TN State Board 11th Commerce Important Questions Chapter 26 Export and Import

Question 1.

What is meant by indent?

Answer:

- An indent is an order placed by an importer with an exporter for the supply of certain goods.

- It contains full details regarding goods to be imported the terms and conditions regarding price, shipment, delivery, the method of payment etc.

Question 2.

Write any two export promotion institutions.

Answer:

- Department of Commerce.

- Export Promotion Council (EPC).

![]()

Question 3.

Mention the types of Indent.

Answer:

There are three types of indent, namely

- Open indent,

- Closed indent and

- Confirmatory indent.

Question 4.

What is the Letter of credit?

Answer:

Letter of Credit is opened only for well- established and reputed importer. It is beneficial both to the exporter and importer. Exporter is assured of payment and need not bother about credit worthiness of importer. The letter of credit simply transfers the burden of settling the transactions to the bank.

Question 5.

What are the contents of Indents?

Answer:

- Quantity of goods sent,

- Design of goods,

- Price,

- Nature of packing shipment,

- Mode of shipment,

- Period of delivery,

- Mode of payment.

![]()

Question 6.

What is meaning of consular invoice?

Answer:

Where the customs duties are charged on the basis of value of goods at import’s port (ad-valorem basis), the customs officers are empowered to open the consignment to calculate duties. In order to avoid this problem exporter obtains consular invoice and sends it over to the importer.

This document is signed by the consul of importer’s country stationed in exporter’s Country. Hence customs officer at the port of destination will not open the consignment and simply access customs duty based on the value declared in the invoice. They simply accept the invoice as true statement of the content of the consignment.

Question 7.

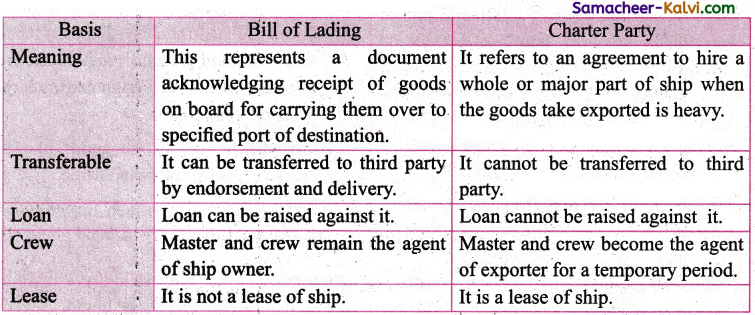

What is meant Charter Party?

Answer:

A charter party is a formal agreement between shipowner and the exporter under which exporter hires an entire ship or a major part of ship either for a particular voyage or for a specific time period when the shipping is heavy.

Question 8.

Write a short note on Mate’s receipt?

Answer:

Mate’s Receipt is the document issued by the captain of the ship acknowledging the receipt of goods on board by him to the port of specified destination. This contains details like quantity of goods shipped, number of packages condition for packing, etc.,

![]()

Question 9.

What is Bill of Lading?

Answer:

Bill of Lading, refers to a document signed by ship owner or to his agent mentioning that goods specified have been received and it would be delivered to the importer or his agent at the port of destination if good condition subject to terms and conditions mentioned therein.

Question 10.

What are the procedures relating to Export trade?

Answer:

(i) Receiving Trade enquiry:

Exporter receives trade enquiry (written request) from the importer / his agent who intends to buy the product.

(a) Specification about the goods like, size, design, quality, and brand name.

(b) The period up to which his proposal to import is valid.

(ii) Receiving Indent and Sending Confirmation:

After the scrutiny of quotation / proforma invoice, the buyer who intends to buy the goods sends an indent to exporter. The latter may either receive the order directly from the importer or through an agent who acts as an intermediary between the exporter and the importer.

(iii) Obtaining Importer Exporter Code (IEC) and RBI code Number:

Exporter has to apply in Ayaab Niryatt Form 2A(ANF2A) to the Regional Authority of the Director-General of Foreign Trade (DGFT) in the region where the registered office of the company is located. Exporter has to mention the number in all the shipping documents.

(iv) Obtaining Registration cum Membership Certificate (RCMC) from export Promotion Council /Commodity Board:

An Exporter is required to obtain RCMC from Export Promotion Councils/ Commodity Board/Development Authority in order to avail himself/herself of export incentives, concessions, and other facilities offered by Government.

