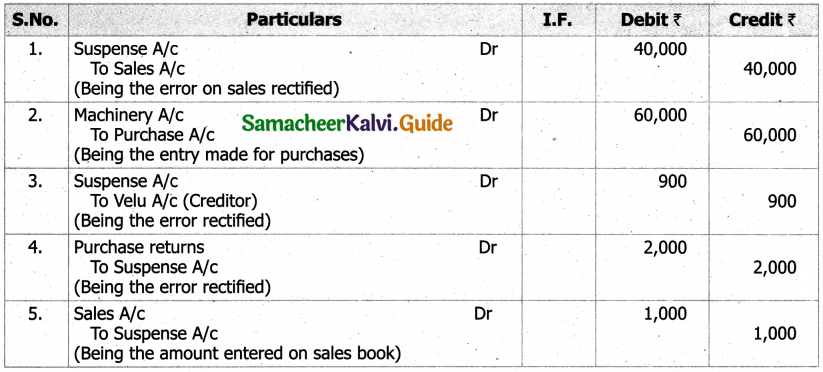

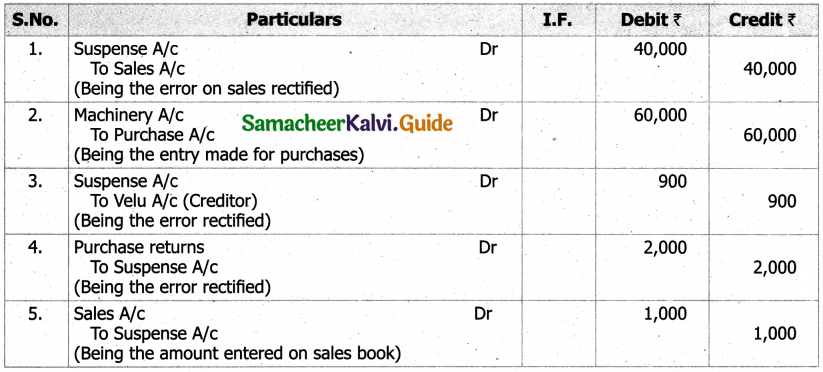

Rectification of Entries

Suspense Account

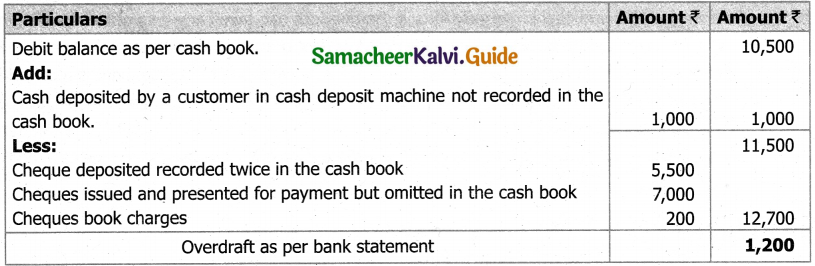

Question 10.

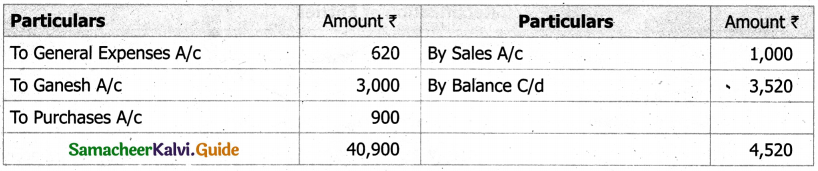

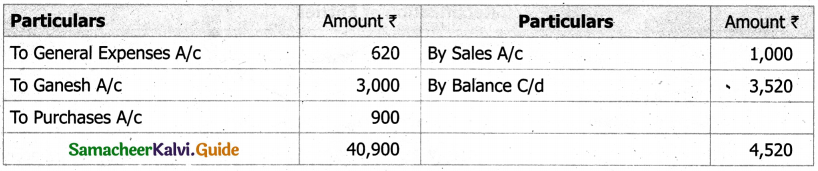

In considering the trial balance, a book-keeper finds that debit total exceeds the credit total by ₹ 3,520. The amount is placed to the credit of a newly opened suspense account. The following mistakes were discovered. Pass the necessary entries for rectifying the mistakes and show the suspense account.

a) Sales day book was overcast by ₹ 1000

b) A sale of ₹ 500 to Rajesh was wrongly debited to Ramesh

c) General expenses ₹ 180 was posted as ₹ 800.

d) Cash received from Ganesh was debited to his account ₹ 1,500

e) While carrying forward the total of one page of the purchases day book to the next the amount of ₹ 12,350 was entered as ₹ 13,250.

