TN State Board 11th Commerce Important Questions Chapter 17 Social Responsibility of Business and Business Ethics

Question 1.

What do you mean by Social Responsibility?

Answer:

Every businessman earns prosperity from business end should give back the benefit of this prosperity to society. This benefit is moral responsibility of business.

Question 2.

Give the meaning of Social Power.

Answer:

Businessmen have considerable social power. Their decisions and actions affect ; the lives and fortunes of the society. They collectively determine for the nation such important matters as level of employment, j rate of economic progress and distribution of income among various groups.

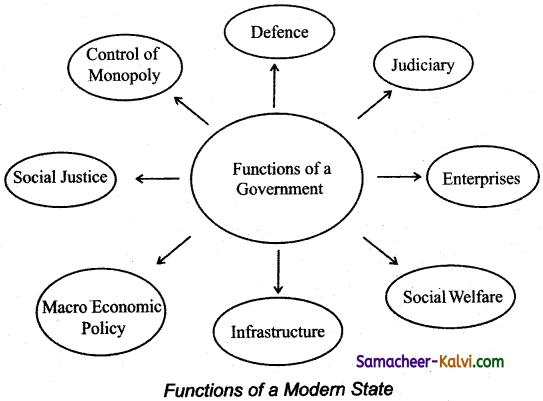

![]()

Question 3.

What is a free enterprise?

Answer:

A business enterprise which accepts and discharges social obligations enjoys greater freedom. Thus, social responsibilities are essential for avoiding governmental action against business. Such action will reduce the freedom of decision making in business.

Question 4.

Who are called Stakeholders?

Answer:

- A business organisation is a coalition of several interest groups are called stakeholders.

eg: Shareholders, customers, employees suppliers etc. - Business should therefore work for the interest of all of them rather than for the benefit of shareholders / owners alone.

Question 5.

What is ethical Responsibility?

Answer:

This includes the behaviour of the firm that is expected by society butnot codified in law. For example, respecting the religious sentiments and dignity of people while advertising for a product. There is an element, of voluntary action in performing this responsibility.

![]()

Question 6.

Define the Concept of Social Responsibility?

Answer:

The term social responsibility is defined in various ways. Every businessman earns prosperity from business and should give back the benefit of this prosperity to society. This is voluntary. This benefit is the moral responsibility of business. As this benefit is supposed to be passed on to society, it can be said to be social responsibility of business.

Question 7.

Why you do think Social Responsibility of business is needed?

Answer:

- Self-Interest.

- Creation of society.

- Social power.

- Image in the society.

- Public Awareness.

- Free Enterprise.

- Law and Order.

- Moral Justification.

- Socio-Cultural Norms.

- Professionalism.

- Trusteeship.

Question 8.

What are the benefits derived by employees of a Socially Responsible business enterprise?

Answer:

Business needs employees or workers to work for it. These employees put their best effort for the benefit of the business. So it is the prime responsibility of every business to take care of the interest of their employees.

If the employees are satisfied and efficient, then the only business can be successful. The responsibilities of business towards its employees include:

- Timely and regular payment of wages and salaries.

- Proper working conditions and welfare amenities.

- Opportunity for better career prospects.

- Job security as well as social security like facilities of provident fund, group insurance, pension, retirement benefits, etc.

- Better living conditions like housing, transport, canteen, creeches etc.

- Timely training and development.

![]()

Question 9.

Enumerate the points relating to why business units are Socially Responsible?

Answer:

Responsibility towards owners: Owners are the persons who own the business. They contribute capital and bear the business risks. The primary responsibilities of business towards its owners are to:

- Run the business efficiently.

- Proper utilisation of capital and other resources.

- Growth and appreciation of capital.

- Regular and fair return on capital invested.

Question 10.

List the kinds of Social Responsibility.

Answer:

- Economic Responsibility.

- Legal Responsibility.

- Ethical Responsibility.

- Discretionary Responsibility.

Question 11.

Explain in detail the concept and need for Social Responsibility?

Answer:

(i) Self-Interest:

A business. unit can sustain in the market for a longer period only by assuming some social obligations. Normally businessmen recognise that they can succeed better by fulfilling the demands and aspirations of society.

(ii) Creation of Society:

Business is a creation of society and uses the resources of society. Therefore, it should fulfil its obligations to society. Businessmen should respond to the demands of society and should utilise the social resources for the benefit of the people at large.

(iii) Social Power:

Businessmen have considerable social power. Their decisions and actions affect the lives and fortunes of the society.

(iv) Image – in the Society:

A business can improve its image in public by assuming social obligations. Good relations with workers, consumers and suppliers help in the success of business. Social obligations improve the confidence and faith of people in a business enterprise

.

(v) Public Awareness:

Now-a-days consumers and workers are well informed about their rights. Consumers expect better quality products at reasonable prices. Similarly, workers desire fair wages and other benefits.

![]()

Question 12.