(v) Manufacturing / Procuring Goods and Packing items:

Exporters steps into manufacturing and procuring of goods required by the importer.

(vi) Export Inspection Certificate:

After specifications of importer, the exporter has to apply to the Export Inspection Agency (EIA) or other designated agency in this connection The agency sends an inspector to inspect the consignment meant for export.

(vii) Insurance of Goods:

Exporter has to arrange for getting the goods insured to protect them against the various risks like deterioration, collision, immersion, fire, entry of seawater etc., as per the instructions of importer if any.

(viii) Certificate of Origin:

Import regulation of foreign countries may require that all these import consignments must accompany a certificate of origin.

![]()

Question 11.

Distinguish between Bill of Lading and Charter Party.

Answer:

Question 12.

What are the documents used in Export Trade?

Answer:

Documents are used regarding goods:

- Open indent

- Closed indent

- Confirmatory indent.

- Certificate of origin.

- Certificate of verification.

Document are used regarding shipment:

- Mate’s receipt.

- Bill of lading.

- Marine insurance.

- Customs Formalities.

- Airway Bill.

Documents are used in payment by away of:

- Letter of credit

- Bills of exchange

- Foreign draft

- Excise duty.

![]()

Question 13.

Explain the various functions of Export Trading Houses.

Answer:

The functions of export house are:

(i) Identifying potential market for a product.

(ii) Finding buyers and their agent and eliciting their response for export proposal.

(iii) Establishing product specification in the light of market needs, standards, and regulation in accordance with suppliers capabilities.

(iv) Determining appropriate mode of transportation and routing keeping in mind the cost, quality of service, and security.

(v) Preparing the goods for delivery at destination.

(vi) Determining buyer’s creditworthiness.

(vii) Negotiating the transactions.

(viii) Arranging proper insurance coverage against maritime risks and currency fluctuations. .

(ix) Financing the transactions and paying for goods and services received.

(x) Preparing document for international trade.

(xi) Settling claim.

Question 14.

Import Trade Procedures.

Answer:

- Trade enquiry.

- Obtain import license

- Obtaining foreign exchange.

- Placing the indent.

- Arranging letter of credit.

- Obtaining shipping documents.

![]()

Question 15.

Agencies involved in Import Trade.

Answer:

- Indent houses.

- Clearing agents.

Question 16.

You should be able to think to simplify Import Trade Procedures.

Answer:

- Trade enquiry,

- Arranging letter of credit.

- Receiving payments.

Question 17.

Create interest in International Business for yourself.

Answer:

- Take interest in International business.

- To get more profit.

- To give employment opportunities to public.

![]()

Choose the Correct Answer:

Question 1.

EPC stands for:

(a) export processing commission

(b) export promotion council

(c) export carriage council

(d) export promotion congress

Answer:

(b) export promotion council

Question 2.

STC is expansion for:

(a) state training centre

(b) state training council

(c) state trading centre

(d) state trading Corporation

Answer:

(d) state trading Corporation

Question 3.

An _______ is document prepared by importer an sent to the exporter to buy the goods.

(a) invoice

(b) indent

(c) enquiry

(d) charter party

Answer:

(b) indent

![]()

Question 4.

The ______ receipt is an acknowledgement of receipt of goods on the ship issued by the Captain.

(a) shipping bill

(b) bill of lading

(c) mate’s receipt

(d) consular invoice

Answer:

(b) bill of lading

Question 5.

The Exporters appoint the _______ agent to fulfill the customs formalities.

(a) clearing agent

(b) forwarding agent

(c) commission agent

(d) factor

Answer:

(b) forwarding agent

![]()

Samacheer Kalvi 11th Commerce Notes Chapter 26 Export and Import

→ Exports have attained greater importance in the competitive world. No country in the world can produce all the goods and services it required. They have to inevitably buy and sell from one another. Therefore countries have to engage in international trade. Export and Import represent two sides of the same coin of international trade.

→ The goods which are not available in home country same goods were imported. The goods which are produced surplus good which will be exported to other countries.

→ Developing countries like India, Bangladesh, South Korea and so on require substantial amount of foreign exchange in order to acquire machineries, equipment, raw materials, petroleum products, technical know – how and so on for their faster economic development.

→ Government of India has initiated several steps to encourage exports. It has been promoting export by providing cash incentives, tax incentives and relief, institutional, support concessional interest rate, loan assistance, tax exemptions, tax holidays and transport concessions.