Solution:

Rectification of Entries

Suspense Account

![]()

Question 11.

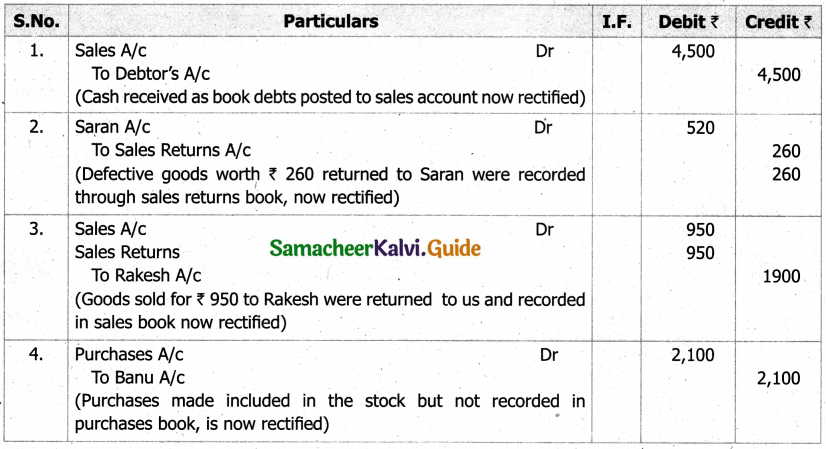

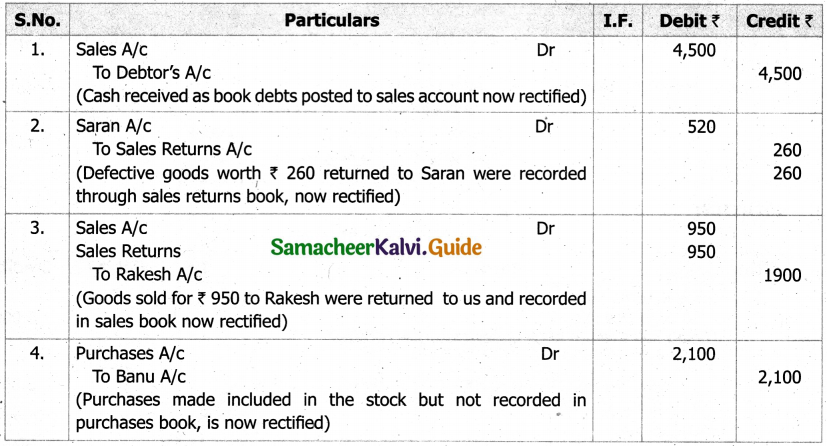

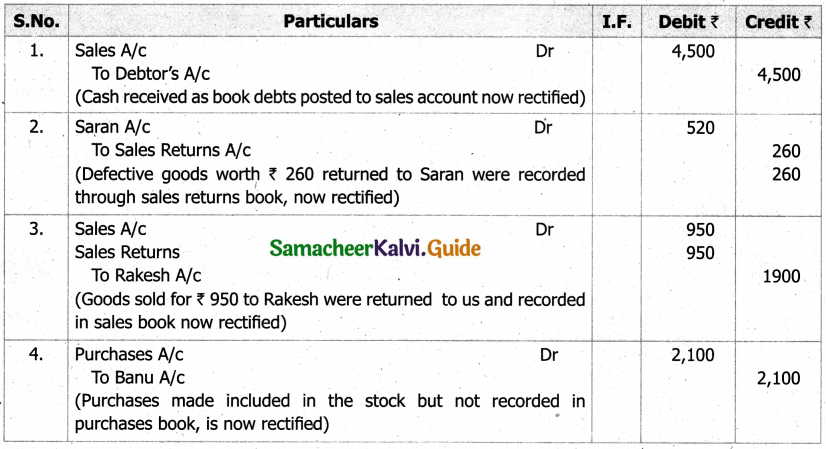

Pass journal entries to rectify the following entries

1. ₹ 4,500 received in respect of a book debt was posted to sales account

2. Defective goods worth ₹ 260 returned to Saran were recorded through sales returns book.

3. Goods sold for ₹ 950 to Rakesh were returned to us and recorded in sales book.

4. A purchase of ₹ 2,100 from Banu on the last day of the year was taken into stock, but the invoice was not passed through the purchase book.

Solution:

Rectification of Entries

Question 12.

Show how you will rectify the following entries .

1. A Credit sales of ₹ 650 to Raja was debited to Kaja.

2. A purchase of goods for ₹ 750 from Shaji was debited to his account.

3. An office typewriter purchased for ₹ 6,500 was debited to Repairs account.

4. A sum of ₹ 3,900 received from a debtor was debited to his account.

5. Purchase of goods for the consumption of proprietor were debited to purchase account ₹ 1,000

Solution:

Rectification of Entries

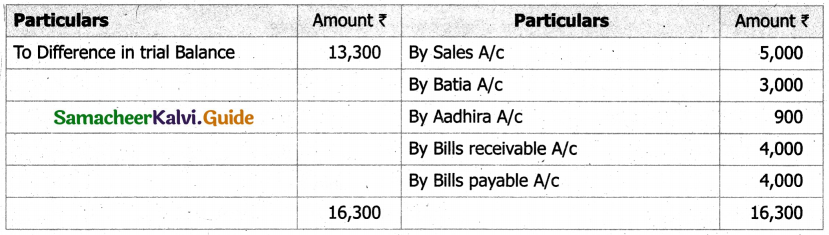

Question 13.

Write down the rectifying journal entries for the following errors and show the suspense account.

1. The sales returns books has been under cast by ₹ 5,000

2. Goods worth ₹ 1,500 sold to Batiya has been credited to his account.

3. Purchase of furniture ₹ 7,000 has been entered in the purchases account.

4. Cash Rs.4,500 from Aadhira has been posted to his account as ₹ 5,400.

5. A bill received from X for ₹ 4,000 has been posted to Bills payable account.

Solution:

Rectification of Entries

Suspense Account

![]()

IV. Long Question Answers

Question 1.

Explain the steps to he followed to locate errors after preparing trial balance

Answer:

The following steps are to be followed to locate errors after preparing trial balance

1. The totals of debit and credit columns of trial balance are to be checked.

2. The balances of various ledger accounts shown in the trial balance are to be checked to ensure whether they are shown in the respective columns (debit or credit).

3. The difference in the trial balance must be halved and compared with balances of ledger to verify whether any ledger balance is recorded on the wrong side of the trial balance.

4. The totals of all the subsidiary books are to be checked, especially if the difference is ₹1 to ₹ 100 etc.

5. If the difference is divisible by 9 the difference may be due to transposition of figures in the books. (Writing ₹ 127 as ₹ 172). Hence, the possibilities of transposition of figures shall be checked.

6. The accounts of all the creditors and debtors are to be verified.

7. Postings from the subsidiary books to different accounts in the ledger are to be checked.

8. The correctness of the balances of various ledger accounts is to be ensured.

9. All the amounts carried forward from one page to the next are to be verified.

10. If the differences still exists, as a final step all the entries in the journals should be verified.

Question 2.