Illustrate with examples the arguments for Social Responsibility?

Answer:

(i) Protection of Stakeholders Interest:

A business organisation is a coalition of several interest groups or stakeholders. Example – shareholders, customers, employees, suppliers, etc.

(ii) Promotion of Society:

Business is a sub-system of society. It draws support and sustenance from society in the form of inputs. Socially responsible behaviour is essential to sustain this relationship between business and society.

(iii) Assessment of Social Impact:

During the course of its fimctioning, a business enterprise makes several decisions and actions. Its activities exercise a strong influence on the interests and values of society.

(iv) Organised Social Power:

Large corpo-rations have acquired tremendous social power through their multifarious Operations. Social power may be misused in the absence of social responsibility.

(v) Legitimacy:

It is in the enlightened self interest of business to assume social responsibility. Social responsibility legitimises and promotes the economic objectives of business.

(vi) Competence:

Business organisations and their managers have proved their competence and leadership in solving economic problems.

(vii) Professional Conduct:

Professional managers are required to display a keen social sensitivity and serve the society as a whole. Social responsibility is one of the professional demands on managers. They adhere to the code of conduct and ethics applicable to respective area of operation.

(viii) Public Opinion:

Adoption of social responsibility as an objective will help to improve the public opinion of business.

![]()

Question 13.

What are the arguments against Social Responsibility?

Answer:

(i) Lack of Conceptual Clarity:

The concept of Social responsibility is very vague and amenable to different interpretations. There is no consensus on its meaning and scope. In such a situation, it would be futile as well as risky to accept social responsibility.

(ii) Dilution of Economic Goals:

By accepting social responsibility, business will compromise with economic goals.

(iii) Lack of Social Skill:

Business organisations and their managers are not familiar with social affairs.

(iv) Burden on Consumers:

If business deals with social problems, cost of doing business would increase. These costs will be passed on to consumers in the form of higher prices or will have to be borne by owners. This would lead to taxation without representation.

(v) Responsibility without Power:

Business organisations possess only economic power and not social power. It is unjust to impose social responsibilities with social power. If business is allowed to intervene in social affairs it may perpetuate its own value system to the detriment of society.

(vi) Misuse of Responsibilities:

Acceptance of social responsibilities will involve diversion of precious managerial time and talent on social action programmes. It may result in dilution of valuable corporate resources.

![]()

Question 14.

Discuss the different groups benefited out of Social Responsibility of business?

Answer:

(i) Business

(ii) Investors,

(iii) Employees,

(iv) Government,

(v) Competitors,

(vi) Society,

(vii) Customers,

(viii) Suppliers.

(i) Responsibility towards Owners:

Owners are the persons who own the business. They contribute capital and bear the business risks. The primary responsibilities of business towards its owners are to

(a) Run the business efficiently

(b) Proper utilisation of capital and other resources.

(c) Growth and appreciation of capital.

(d) Regular and fair return on capital invested.

(ii) Responsibility towards Investors:

Investors are those who provide finance by way of investment in debentures, bonds, deposits etc. Banks, financial institutions, and investing public are all included in this category. The responsibilities of business towards its investors are:

(a) Ensuring safety of their investment,

(b) Regular payment of interest,

(c) Timely repayment of principal amount.

(iii) Responsibility towards Employees:

Business needs employees or workers to work for it. These employees put their best effort for the benefit of the business. So it is the prime responsibility of every business to take care of the interest of their employees. If the employees are satisfied and efficient, then the only business can be successful. The responsibilities of business towards its employees include:

(a) Timely and regular payment of wages and salaries.

(b) Proper working conditions and welfare amenities,

(c) Opportunity for better career prospects,

(d) Job security as well as social security like facilities of provident fund, group insurance, pension, retirement benefits, etc.

(e) Better living conditions like housing, transport, canteen, creches etc.

(f) Timely training and development.

(iv) Responsibility towards Suppliers:

Suppliers are businessmen who supply raw materials and other items required by manufacturers and traders. Certain suppliers, called distributors, supply finished products to the consumers. The responsibilities of business towards these suppliers are:

(a) Giving regular orders for purchase of goods,

(b) Dealing on fair terms and conditions,

(c) Availing reasonable credit period,

(d) Timely payment of dues.

(v) Responsibility towards Customers:

No business can survive without the support of customers. As a part of the responsibility of business towards them the business should provide the following facilities:

(a) Products and sendees must be able to take care of the needs of the customers,

(b) Products and services must be qualitative,

(c) There must be regularity in supply of goods and services.

![]()

Question 15.

How do you classify Social Responsibility?

Answer:

(i) Economic Responsibility:

A business enterprise is basically an economic entity and, therefore, its primary social responsibility is economic i.e., produce goods and services that society wants and sell them at a profit. There is little discretion in performing this responsibility.

(ii) Legal Responsibility:

Every business has a responsibility to operate within the laws of the land. Since these laws are meant for the good of the society, a law abiding enterprise is a socially responsible enterprise as well.