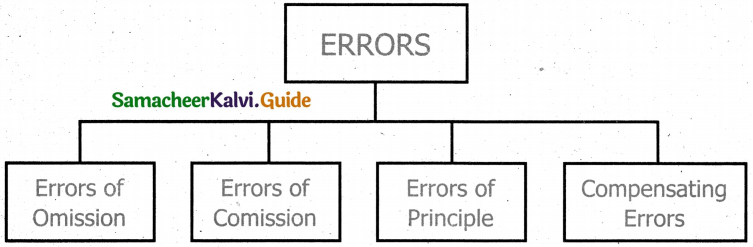

Briefly explain the Classification or errors

Answer:

The failure of the accountant to record a transaction or an item in the books of accounts is known as an error of omission. It can be complete omission or partial omission.

1. Error of complete omission – It means the failure to record a transaction in the journal or subsidiary book or failure to postboth the aspects in ledger. This error affects two or more accounts.

2. Error of partial omission – When the accountant has failed to record a part of the transaction, it is known as error of partial omission. This error usually occurs in posting. This error affects only one account.

3. Error of commission – When a transaction is incorrectly recorded, it is known as error of commission. It usually occurs due to lack of concentration or carelessness of the accountant.

Errors of Principle: It means the mistake committed in the application of fundamental accounting principles inrecording a transaction in the books of accounts.

4. Compensating errors – The errors that make up for each other or neutralize each other are known as compensatingerrors. These errors may occur in related or unrelated accounts. Thus, excess debit or credit inoneaccount may be compensated by excess credit or debit in some other account. These arealso known as offsetting errors.

5. Errors disclosed by the trial balance and errors not disclosed by thetrial balance – Generally, one-sided errors are revealed by trial balance. They will cause disagreement of totals of debit balances and credit balances. Two-sided errors are not revealed by trial balance.

![]()

V. Additional Sums

Question 1.

Rectify the following errors

i) Purchases book overcast by ₹ 1,300

ii) Sales book under cast by ₹ 2,500

Solution:

i) Credit – Purchases A/c with ₹ 1,300

ii) Credit – Sales A/c with ₹ 2,500

Question 2.

Rectify the following errors

i) Purchases return book overcast by ₹ 750

ii) Sales return book under cast by ₹ 600

Solution:

i) Debit – Purchases return A/c with ₹ 750

ii) Debit – Sales return A/c with ₹ 600

Question 3.

Rectify the following errors

i) Purchases book is carried forward ₹ 850 Less

ii) Sales book total is carried toward ₹ 2,500 More

Solution:

i) Debit – Purchases A/c with ₹ 850

ii) Debit – Sales A/c with ₹ 2,500

Question 4.

Rectify the following errors

i) A total of ₹ 7,580 in the purchases book has been carried forward as ₹ 8,570

ii) The total of the sales book ₹ 7,500 or page 20 was carried forward to page 21 as ₹ 5,570

iii) Purchases return book was carried forward as ₹ 1,520 instead of ₹ 5,120

Solution:

i) Credit – Purchases A/c with ₹ 990

ii) Credit – Sales A/c with ₹ 1,980

iii) Credit – Purchases return A/c with ₹ 3,600

Question 5.

Rectify the following errors

i) Purchases from Bagavathi for ₹ 4,500 has been posted to the debit side of her account

ii) Sales to Vijay for ₹ 1,520 has been posted to his credit as ₹ 1,250

Solution:

i) Purchases from Bagavathi should have been posted to the credit of Bagavathi’s A/c, but it has been . debited. Hence, credit Bagavathi’s A/c with double the amount i.e, ₹ 9,000

ii) Sales to Vijay has to be debited in Vijay’s account but his account is credited with ₹ 1,250. Hence Debit Vijay’s A/c with ₹ 1,250 to ₹ 1,520 i.e, ₹ 2,770

Question 6.

Rectify the following errors

i) Purchases from should for ₹ 750 has been omitted to be posted to the personal A/c

ii) Sales to Khader for ₹ 780 has been posted to his account as ₹ 870

Solution:

i) This is an error of omission. Posting must be to the credit of Shakila’s A/c. Hence, post ₹ 750 to the credit of Skakila’s A/c.

ii) Here Khader’s has been debited with a wrong amount i.e., with excess amount. To rectify this error, the excess amount must be credited to his account. Hence, Credit Khader’s A/c with ₹ 90.

![]()

Question 7.

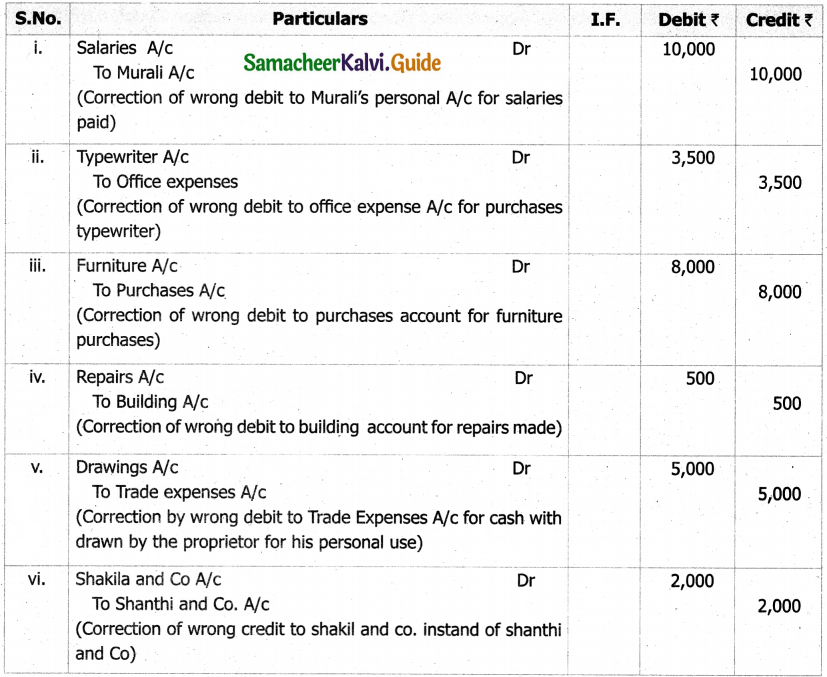

The following errors were found in the book of pradhu. Give the necessary entries to correct them.

i) Salary of ₹ 10,000 paid to Murali has been debited to his personal account.

ii) ₹ 3,500 paid for a typewriter was charged to office expenses account.

iii) ₹ 8,000 paid for furniture purchased has been charged to purchases account.

iv) Repairs made were debited to building account for ₹ 500

v) An amount of ₹ 5,000 withdrawn by the proprietor for his personal use has been debited to trade expenses account.

iv) ₹ 2,000 received from Shanthi and Co. has been wrongly entered as from Shakila and Co.

Solution:

In the book of Prathu – Rectification of Errors

Question 8.

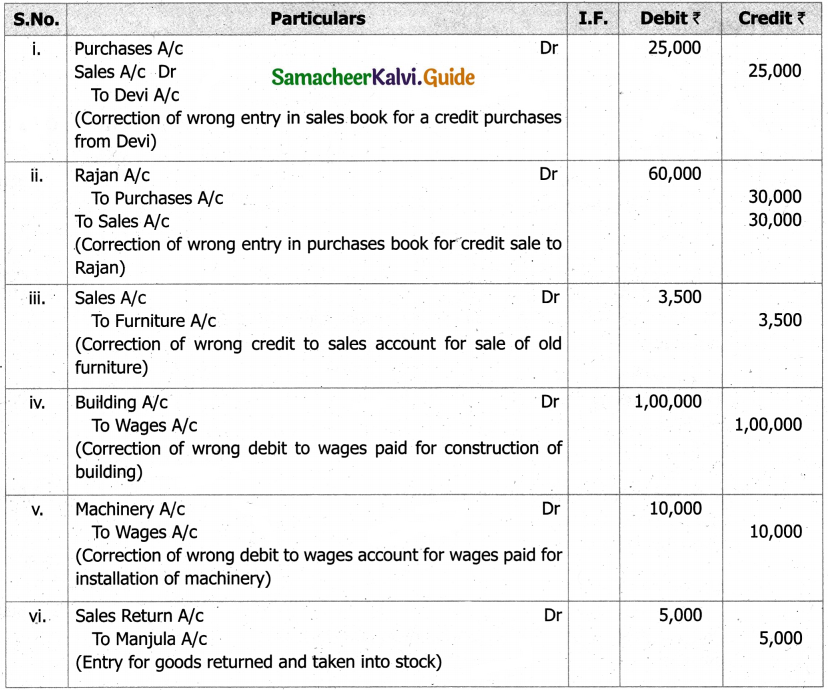

Give journal entries to rectify the following errors

i) Purchases of goods from Devi amounting to ₹ 25,000 has been wrongly passed through the sales Book.