(iii) Ethical Responsibility:

This includes the behaviour of the firm that is expected by society but not codified in law. For example, respecting the religious sentiments and dignity of people while advertising for a product. There is an element of voluntary action in performing this responsibility.

(iv) Discretionary, Responsibility:

This refers to purely voluntary obligation that an enterprise assumes, for instance, providing charitable contributions to educational institutions or helping the affected people during floods or earthquakes. It is the responsibility of the company management to safeguard the capital investment by avoiding speculative activity and undertaking only healthy business ventures which give good returns on investment,

Question 16.

To identify ethical and unethical practices of business enterprises.

Answer:

(a) Ethical:

- Investors: Ensuring safety of their money and timely payment of interest.

- Employers: Provision of fair opportunities in promotions and training, good working environment and timely payment of salaries.

- Customers: Complete information of the service and product should be made available. Personal information of the customers. Should not be used on personal gain.

(b) Unethical:

- Resorting to dishonesty, trickery or deception.

- Distortion of facts to mislead or confuse.

- People emotionally by exploiting their vulnerabilities.

- Greed to a mass excessive profit.

![]()

Question 17.

To understand the level of discharging Socially Responsibility practises of business units.

Answer:

Business is an economic activity. It is argued by the opponents of social responsibility that basic function of a business enterprise is to look into economic viability of its operations. It is the government to look after interests of the society. The prime responsibility of assuming social responsibility should therefore be of the government and not of the business enterprises.

Question 18.

To analysis the impact of Social Responsibility Of Small, Medium and Large scale enterprises in the Society.

Answer:

- Respect for the employers right.

- Ensuring operationaEsafety and security at the work place.

- Occupational health.

- Good governance and good practices.

- Compliance to the laws.

Question 19.

To clearly distinguish the benefits derived by different stakeholders while* discharging of Social Responsibility of business units.

Answer:

CSR should not be taken to include steps taken as a result of legal obligations to prevent or mitigate harm. Ih that regard a growing number of theorists are now suggesting that companies have a fundamental existential obligation to adequately plan for and manage sustainability issues in order to avoid breaches of directors duties as a result of a failure to mitigate risk in this area.

![]()

Question 20.

To evaluate the impact of social responsibility on profitability of business unit.

Answer:

There is an impressive history associated with the evolution of the concept and definition of corporate social responsibility. In this article the author traces the evolution to the CSR construct beginning in the 1950’s which marks the modem area of CSR.

Question 21.

To predict methods by which social responsibility can be discharged.

Answer:

We use data from different sources to analyze whether actual environmental outcomes such as emissions and environmental fines can be explained by lagged environmental ratings.

Question 22.

To depict through pictures, the stakeholders position in a company taking socially responsible activities.

Answer:

In order to completely understand the context of corporate social responsibility you must first understand the role stakeholders for an organization. The next section will describe the role of stakeholders. Two types of primary stakeholders and secondary stakeholders.

![]()

Choose the Correct Answer:

Question 1.

Which type of Responsibility gives the benefit to the Society out of its profits earned?

(a) Legal

(b) Ethical

(c) Moral

(d) Economic

Answer:

(c) Moral

Question 2.

The Stakeholders of Socially Responsible j business units are except:

(a) shareholders

(b) employees

(c) government

(d) company

Answer:

(d) company

Question 3.

Assuming Social Responsibility of business helps the enterprise in:

(a) increase profit

(b) decrease profit

(c) sustainability

(d) equilibrium

Answer:

(c) sustainability

![]()

Question 4.

Socially Responsible business provides goods at:

(a) high price

(b) low price

(c) reasonable price

(d) moderate price

Answer:

(c) reasonable price

Question 5.

Social Responsibility towards employees represents the following except:

(a) reasonable remuneration

(b) proper facilities

(c) Social security

(d) exploitation

Answer:

(d) exploitation

![]()

Samacheer Kalvi 11th Commerce Notes Chapter 17 Social Responsibility of Business and Business Ethics

→ A business entity carries out economic activities on a regular basis to earn profit. These entities spend money on different aspects of business which do not give them profit directly. For example businessmen take the responsibility of maintaining and developing gardens and parks on streets and squares in cities.

→ Some businessmen engage themselves in research for improving the quality of products, some provide housing transport education and health to their families. In some places businessmen provide free medical facility to poor patients.

![]()

→ Sometimes they also sponsor games and sports at national as well as international level. Social responsibility of business broadly divided into four categories. Which are as follows. i.e.,

(i) Economic Responsibility,

(ii) Ethical responsibility,

(iii) Legal responsibility,

(iv) Discretionary responsibility.

→ Responsibility of business towards different interest groups,

(i) Business,

(ii) Investors,

(iii) Employees,

(iv) Government,

(v) Competitors,

(vi) Society,

(vii) Customer,

(viii) Suppliers.