ii) Credit sale of goods ₹ 30,000 to Rajan has been wrongly passed through the purchases Book

iii) Sold old furniture for ₹ 3,500 passed through the sales Book.

iv) Paid wages for the construction of Building debited to wages account ₹ 1,00,000

v) Paid ₹ 10,000 for the installation of machinery debited to wages account.

vi) On 31st December 2003 goods worth ₹ 5,000 were retuned by Manjia and were taken into stock on the same date, but no entry was passed in the books.

Solution:

Rectification of Errors

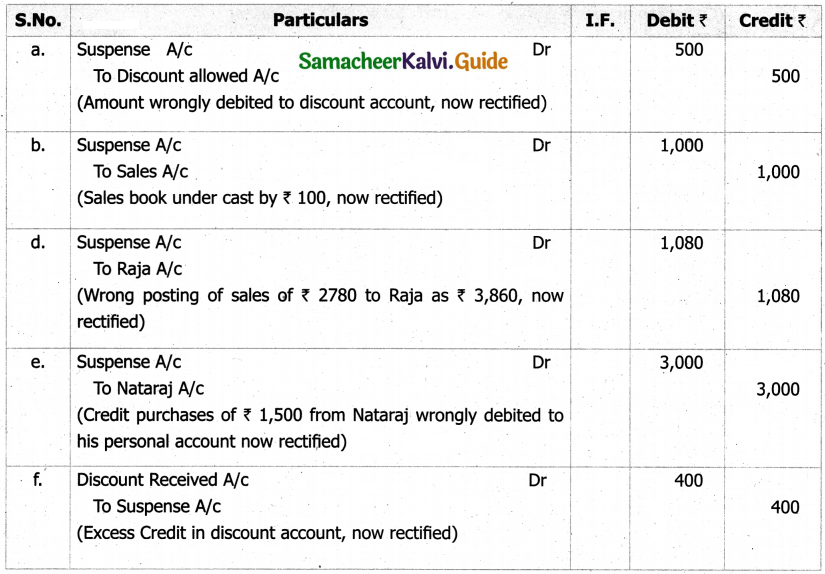

Question 9.

An accountant could not tally the Trial Balance. The difference of ₹ 5,180 was Temporality placed to the credit of suspense account for preparing the final account. The following errors were taken located.

i) Commission of ₹ 500 paid, was posted twice, once to, discount allowed account and once to commission account.

ii) The sales book was under cast by ₹ 1,000

iii) A Credit sales of ₹ 2,780 to Raja though correctly entered in sale book, was posted wrongly to her account as Rs.3,860

iv) A Credit purchase from Nataraj of ₹ 1,500, though correctly entered in purchases book, was wrongly debited to his personal account.

v) Discount column of the payments side of the book was wrongly added as ₹ 2,800 instead of ₹ 2,400

You are required to

i) Pass the necessary rectifying entries.

ii) Prepare suspense Account.

Solution:

Rectification of Errors

Suspense Account

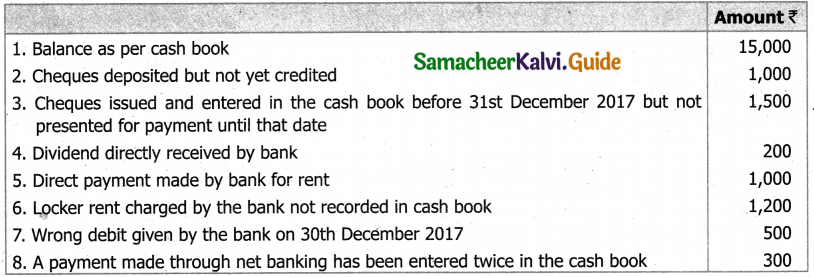

Question 10.

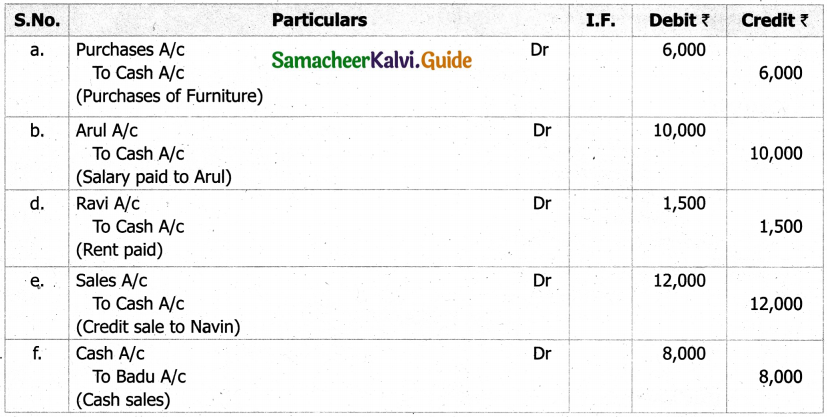

Rectify the following Journal Entries

Rectification of Errors

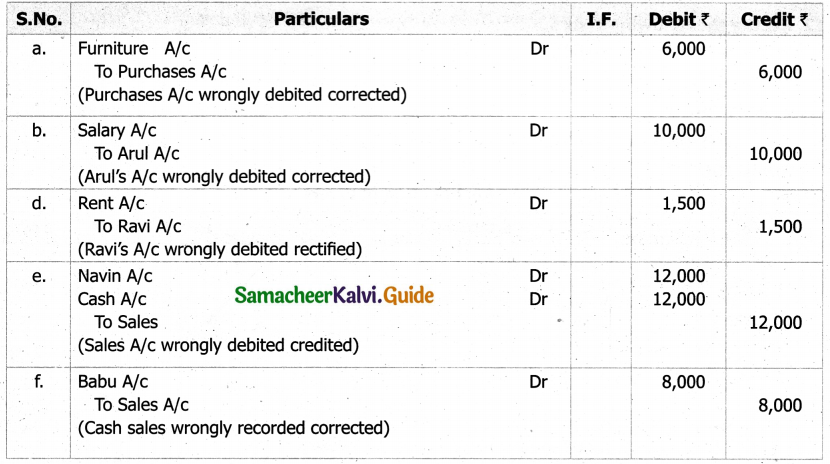

Solution:

Rectification of Errors

Question 11.

Rectify the following Errors

i) ₹ 12,000 paid of salary to cashier Govind, stands debited to his personal account.

ii) An amount of ₹ 5,000 with drawn by the proprietor for his personal use has been debited to trade Expenses A/c

iii) Cash received from Bala ₹ 300 was credited to Balu.

iv) A credit sale of ₹ 2,000 to Janakiram has been wrongly passed through the purchase book.

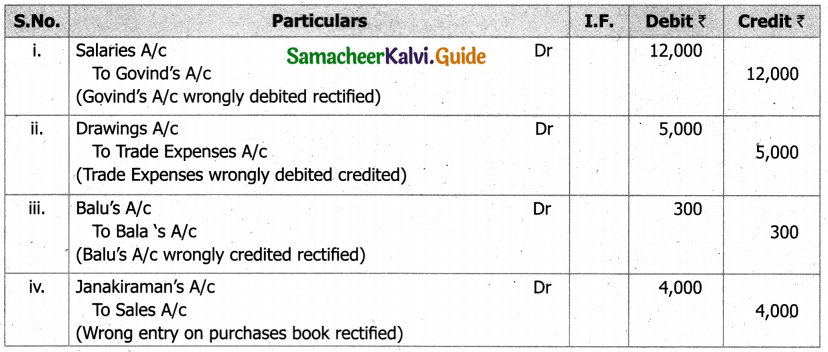

Solution:

Rectification of Errors

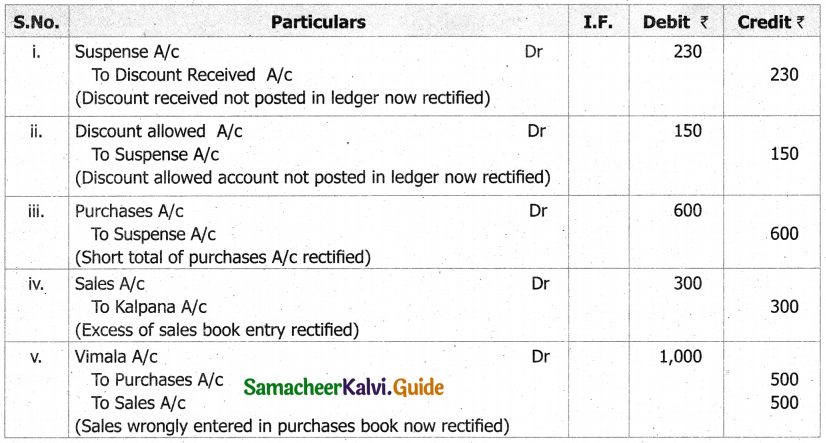

Question 12.

Rectify the following Errors

i) Repairs made were debited to building account ₹ 5,000

ii) Mahesh networked goods worth ₹ 2,000 no Entry was passed in the Book to this Effects

iii) Purchases of goods from Antony amounting to ₹ 1,500 has been debited to his accounts.

iv) ₹ 5,200 paid for the purchases of typewriter was charged to office expenses account.

Solution:

Rectification of Errors

![]()

Question 13.

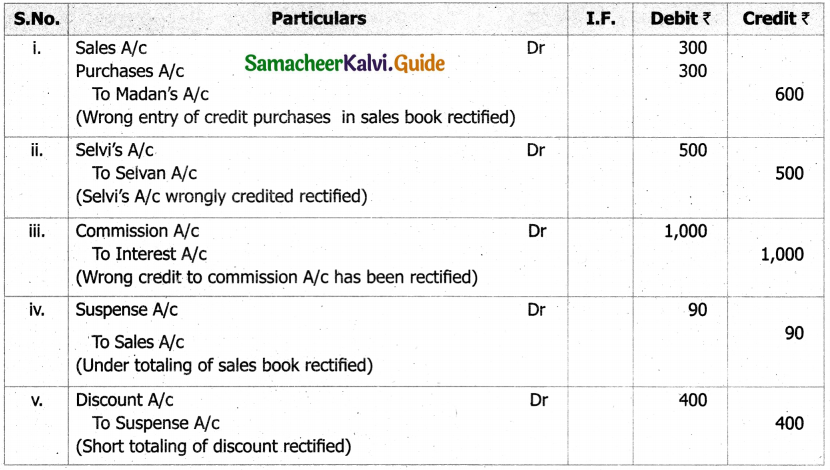

Rectify the following Errors

i) Credit purchases of goods from Madhan of ₹ 300 has been wrongly Entered in the sales book.

ii) ₹ 500 received from Seivan has been credited to Selvi’s account

iii) ₹ 1,000 received as interest was credited to commission account.

iv) Sales book total ₹ 878 was wrongly totalled as ₹ 788.

v) The total of this discount column, on the debit side of the cash book has been added short by ₹ 400.

Solution:

Rectification of Errors

Question 14.

Rectify the following Errors

A Book keeper found his trial balance not balanced, placed the difference amount in the suspense account and subsequently found the following errors

a) Sales book was over cast by ₹ 1,500

b) ₹ 2900 received from Vani in full settlement of her account of ₹ 3,000 was posted in cash book but omitted to be entered in her account.

c) The total of the sales book ₹ 12,000 was debited to sales return accounts.

d) ₹ 1,000 received as interest was credited to interest as ₹ 100 Give rectifying entries and show the suspense account.

Solution:

Rectification of Errors

Suspense Account